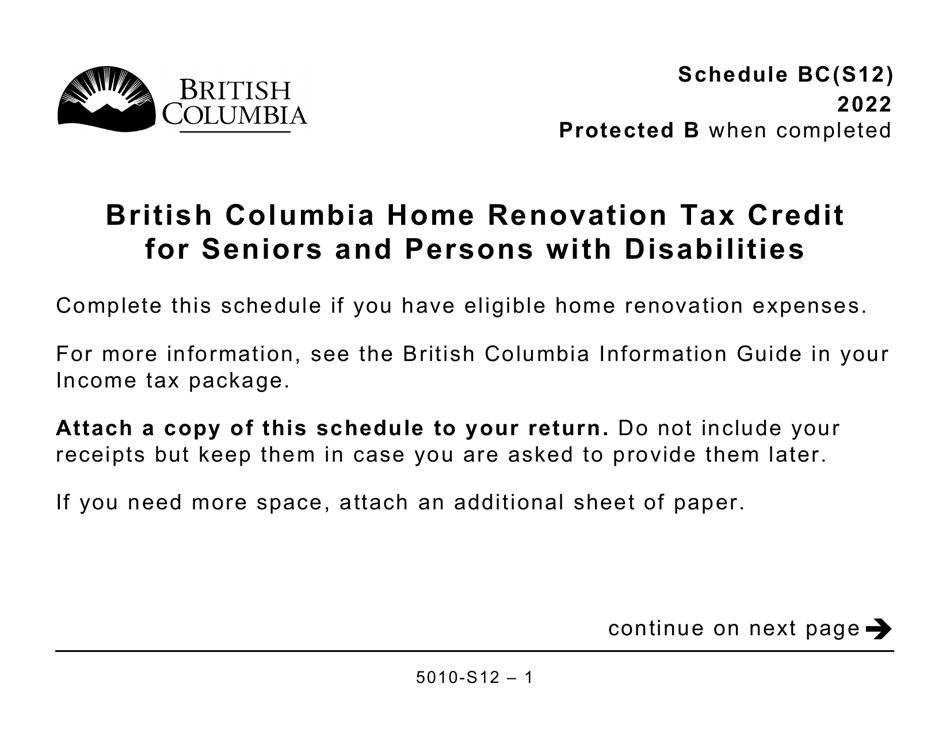

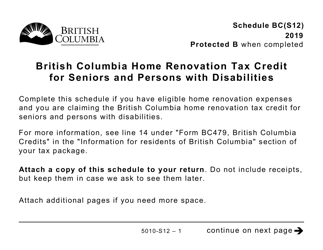

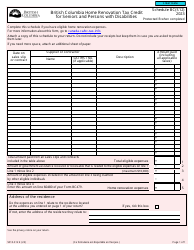

Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities (Large Print) - Canada

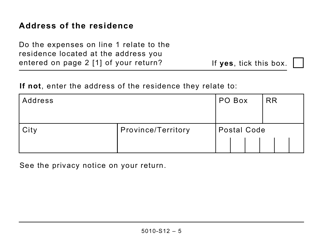

Form 5010-S12 Schedule BC(S12) is used in Canada for claiming the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities. It is a tax credit program that provides financial assistance to eligible individuals who make home renovations to improve accessibility and mobility. The large print version of the form is available to ensure accessibility for individuals with visual impairments.

The Form 5010-S12 Schedule BC(S12) British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities (Large Print) in Canada is filed by seniors and persons with disabilities who are claiming the home renovation tax credit.

FAQ

Q: What is Form 5010-S12 Schedule BC(S12)?

A: Form 5010-S12 Schedule BC(S12) is a document related to the British Columbia Home Renovation Tax Credit for Seniors and Persons With Disabilities.

Q: What is the purpose of the British Columbia Home Renovation Tax Credit?

A: The purpose of the British Columbia Home Renovation Tax Credit is to provide financial assistance to seniors and persons with disabilities for home renovations.

Q: Who is eligible for the British Columbia Home Renovation Tax Credit?

