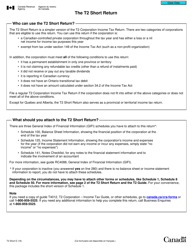

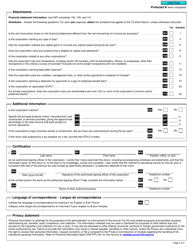

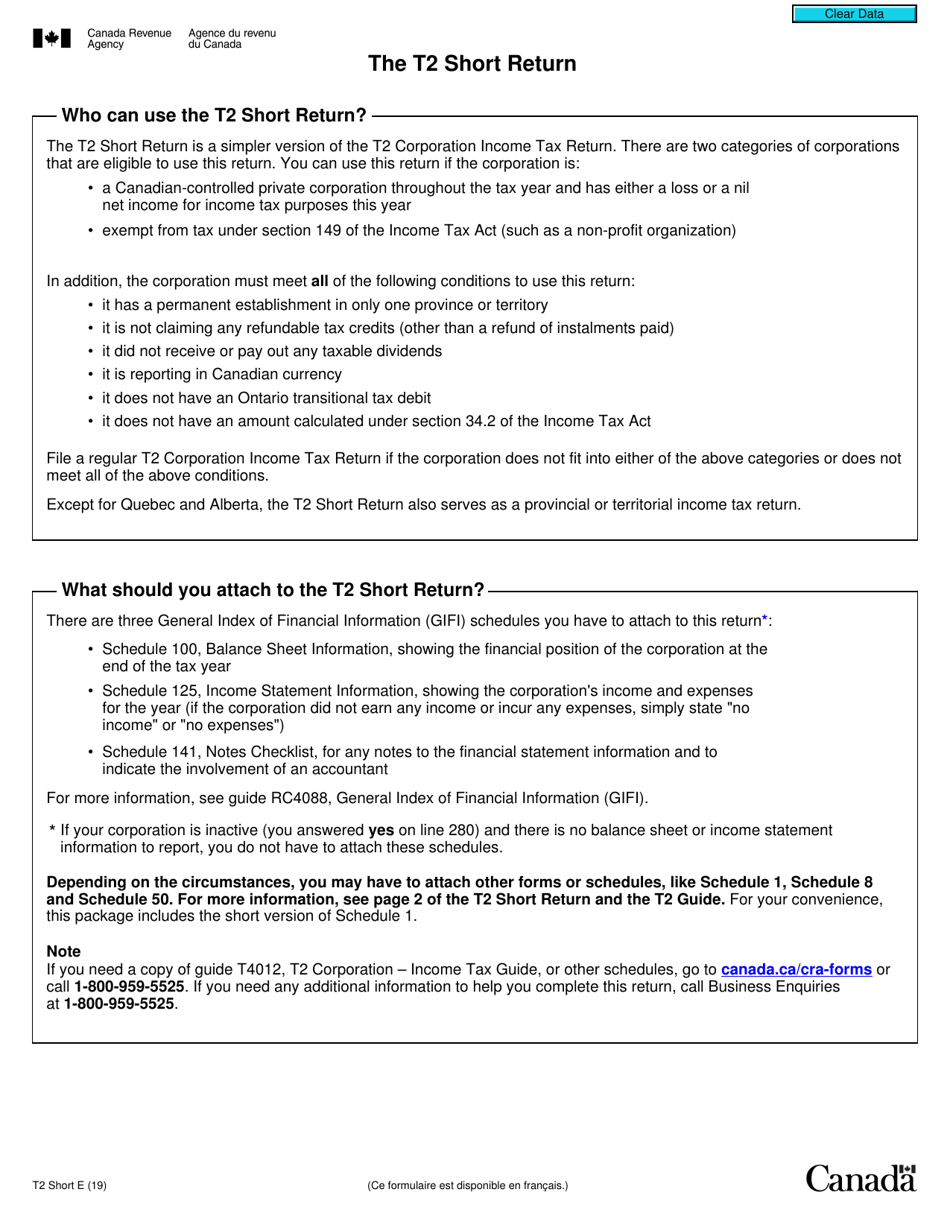

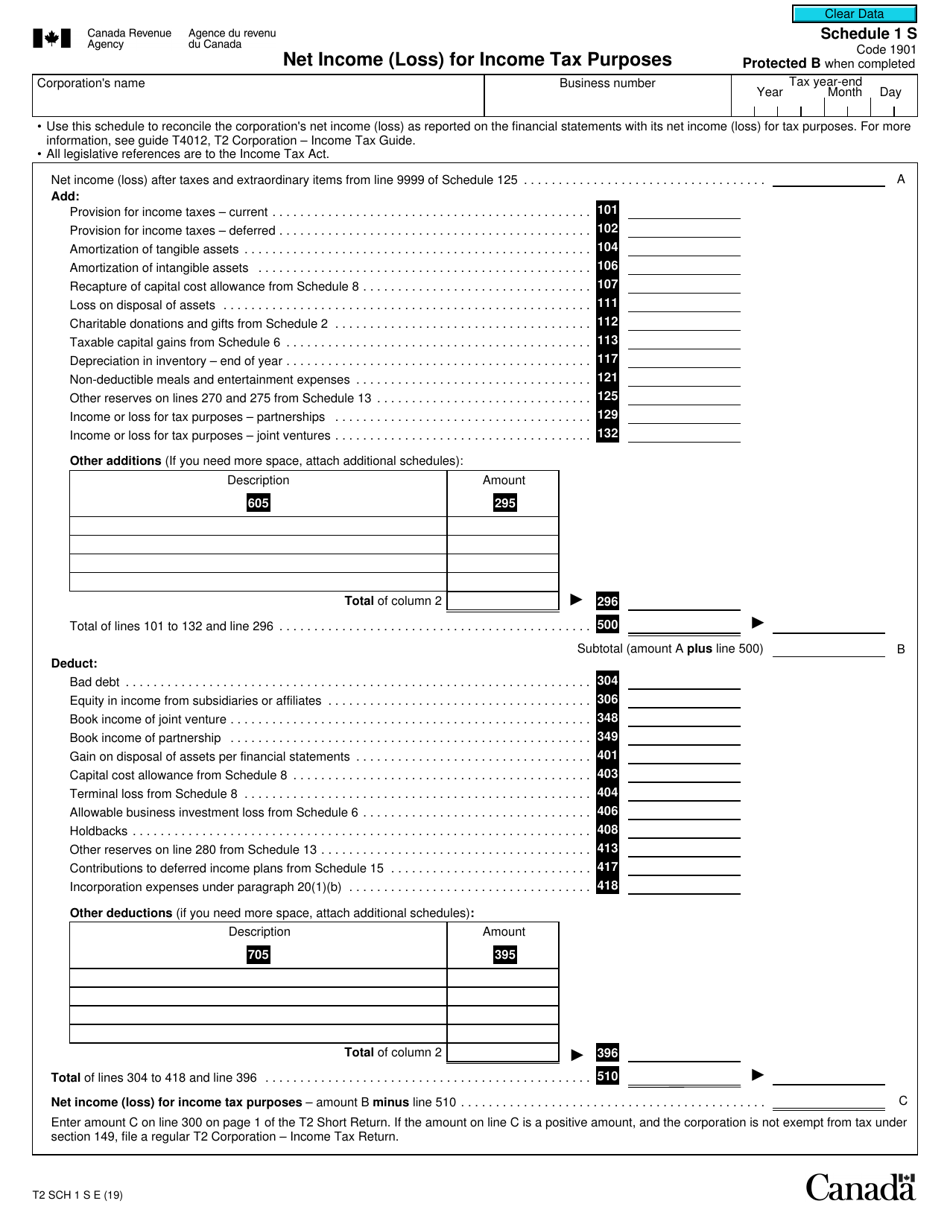

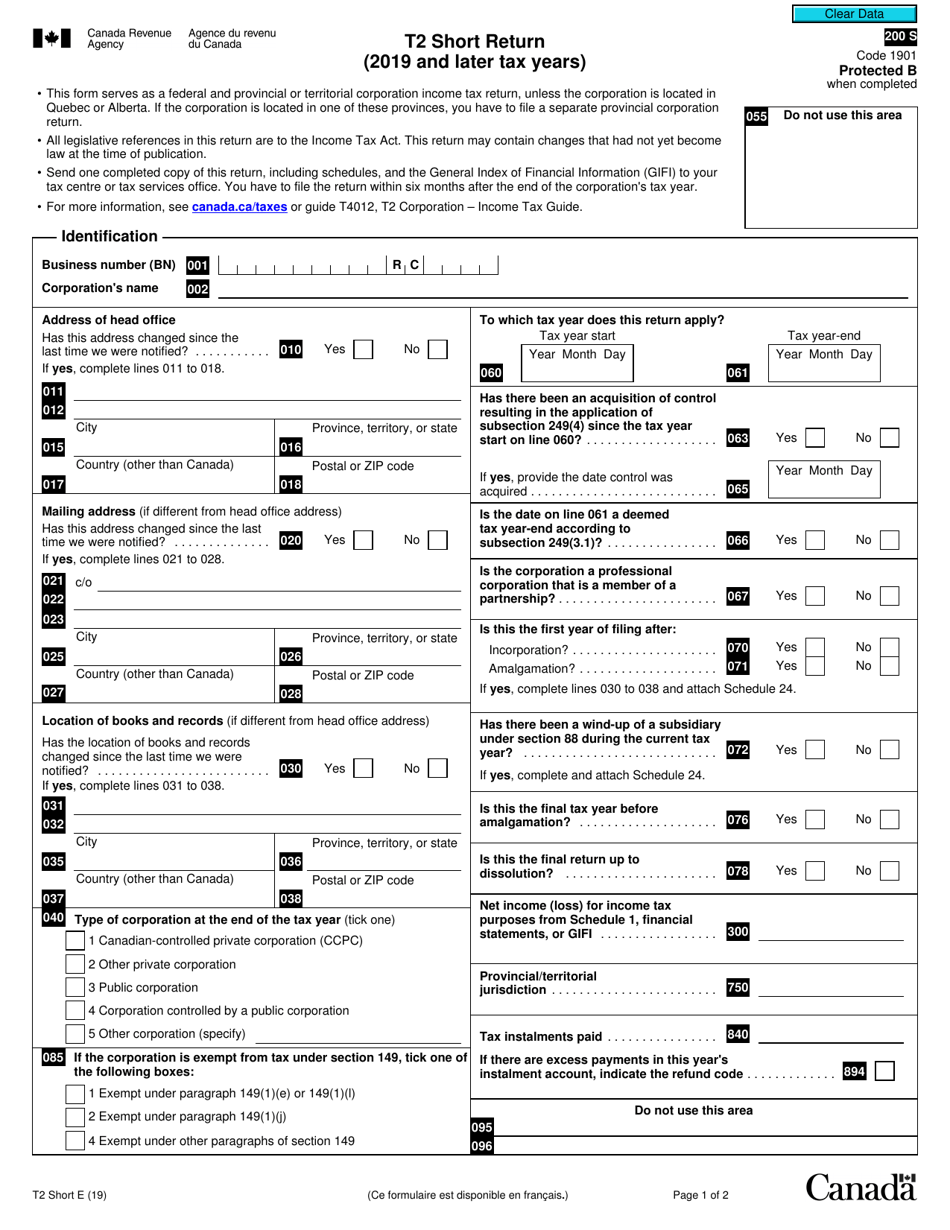

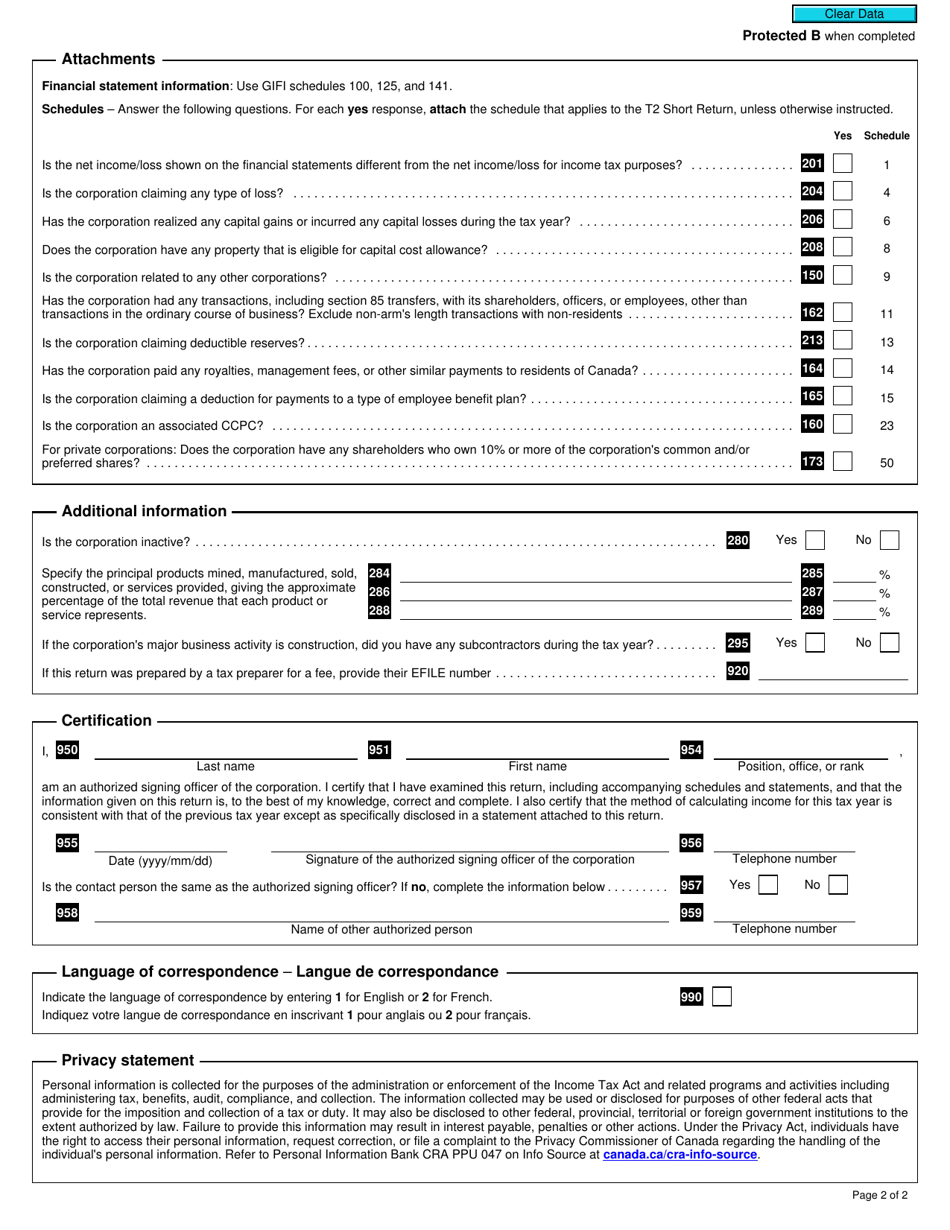

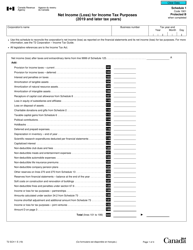

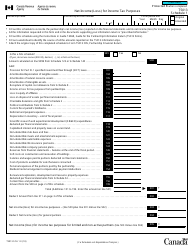

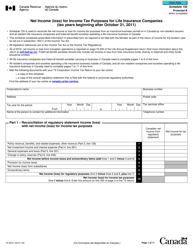

Form T2 SHORT Net Income (Loss) for Income Tax Purposes - Canada

Form T2 SHORT Net Income (Loss) for Income Tax Purposes is a document used in Canada for reporting the net income or loss of a corporation for income tax purposes. It helps calculate the amount of taxes owed by the corporation based on its net income.

