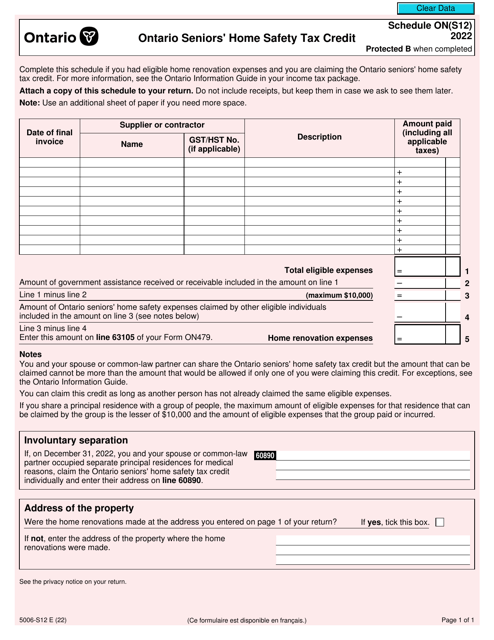

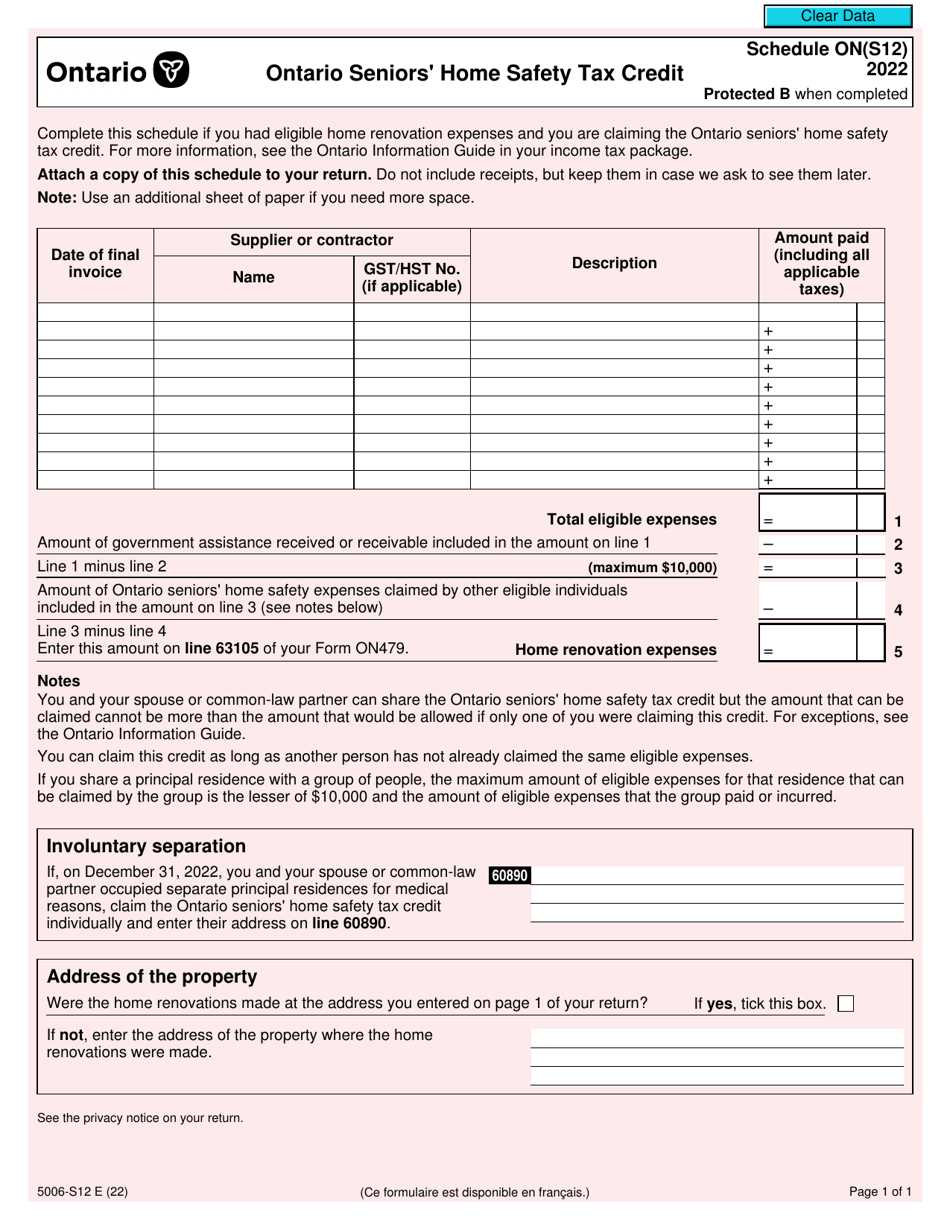

Form 5006-S12 Schedule ON(S12) Ontario Seniors' Home Safety Tax Credit - Canada

Form 5006-S12 Schedule ON(S12) is used in Ontario, Canada for claiming the Ontario Seniors' Home Safety Tax Credit. This tax credit is available to eligible seniors who make improvements to their homes to increase accessibility and safety.

The Form 5006-S12 Schedule ON(S12) for the Ontario Seniors' Home Safety Tax Credit in Canada is filed by eligible seniors who qualify for the tax credit.

FAQ

Q: What is the Form 5006-S12?

A: Form 5006-S12 is a schedule for claiming the Ontario Seniors' Home Safety Tax Credit in Canada.

Q: What is the Ontario Seniors' Home Safety Tax Credit?

A: The Ontario Seniors' Home Safety Tax Credit is a tax credit available to seniors in Ontario to help cover the costs of making their homes safer.

Q: Who is eligible for the Ontario Seniors' Home Safety Tax Credit?

A: Seniors aged 65 or older who are homeowners or tenants in Ontario are eligible for the tax credit.

Q: What expenses does the Ontario Seniors' Home Safety Tax Credit cover?

A: The tax credit covers expenses related to renovations or purchases of eligible safety devices, equipment, or modifications to make a home safer and more accessible for seniors.

Q: How much can I claim with the Ontario Seniors' Home Safety Tax Credit?

A: The tax credit allows you to claim 25% of eligible expenses, up to a maximum of $10,000 per year.

Q: How do I claim the Ontario Seniors' Home Safety Tax Credit?

A: You can claim the tax credit by completing Form 5006-S12 and including it with your annual tax return.

Q: Is the Ontario Seniors' Home Safety Tax Credit refundable?

A: No, the tax credit is non-refundable, which means it can only reduce the amount of tax you owe, but cannot create a refund.

Q: Can I claim the Ontario Seniors' Home Safety Tax Credit for expenses incurred in previous years?

A: No, the tax credit can only be claimed for expenses incurred in the current tax year.

Q: Are there any other tax credits or benefits available for seniors in Ontario?

A: Yes, there are other tax credits and benefits available for seniors in Ontario, such as the Ontario Senior Homeowners' Property Tax Grant and the Ontario Senior Homeowners' Property Tax Deferral Program.