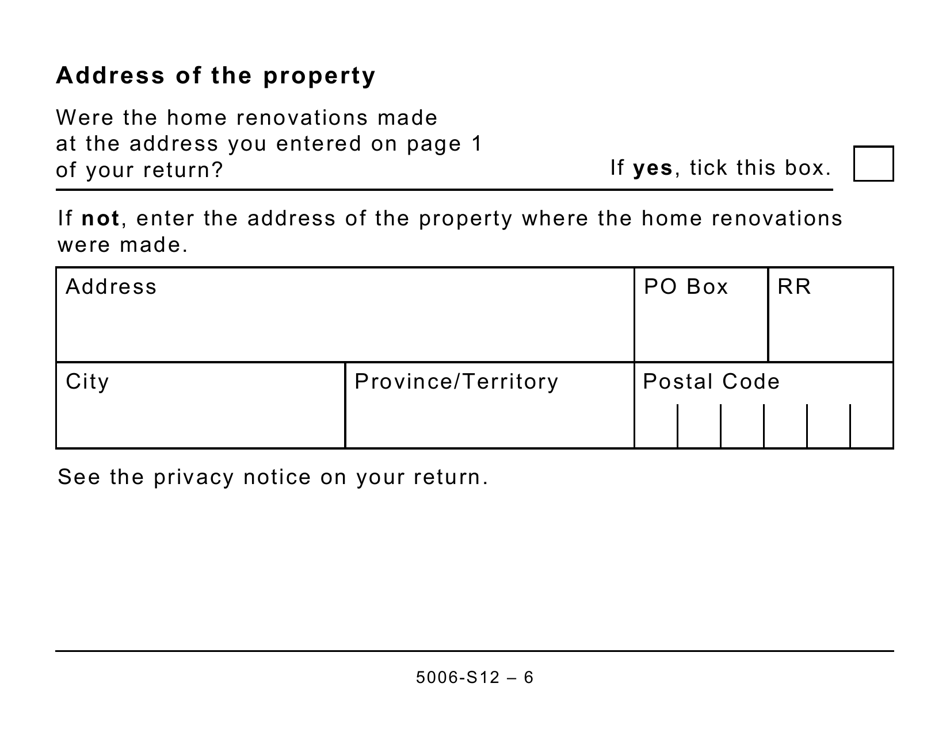

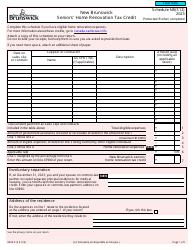

Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit (Large Print) - Canada

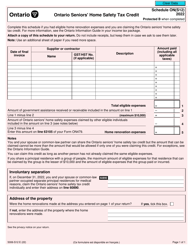

Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit (Large Print) is used in Canada by Ontario residents who are seniors to claim a tax credit for eligible expenses related to home renovations or improvements that enhance safety and accessibility in their homes.

The Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit (Large Print) in Canada is usually filed by eligible Ontario seniors who are claiming the Ontario Seniors' Home Safety Tax Credit.

FAQ

Q: What is Form 5006-S12?

A: Form 5006-S12 is the Ontario Seniors' Home Safety Tax Credit schedule in large print format.

Q: What is the Ontario Seniors' Home Safety Tax Credit?

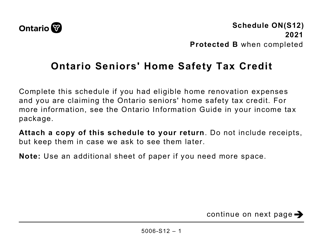

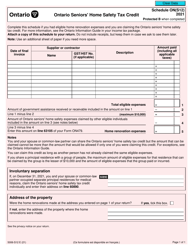

A: The Ontario Seniors' Home Safety Tax Credit is a provincial tax credit designed to help seniors make their homes safer.

Q: What is Schedule ON(S12)?

A: Schedule ON(S12) is the specific form used to claim the Ontario Seniors' Home Safety Tax Credit.

