This version of the form is not currently in use and is provided for reference only. Download this version of

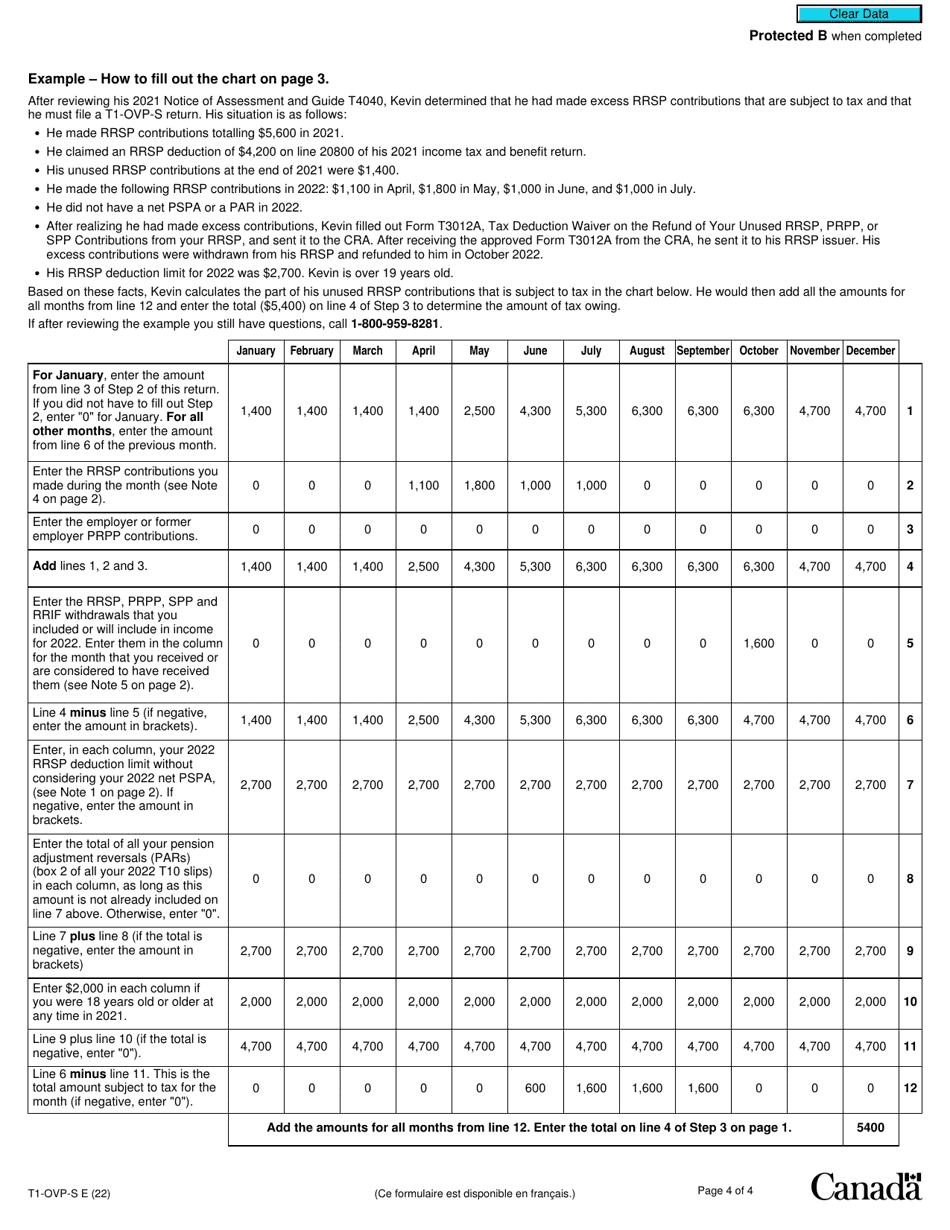

Form T1-OVP-S

for the current year.

