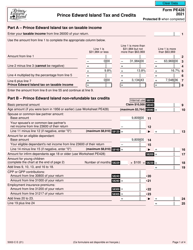

This version of the form is not currently in use and is provided for reference only. Download this version of

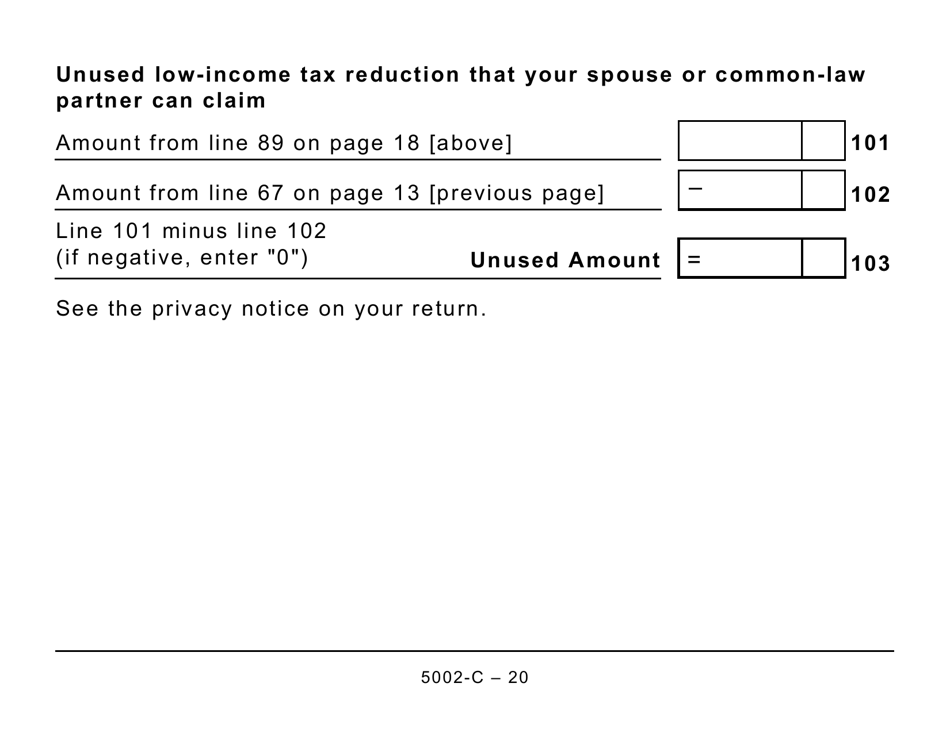

Form 5002-C (PE428)

for the current year.

