This version of the form is not currently in use and is provided for reference only. Download this version of

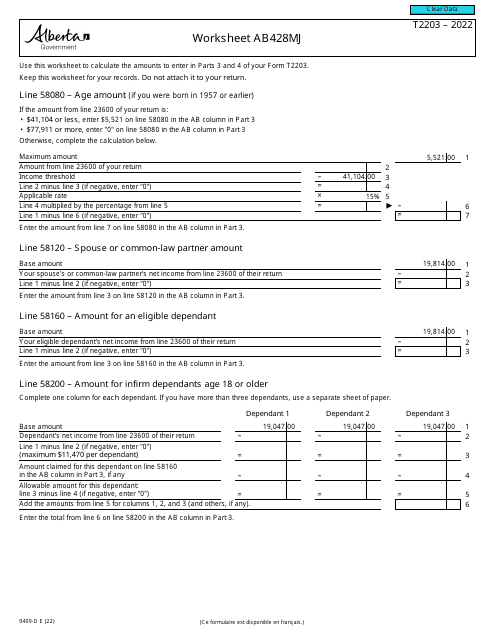

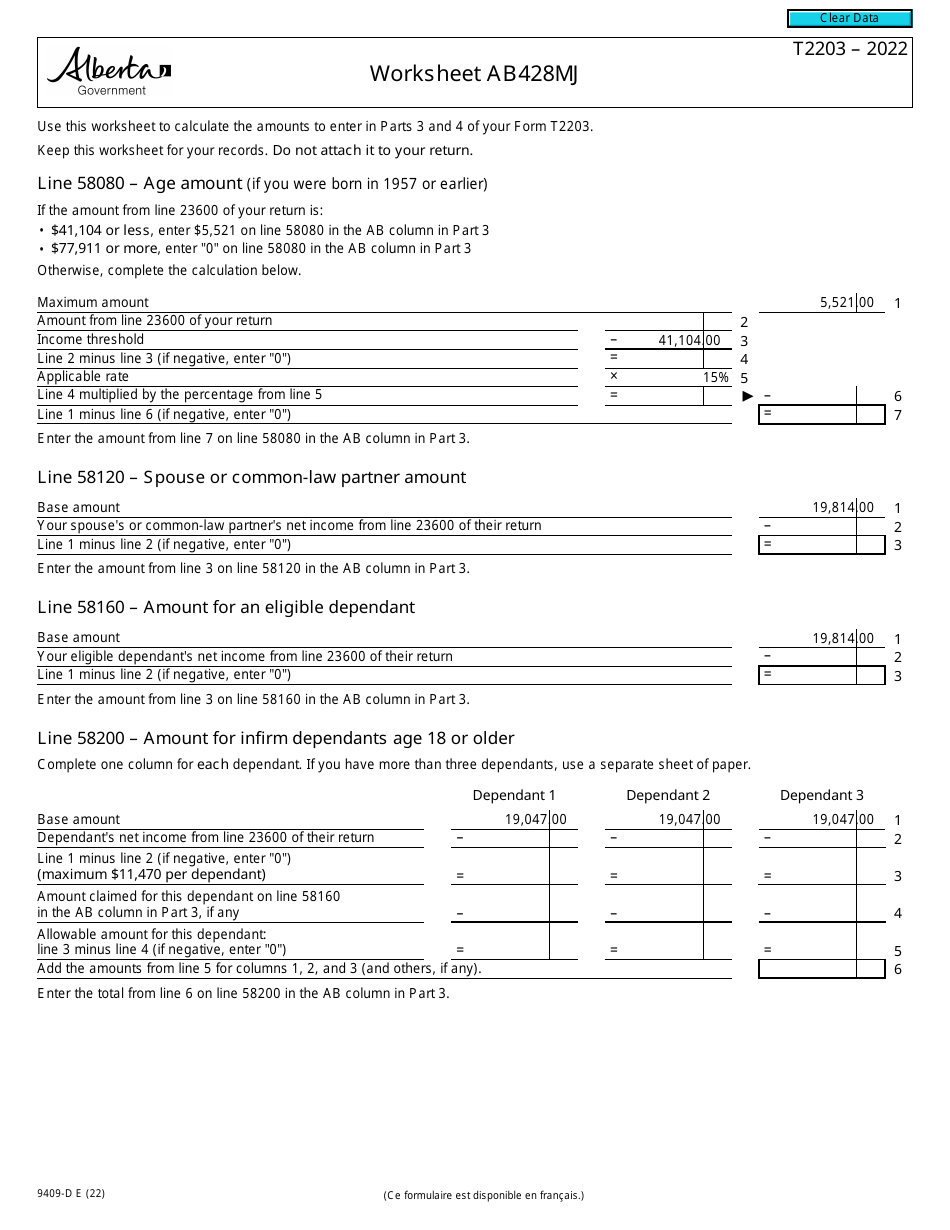

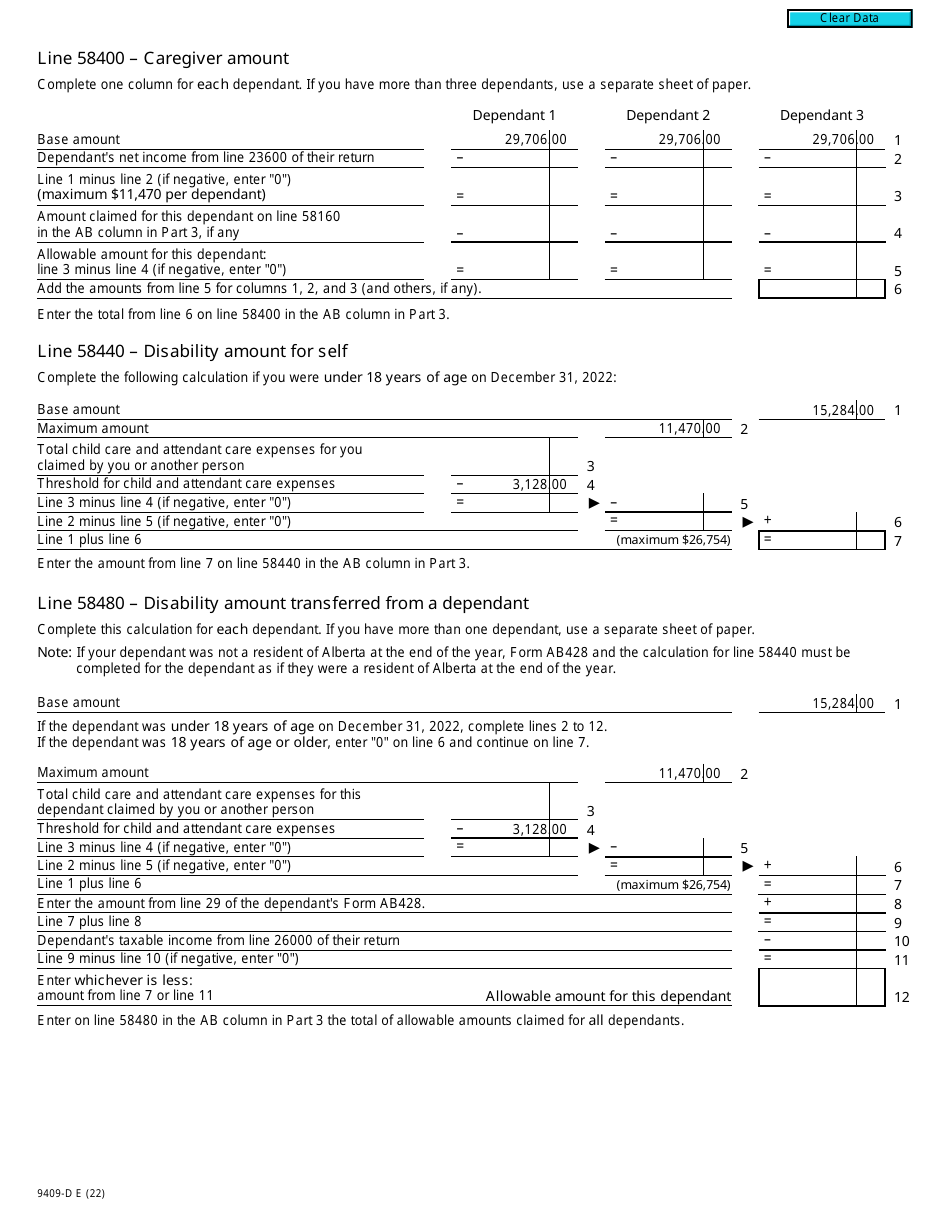

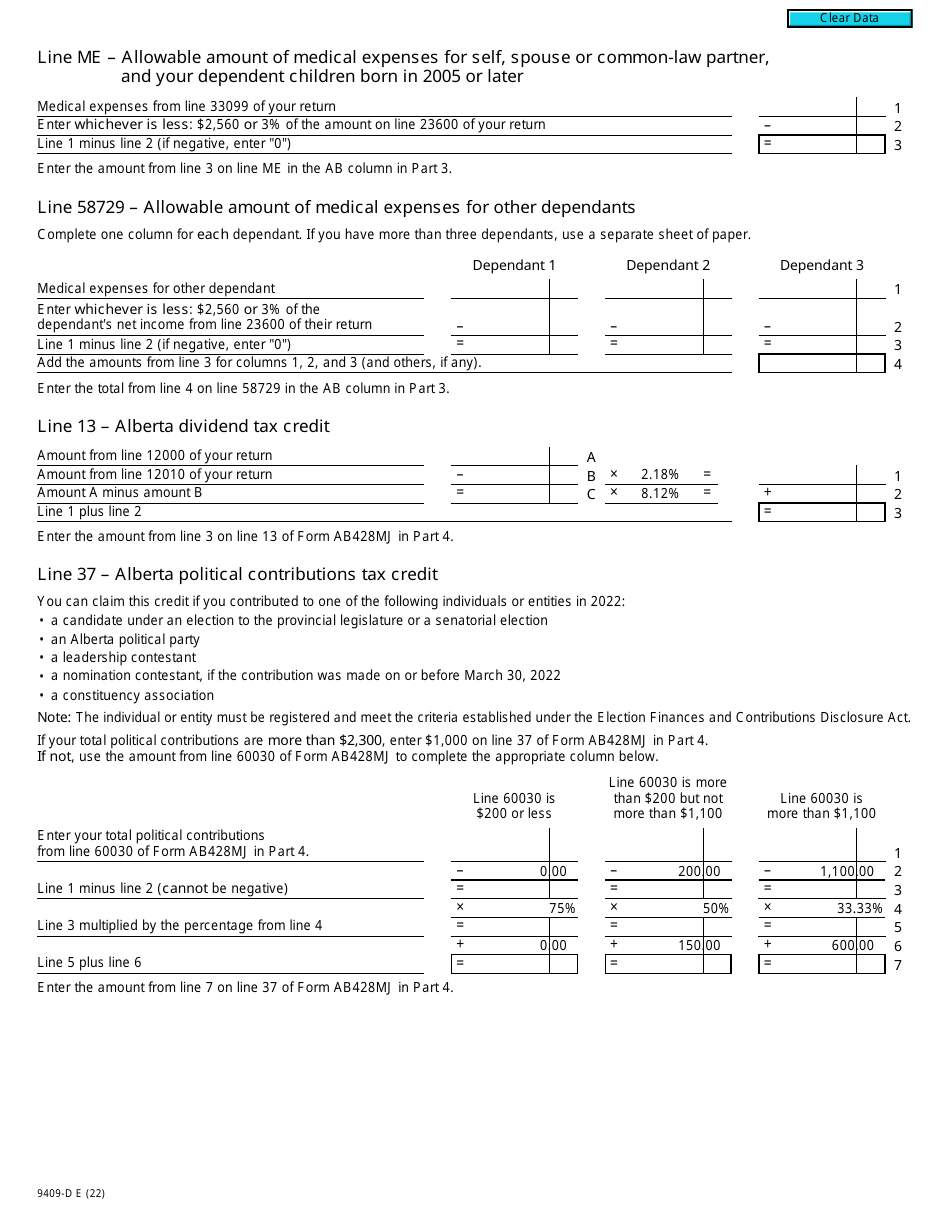

Form T2203 (9409-D) Worksheet AB428MJ

for the current year.

Form T2203 (9409-D) Worksheet AB428MJ Alberta - Canada

Form T2203 (9409-D) Worksheet AB428MJ is used by residents of Alberta, Canada for the purpose of calculating the provincial tax payable for the taxation year. It is specifically designed for individuals who are claiming the Alberta Political Contribution Tax Credit. This worksheet is used to determine the amount of the credit that can be claimed on the individual's personal income tax return.

The Form T2203 (9409-D) Worksheet AB428MJ for Alberta, Canada is typically filed by individuals who are residents of Alberta and want to claim various tax credits and deductions specific to the province. It is used to calculate the Alberta tax payable and determine the amount of tax credits and deductions that can be claimed.

