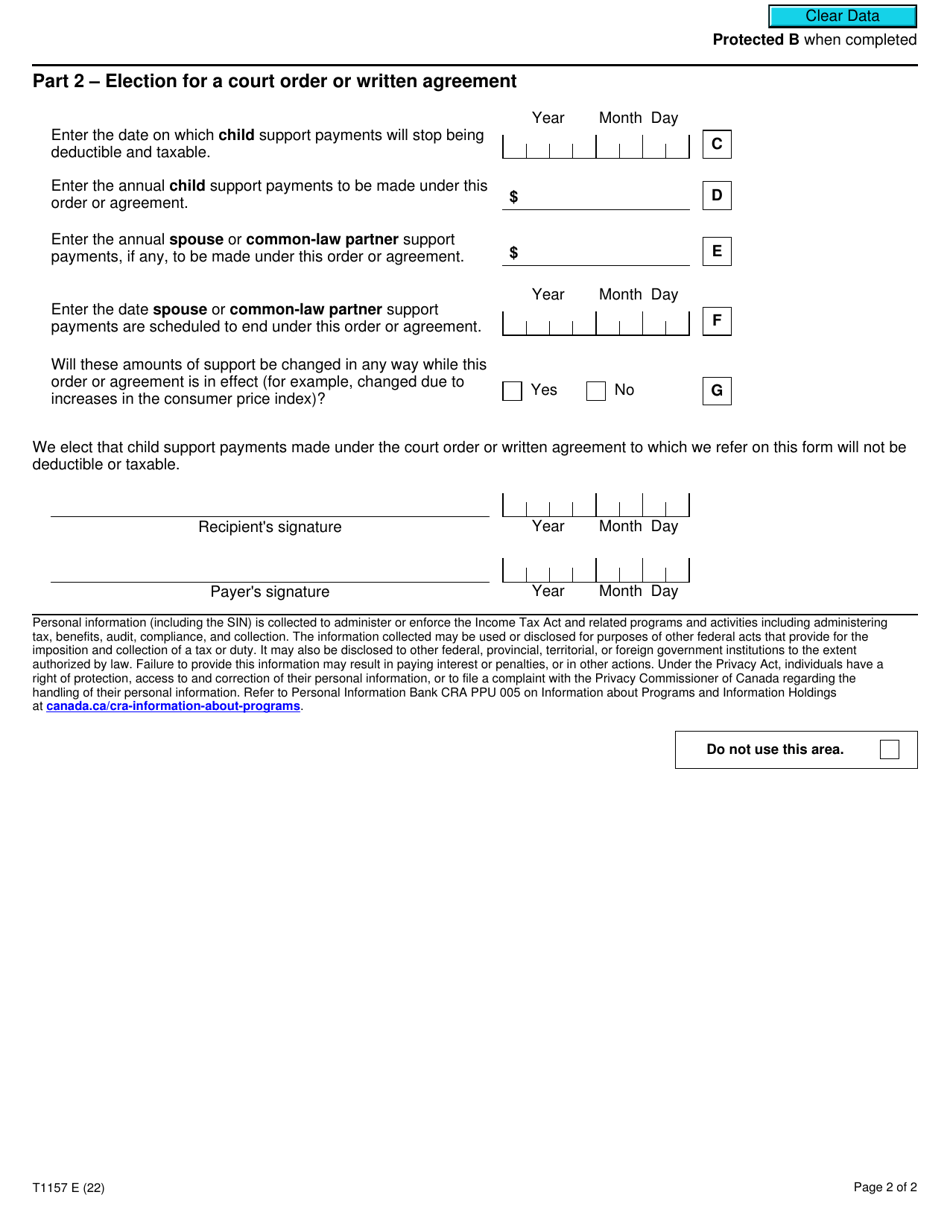

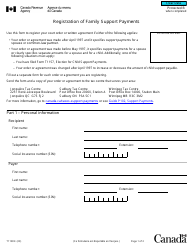

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1157

for the current year.

