This version of the form is not currently in use and is provided for reference only. Download this version of

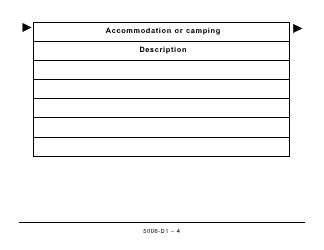

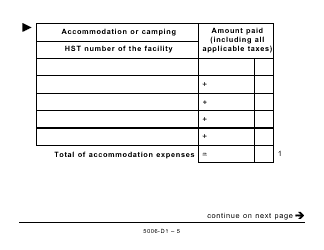

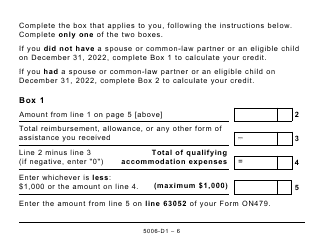

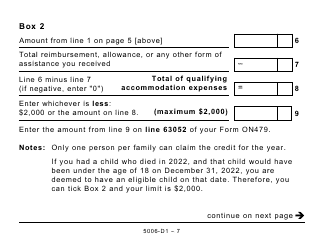

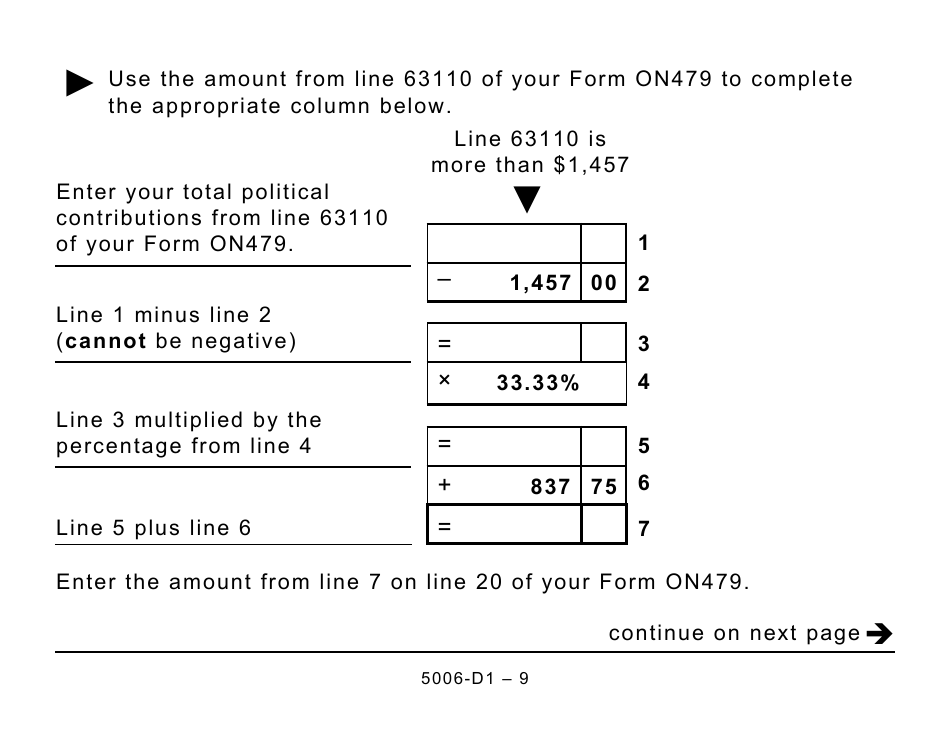

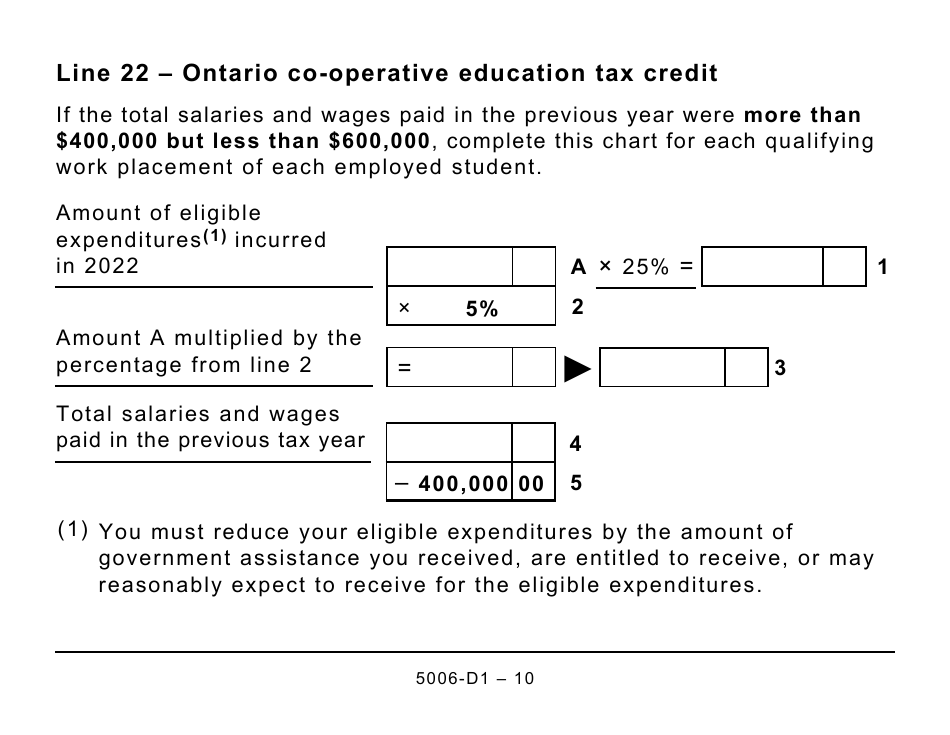

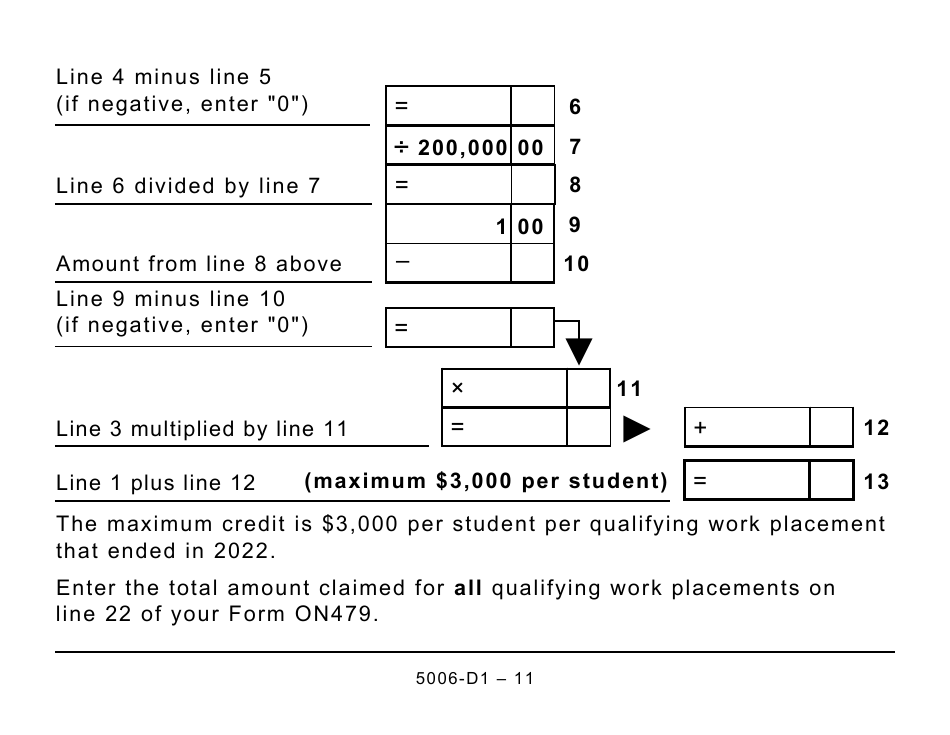

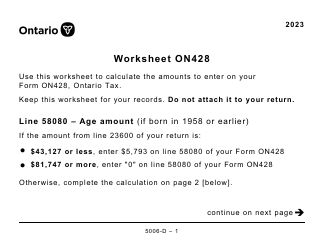

Form 5006-D1 Worksheet ON479

for the current year.