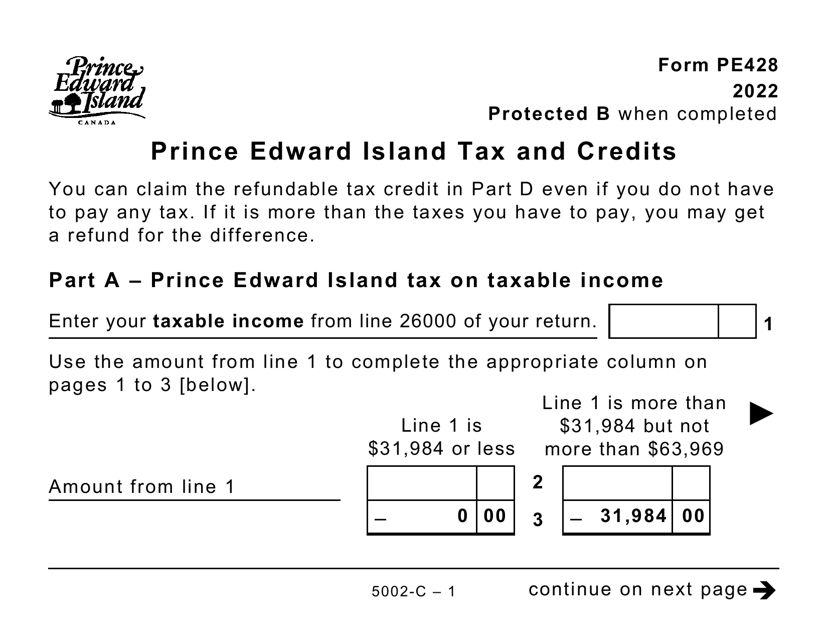

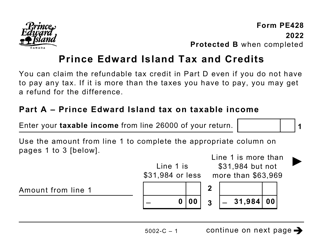

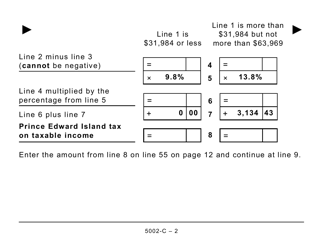

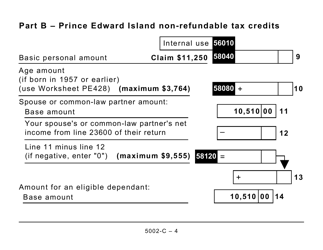

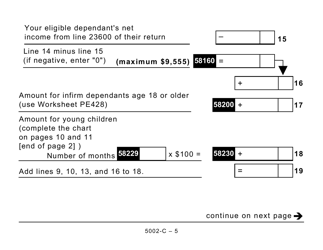

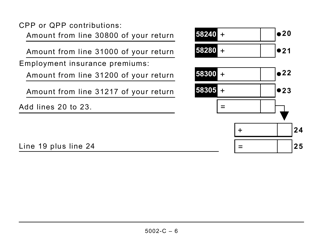

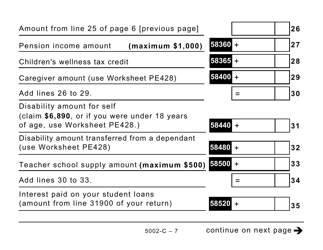

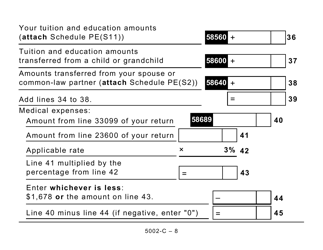

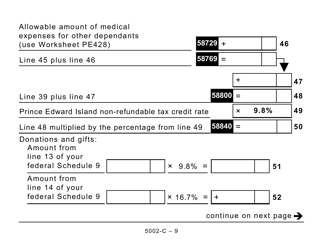

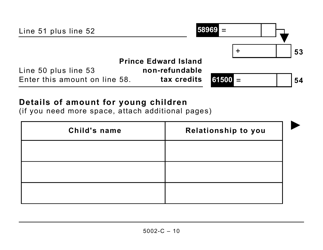

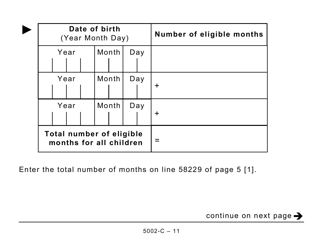

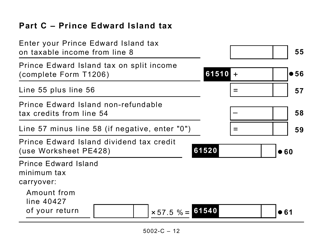

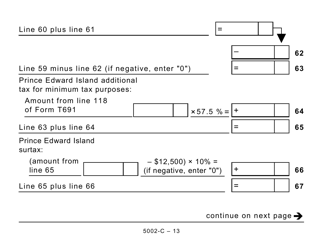

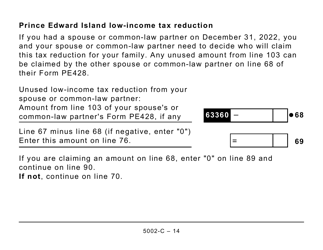

