This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC243 Schedule A

for the current year.

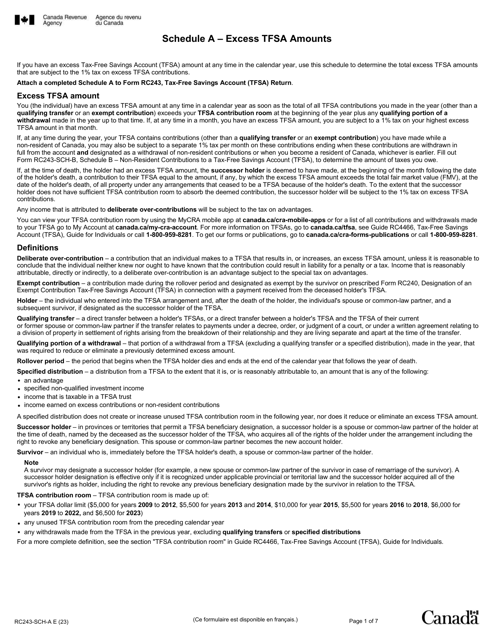

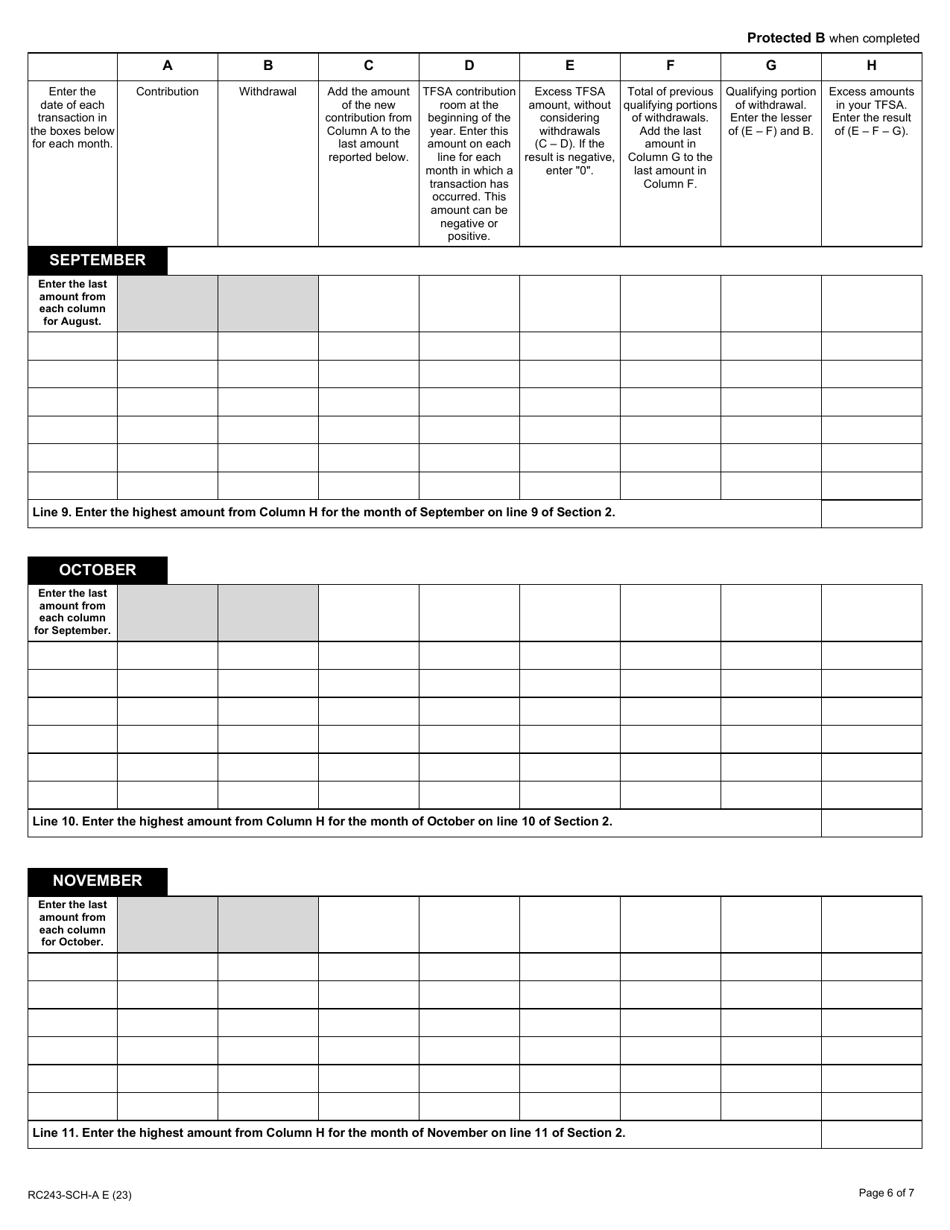

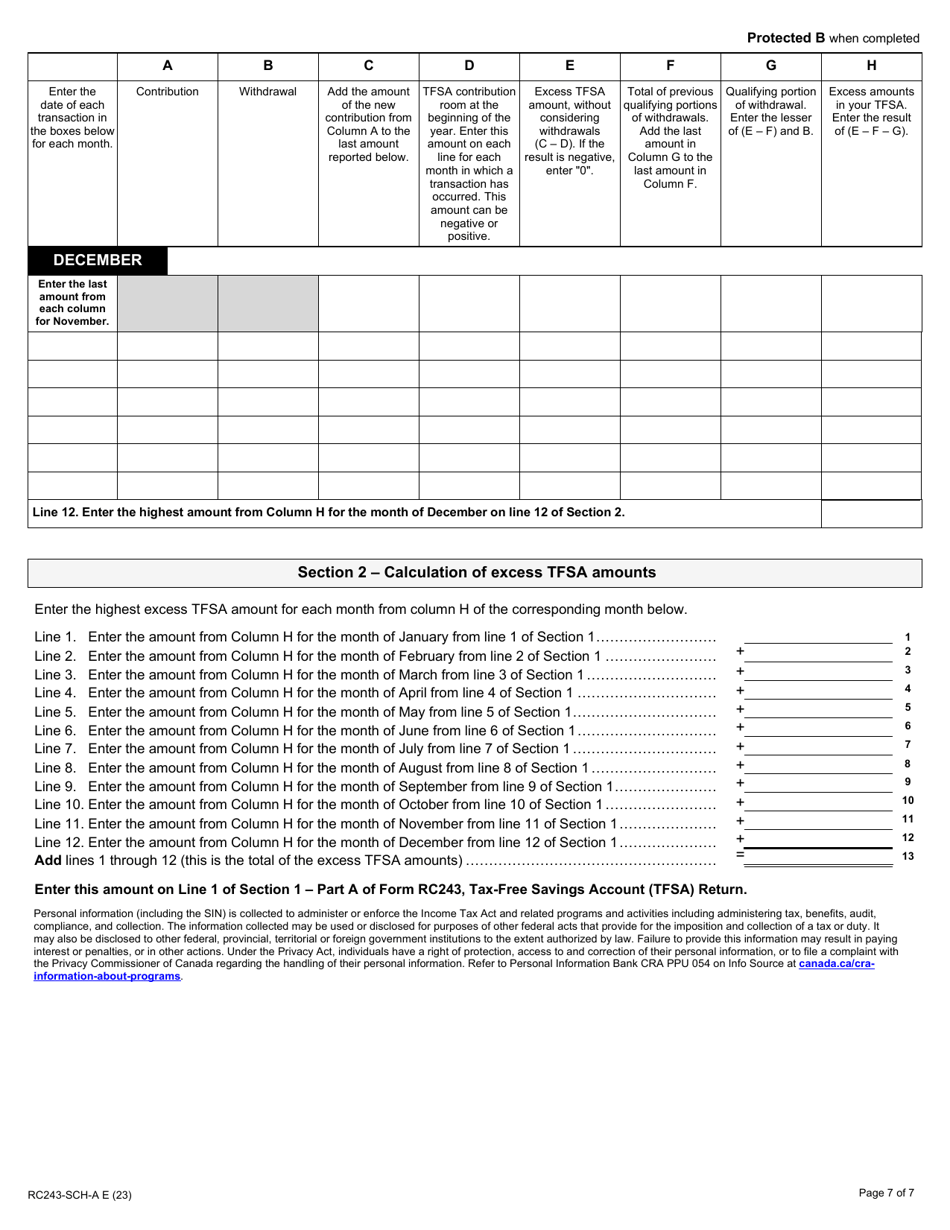