Form 5006-D1 Worksheet ON479 Ontario (Large Print) - Canada

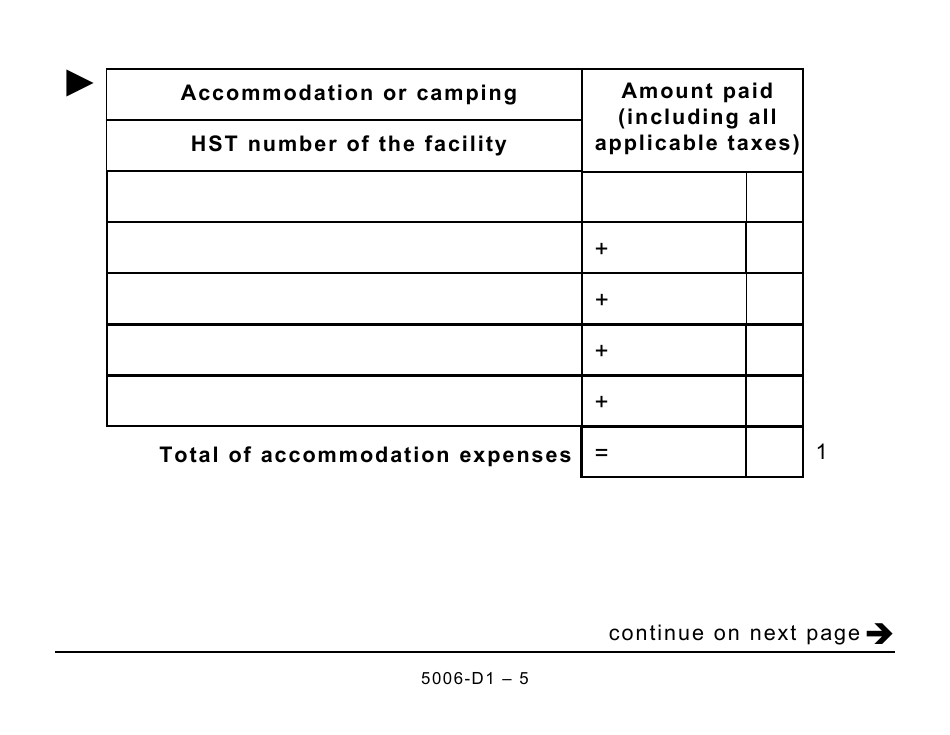

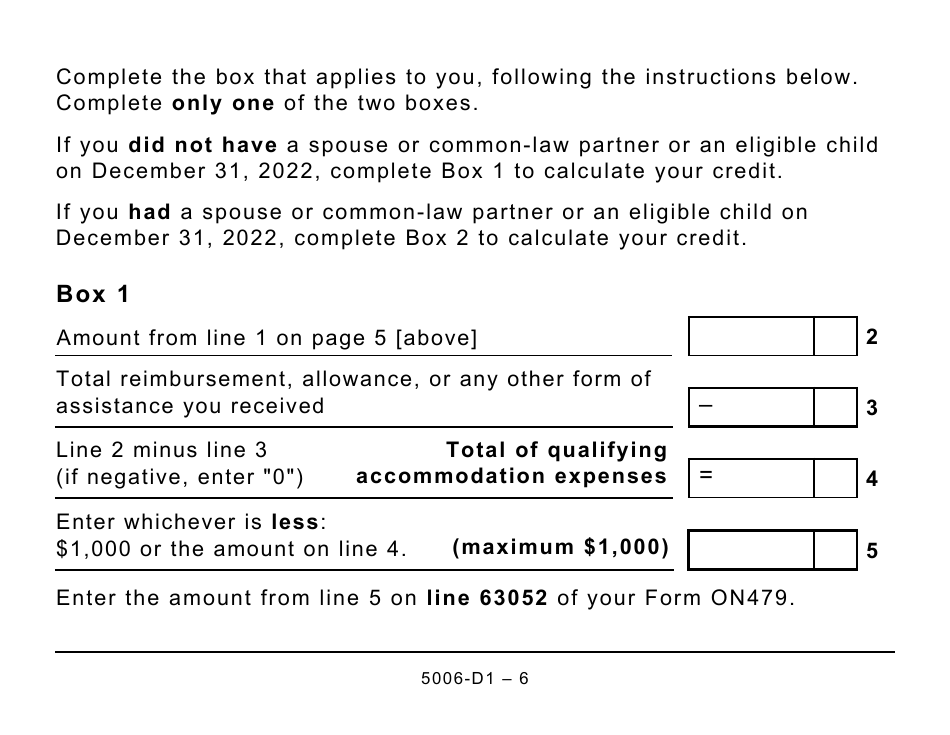

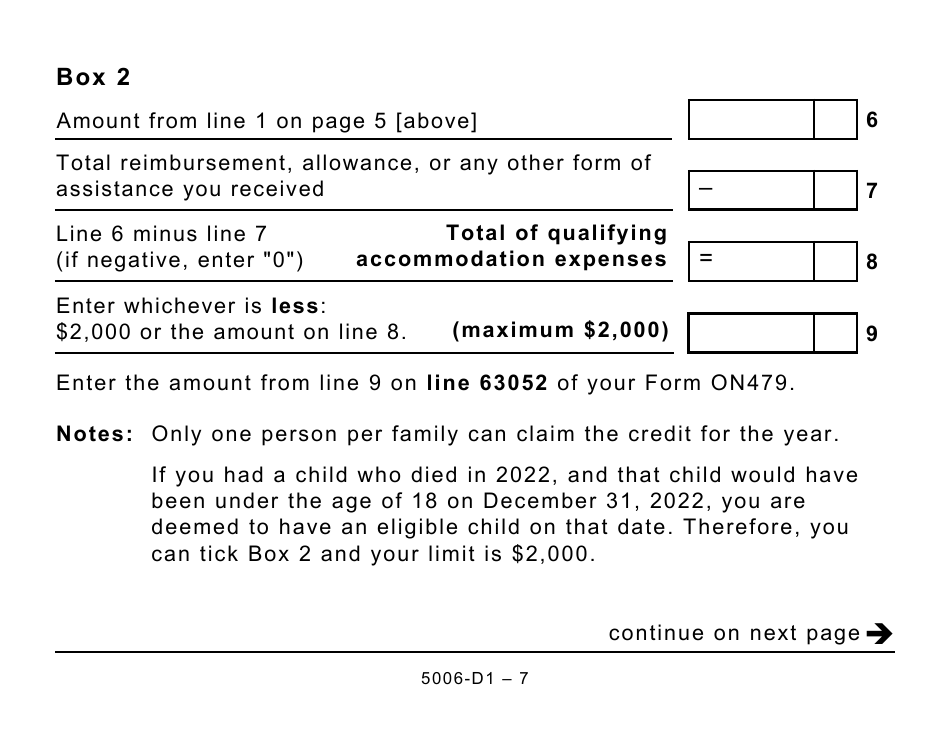

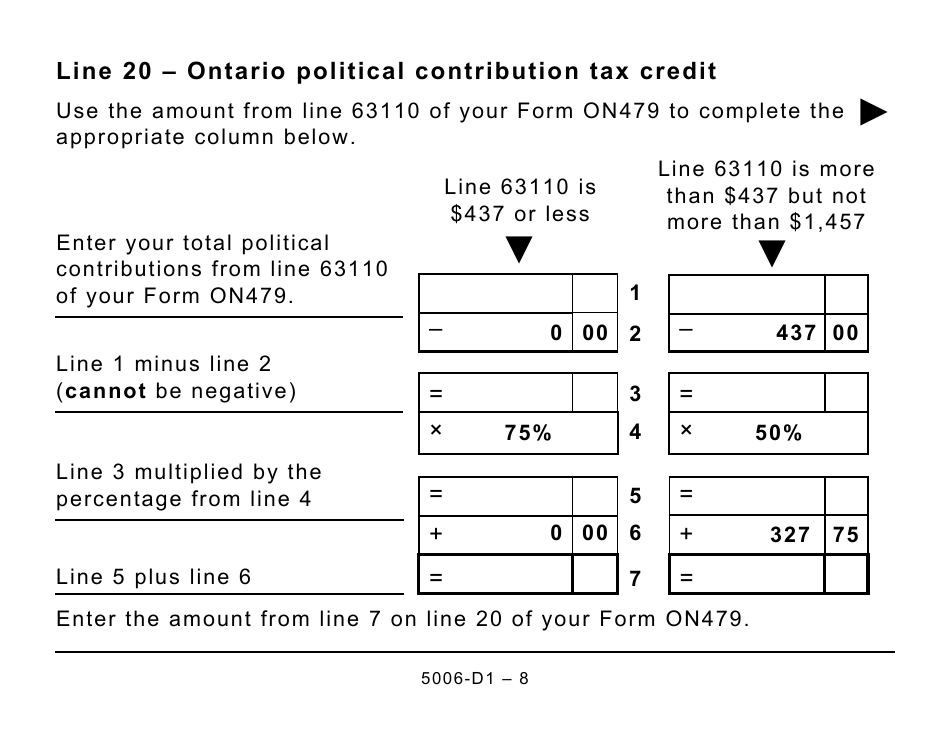

Form 5006-D1 Worksheet ON479 Ontario (Large Print) is used in Canada for individuals to calculate their Ontario credits and deductions for the purpose of filing their tax return.

The Form 5006-D1 Worksheet ON479 Ontario (Large Print) is filed by individual taxpayers in Ontario, Canada.

FAQ

Q: What is Form 5006-D1 Worksheet ON479 Ontario?

A: Form 5006-D1 Worksheet ON479 Ontario is a tax form used in Ontario, Canada.

Q: What is the purpose of Form 5006-D1 Worksheet ON479 Ontario?

