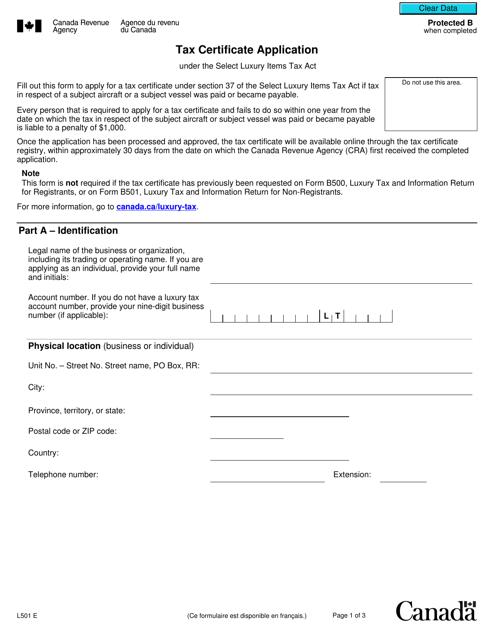

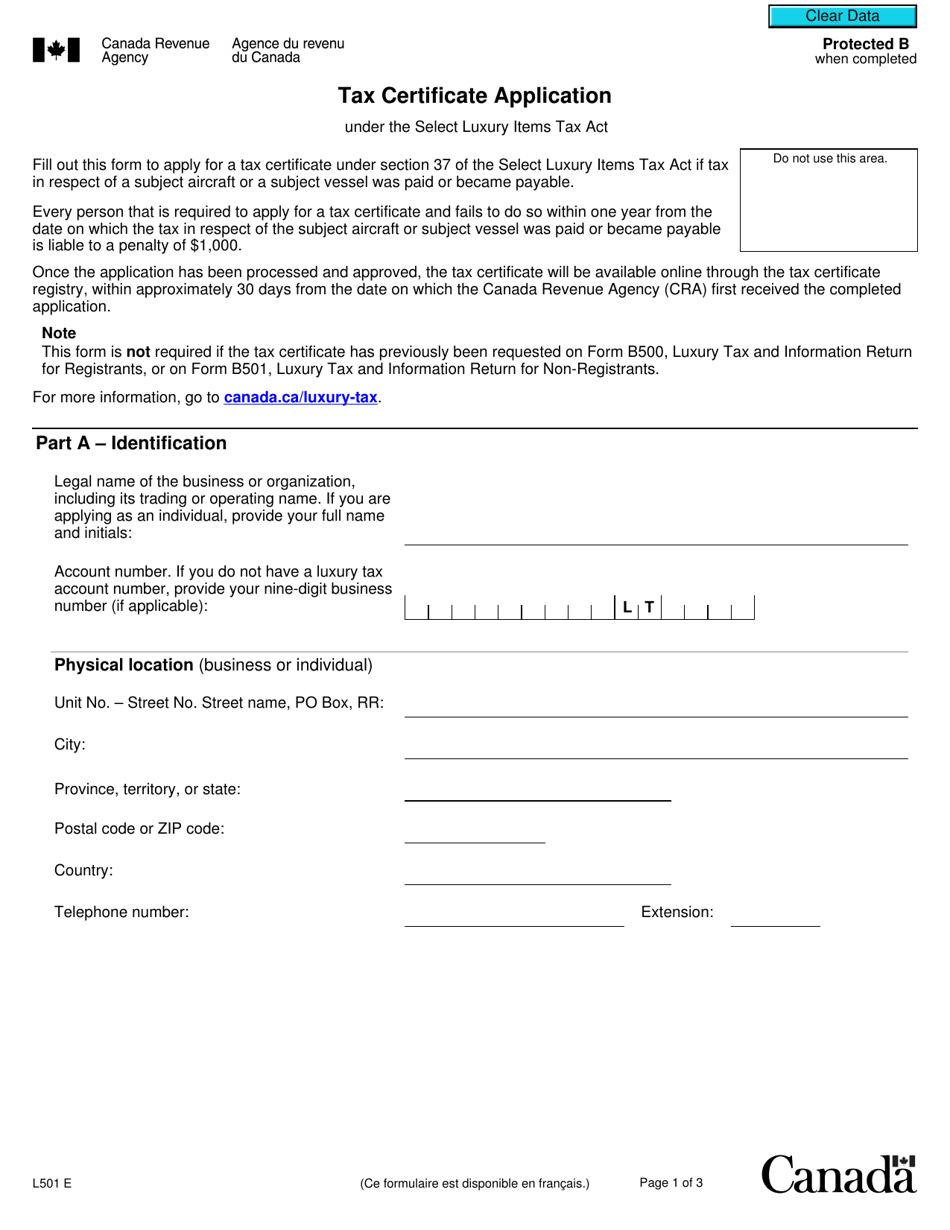

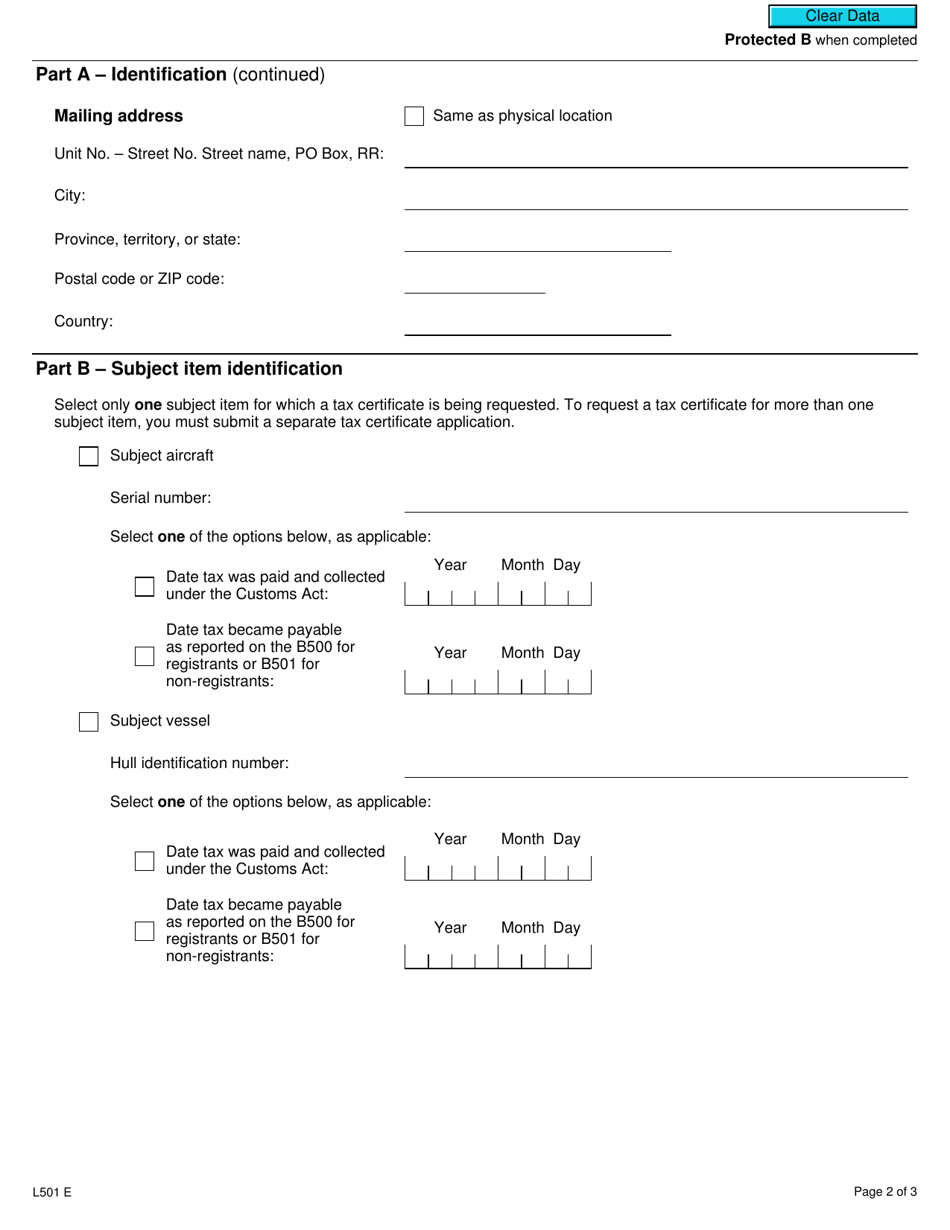

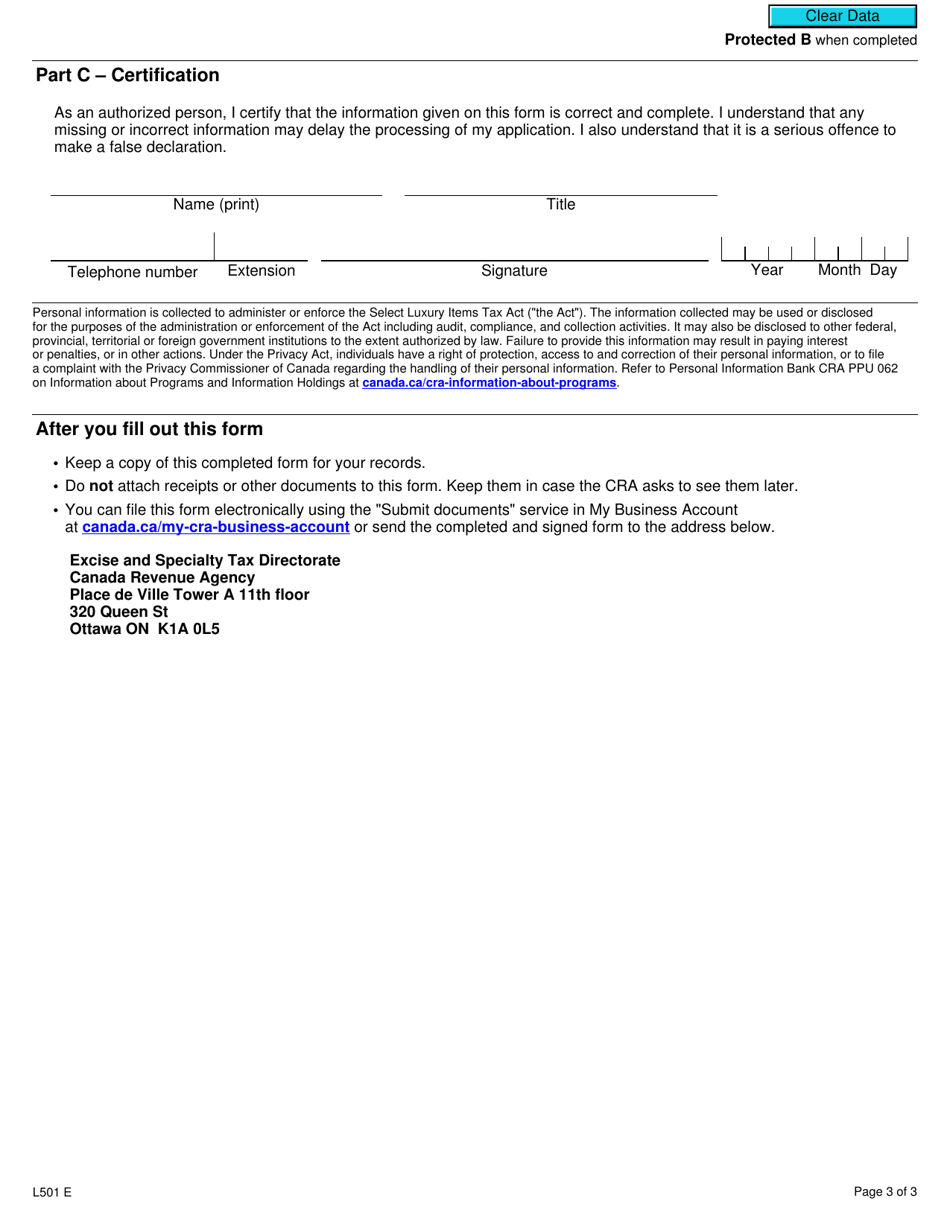

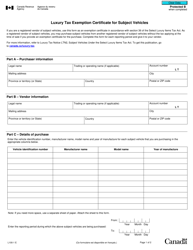

Form L501 Tax Certificate Application - Canada

Form L501 is the application for a Tax Certificate in Canada. Tax Certificate is used to verify the income information of an individual or a business for various purposes, such as applying for loans, mortgages, or other financial transactions.

In Canada, the Form L501 Tax Certificate Application is filed by the individual or entity seeking to obtain a tax certificate.

FAQ