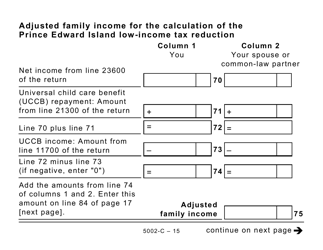

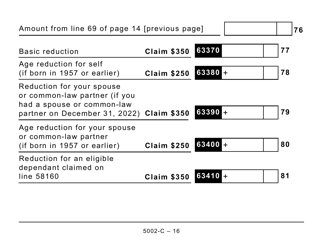

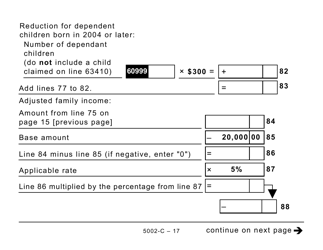

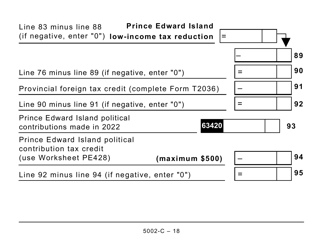

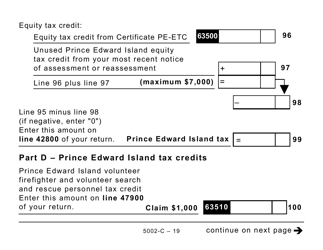

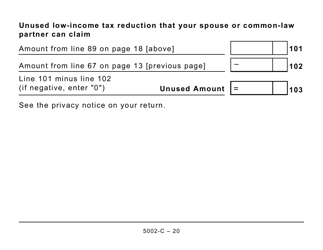

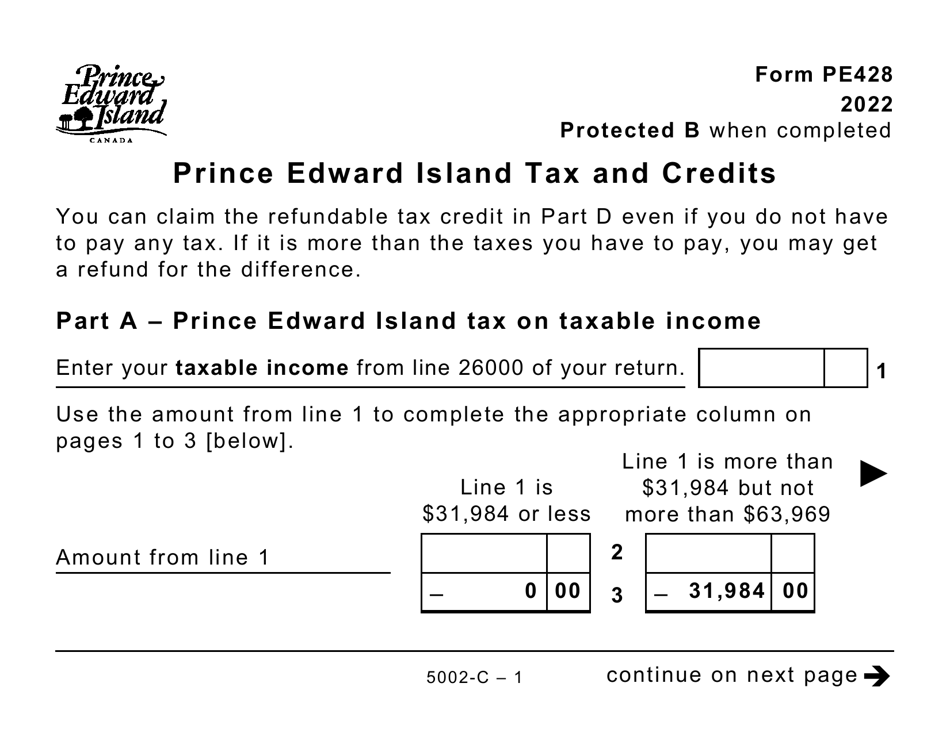

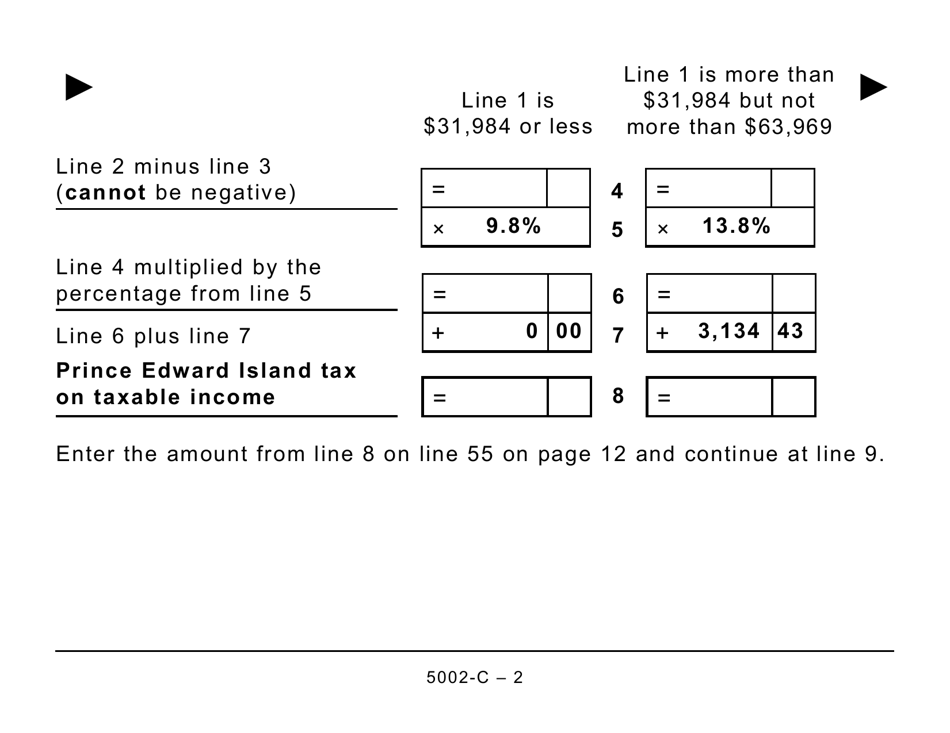

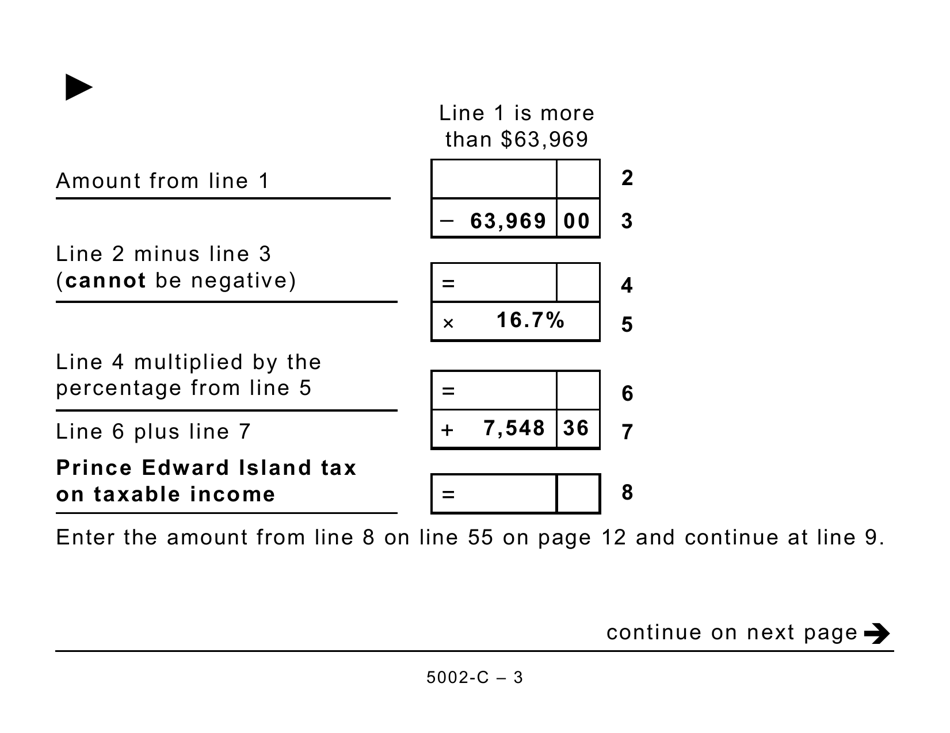

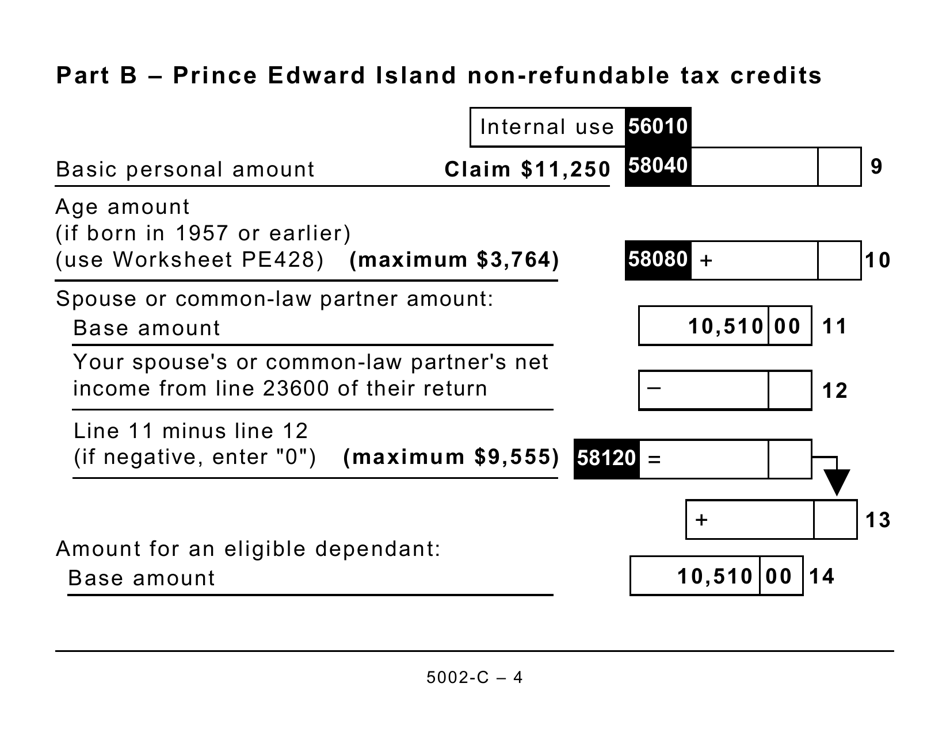

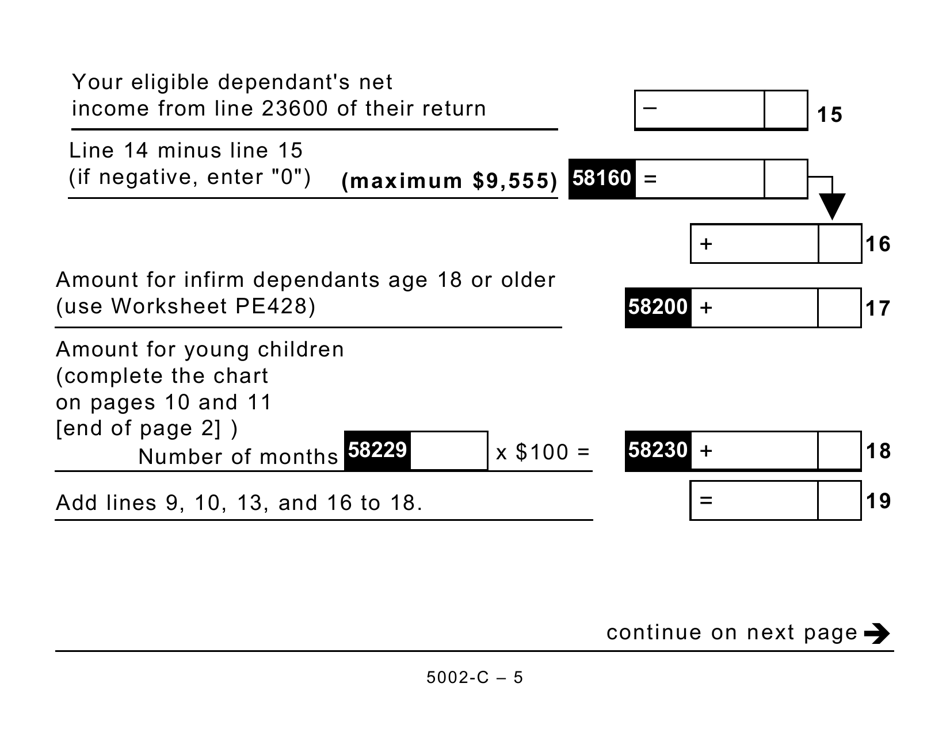

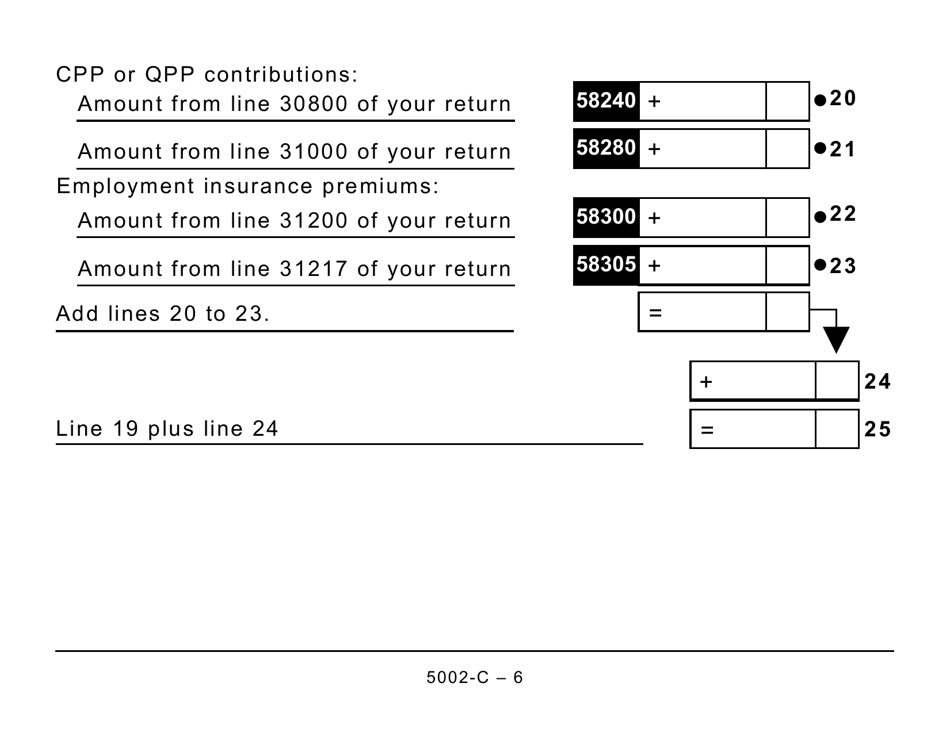

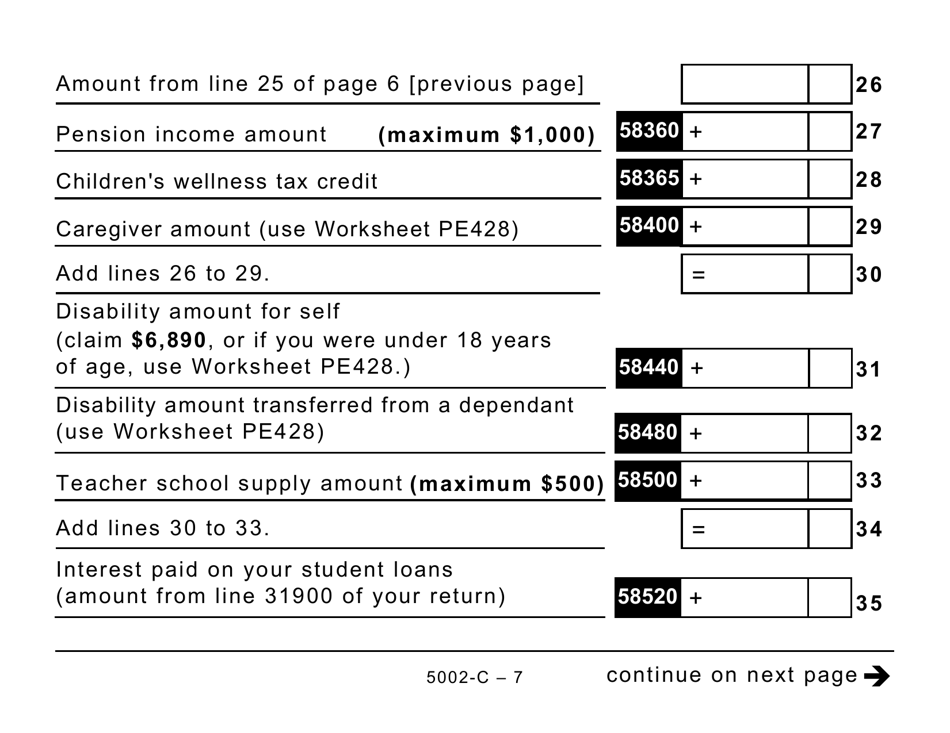

