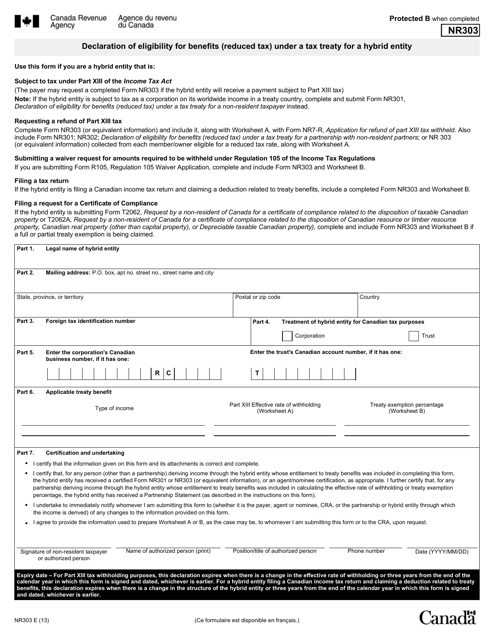

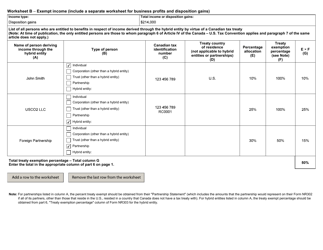

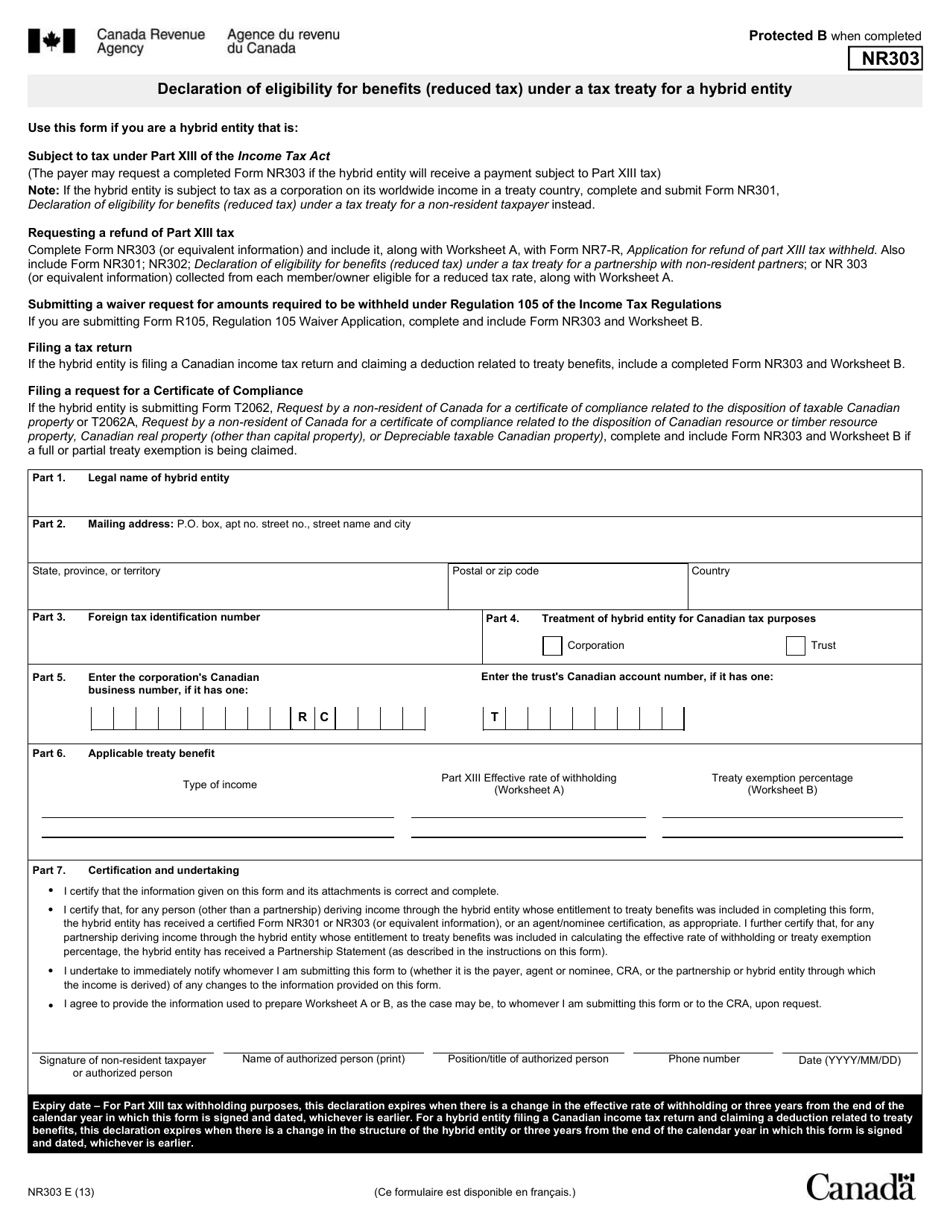

Form NR303 Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Hybrid Entity - Canada