The Form T2 SHORT Net Income (Loss) for Income Tax Purposes in Canada is filed by corporations.

FAQ

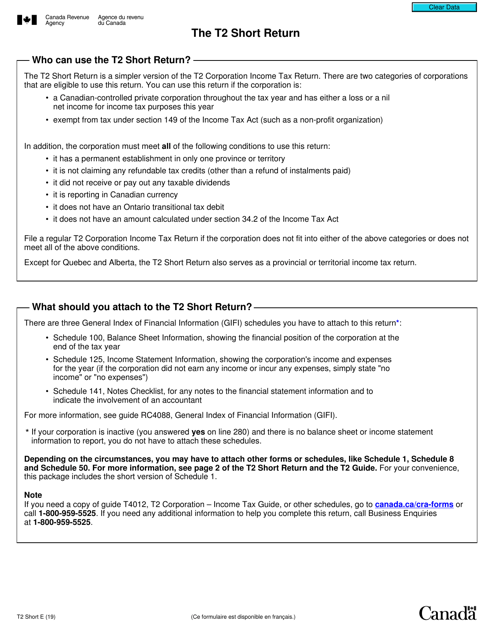

Q: What is Form T2?

A: Form T2 is a tax form used in Canada to report the net income or loss of a corporation for income tax purposes.

Q: What is the purpose of Form T2?

A: The purpose of Form T2 is to provide the Canada Revenue Agency (CRA) with the information about the net income or loss of a corporation, which is used to calculate the amount of income tax payable.

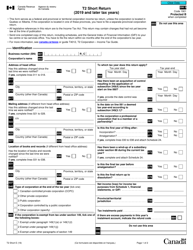

Q: Who is required to file Form T2?

A: Corporations operating in Canada are required to file Form T2 if they have taxable income or are claiming a refund.

Q: What is net income (loss) for income tax purposes?

A: Net income (loss) for income tax purposes refers to the taxable income or loss of a corporation, which is used as a basis for calculating the amount of income tax due.

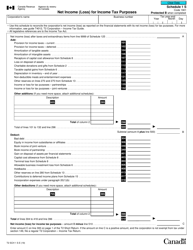

Q: Is there a deadline for filing Form T2?

A: Yes, the deadline for filing Form T2 is generally six months after the end of the corporation's fiscal year.

Q: Are there any penalties for late filing of Form T2?

A: Yes, there can be penalties for late filing of Form T2, so it is important to file the form by the deadline.

Q: Are there any other forms or schedules that need to be filed along with Form T2?

A: Yes, depending on the specific circumstances of the corporation, additional schedules may need to be filed along with Form T2. It is important to review the instructions provided by the CRA.

Q: Can I get help with filling out Form T2?

A: Yes, the CRA provides resources and guides to assist corporations with filling out Form T2. Additionally, professional tax advisors can provide assistance as well.