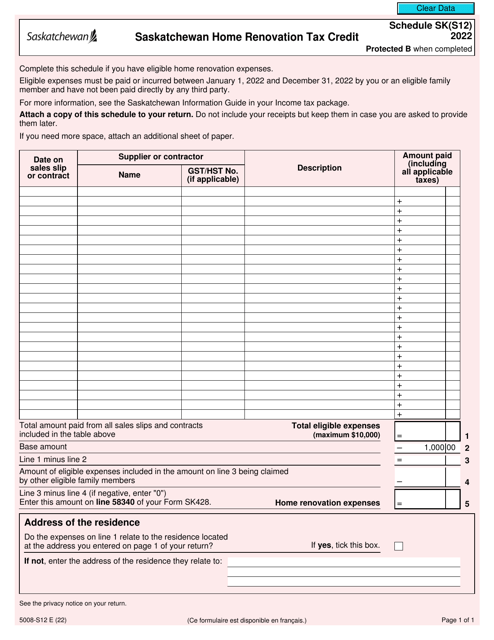

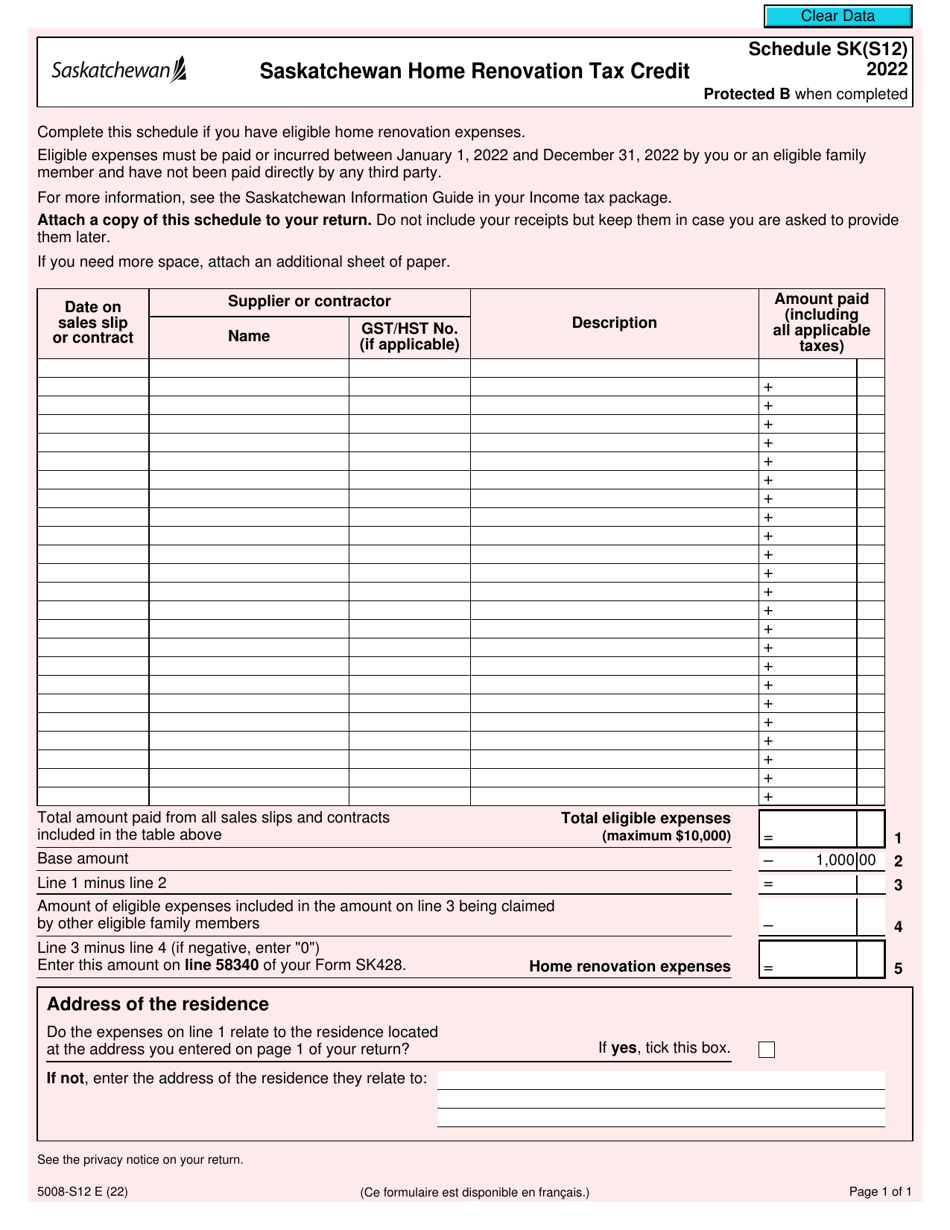

Form 5008-S12 Schedule SK(S12) Saskatchewan Home Renovation Tax Credit - Canada

Form 5008-S12 Schedule SK(S12) is used in Canada to claim the Saskatchewan Home Renovation Tax Credit. This credit is for expenses incurred for qualifying home renovations in the province of Saskatchewan. It provides a tax credit for eligible homeowners to help offset the cost of home renovations.

The individual or family who is claiming the Saskatchewan Home Renovation Tax Credit in Canada would need to file the Form 5008-S12 Schedule SK(S12).

FAQ

Q: What is Form 5008-S12 Schedule SK?

A: Form 5008-S12 Schedule SK is a tax form used in Canada for claiming the Saskatchewan Home Renovation Tax Credit.

Q: What is the Saskatchewan Home Renovation Tax Credit?

A: The Saskatchewan Home Renovation Tax Credit is a tax credit available to residents of Saskatchewan, Canada, for eligible home renovation expenses.

Q: Why do I need to fill out Form 5008-S12 Schedule SK?

A: You need to fill out this form to claim the Saskatchewan Home Renovation Tax Credit on your tax return.

Q: What are eligible home renovation expenses?

A: Eligible home renovation expenses include costs related to renovations, improvements, or repairs made to your principal residence in Saskatchewan.

Q: Is the Saskatchewan Home Renovation Tax Credit refundable?

A: No, the Saskatchewan Home Renovation Tax Credit is non-refundable. It can only be used to reduce your tax payable.

Q: Are there any deadlines for claiming the Saskatchewan Home Renovation Tax Credit?

A: Yes, the tax credit is available for expenses incurred between October 1, 2020, and December 31, 2022. You must claim it on your tax return for the corresponding tax year.

Q: Can I claim the Saskatchewan Home Renovation Tax Credit for expenses incurred on a rental property?

A: No, the tax credit is only available for expenses incurred on your principal residence in Saskatchewan, not on rental properties.

Q: How much is the Saskatchewan Home Renovation Tax Credit?

A: The tax credit is equal to 11% of eligible home renovation expenses, up to a maximum of $20,000.

Q: Can I claim the tax credit for expenses already claimed under other tax credits?

A: No, you cannot claim the tax credit for expenses that have already been claimed under other tax credits, grants, or similar benefits.