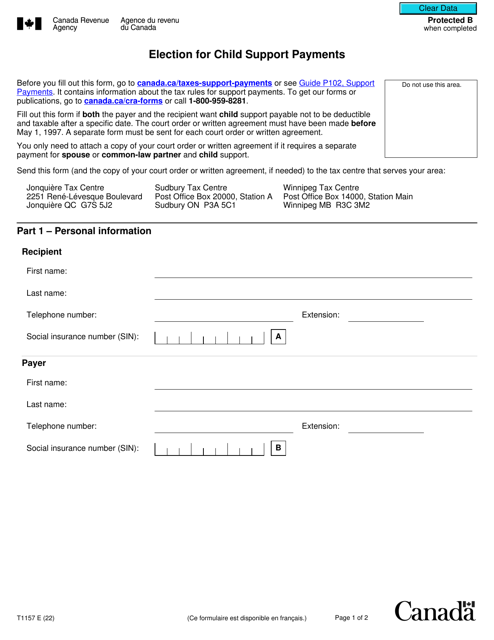

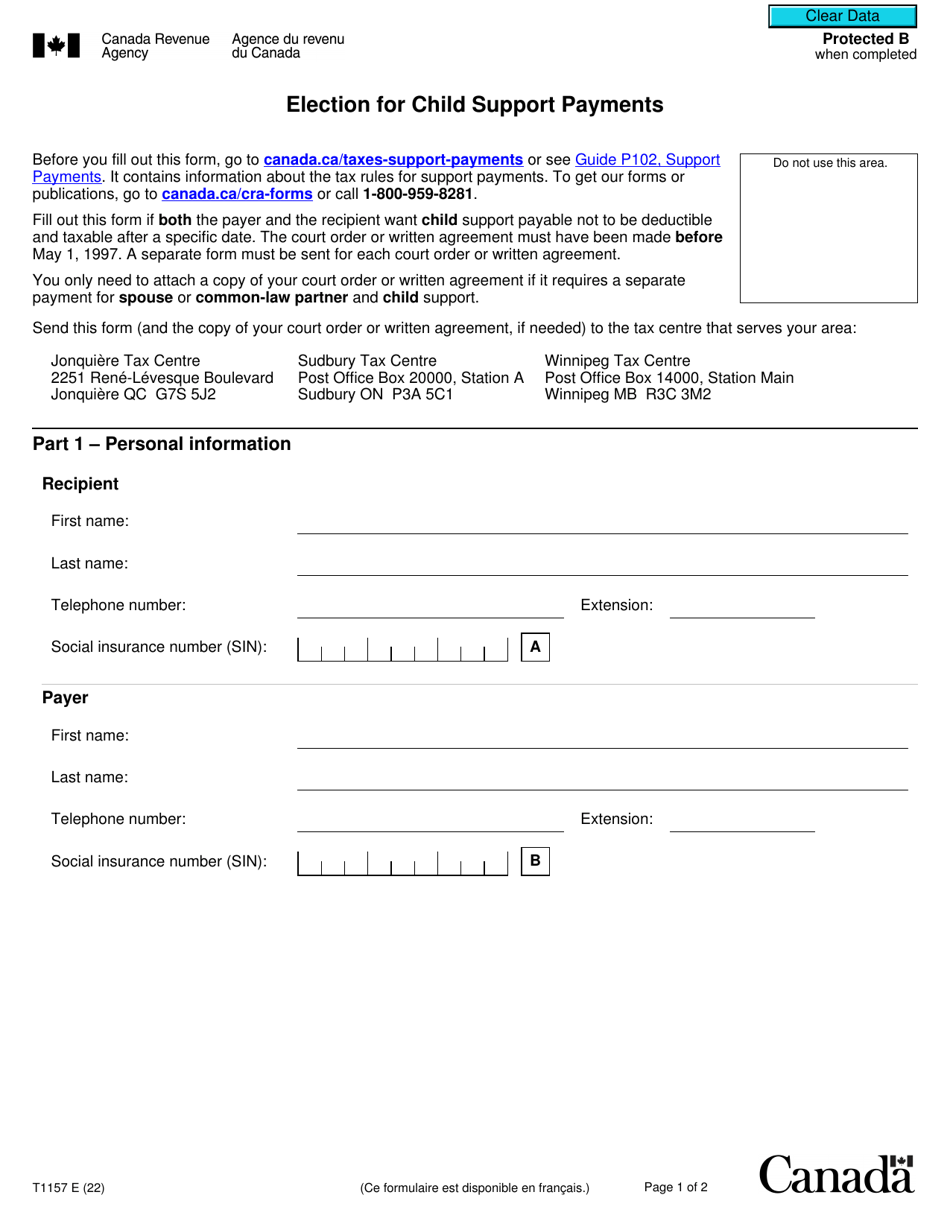

Form T1157 Election for Child Support Payments - Canada

Form T1157 Election for Child Support Payments in Canada is used by a taxpayer to report child support payments they receive as income. The form is used to elect to include the child support payments in the taxpayer's income, which allows them to claim related deductions and credits.

The person receiving child support payments files the Form T1157 Election for Child Support Payments in Canada.

FAQ

Q: What is Form T1157?

A: Form T1157 is a tax form used in Canada for making an election regarding child support payments.

Q: Who needs to fill out Form T1157?

A: Form T1157 needs to be filled out by the person making child support payments and the person receiving them.

Q: What is the purpose of Form T1157?

A: The purpose of Form T1157 is to elect to include child support payments as income for the recipient and as a deduction for the payor.

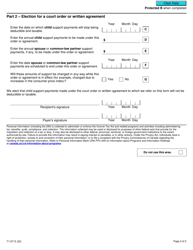

Q: When should Form T1157 be filed?

A: Form T1157 should be filed with the CRA by the due date of your tax return for the year in which the election is being made.