This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC249

for the current year.

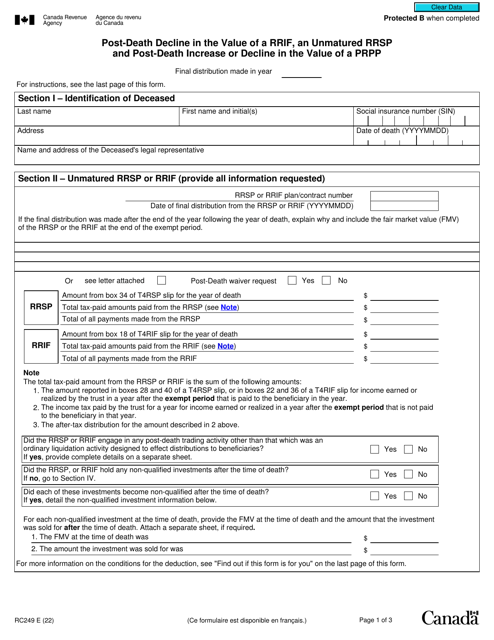

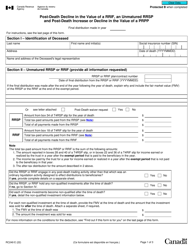

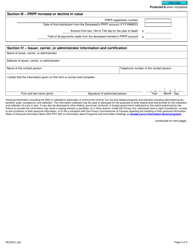

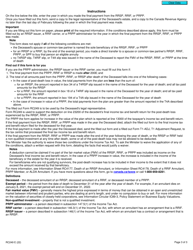

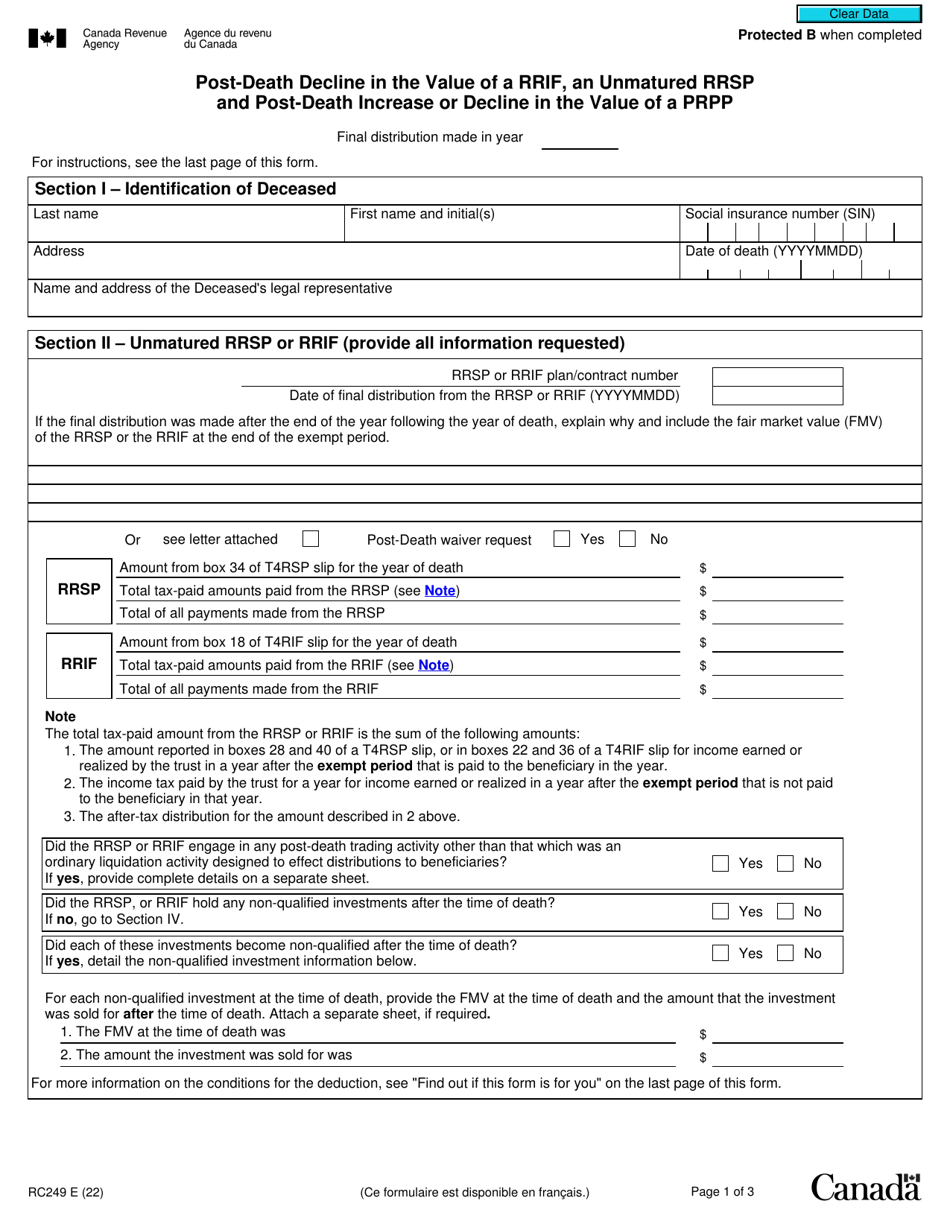

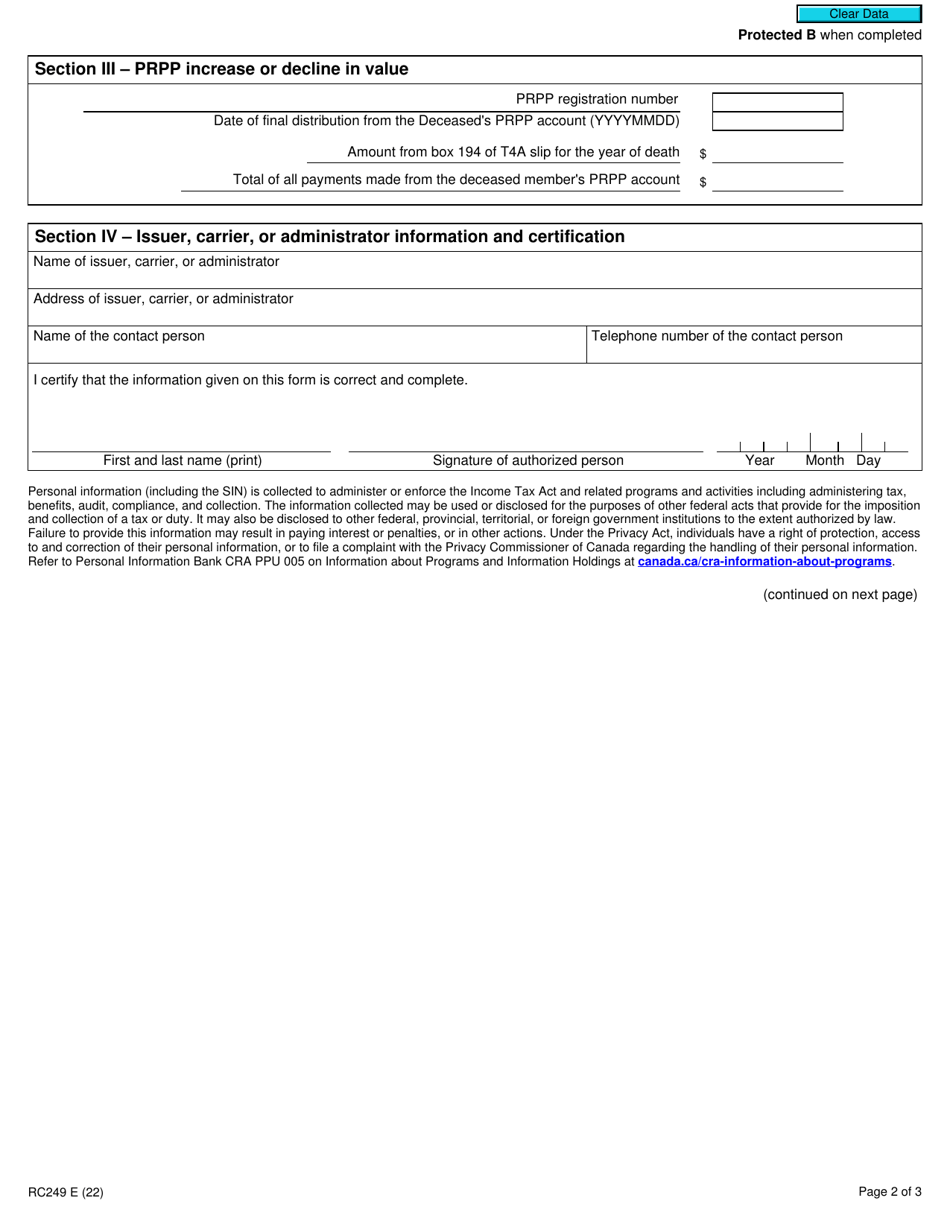

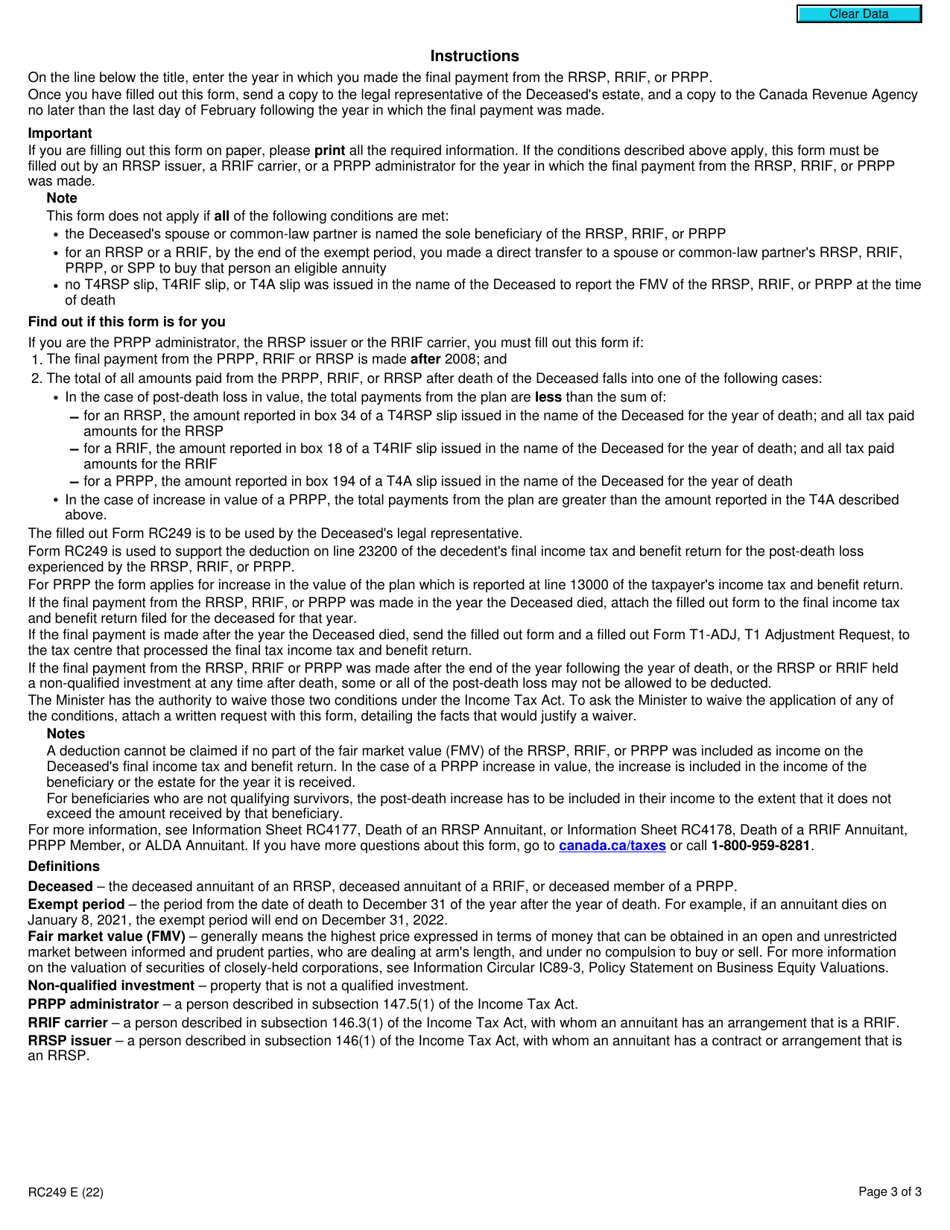

Form RC249 Post-death Decline in the Value of a Rrif, an Unmatured Rrsp and Post-death Increase or Decline in the Value of a Prpp - Canada

The Form RC249 in Canada is used to report the post-death decline in the value of a Registered Retirement Income Fund (RRIF), an unmatured Registered Retirement Savings Plan (RRSP), and the post-death increase or decline in the value of a Pooled Registered Pension Plan (PRPP). It is used for tax purposes and helps calculate any tax implications resulting from these changes.

