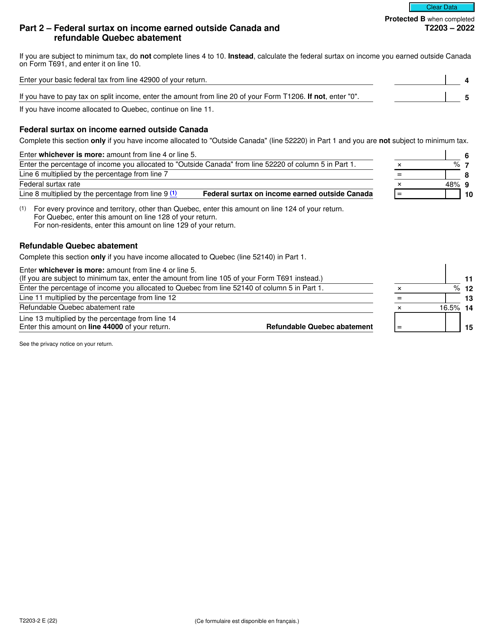

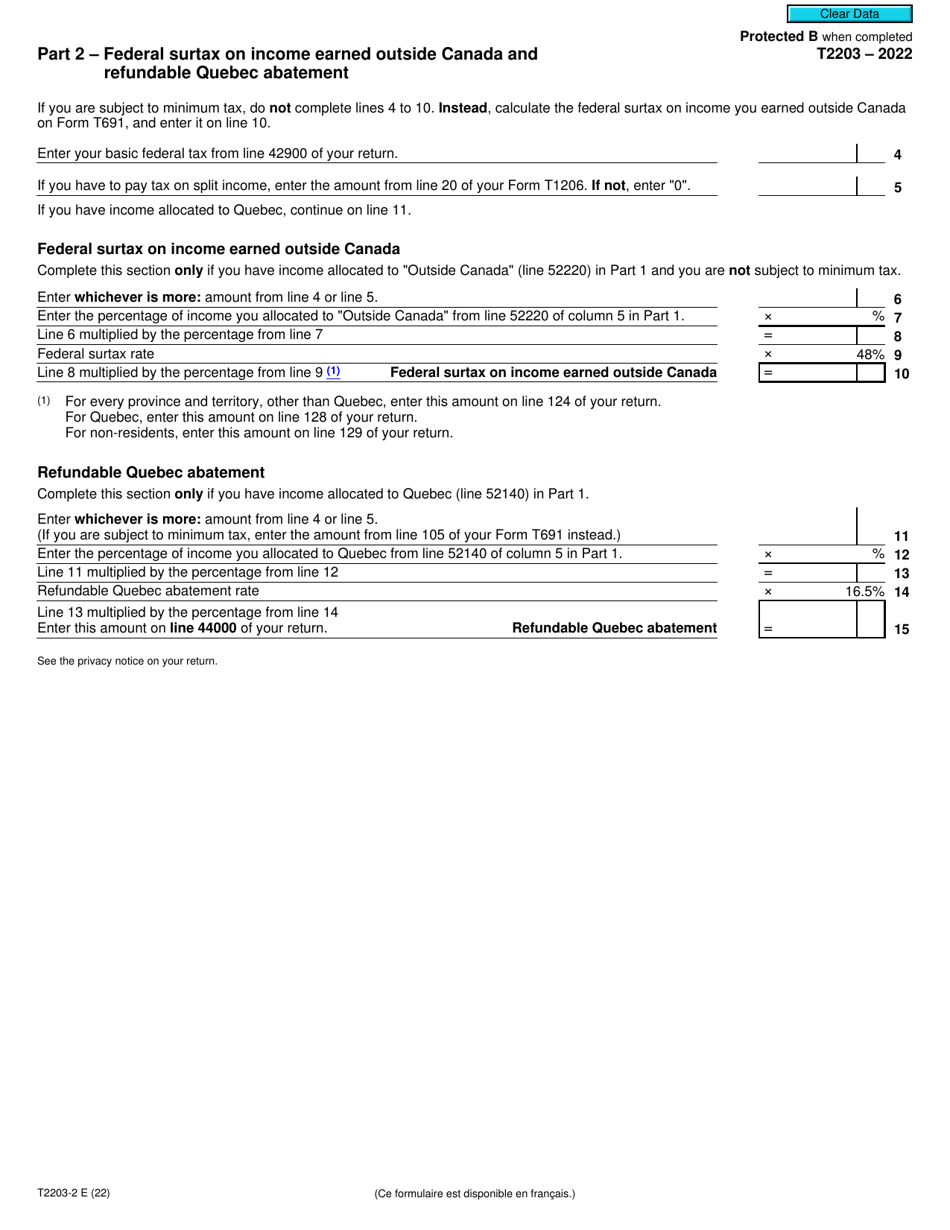

Form T2203-2 Part 2 Federal Surtax on Income Earned Outside Canada and Refundable Quebec Abatement - Canada

Form T2203-2 Part 2, also known as the Federal Surtax on Income Earned Outside Canada and Refundable Quebec Abatement, is a form used in Canada for individuals who have earned income outside of Canada and are eligible for certain tax benefits. This form helps calculate the federal surtax amount and the refundable Quebec abatement based on the income earned abroad.

Individuals who are Canadian residents and have income earned outside Canada file the Form T2203-2 Part 2 Federal Surtax on Income Earned Outside Canada and Refundable Quebec Abatement.

FAQ

Q: What is Form T2203-2?

A: Form T2203-2 is a tax form used in Canada.

Q: What is Part 2 of Form T2203-2 for?

A: Part 2 of Form T2203-2 is for reporting the Federal Surtax on Income Earned Outside Canada and the Refundable Quebec Abatement.

Q: What is the Federal Surtax on Income Earned Outside Canada?

A: The Federal Surtax is an additional tax imposed on income earned outside of Canada.

Q: What is the Refundable Quebec Abatement?

A: The Refundable Quebec Abatement is a reduction in taxes owed to the province of Quebec.

Q: Who needs to complete Form T2203-2?

A: Individuals who have income earned outside Canada and are eligible for the refundable Quebec abatement may need to complete this form.

Q: Do I need to file Form T2203-2 with my tax return?

A: Yes, if you are eligible for the refundable Quebec abatement and have income earned outside Canada, you should file Form T2203-2 along with your tax return.

Q: Are there any other forms related to Form T2203-2?

A: Yes, there may be additional forms or schedules that need to be filed depending on your specific tax situation. It is recommended to consult the CRA or a tax professional for guidance.