This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5011-S2 Schedule YT(S2)

for the current year.

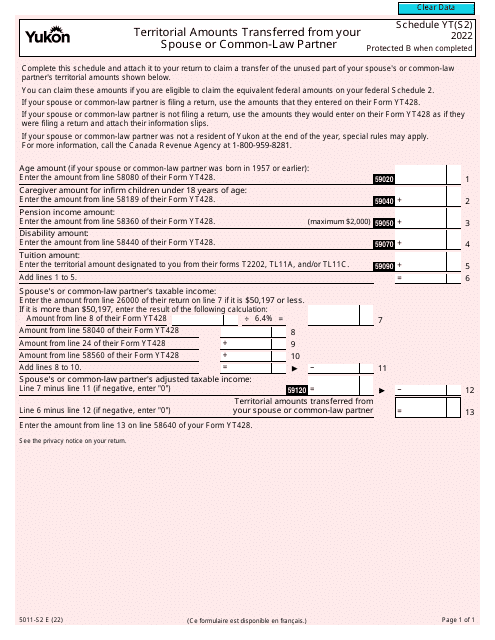

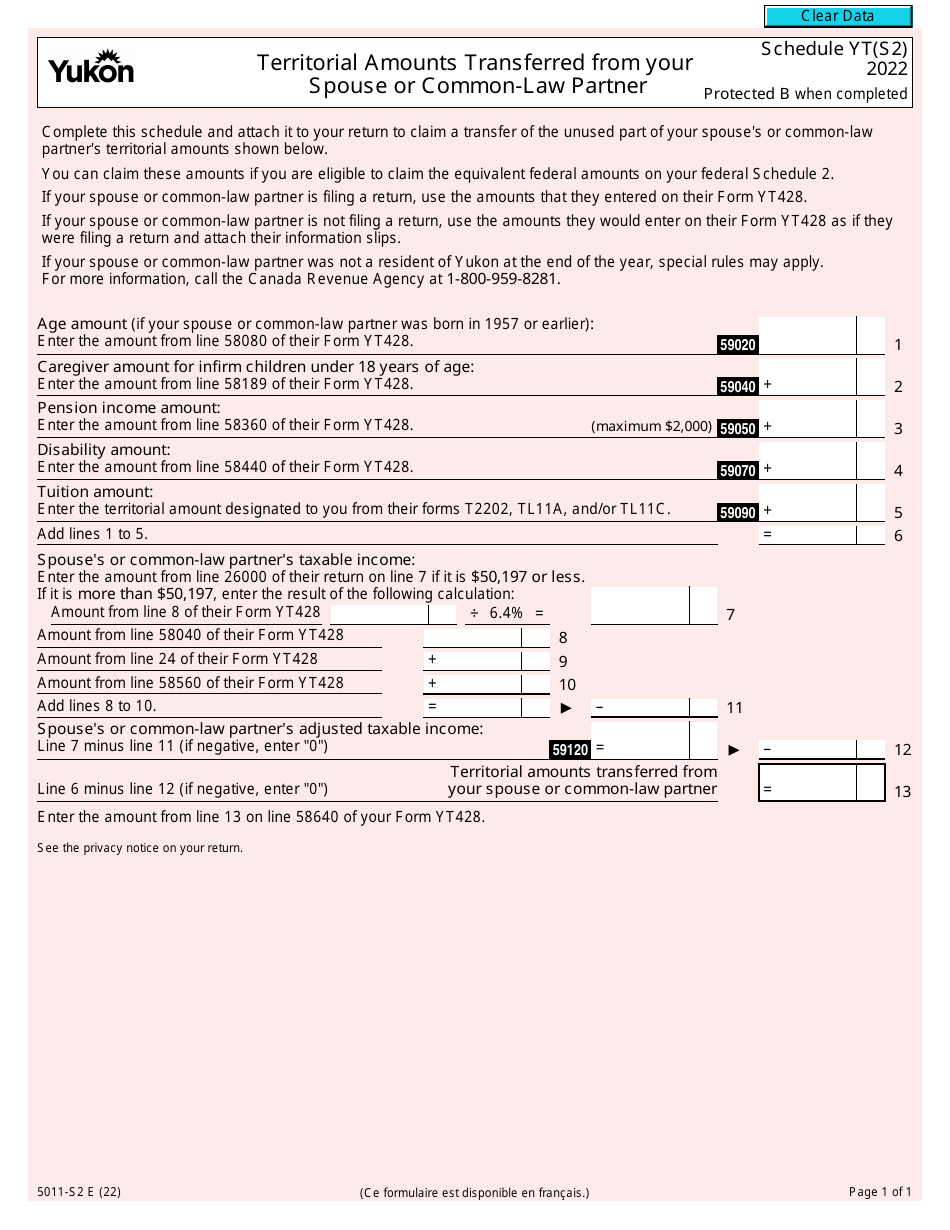

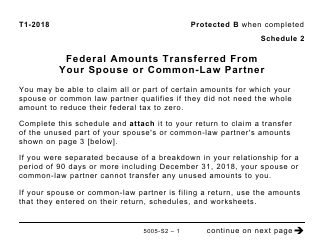

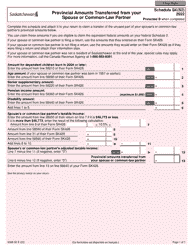

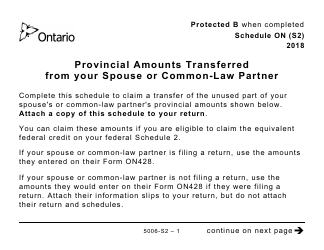

Form 5011-S2 Schedule YT(S2) Territorial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5011-S2 Schedule YT(S2) is used in Canada to report territorial amounts transferred from your spouse or common-law partner. It is specifically used for determining territorial tax credits and deductions on your tax return.

FAQ

Q: What is Form 5011-S2 Schedule YT(S2)?

A: Form 5011-S2 Schedule YT(S2) is a tax form used in Canada to report territorial amounts transferred from your spouse or common-law partner.

Q: What are territorial amounts?

A: Territorial amounts are amounts that can be transferred between spouses or common-law partners in Canada for tax purposes.

Q: Who needs to file Form 5011-S2 Schedule YT(S2)?

A: Individuals in Canada who have territorial amounts transferred from their spouse or common-law partner need to file Form 5011-S2 Schedule YT(S2).

Q: How do I fill out Form 5011-S2 Schedule YT(S2)?

A: You need to provide your personal information, as well as details about the territorial amounts transferred from your spouse or common-law partner.

Q: When do I need to file Form 5011-S2 Schedule YT(S2)?

A: Form 5011-S2 Schedule YT(S2) should be filed with your annual tax return, typically by the tax filing deadline in Canada.

Q: Are there any penalties for not filing Form 5011-S2 Schedule YT(S2) when required?

A: Yes, there can be penalties for not filing Form 5011-S2 Schedule YT(S2) when required. It's important to comply with the tax filing requirements set by the Canada Revenue Agency (CRA).

Q: Can I e-file Form 5011-S2 Schedule YT(S2)?

A: No, currently you cannot e-file Form 5011-S2 Schedule YT(S2). You need to submit it by mail or in person to the Canada Revenue Agency (CRA).

Q: Is Form 5011-S2 Schedule YT(S2) only for residents of Canada?

A: Yes, Form 5011-S2 Schedule YT(S2) is specifically for residents of Canada who have territorial amounts transferred from their spouse or common-law partner.