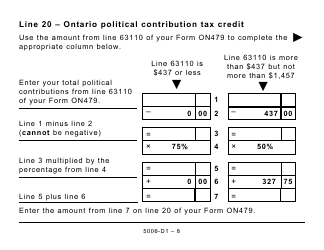

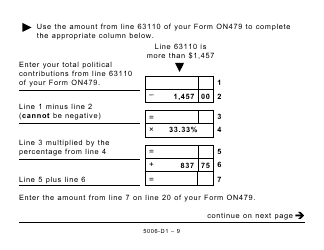

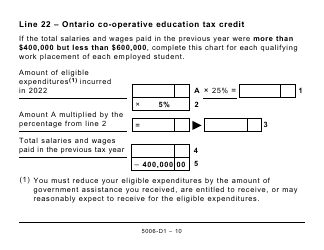

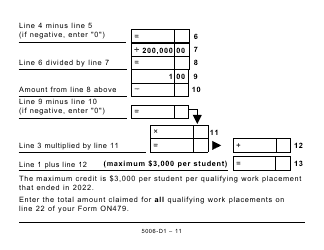

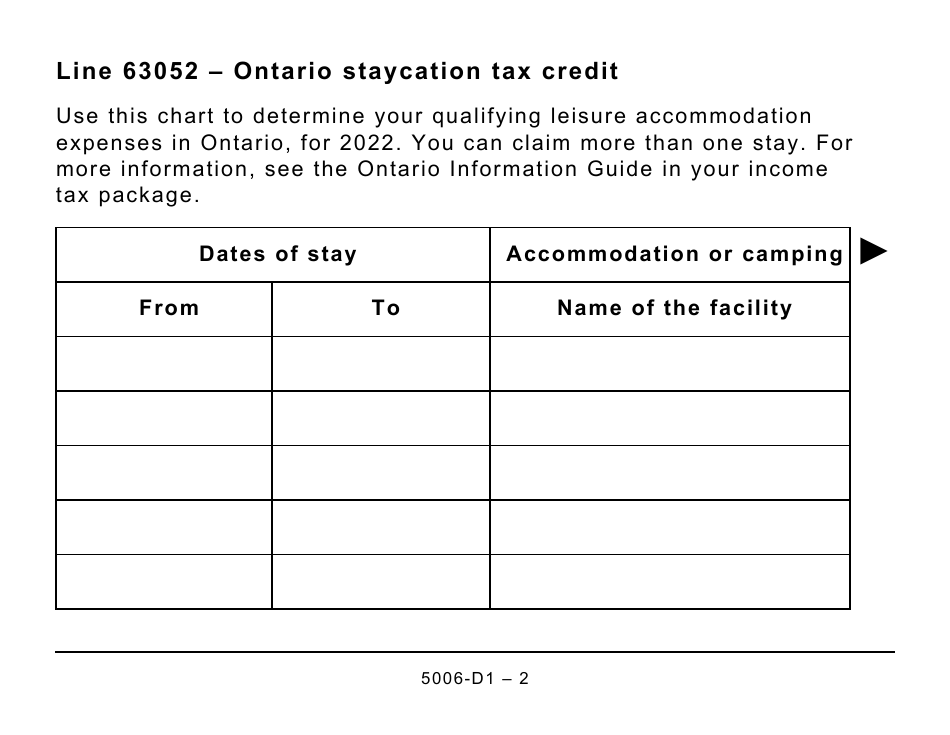

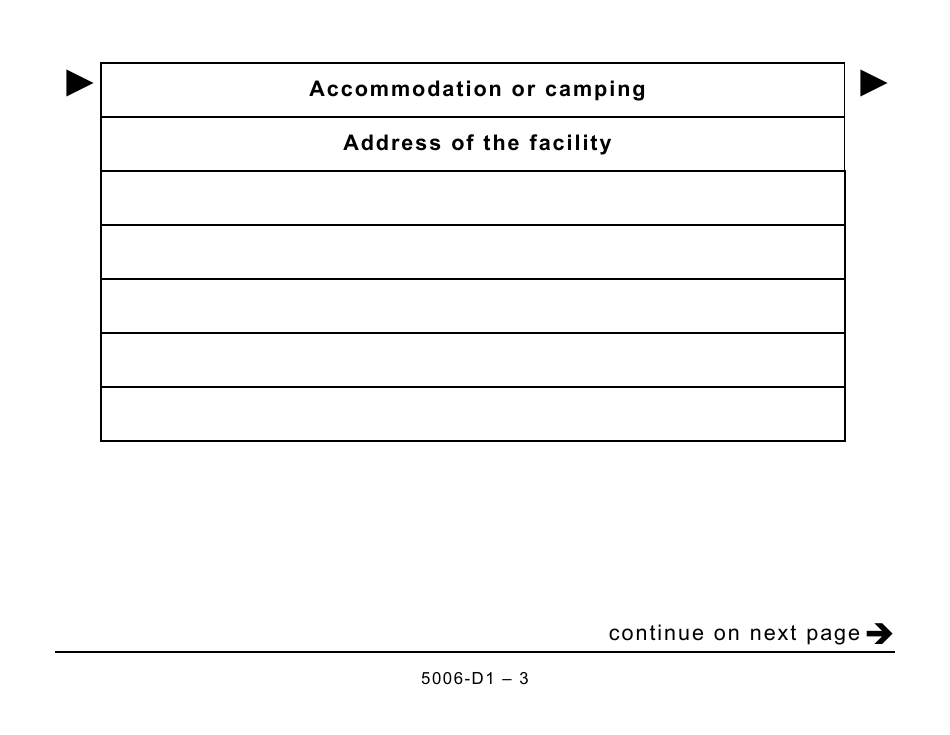

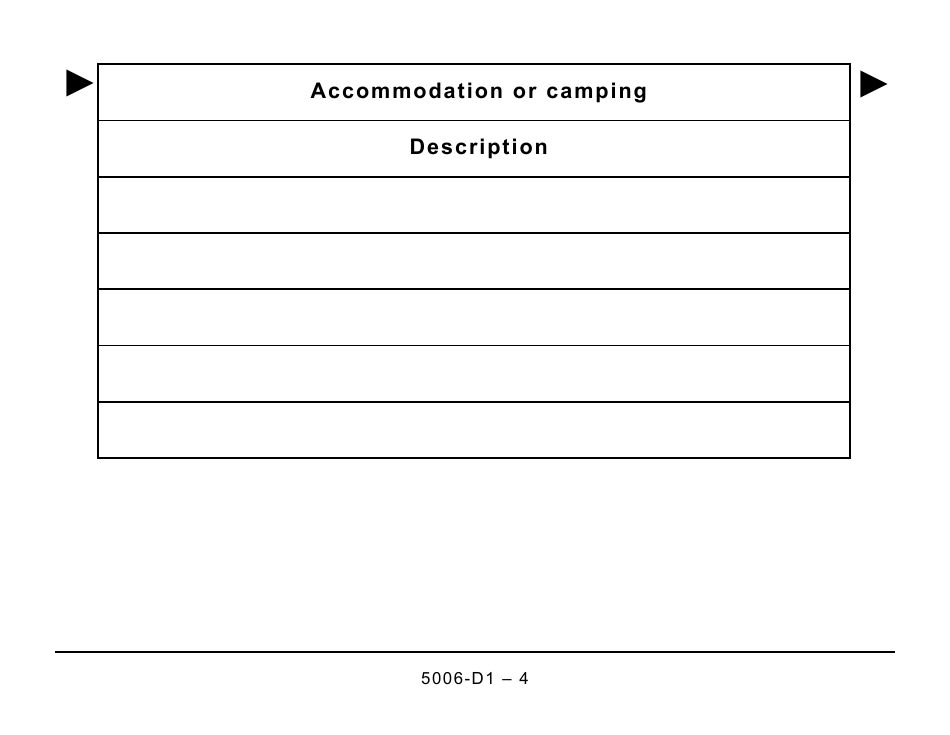

A: Form 5006-D1 Worksheet ON479 Ontario is used to calculate provincial tax credits and deductions for Ontario residents.

Q: Who should use Form 5006-D1 Worksheet ON479 Ontario?

A: Form 5006-D1 Worksheet ON479 Ontario should be used by Ontario residents who want to calculate their provincial tax credits and deductions.

Q: When is Form 5006-D1 Worksheet ON479 Ontario due?

A: Form 5006-D1 Worksheet ON479 Ontario is due on the same day as your federal tax return, which is usually April 30th.

Q: What should I do if I need help filling out Form 5006-D1 Worksheet ON479 Ontario?

A: If you need help filling out Form 5006-D1 Worksheet ON479 Ontario, you can contact the Canada Revenue Agency (CRA) or consult a tax professional.

Q: Is Form 5006-D1 Worksheet ON479 Ontario only for individuals?

A: No, Form 5006-D1 Worksheet ON479 Ontario can also be used by self-employed individuals and partners in a partnership.

Q: What information do I need to fill out Form 5006-D1 Worksheet ON479 Ontario?

A: To fill out Form 5006-D1 Worksheet ON479 Ontario, you will need information such as your social insurance number, income amounts, and expenses related to tax credits and deductions.