This version of the form is not currently in use and is provided for reference only. Download this version of

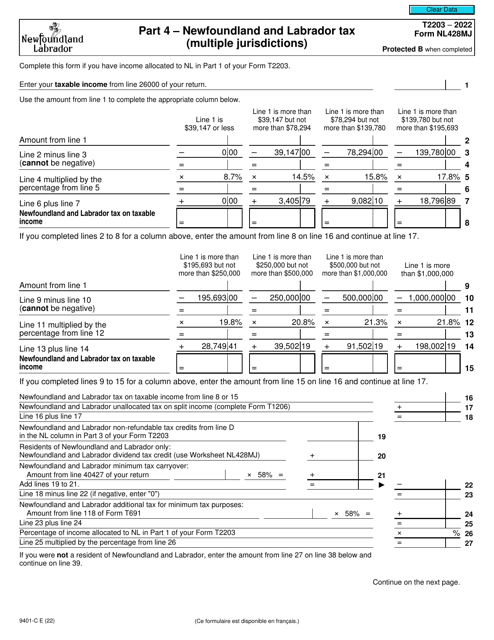

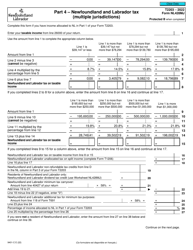

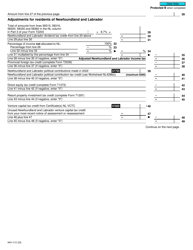

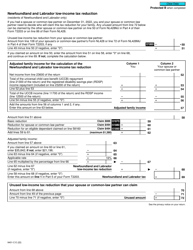

Form T2203 (NL428MJ; 9401-C) Part 4

for the current year.