A: Seniors and persons with disabilities who meet certain criteria are eligible for the British Columbia Home Renovation Tax Credit.

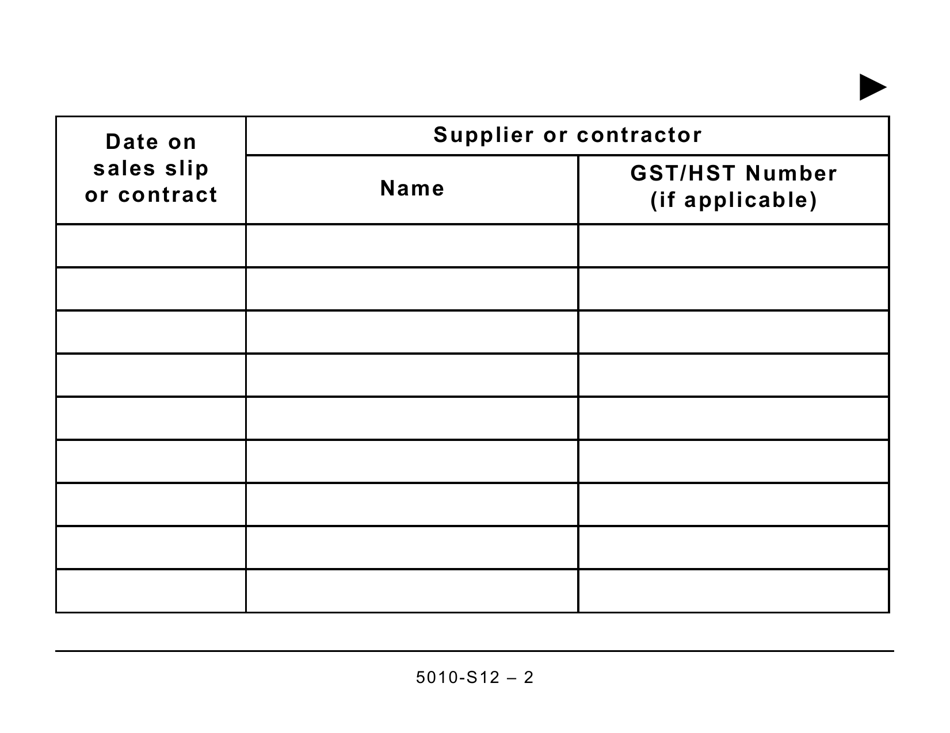

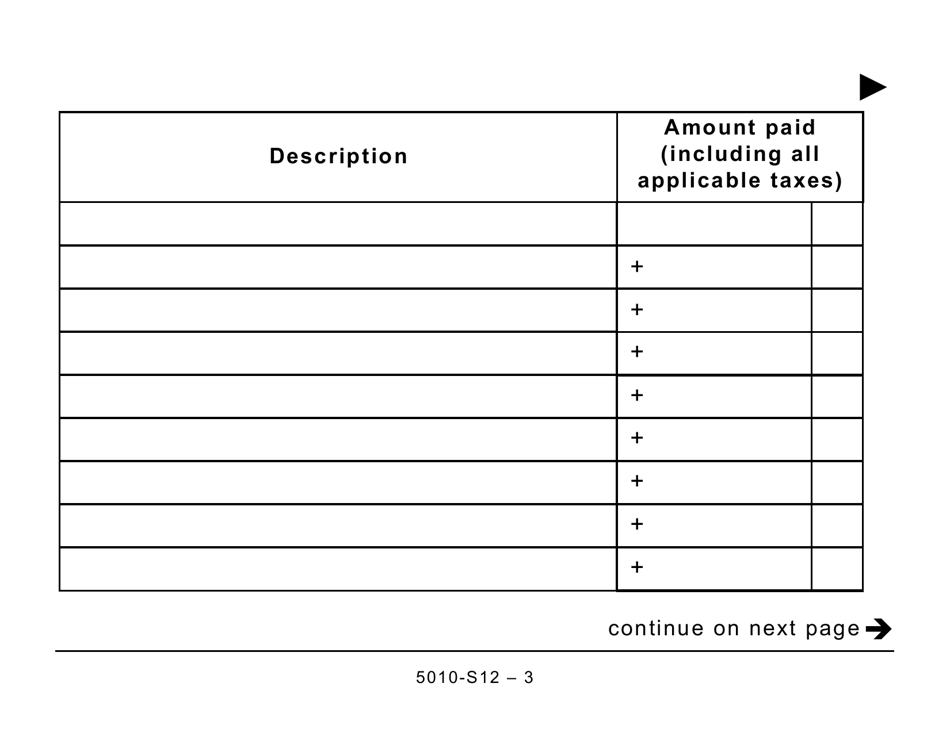

Q: What type of renovations are eligible for the tax credit?

A: Renovations that improve accessibility, safety, or mobility in a home are typically eligible for the tax credit.

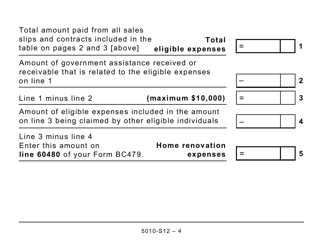

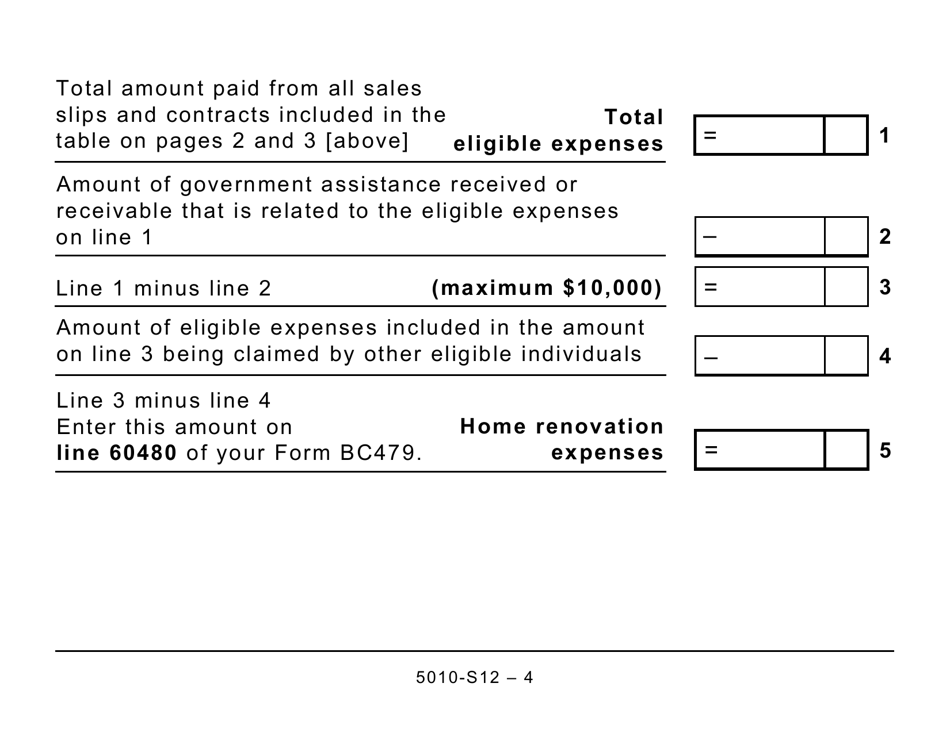

Q: Is there a maximum amount that can be claimed for the tax credit?

A: Yes, there is a maximum amount that can be claimed for the British Columbia Home Renovation Tax Credit. The specific amount may vary depending on the year and other factors.

Q: Is the tax credit available to residents of other provinces in Canada?

A: No, the British Columbia Home Renovation Tax Credit is specific to residents of British Columbia.

Q: Are there any other tax credits or benefits available for seniors and persons with disabilities in Canada?

A: Yes, there are other tax credits and benefits available for seniors and persons with disabilities in Canada. It is recommended to consult the CRA or a tax professional for more information.