Form RC243 Schedule A Excess Tfsa Amounts - Canada

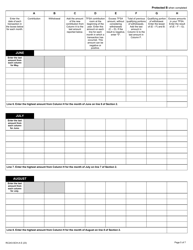

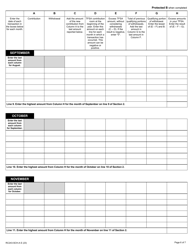

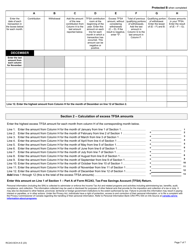

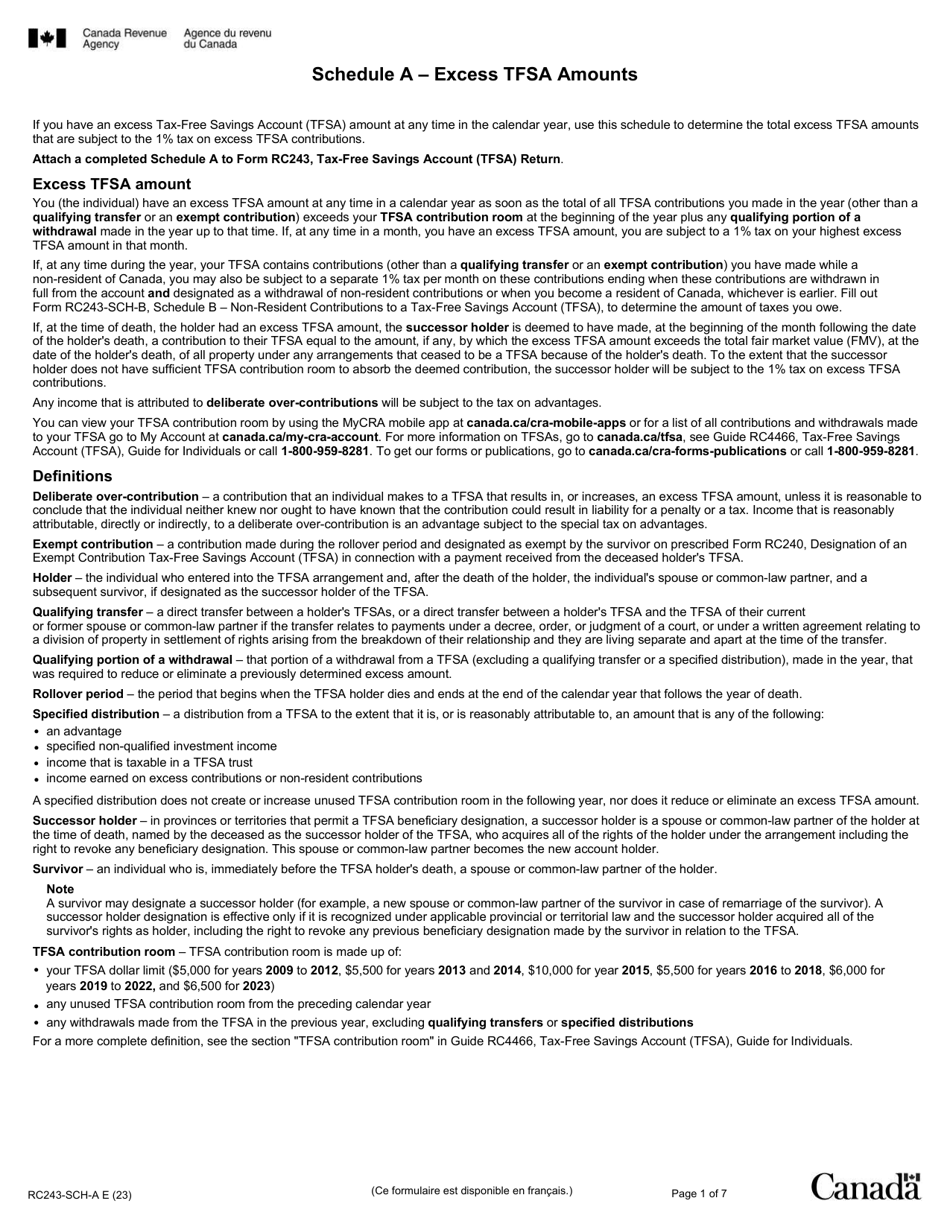

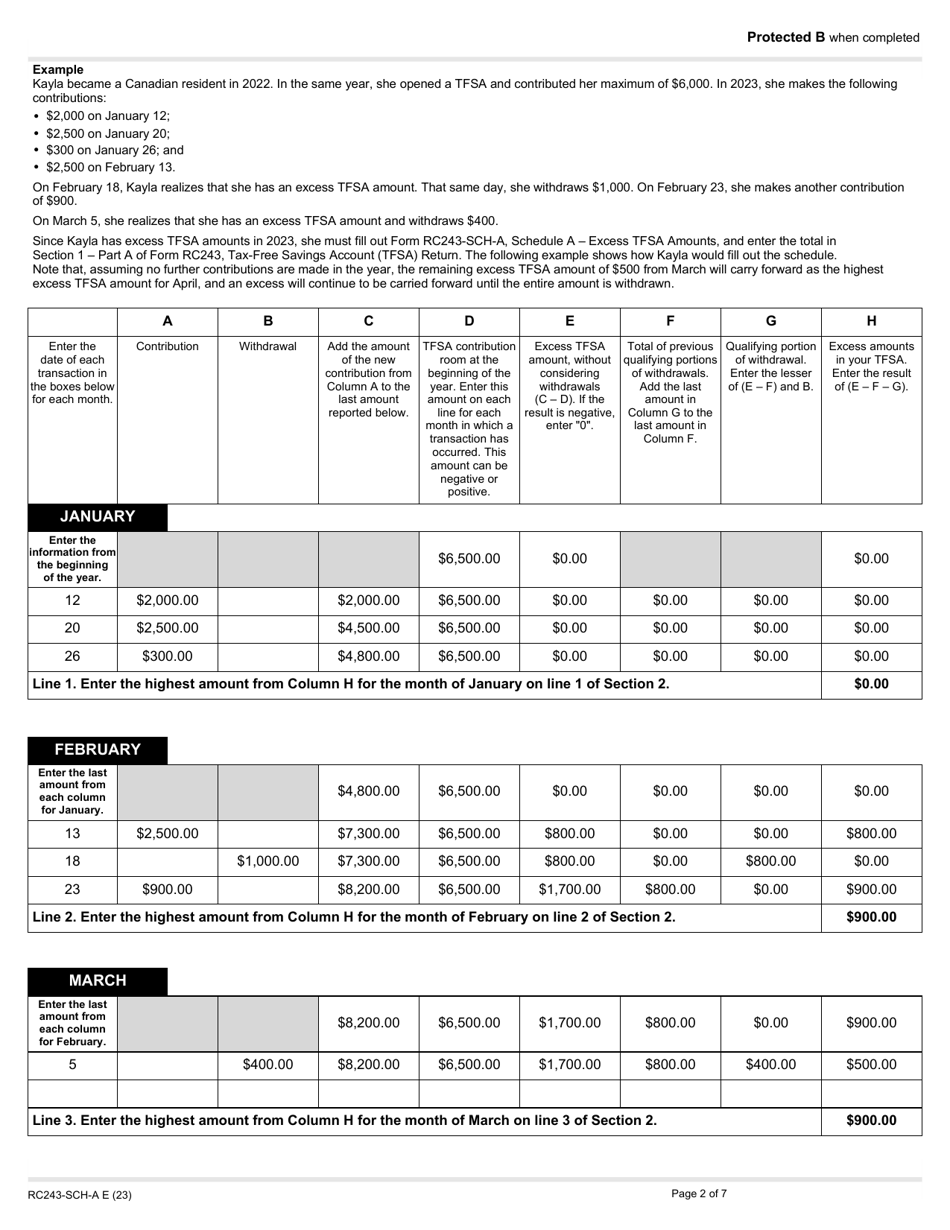

Form RC243 Schedule A Excess TFSA Amounts is used in Canada to calculate and report any excess contributions made to a Tax-Free Savings Account (TFSA). This form is used to determine the penalty tax that may be owed on the excess TFSA amount.

Individuals who have excess Tax-Free Savings Account (TFSA) contributions in Canada are required to file Form RC243 Schedule A - Excess TFSA Amounts. This form is filed by the TFSA holder themselves.