Q: Who is eligible for the Ontario Seniors' Home Safety Tax Credit?

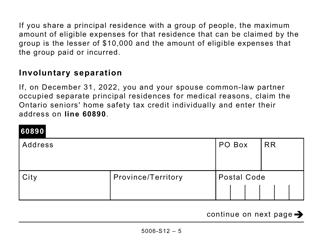

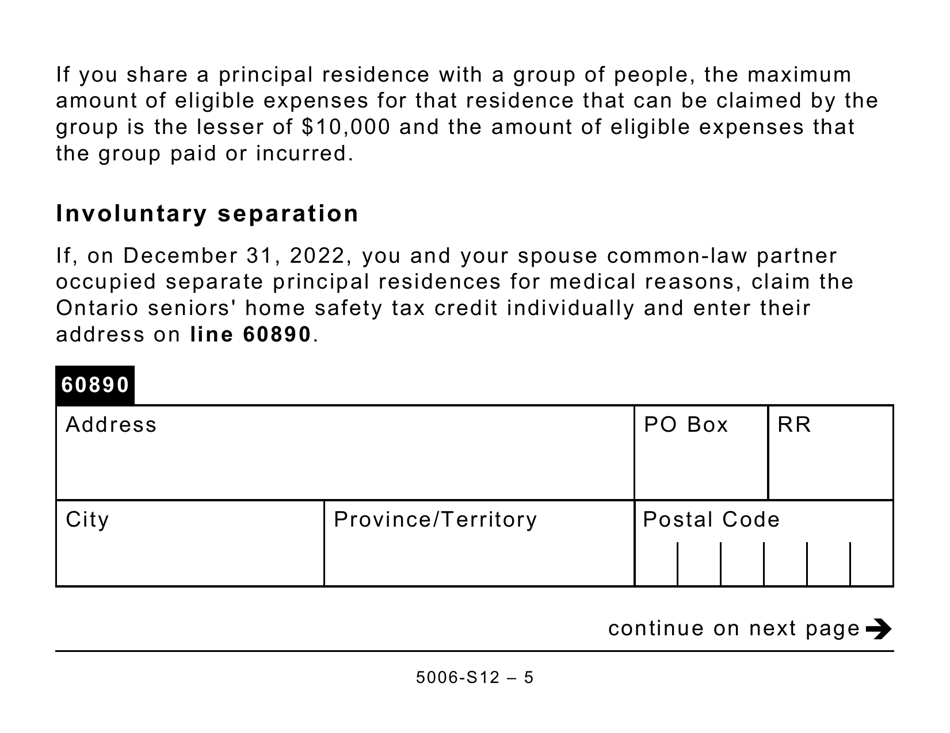

A: Seniors who are 65 years of age or older and own a home in Ontario are eligible for the tax credit.