Q: What is the Form L501?

A: Form L501 is a Tax Certificate Application form used in Canada.

Q: How do I obtain Form L501?

A: You can obtain Form L501 by contacting the Canada Revenue Agency (CRA).

Q: What is the purpose of Form L501?

A: The purpose of Form L501 is to apply for a tax certificate in Canada.

Q: Who can use Form L501?

A: Form L501 can be used by individuals and businesses in Canada.

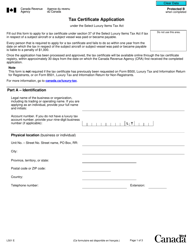

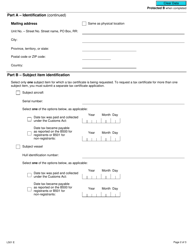

Q: What information is required on Form L501?

A: Form L501 requires information such as your name, address, social insurance number, and the tax year you are applying for.

Q: Is there a fee for applying for a tax certificate using Form L501?

A: No, there is no fee for applying for a tax certificate using Form L501.

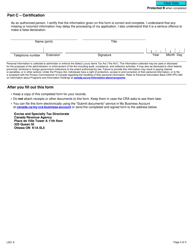

Q: How long does it take to process Form L501?

A: The processing time for Form L501 may vary, but it typically takes a few weeks to receive the tax certificate.

Q: What can I use the tax certificate obtained through Form L501 for?

A: The tax certificate obtained through Form L501 can be used as proof of your tax compliance for various purposes, such as applying for a loan or participating in government programs.