FAQ

Q: What is Form RC243 Schedule A?

A: Form RC243 Schedule A is a form used in Canada to report excess TFSA (Tax-Free Savings Account) amounts.

Q: What are excess TFSA amounts?

A: Excess TFSA amounts refer to contributions made to a TFSA that exceed the allowable limit set by the Canada Revenue Agency (CRA).

Q: Why do I need to file Form RC243 Schedule A?

A: You need to file Form RC243 Schedule A if you have excess TFSA amounts and want to report them to the CRA.

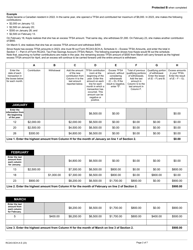

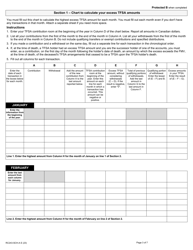

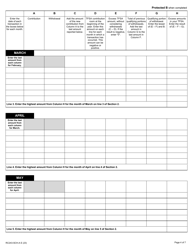

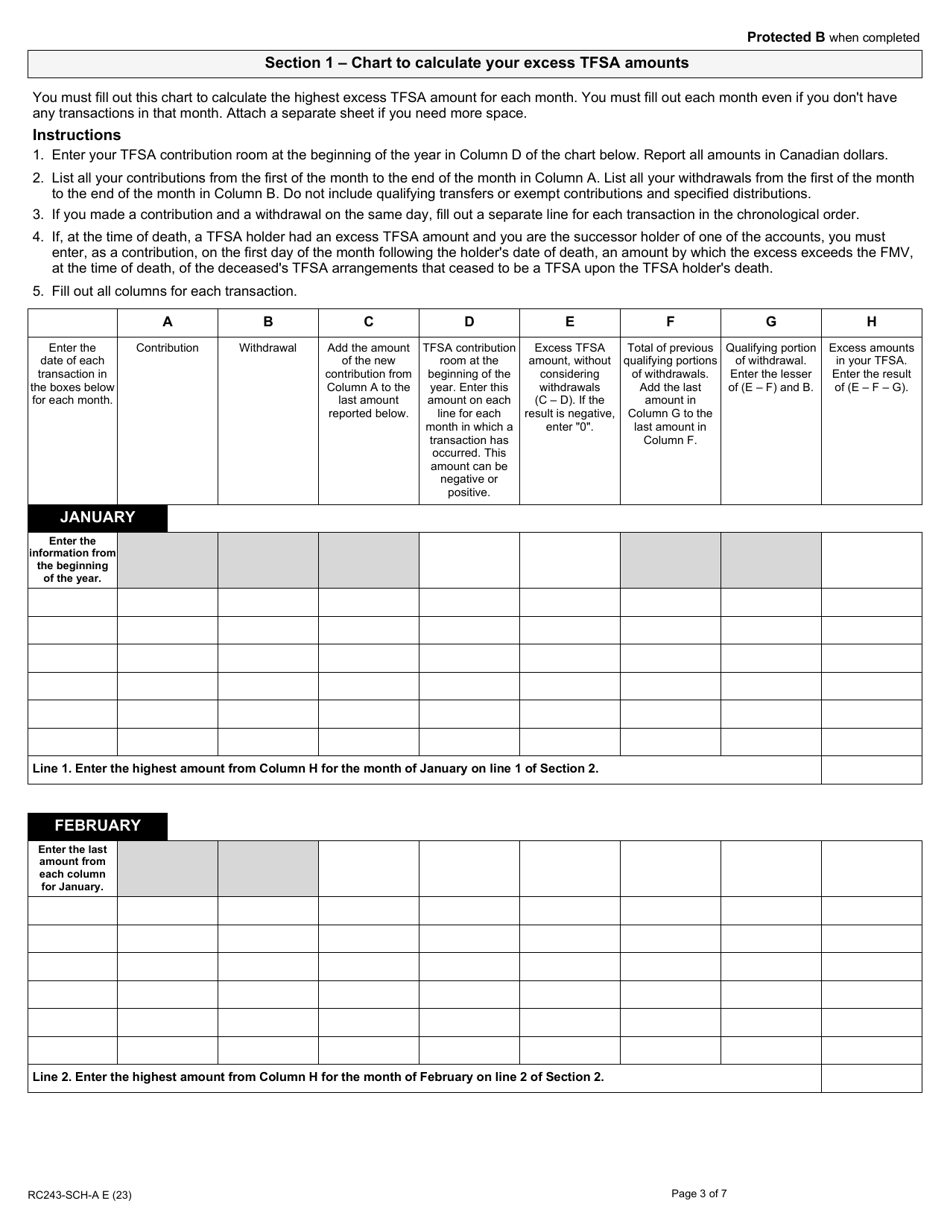

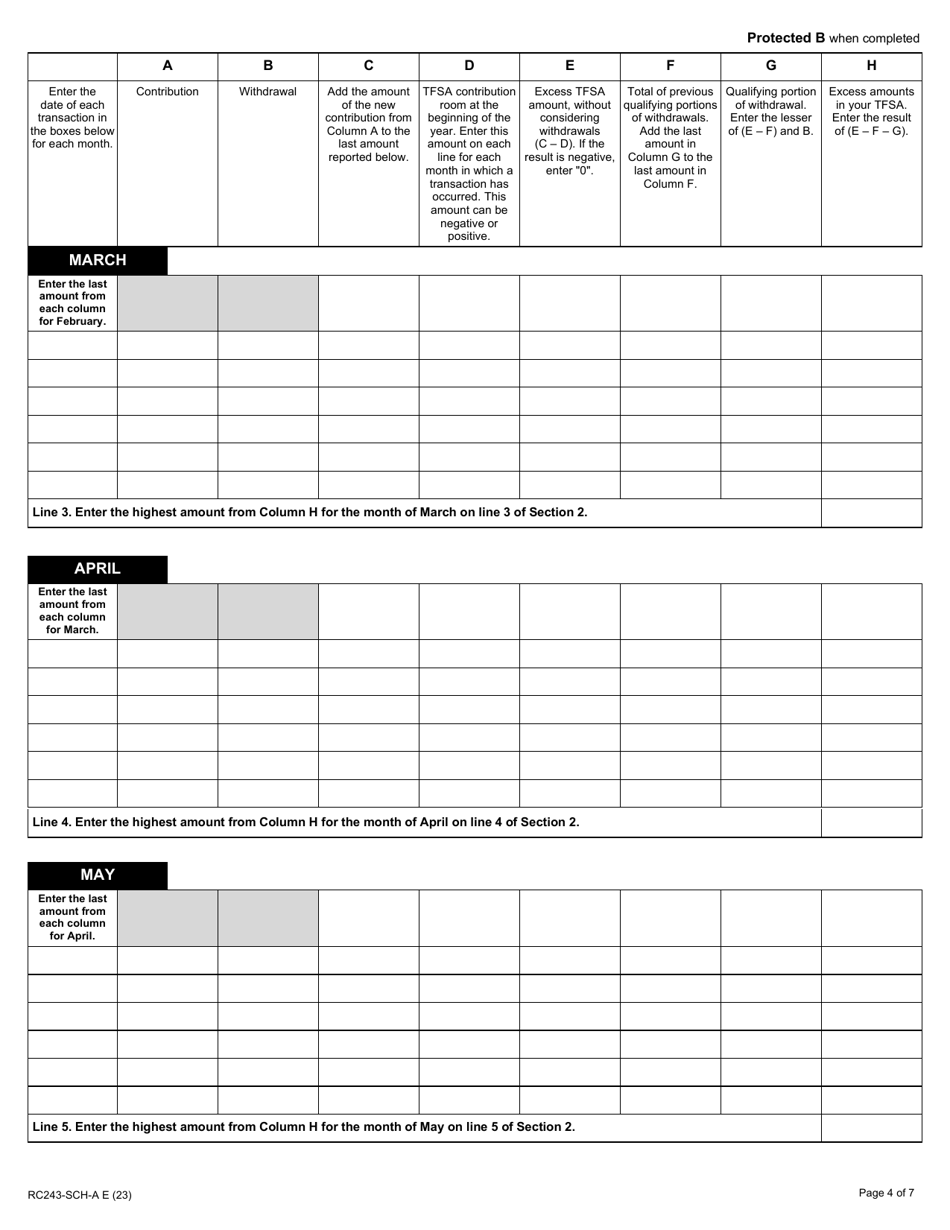

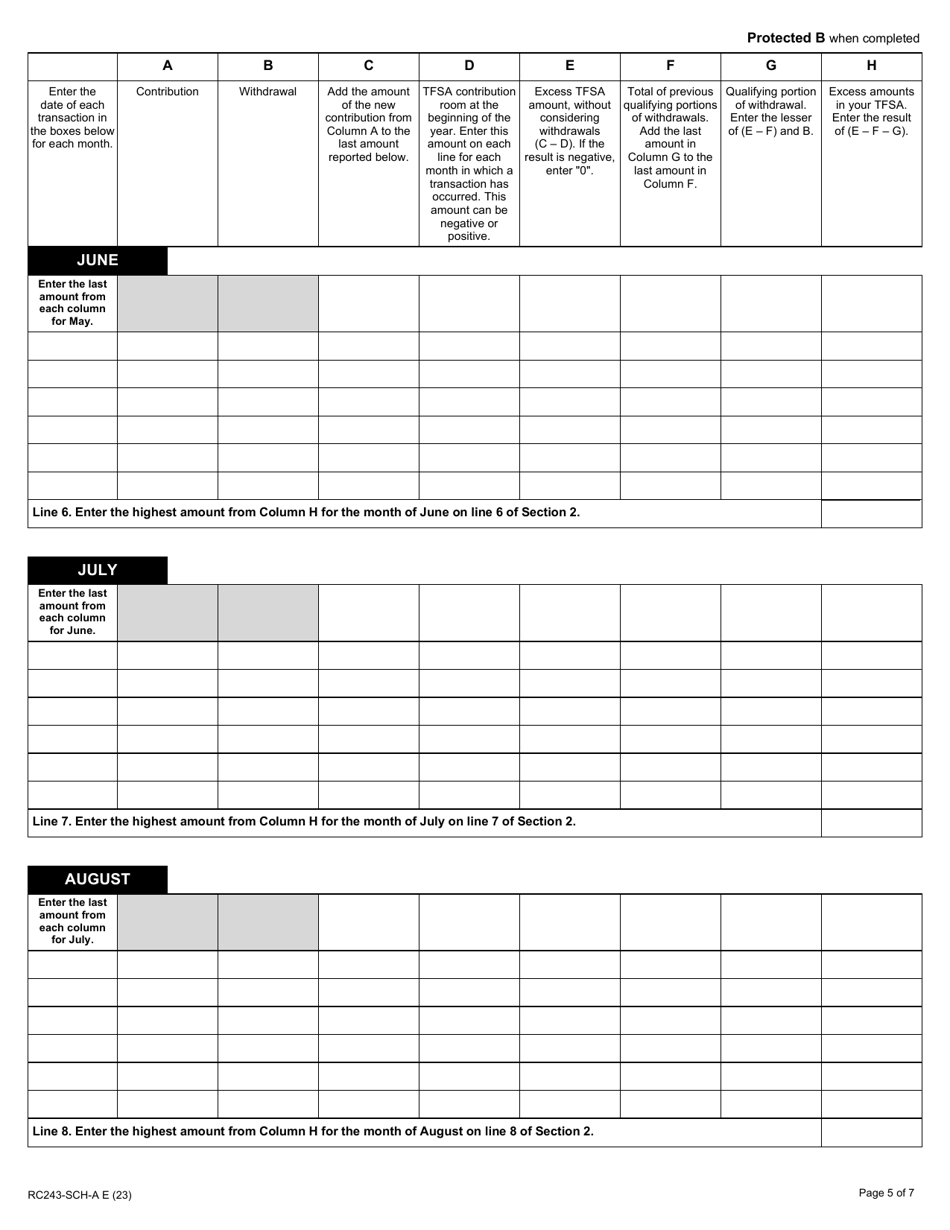

Q: How do I fill out Form RC243 Schedule A?

A: To fill out Form RC243 Schedule A, you need to provide your personal information, specify the year of the excess amount, and calculate the amount of the excess.

Q: When is the deadline to file Form RC243 Schedule A?

A: The deadline to file Form RC243 Schedule A is usually on or before your personal tax returnfiling deadline for the year in which the excess TFSA amounts occurred.