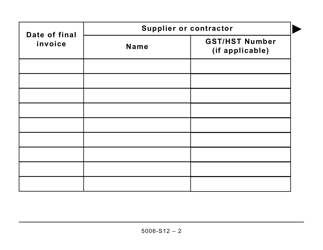

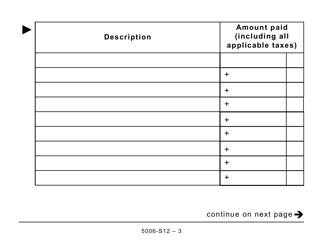

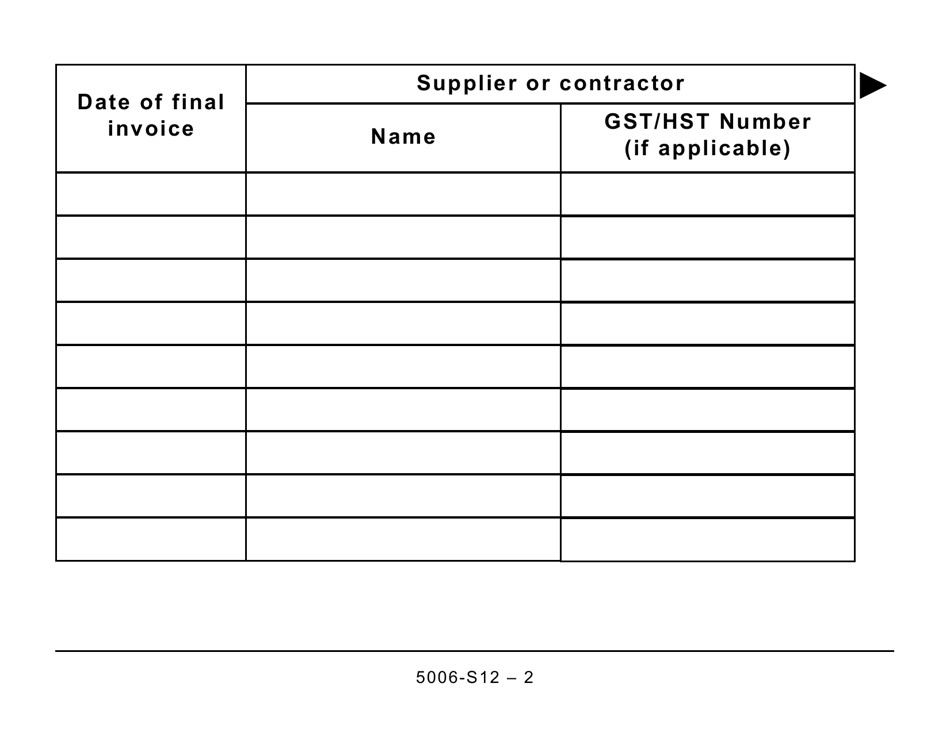

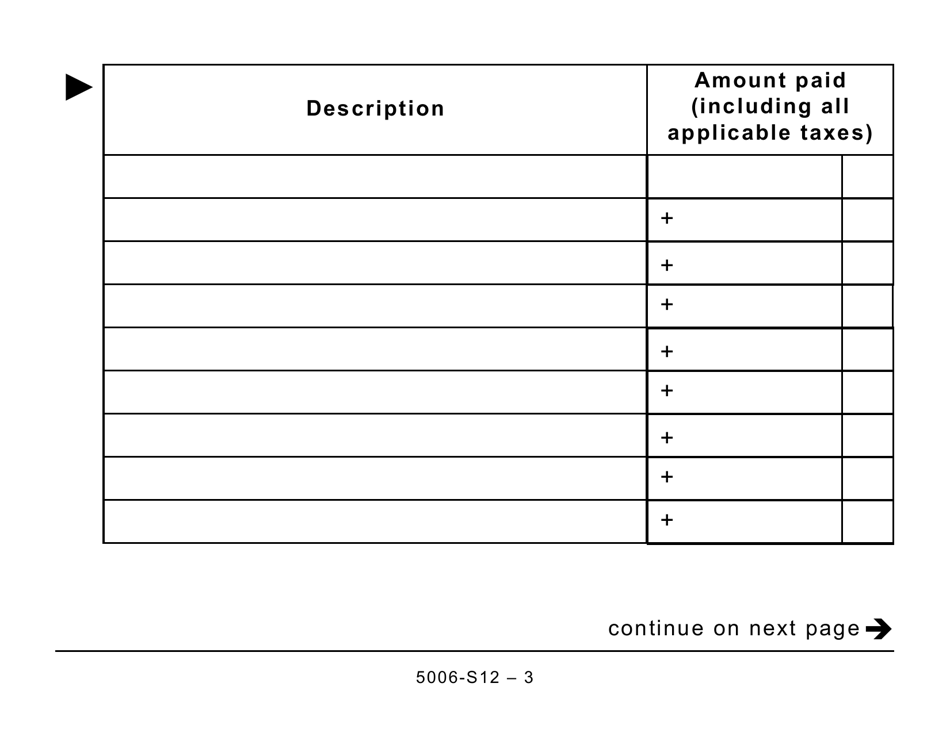

Q: What expenses can be claimed under this tax credit?