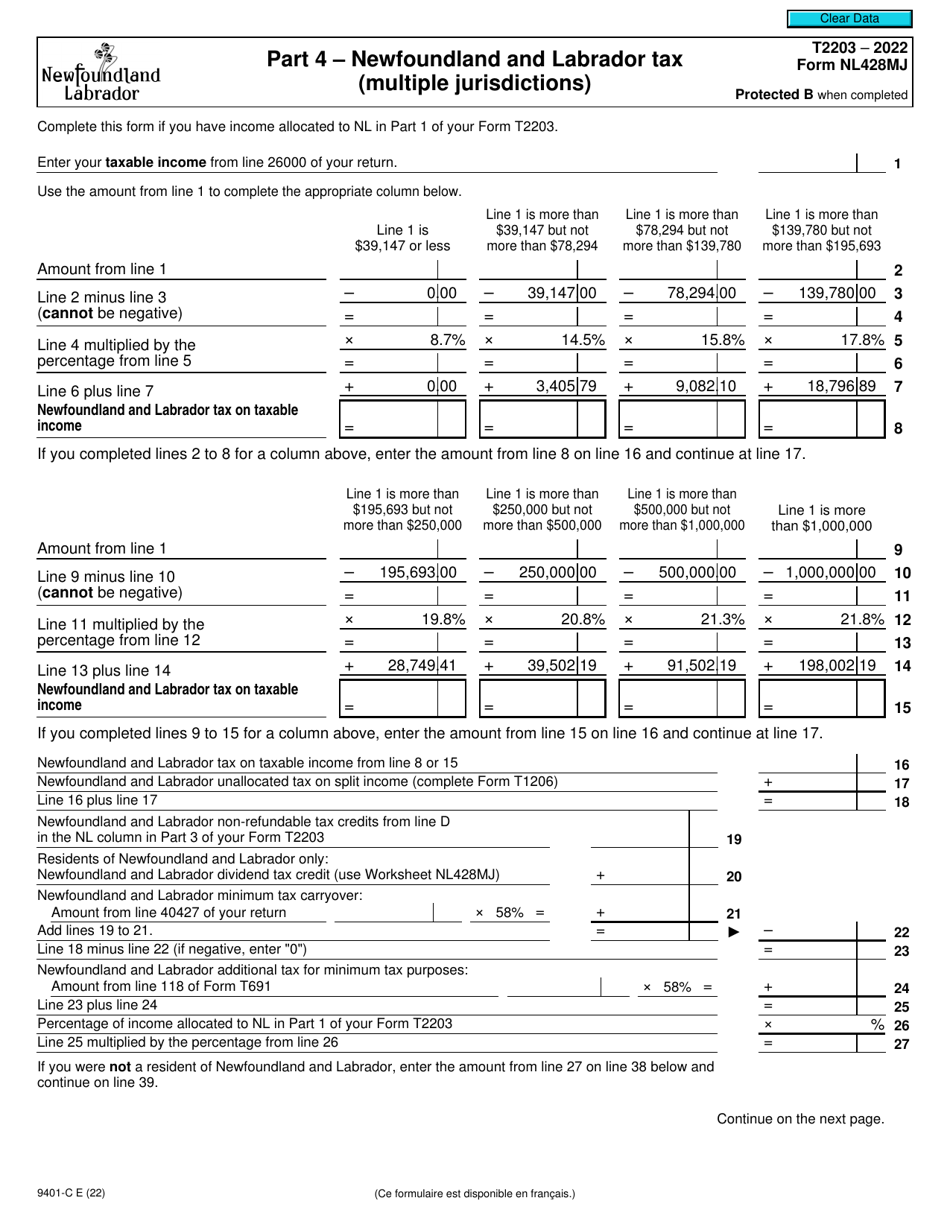

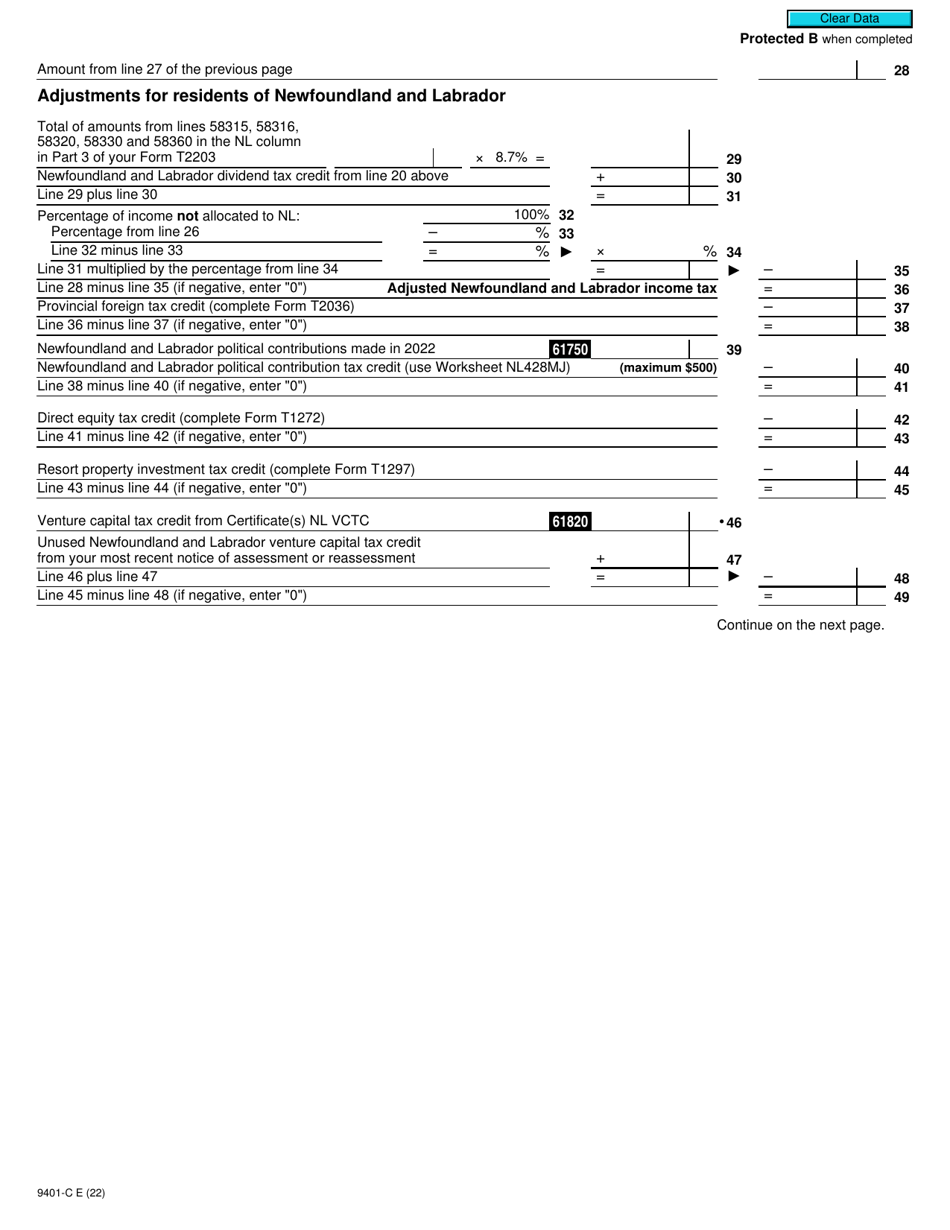

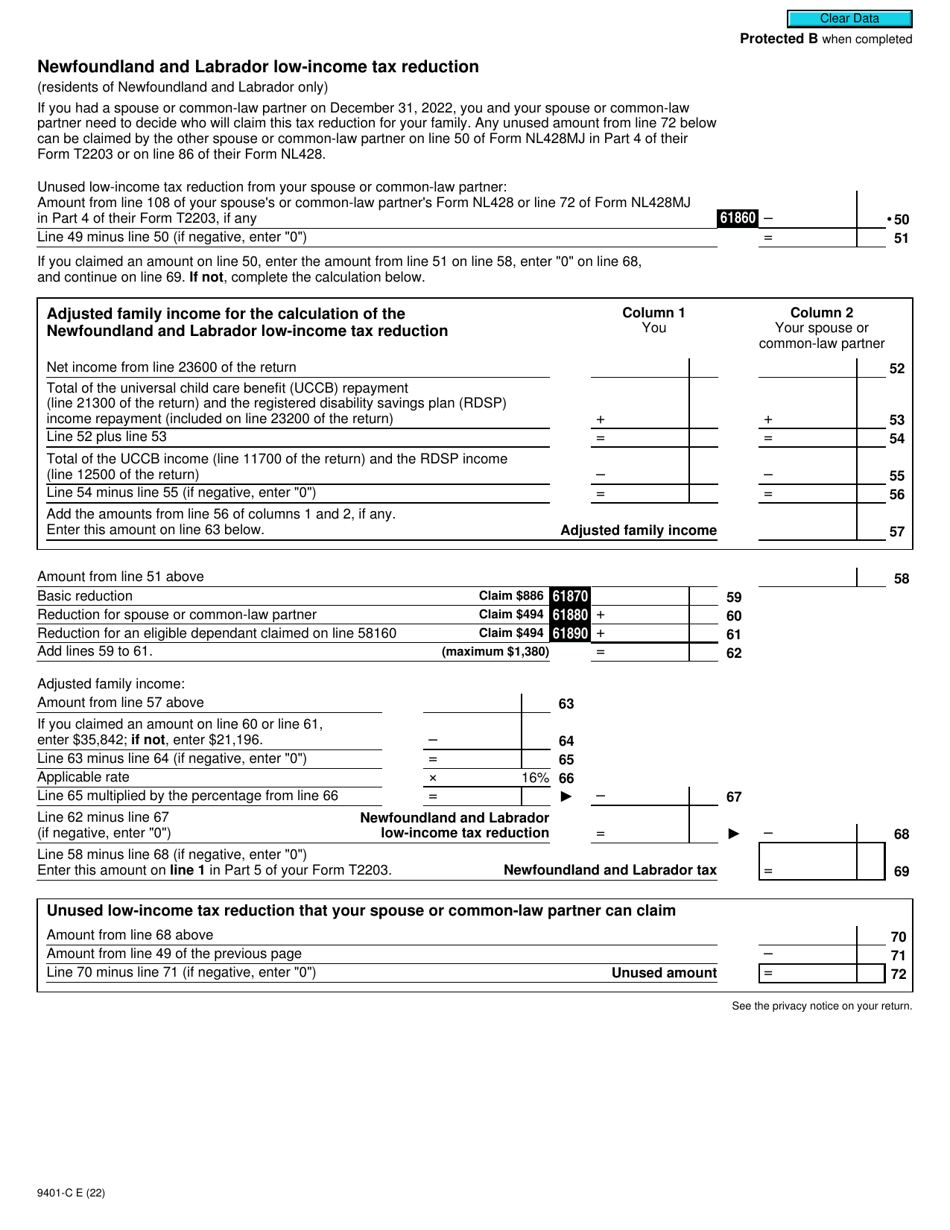

Form T2203 (NL428MJ; 9401-C) Part 4 Newfoundland and Labrador Tax (Multiple Jurisdictions) - Canada

Form T2203 (NL428MJ; 9401-C) Part 4 is used for reporting Newfoundland and Labrador tax for individuals who reside in multiple jurisdictions in Canada. It is a specific form that allows taxpayers to calculate and pay the correct amount of tax owed for their income in Newfoundland and Labrador.

The Form T2203 (NL428MJ; 9401-C) Part 4 Newfoundland and Labrador Tax (Multiple Jurisdictions) in Canada is filed by individuals who are residents of Newfoundland and Labrador and have income from multiple jurisdictions.

FAQ

Q: What is Form T2203?

A: Form T2203 is a tax form used in Canada.

Q: What is NL428MJ and 9401-C?

A: NL428MJ and 9401-C are specific codes or references related to the form.

Q: What is Part 4 of Form T2203?

A: Part 4 of Form T2203 refers to the section of the form that deals with Newfoundland and Labrador Tax.

Q: What is Newfoundland and Labrador Tax?

A: Newfoundland and Labrador Tax refers to the provincial tax imposed in the Newfoundland and Labrador province of Canada.

Q: What does 'Multiple Jurisdictions' mean on Form T2203?

A: 'Multiple Jurisdictions' on Form T2203 refers to the fact that the form is used to report taxes for multiple provinces within Canada.