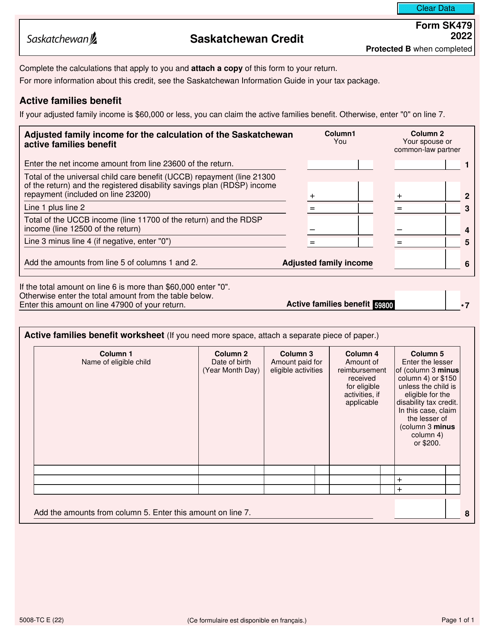

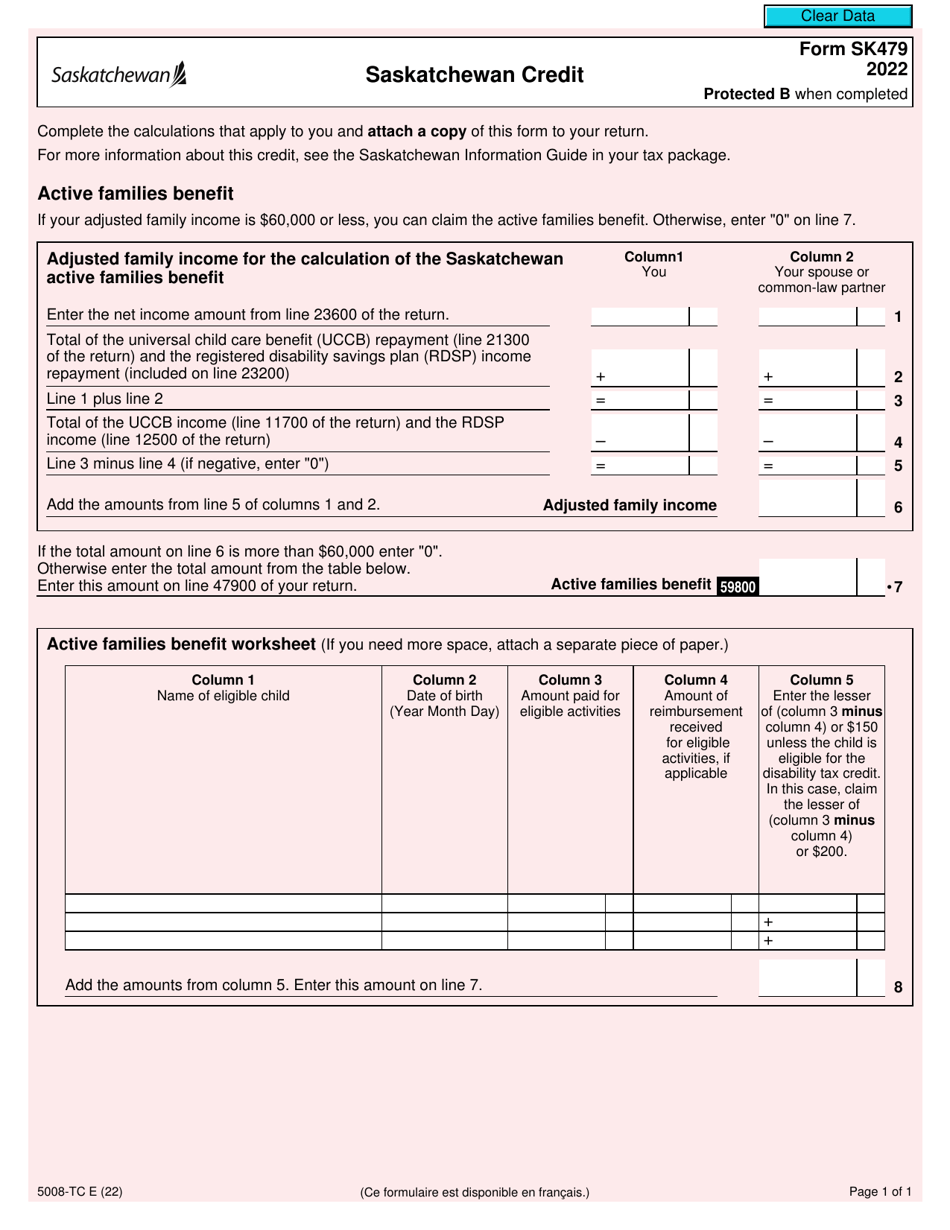

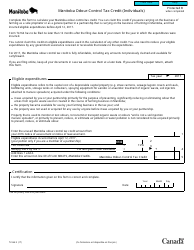

Form SK479 (5008-TC) Saskatchewan Credit - Canada

Form SK479 (5008-TC) Saskatchewan Credit - Canada is used for claiming the Saskatchewan tax credit on your Canadian income tax return. This credit is available to eligible taxpayers who reside in Saskatchewan and meet certain criteria.

The Form SK479 (5008-TC) Saskatchewan Credit - Canada is filed by residents of Saskatchewan, Canada who meet the eligibility requirements for the Saskatchewan tax credit.

FAQ

Q: What is Form SK479?

A: Form SK479 is a tax form used in Saskatchewan, Canada.

Q: What is the purpose of Form SK479?

A: Form SK479 is used to claim the Saskatchewan credit on your Canadian tax return.

Q: Who is eligible to claim the Saskatchewan credit?

A: Residents of Saskatchewan who meet the eligibility criteria are eligible to claim the Saskatchewan credit.

Q: What is the eligibility criteria for the Saskatchewan credit?

A: To be eligible for the Saskatchewan credit, you must have been a resident of Saskatchewan, have a net income for tax purposes, and meet the other criteria set by the government.

Q: What expenses can be claimed on Form SK479?

A: Form SK479 allows you to claim expenses such as childcare expenses, employment expenses, and other eligible deductions.

Q: When is the deadline to file Form SK479?

A: The deadline to file Form SK479 is typically the same as the deadline for filing your Canadian tax return, which is April 30th.

Q: Are there any penalties for late filing of Form SK479?

A: Late filing of Form SK479 may result in penalties, so it is important to file it on time.

Q: Can I file Form SK479 electronically?

A: Yes, you can file Form SK479 electronically using the CRA's NetFile system.

Q: What should I do if I have questions or need help with Form SK479?

A: If you have questions or need help with Form SK479, you can contact the Canada Revenue Agency or seek assistance from a tax professional.