This version of the form is not currently in use and is provided for reference only. Download this version of

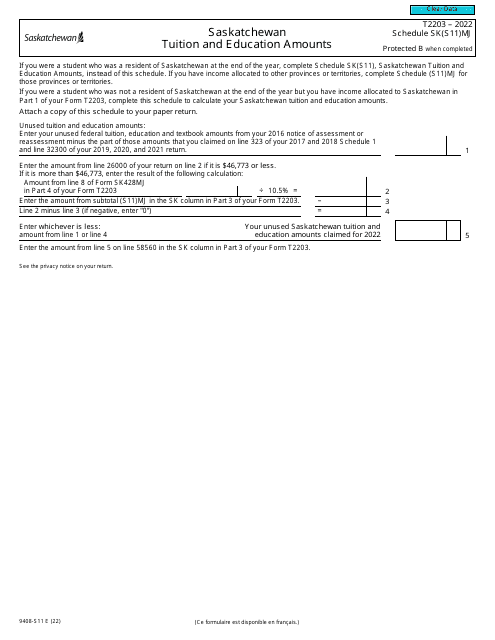

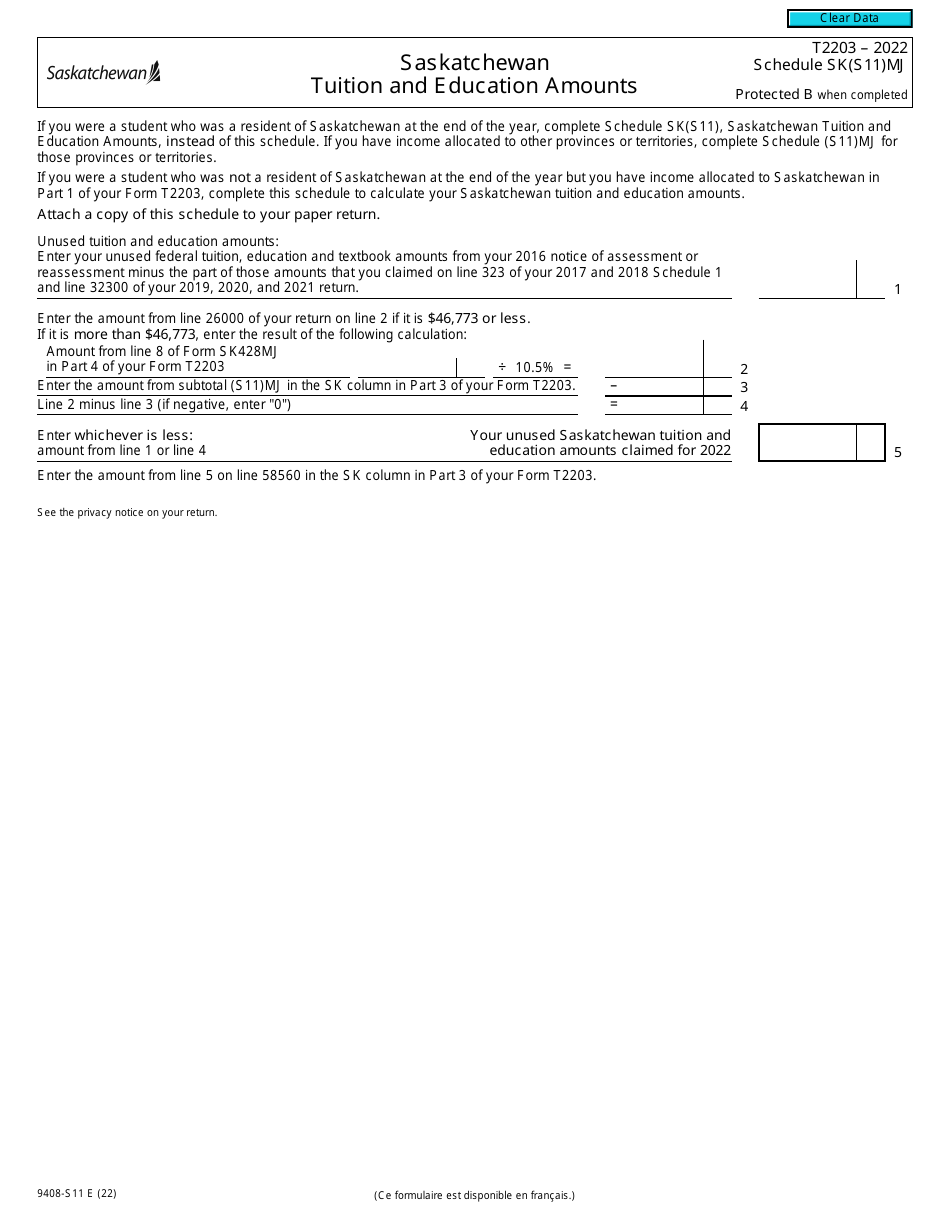

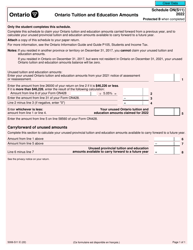

Form T2203 (9408-S11) Schedule SK(S11)MJ

for the current year.

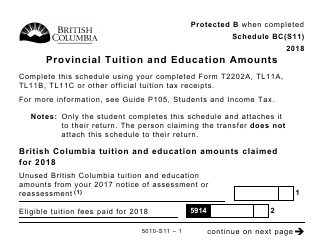

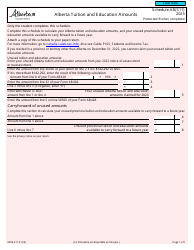

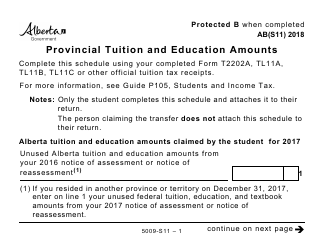

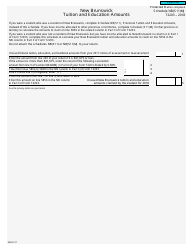

Form T2203 (9408-S11) Schedule SK(S11)MJ Saskatchewan Tuition and Education Amounts - Canada

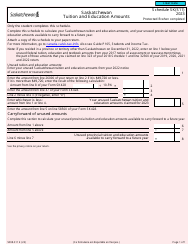

Form T2203 (9408-S11) Schedule SK(S11)MJ is used in Canada for claiming the Saskatchewan Tuition and Education Amounts. This form is specifically for residents of Saskatchewan to claim their tuition and education expenses on their tax return.

The Form T2203 (9408-S11) Schedule SK(S11)MJ Saskatchewan Tuition and Education Amounts - Canada is filed by residents of Saskatchewan, Canada who are claiming tuition and education amounts for tax purposes.

FAQ

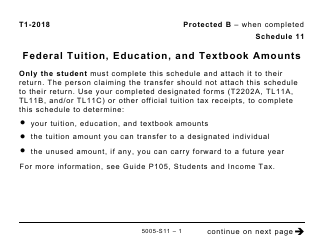

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada to claim tuition and education amounts for the province of Saskatchewan.

Q: What is Schedule SK(S11)MJ?

A: Schedule SK(S11)MJ is a specific schedule within Form T2203 that is used to claim tuition and education amounts specifically for Saskatchewan.

Q: What are tuition and education amounts?

A: Tuition and education amounts refer to expenses incurred for post-secondary education, such as tuition fees, textbooks, and other eligible education-related expenses.

Q: Who can claim tuition and education amounts?

A: Canadian residents who are enrolled in a qualifying post-secondary education program can claim tuition and education amounts.

Q: What is the purpose of this form?

A: The purpose of this form is to calculate and claim the tuition and education amounts for the province of Saskatchewan, which may result in tax credits or deductions.

Q: Are there any eligibility criteria for claiming tuition and education amounts?

A: Yes, there are eligibility criteria, such as being a Canadian resident and attending a qualifying educational institution. It is recommended to review the specific requirements outlined in the form instructions or consult a tax professional.

Q: When is the deadline to submit Form T2203?

A: The deadline to submit Form T2203 is usually the same as the deadline for filing your annual income tax return in Canada, which is April 30th of the following year (or June 15th for self-employed individuals).