This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (9414-S2) Schedule NU(S2)MJ

for the current year.

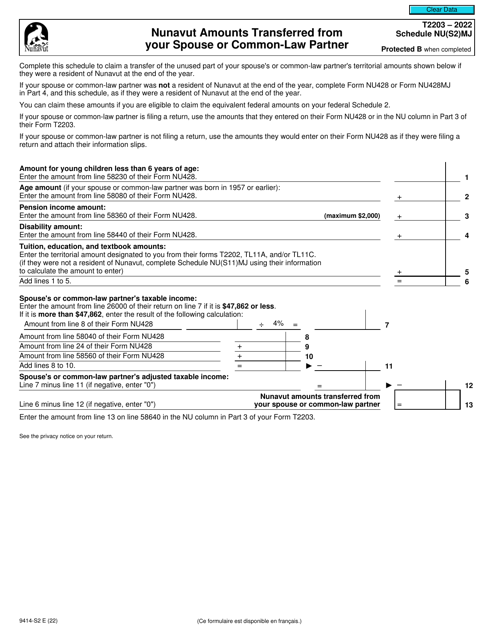

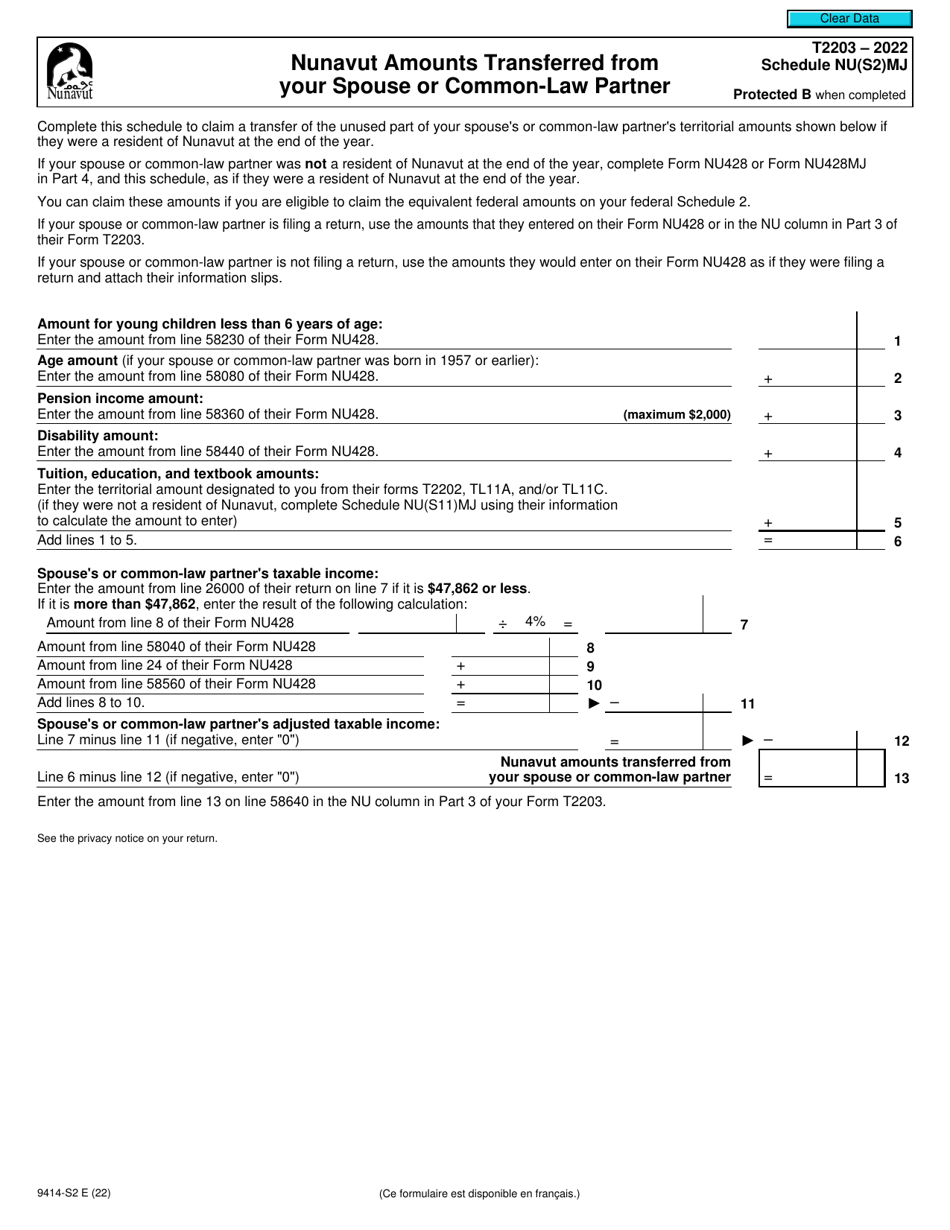

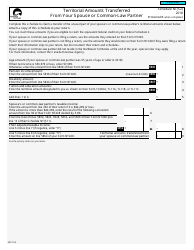

Form T2203 (9414-S2) Schedule NU(S2)MJ Nunavut Amounts Transferred From Your Spouse or Common-Law Partner - Canada

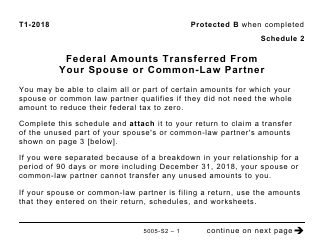

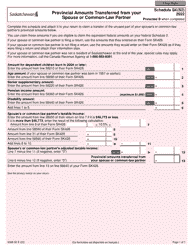

Form T2203 (9414-S2) Schedule NU(S2)MJ Nunavut Amounts Transferred From Your Spouse or Common-Law Partner - Canada is used for reporting amounts transferred from your spouse or common-law partner for the purpose of calculating the Nunavut tax payable. It is a tax form specific to the province of Nunavut in Canada.

Form T2203 (9414-S2) Schedule NU(S2)MJ is filed by residents of Nunavut, Canada. It is used to report and claim amounts that have been transferred from their spouse or common-law partner for tax purposes.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form in Canada.

Q: What is Schedule NU(S2)MJ?

A: Schedule NU(S2)MJ is a schedule of Form T2203.

Q: What does Schedule NU(S2)MJ report?

A: Schedule NU(S2)MJ reports Nunavut amounts transferred from your spouse or common-law partner.

Q: Who is eligible to use Schedule NU(S2)MJ?

A: Individuals who reside in Nunavut and have a spouse or common-law partner are eligible to use Schedule NU(S2)MJ.

Q: What is the purpose of transferring amounts on Schedule NU(S2)MJ?

A: The purpose of transferring amounts on Schedule NU(S2)MJ is to allocate certain tax credits and deductions between the transferor and the transferee.