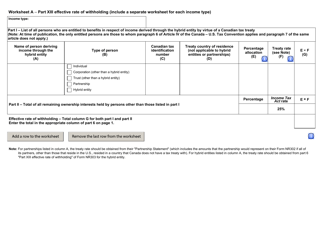

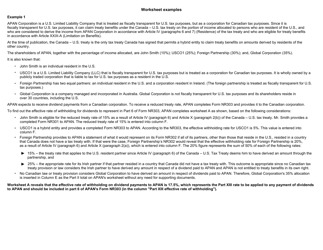

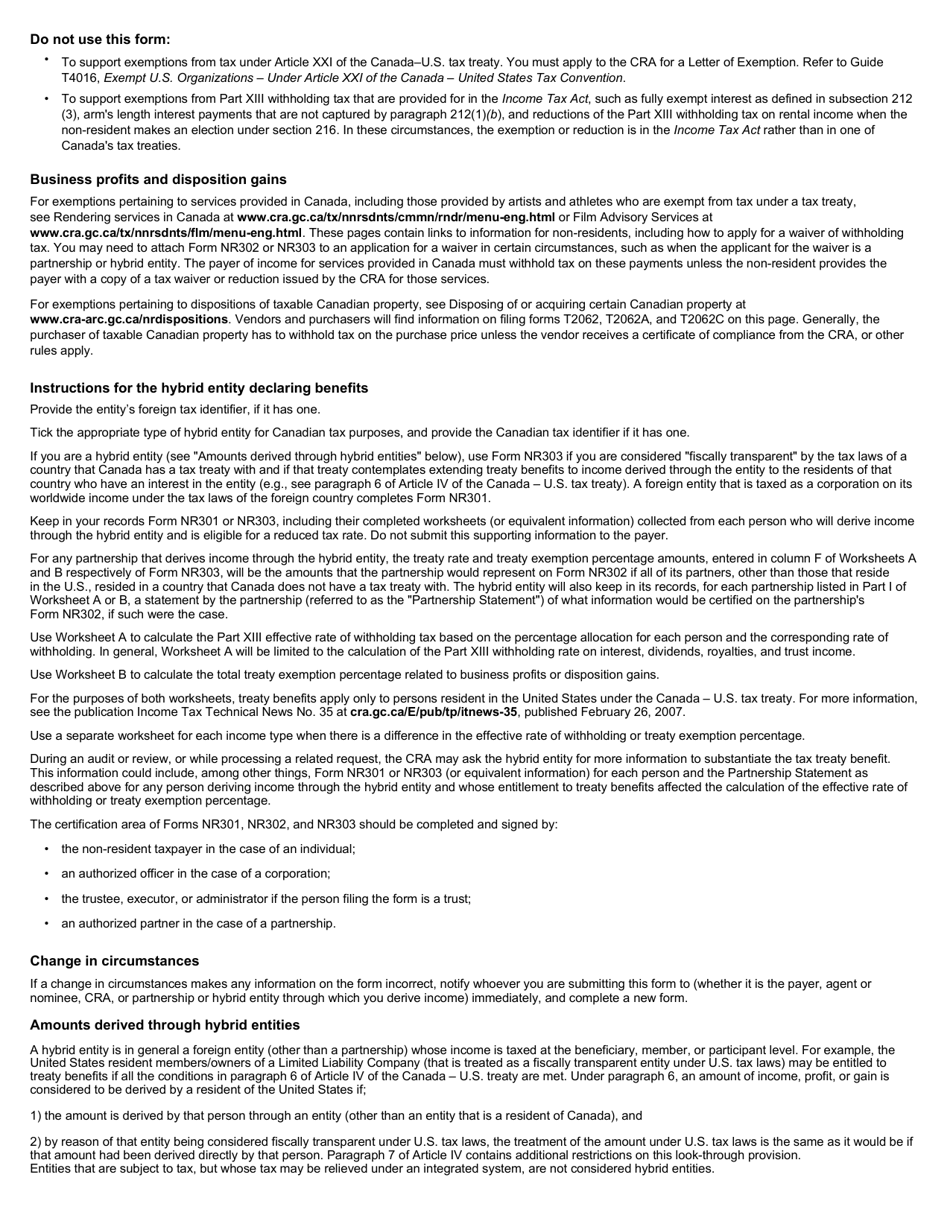

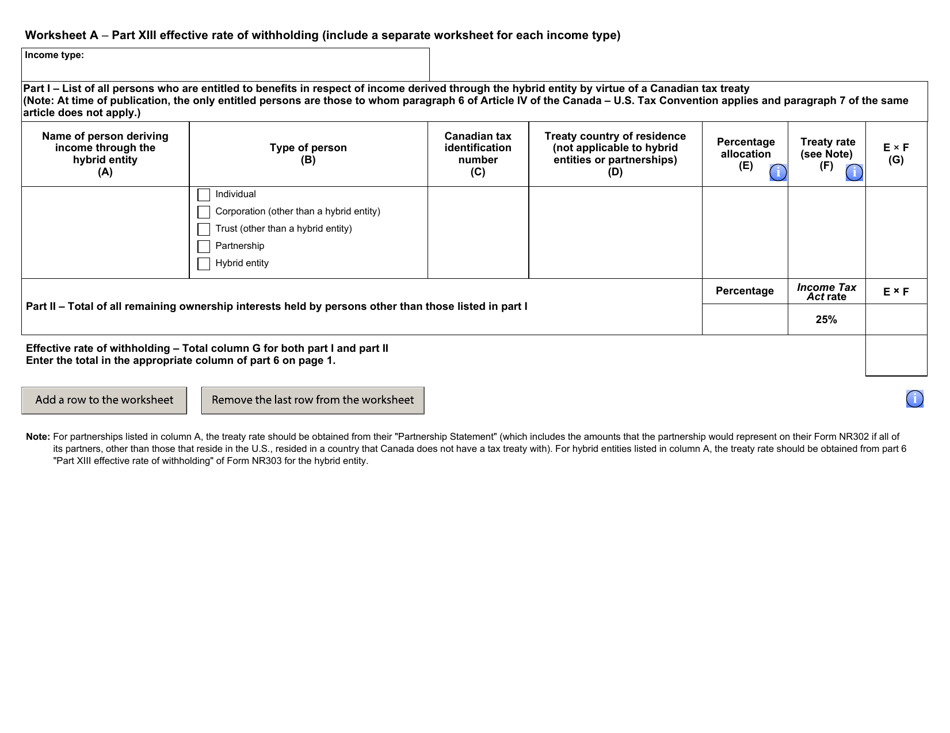

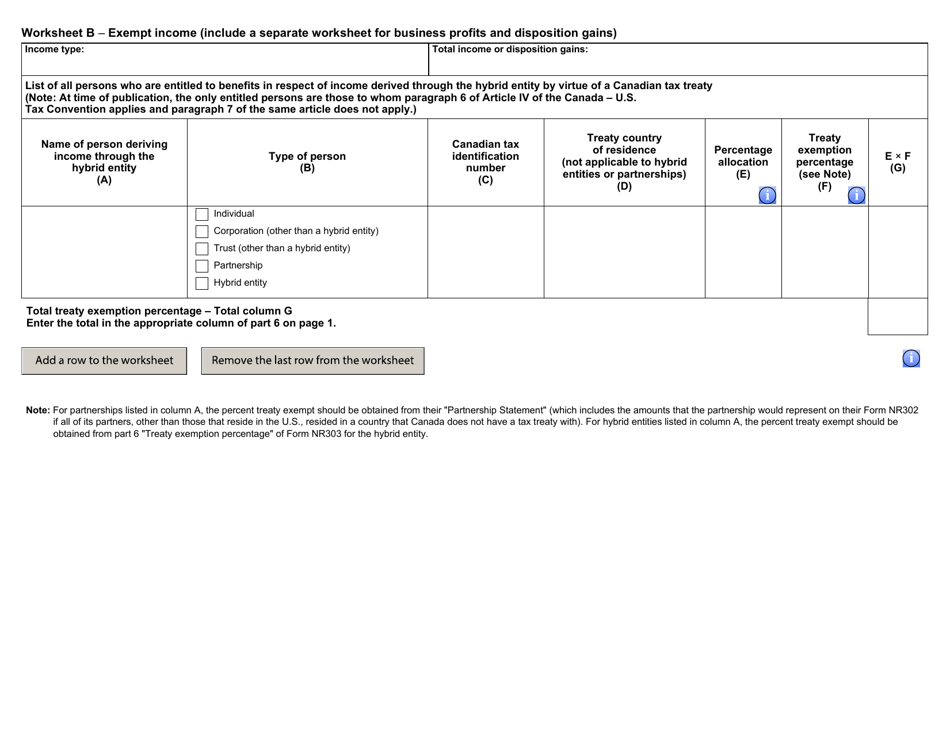

Form NR303 Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Hybrid Entity - Canada is used to determine if a hybrid entity in Canada is eligible for reduced tax rates under a tax treaty between the United States and Canada.

The Form NR303 Declaration of Eligibility for Benefits (Reduced Tax) Under a Tax Treaty for a Hybrid Entity in Canada is filed by the hybrid entity itself.

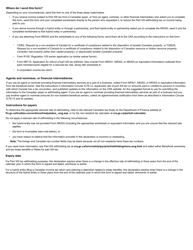

FAQ

Q: What is Form NR303?

A: Form NR303 is a declaration of eligibility for benefits under a tax treaty for a hybrid entity - Canada.

Q: What is the purpose of Form NR303?

A: The purpose of Form NR303 is to declare eligibility for reduced tax benefits under a tax treaty for a hybrid entity.

Q: Who needs to file Form NR303?

A: Form NR303 needs to be filed by a hybrid entity in Canada that wants to claim reduced tax benefits under a tax treaty.

Q: What are reduced tax benefits under a tax treaty?

A: Reduced tax benefits under a tax treaty refer to special tax rates or exemptions that a hybrid entity may be eligible for.

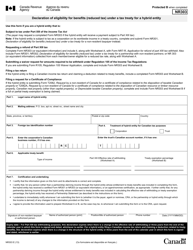

Q: Do I need to include any supporting documents with Form NR303?

A: Yes, you may need to include supporting documents that prove your eligibility for reduced tax benefits.

Q: When should I file Form NR303?

A: Form NR303 should be filed before the first payment subject to withholding tax.