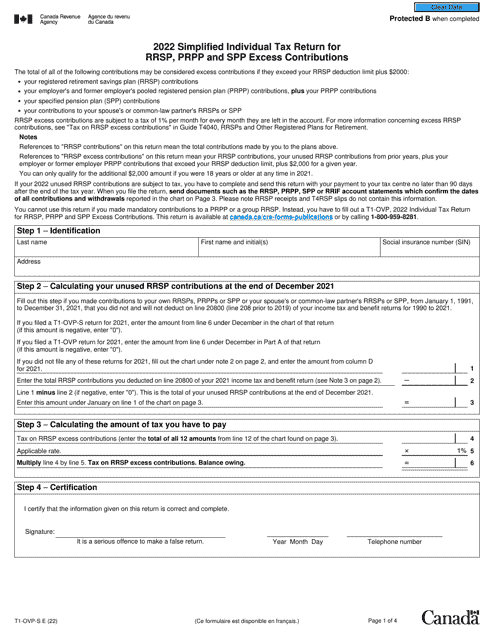

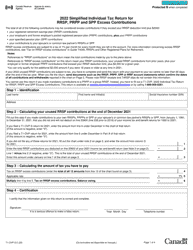

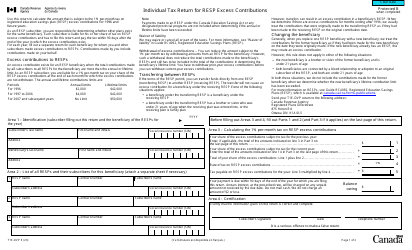

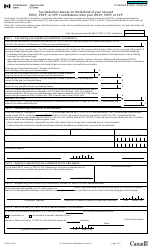

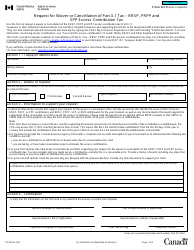

Form T1-OVP-S Simplified Individual Tax Return for Rrsp, Prpp and Spp Excess Contributions - Canada

