This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2203 (BC428MJ; 9410-C) Part 4

for the current year.

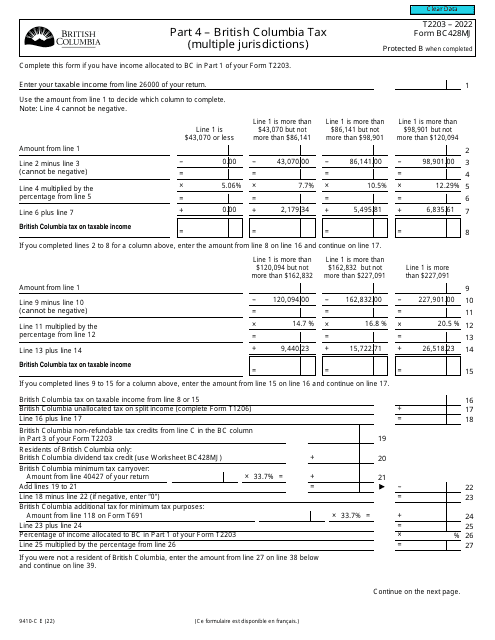

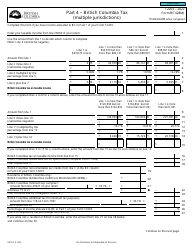

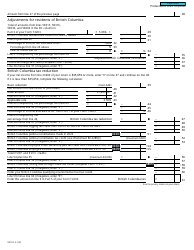

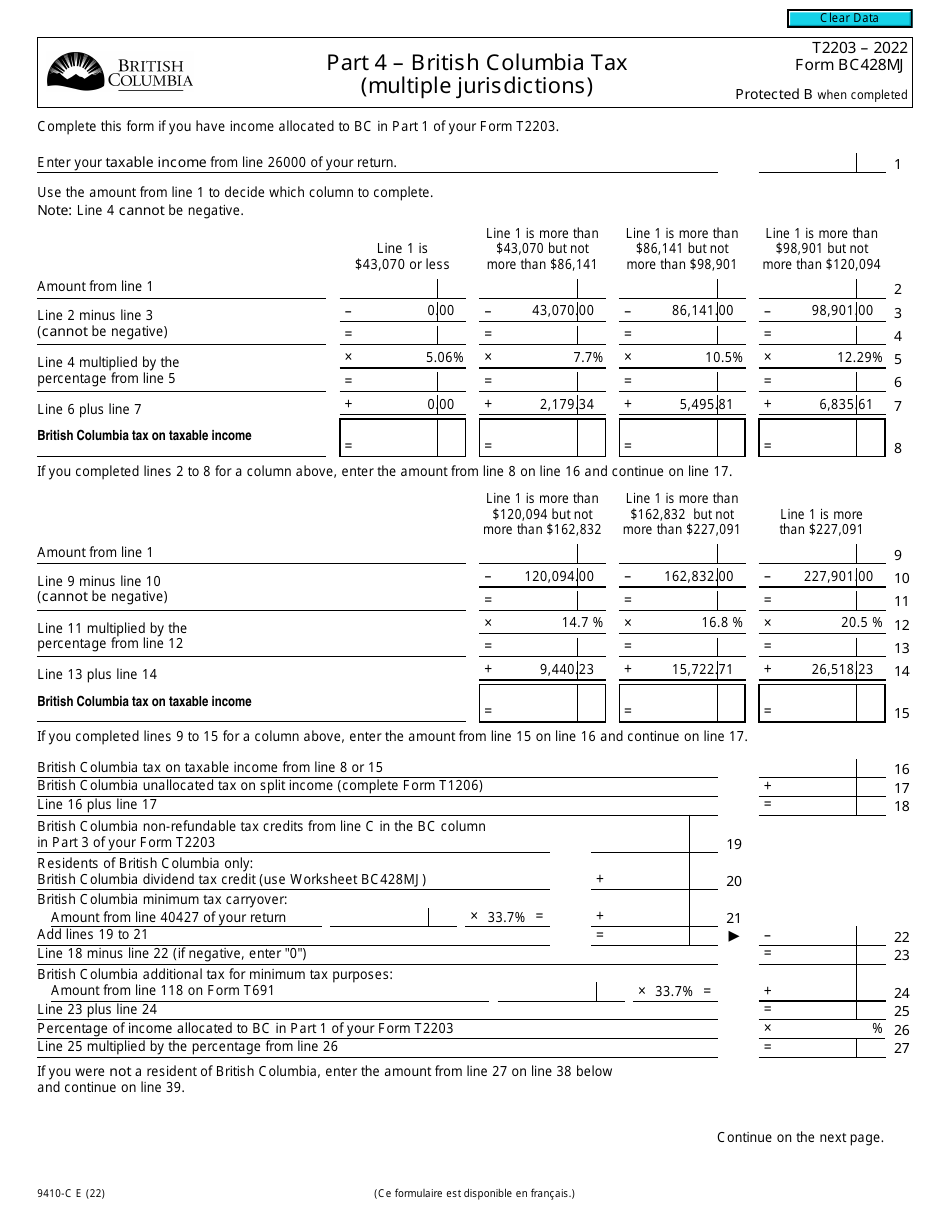

Form T2203 (BC428MJ; 9410-C) Part 4 British Columbia Tax (Multiple Jurisdictions) - Canada

Form T2203 (BC428MJ; 9410-C) Part 4 is used for reporting British Columbia Tax (Multiple Jurisdictions) in Canada. This form is specifically for residents of British Columbia who have income from multiple jurisdictions within Canada. It helps determine the amount of tax owed to British Columbia based on this income.

The form T2203 (BC428MJ; 9410-C) Part 4 is filed by individuals in British Columbia who need to report their taxes for multiple jurisdictions in Canada.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to report British Columbia Tax.

Q: What does BC428MJ refer to?

A: BC428MJ refers to the form number for reporting British Columbia Tax on Form T2203.

Q: What is 9410-C?

A: 9410-C refers to the code for reporting multiple jurisdictions on Form T2203.

Q: What is Part 4 on Form T2203?

A: Part 4 on Form T2203 is the section where you report British Columbia Tax.

Q: What is British Columbia Tax?

A: British Columbia Tax is a provincial tax imposed by the government of British Columbia, Canada.