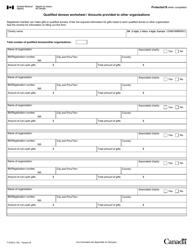

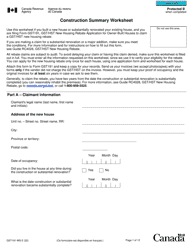

This version of the form is not currently in use and is provided for reference only. Download this version of

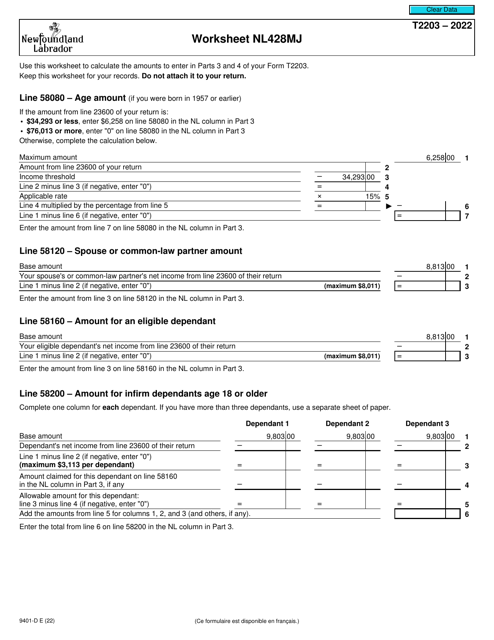

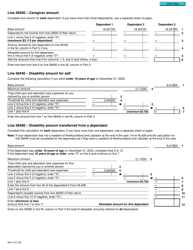

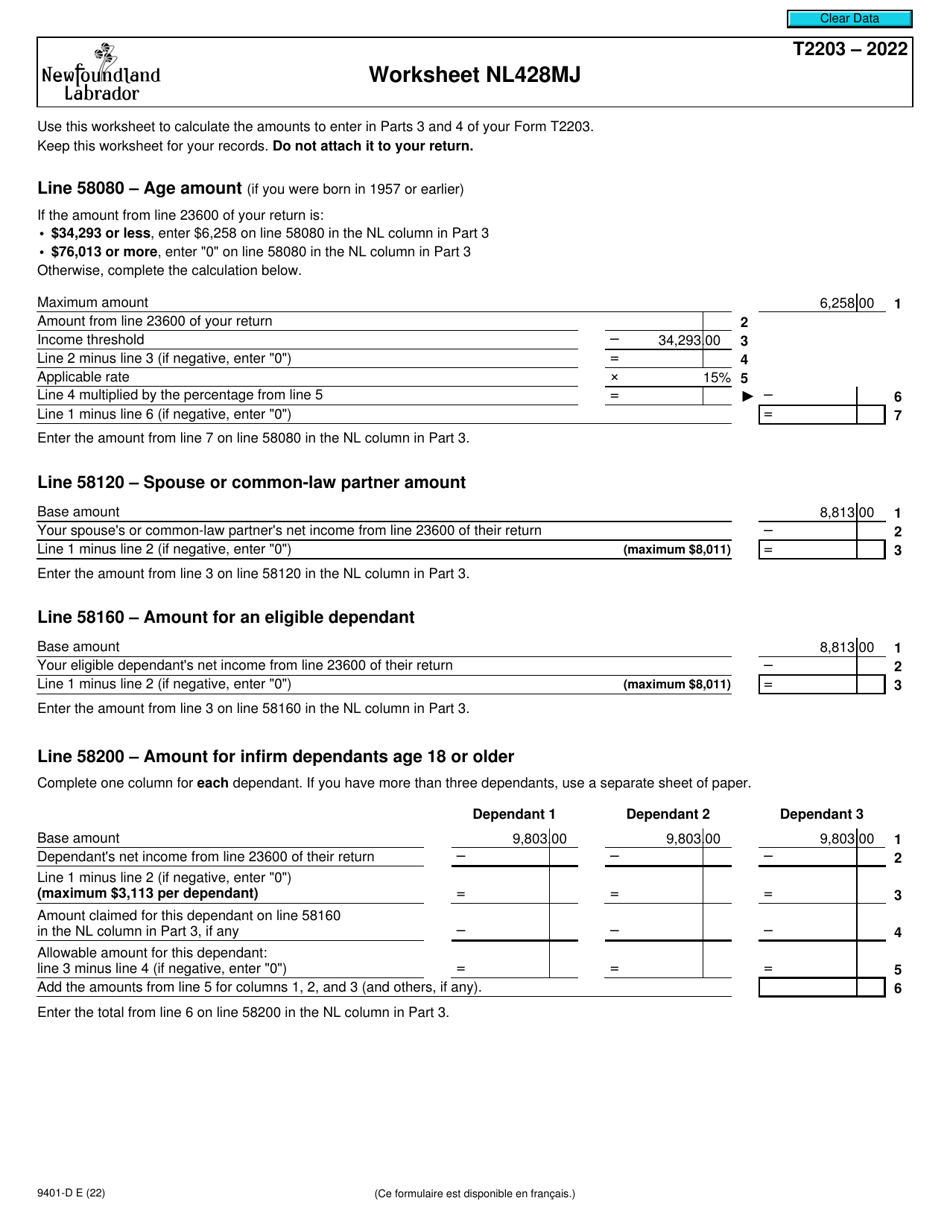

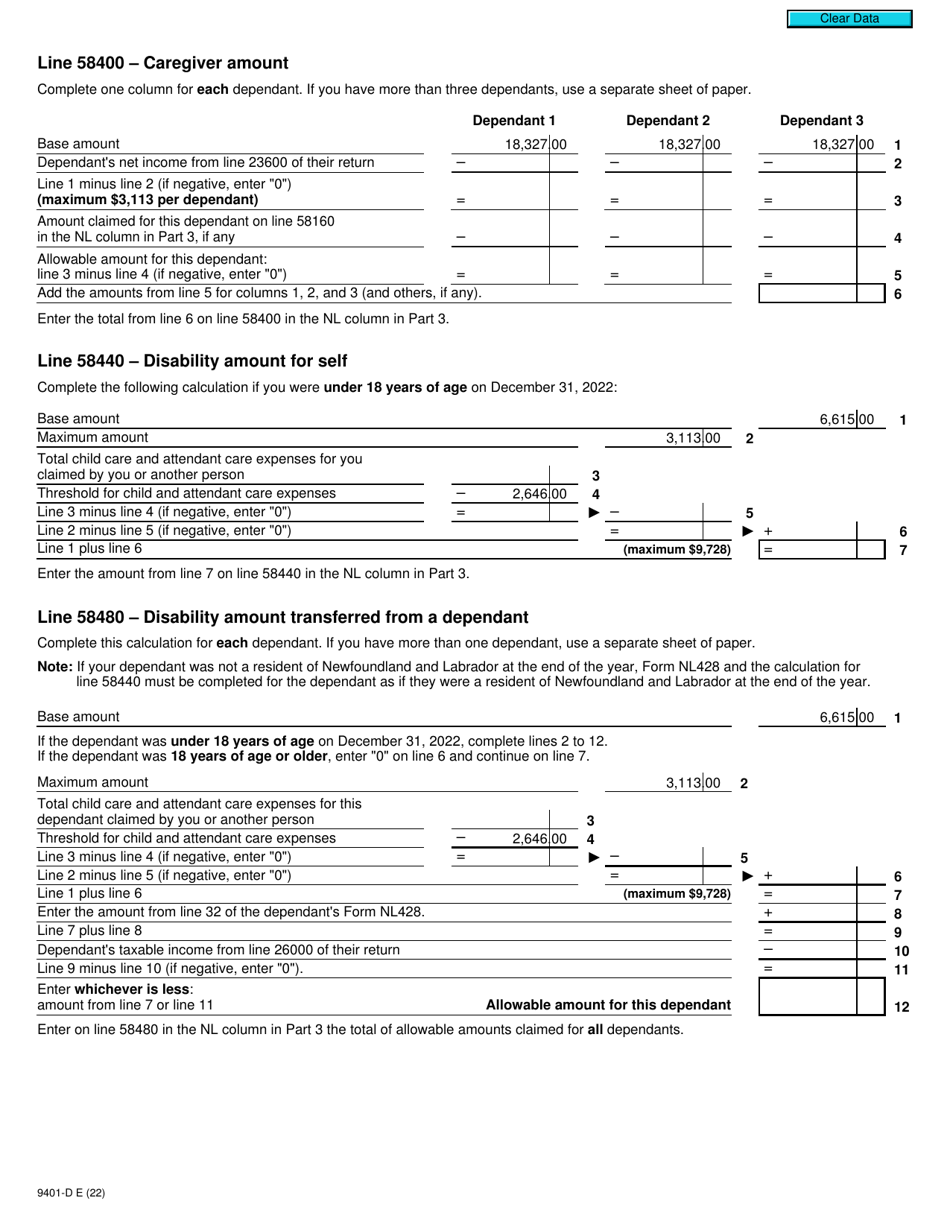

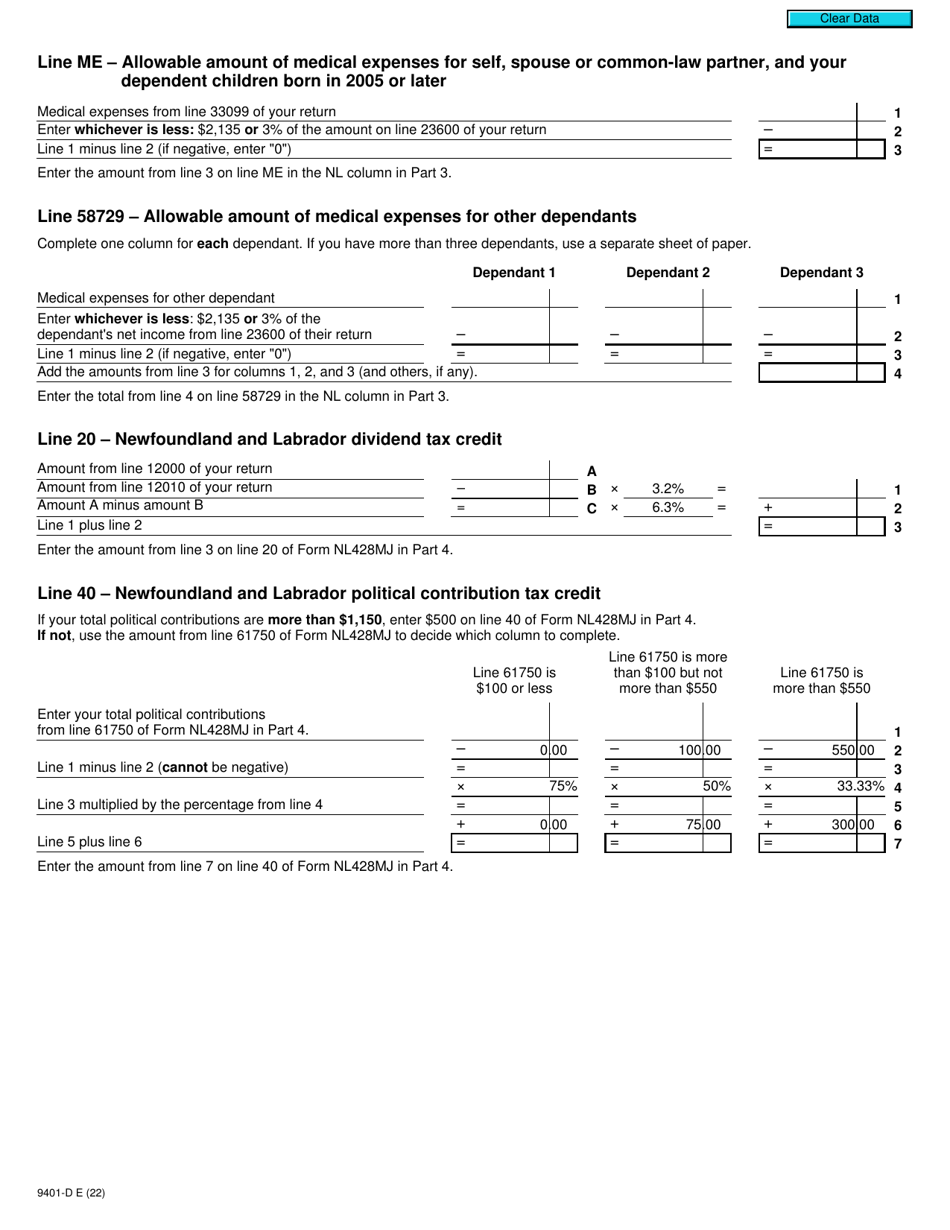

Form T2203 (9401-D) Worksheet NL428MJ

for the current year.

Form T2203 (9401-D) Worksheet NL428MJ Newfoundland and Labrador - Canada

Form T2203 (9401-D) Worksheet NL428MJ is used in Newfoundland and Labrador, Canada, for calculating the provincial tax credits and deductions for individuals. It helps individuals determine their Newfoundland and Labrador