The form RC249 Post-death Decline in the Value of a RRIF, an Unmatured RRSP and Post-death Increase or Decline in the Value of a PRPP is filed by the deceased person's legal representative or estate trustee in Canada.

FAQ

Q: What is a Form RC249?

A: Form RC249 is a form used in Canada to report any post-death decline in value of a RRIF, an unmatured RRSP, or a post-death increase or decline in value of a PRPP.

Q: What is a RRIF?

A: RRIF stands for Registered Retirement Income Fund. It is a retirement income option in Canada where the funds in your RRSP are converted into regular payments to provide retirement income.

Q: What is an RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a tax-advantaged savings account in Canada that allows individuals to save for their retirement.

Q: What is a PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a type of pension plan in Canada that is designed to provide retirement income to employees of multiple employers.

Q: When should Form RC249 be used?

A: Form RC249 should be used when there is a post-death decline in the value of a RRIF, an unmatured RRSP, or a post-death increase or decline in the value of a PRPP.

Q: Who needs to fill out Form RC249?

A: The legal representative of the deceased individual's estate needs to fill out Form RC249.

Q: Are there any deadlines for submitting Form RC249?

A: Yes, there are specific deadlines for submitting Form RC249. It should be submitted within 180 days after the end of the year in which the post-death decline in value or increase or decline in value occurred.

Q: What information is required to fill out Form RC249?

A: The form requires information such as the deceased individual's name, social insurance number, the value of the RRIF, RRSP or PRPP at death, and details of the post-death decline or increase or decline in value.