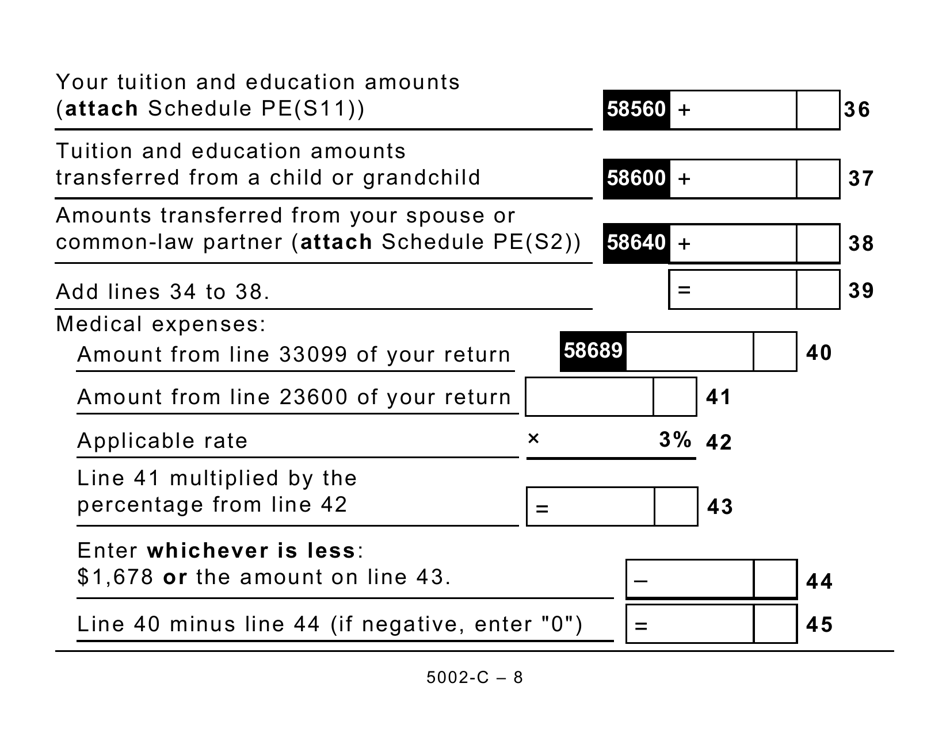

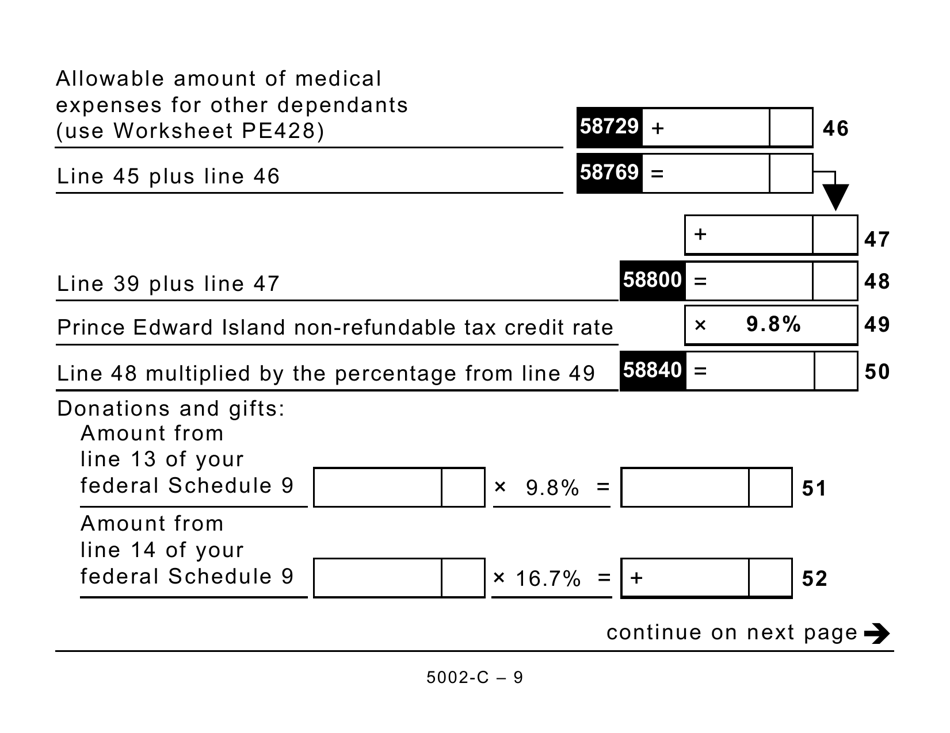

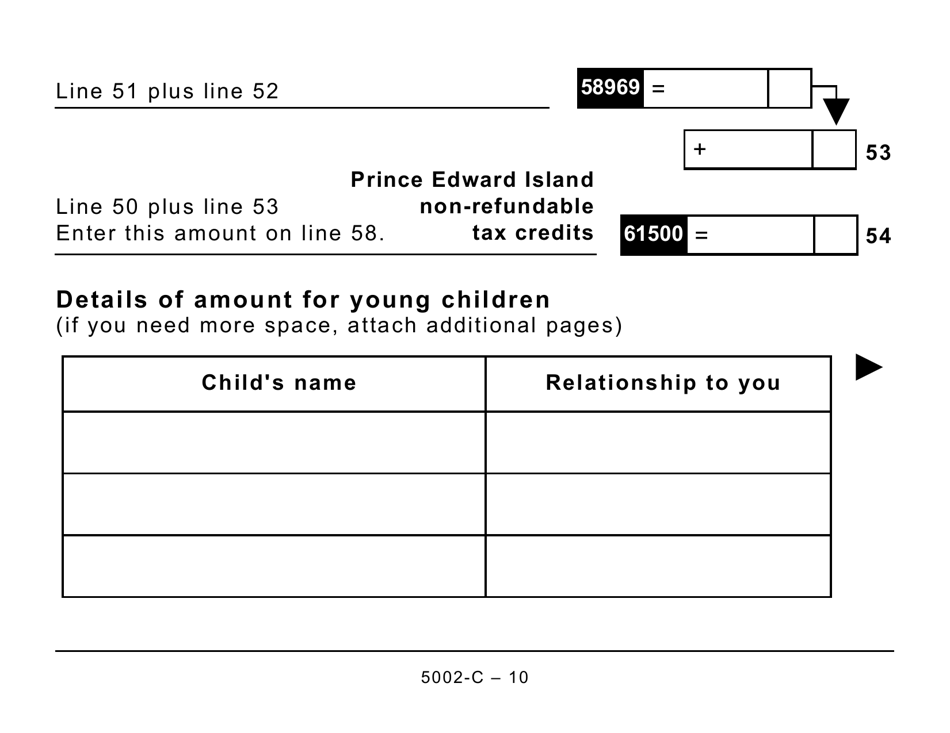

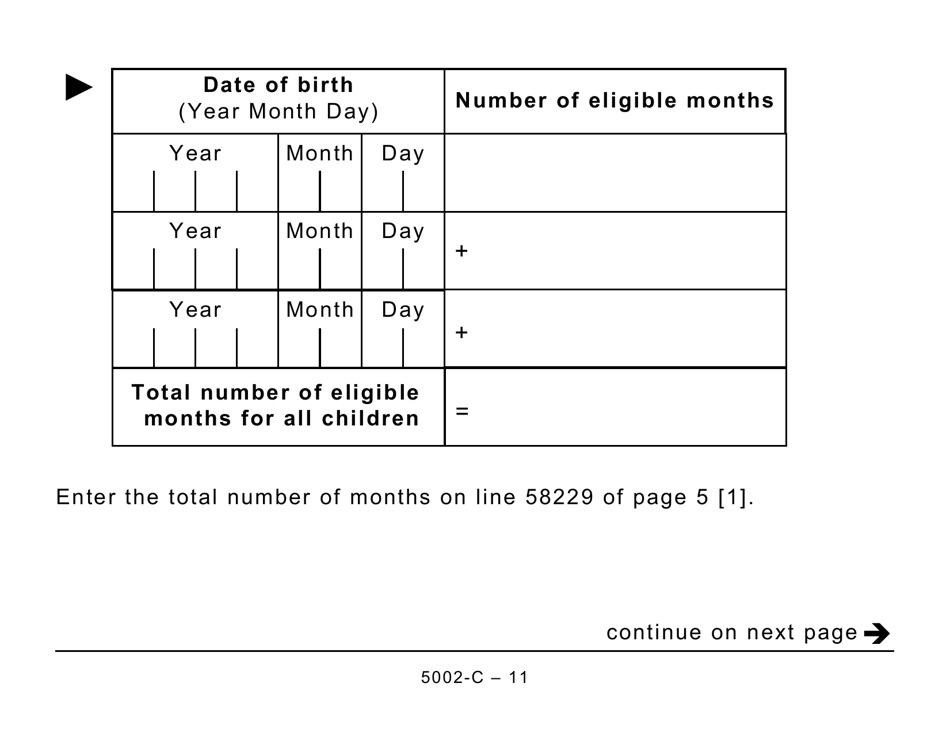

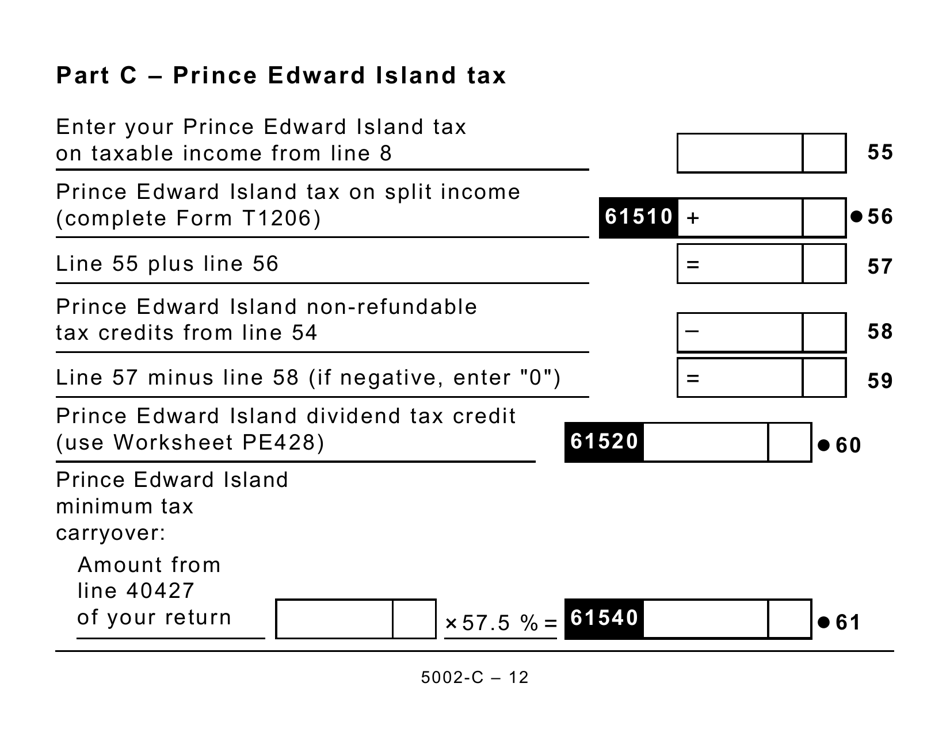

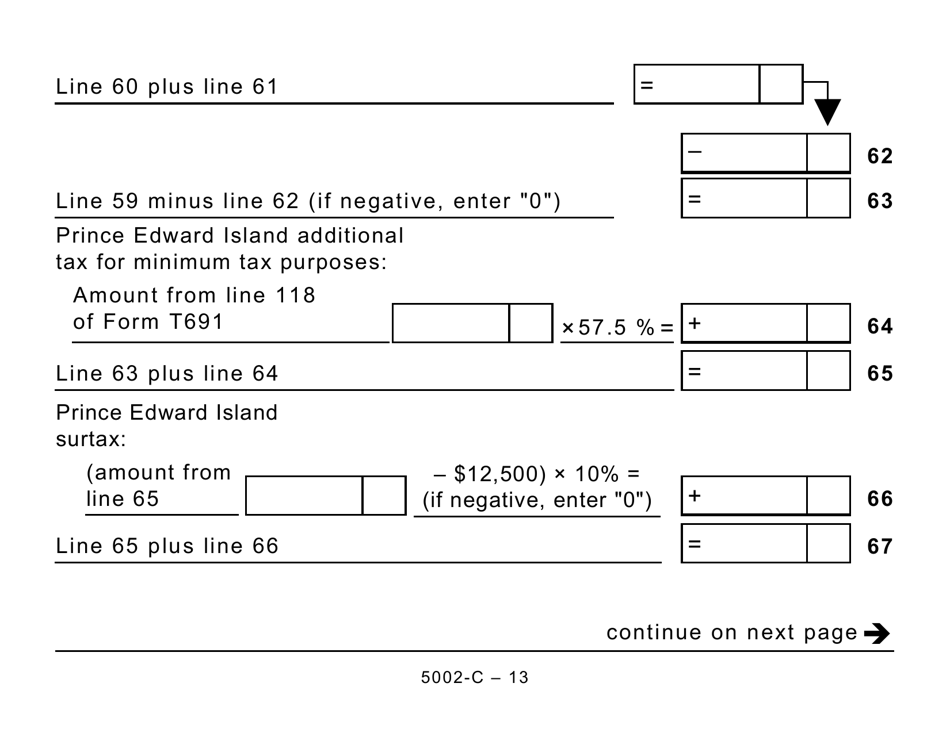

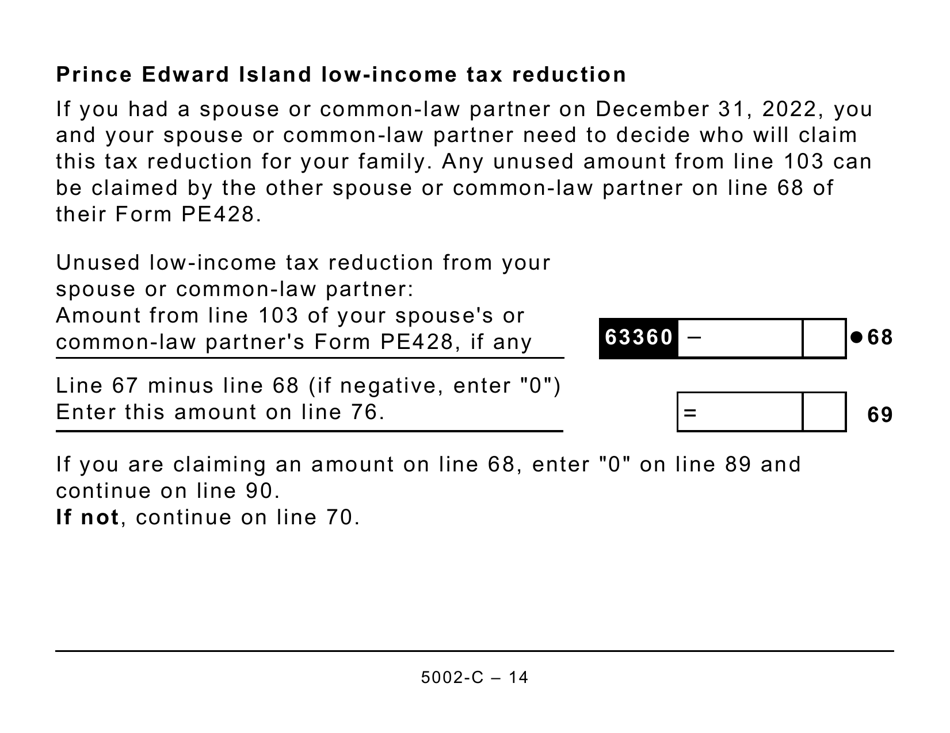

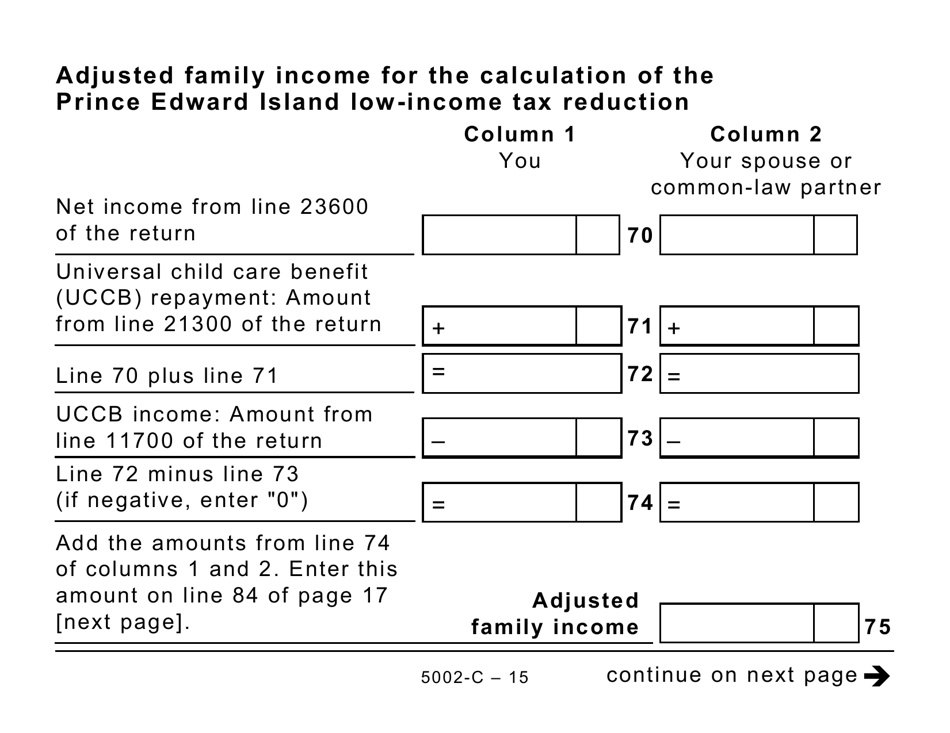

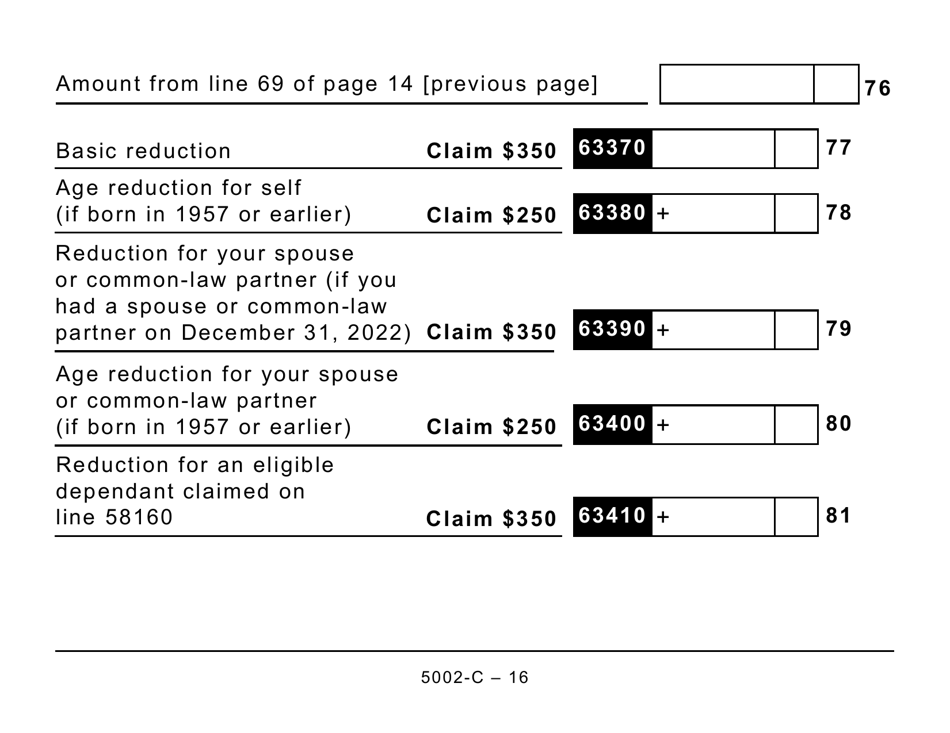

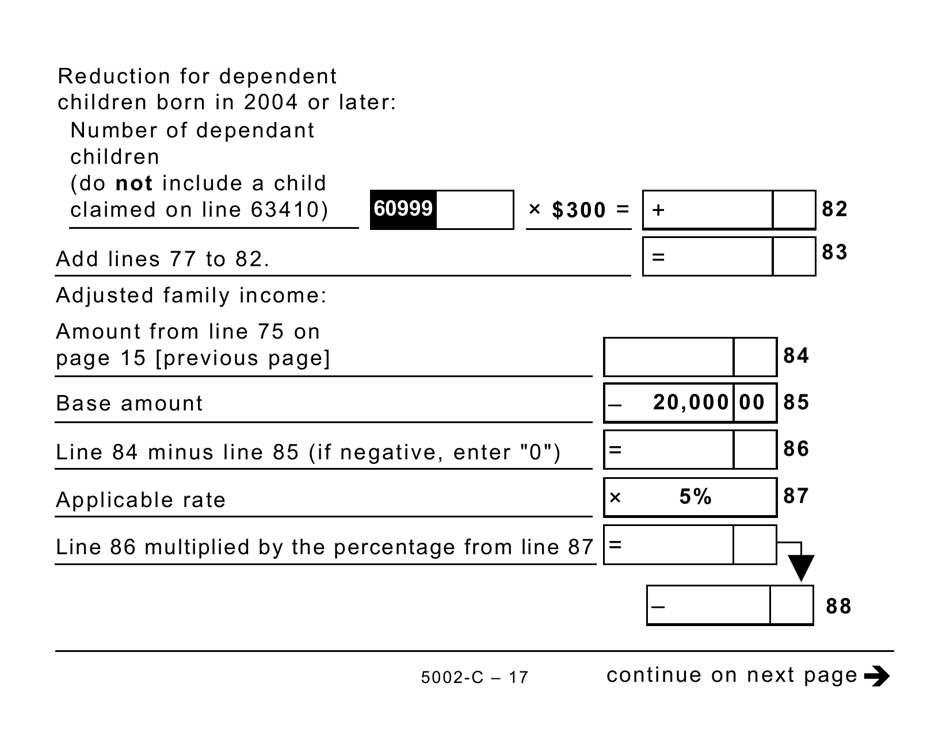

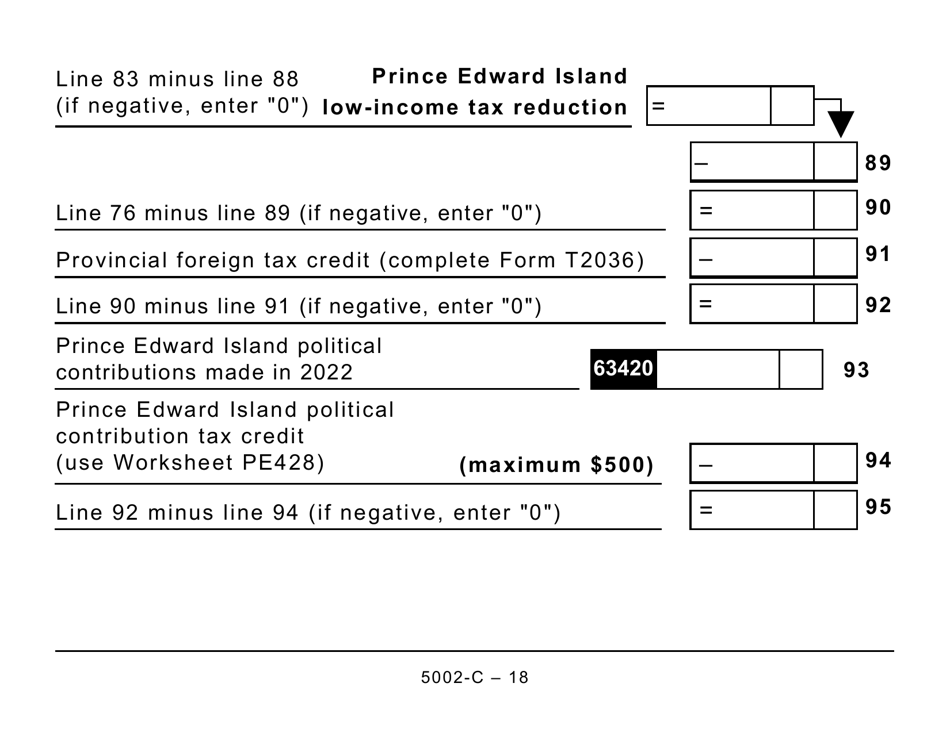

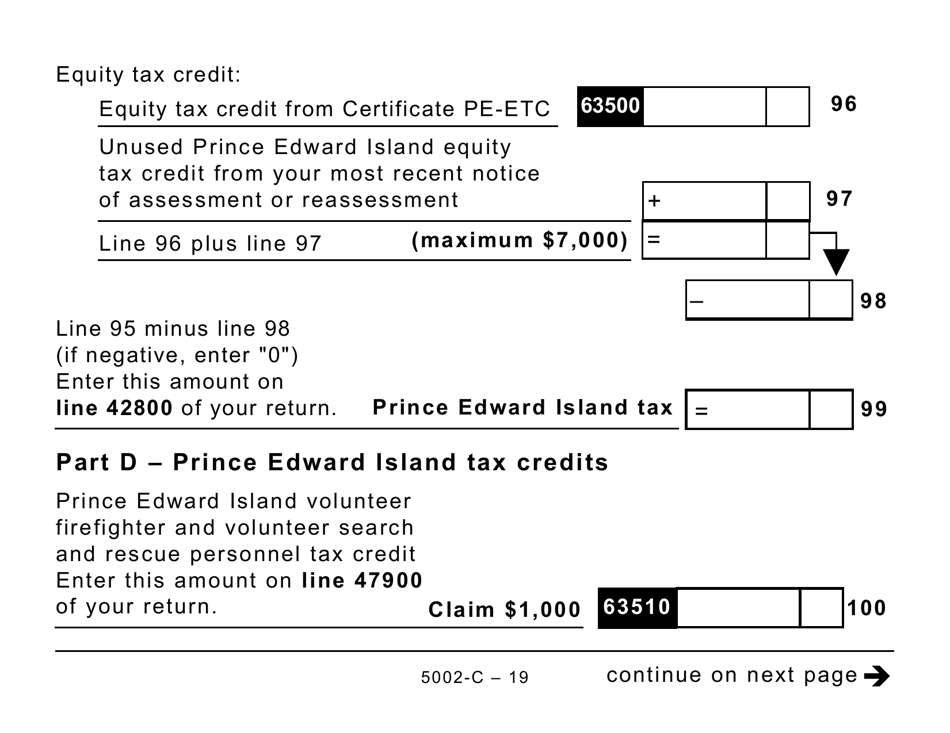

Form 5002-C (PE428) Prince Edward Island Tax and Credits (Large Print) - Canada