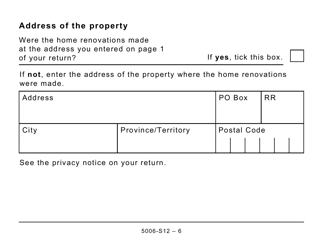

A: Expenses related to home modifications and assistive devices to improve safety and accessibility for seniors can be claimed under this tax credit.

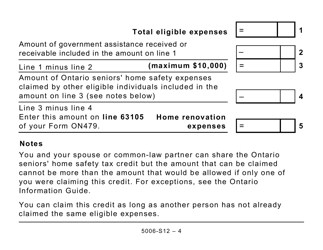

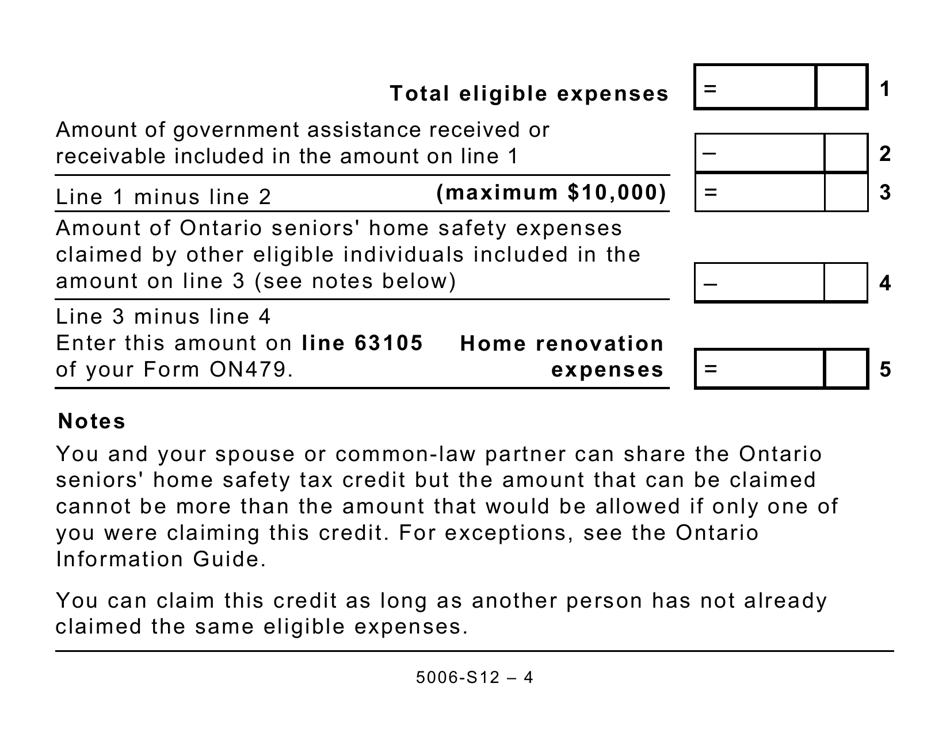

Q: Is there a maximum amount that can be claimed under the Ontario Seniors' Home Safety Tax Credit?

A: Yes, the maximum amount that can be claimed is $10,000.

Q: Can I claim this tax credit if I rent my home?

A: No, this tax credit is only available to seniors who own their homes.

Q: How do I claim the Ontario Seniors' Home Safety Tax Credit?

A: You must complete Schedule ON(S12) and include it with your provincial tax return.

Q: Is there a deadline for claiming this tax credit?

A: The tax credit can be claimed for expenses incurred after October 1, 2021, and must be claimed within 12 months of the end of the tax year in which the expenses were incurred.