FAQ

Q: What is Form T2203 (9409-D) Worksheet AB428MJ?

A: Form T2203 (9409-D) Worksheet AB428MJ is a tax form specific to the province of Alberta in Canada. It is used to calculate the Alberta Family Employment Tax Credit (AFETC) for eligible individuals and families.

Q: What is the Alberta Family Employment Tax Credit (AFETC)?

A: The Alberta Family Employment Tax Credit (AFETC) is a tax credit provided by the government of Alberta in Canada. It is designed to assist lower-income working families with the cost of raising children.

Q: Who is eligible for the Alberta Family Employment Tax Credit?

A: To be eligible for the Alberta Family Employment Tax Credit (AFETC), you must be a resident of Alberta, have earned employment income, have a net income below the maximum threshold set by the government, and have eligible children under the age of 18.

Q: How is the Alberta Family Employment Tax Credit calculated?

A: The calculation of the Alberta Family Employment Tax Credit (AFETC) is based on your family net income and the number of eligible children you have. The specific calculation can be found on Form T2203 (9409-D) Worksheet AB428MJ.

Q: How do I file Form T2203 (9409-D) Worksheet AB428MJ?

A: To file Form T2203 (9409-D) Worksheet AB428MJ, you need to complete the worksheet with accurate information and calculations. You can then include it with your provincial tax return or submit it separately, depending on the instructions provided by the CRA.

Q: Are there any deadlines for filing Form T2203 (9409-D) Worksheet AB428MJ?

A: The deadline for filing Form T2203 (9409-D) Worksheet AB428MJ is generally the same as the deadline for filing your provincial tax return. This deadline is typically on or before April 30th of the following year, but it may vary. It's best to check the specific deadlines with the CRA or consult a tax professional.

Q: What happens after I file Form T2203 (9409-D) Worksheet AB428MJ?

A: After you file Form T2203 (9409-D) Worksheet AB428MJ, the Canada Revenue Agency (CRA) will review your submission to determine your eligibility for the Alberta Family Employment Tax Credit (AFETC). If approved, the tax credit will be applied to reduce your overall tax liability or increase your tax refund.

Q: Is the Alberta Family Employment Tax Credit refundable?

A: No, the Alberta Family Employment Tax Credit (AFETC) is not a refundable tax credit. It can only be used to reduce your overall tax liability or increase your tax refund, but it will not result in a cash refund on its own.

Q: Can I claim the Alberta Family Employment Tax Credit if I receive other government benefits?

A: Yes, you can still claim the Alberta Family Employment Tax Credit (AFETC) if you receive other government benefits. The AFETC is separate from other benefits and is not affected by their eligibility or receipt.