Form 5002-C (PE428) Prince Edward Island Tax and Credits (Large print) in Canada is used for reporting and calculating provincial income tax owed by residents of Prince Edward Island. This form is specifically designed to provide a larger print size for individuals with visual impairments.

The Form 5002-C (PE428) Prince Edward Island Tax and Credits (Large Print) is filed by individual taxpayers in Prince Edward Island, Canada.

FAQ

Q: What is Form 5002-C (PE428)?

A: Form 5002-C (PE428) is the tax form specific to Prince Edward Island (PEI) residents for reporting their tax information and claiming credits.

Q: Who needs to file Form 5002-C (PE428)?

A: All residents of Prince Edward Island who have income to report and are eligible for tax credits must file Form 5002-C (PE428).

Q: What is the purpose of Form 5002-C (PE428)?

A: Form 5002-C (PE428) is used to determine the amount of tax owed or refund due to residents of Prince Edward Island. It also helps individuals claim any applicable tax credits.

Q: What information do I need to complete Form 5002-C (PE428)?

A: To complete Form 5002-C (PE428), you will need information about your income, deductions, and tax credits. You may also need supporting documents such as T4 slips and receipts for expenses.

Q: When is the deadline for filing Form 5002-C (PE428)?

A: The deadline for filing Form 5002-C (PE428) is typically April 30th of each year. However, it is always best to check the current year's deadline as it may vary.

Q: What should I do if I need help completing Form 5002-C (PE428)?

A: If you need help completing Form 5002-C (PE428), you can contact the Canada Revenue Agency or seek assistance from a tax professional.

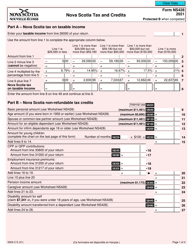

Q: Are there any important credits specific to Prince Edward Island on Form 5002-C (PE428)?

A: Yes, Form 5002-C (PE428) includes credits such as the Prince Edward Island Charitable Donation Tax Credit and the Prince Edward Island Home Accessibility Tax Credit, among others.

Q: What happens if I file Form 5002-C (PE428) incorrectly?

A: If you file Form 5002-C (PE428) incorrectly, it may result in errors in your tax calculations, delays in processing, or potential penalties. It's important to double-check your form before submitting it.