provincial tax liability and claim any applicable tax credits and deductions when filing their personal income tax return.

The Form T2203 (9401-D) Worksheet NL428MJ is filed by individuals who are residents of Newfoundland and Labrador in Canada. It is used to calculate the amount of provincial tax credits and adjustments that can be claimed on their income tax return.

FAQ

Q: What is Form T2203 (9401-D) Worksheet NL428MJ?

A: Form T2203 (9401-D) Worksheet NL428MJ is a tax form used by residents of Newfoundland and Labrador, Canada to calculate their provincial tax credits and deductions.

Q: Who is eligible to use Form T2203 (9401-D) Worksheet NL428MJ?

A: Residents of Newfoundland and Labrador, Canada are eligible to use Form T2203 (9401-D) Worksheet NL428MJ if they have income that is subject to provincial taxes.

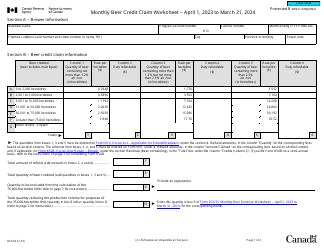

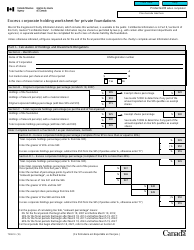

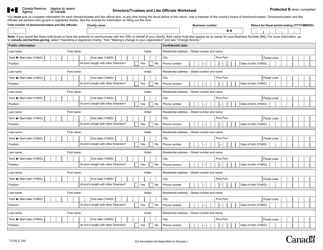

Q: What information is required to complete Form T2203 (9401-D) Worksheet NL428MJ?

A: To complete the form, you will need to provide personal information, details of your income, and information related to provincial tax credits and deductions.

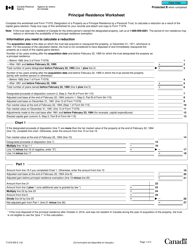

Q: What are the benefits of using Form T2203 (9401-D) Worksheet NL428MJ?

A: By using this form, you can calculate and claim provincial tax credits and deductions specific to Newfoundland and Labrador, which can help reduce your overall tax liability.

Q: When is the deadline to file Form T2203 (9401-D) Worksheet NL428MJ?

A: The deadline to file Form T2203 (9401-D) Worksheet NL428MJ is generally the same as the federal tax return deadline, which is April 30th of the following year.

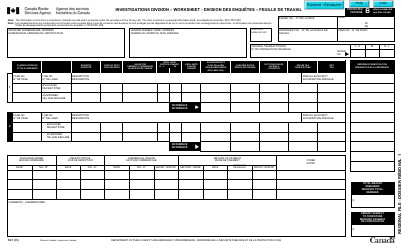

Q: Can I file Form T2203 (9401-D) Worksheet NL428MJ electronically?

A: Yes, you can file Form T2203 (9401-D) Worksheet NL428MJ electronically using the CRA's NETFILE service or through certain certified tax software.

Q: Are there any specific instructions or guidelines for completing Form T2203 (9401-D) Worksheet NL428MJ?

A: Yes, the form comes with detailed instructions that provide guidance on how to complete each section and calculate the provincial tax credits and deductions accurately.