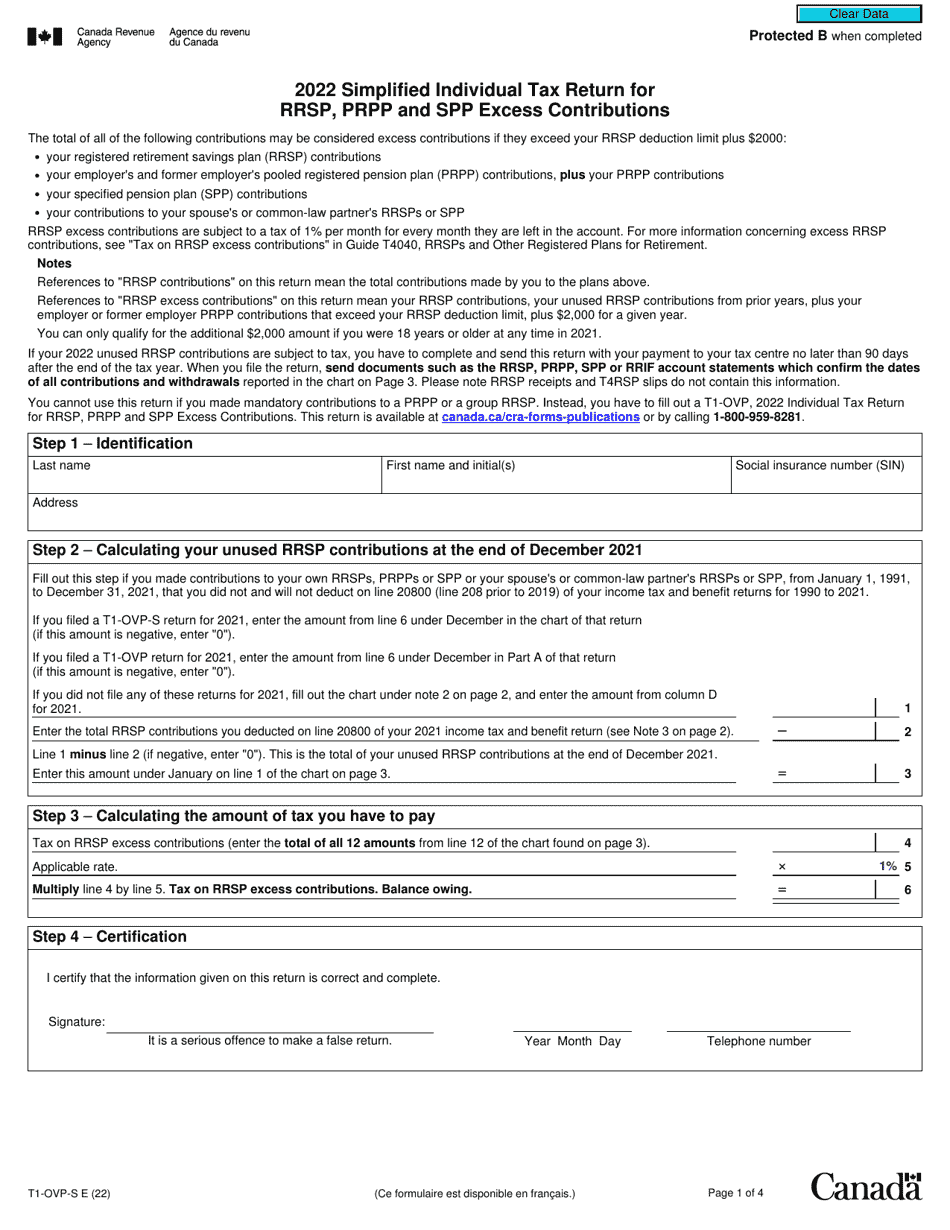

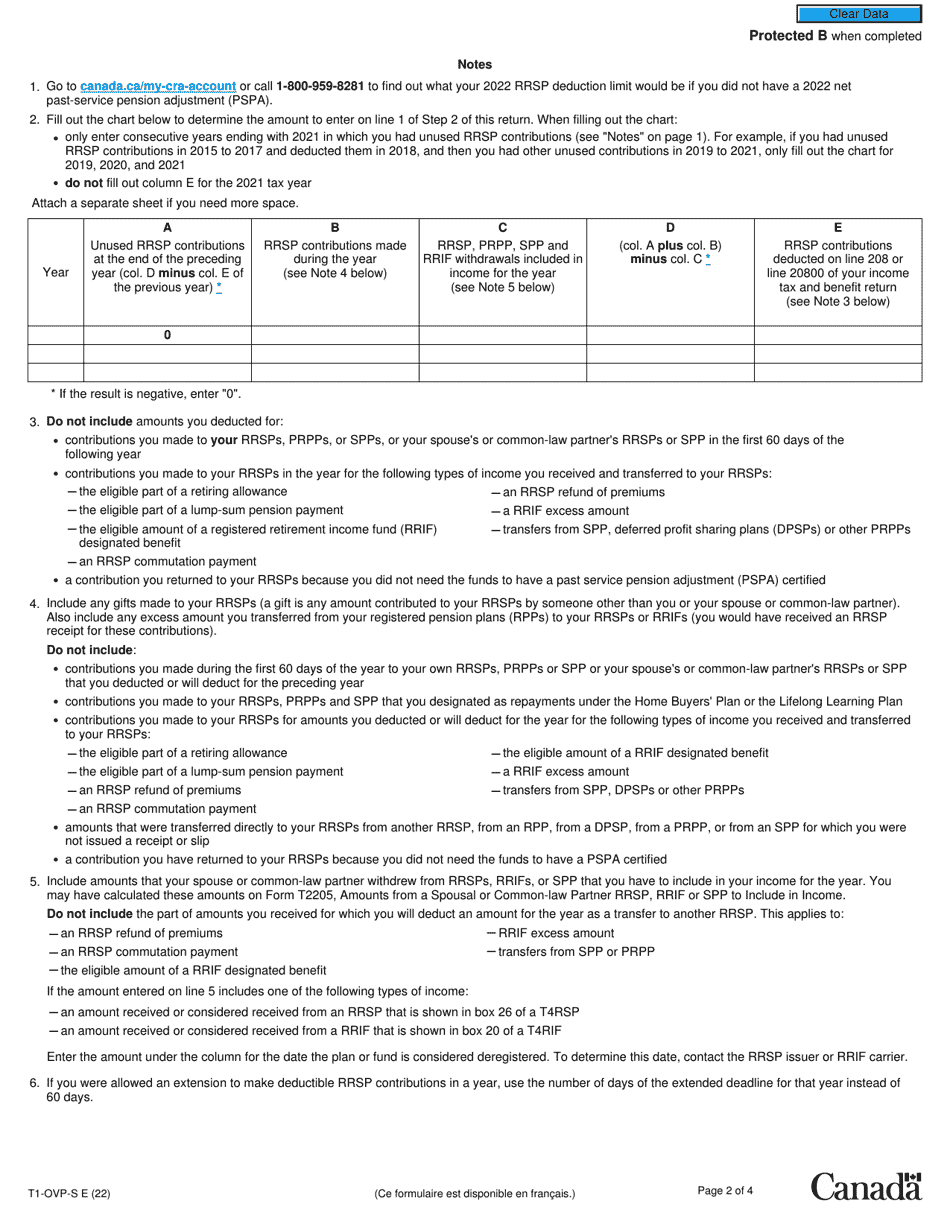

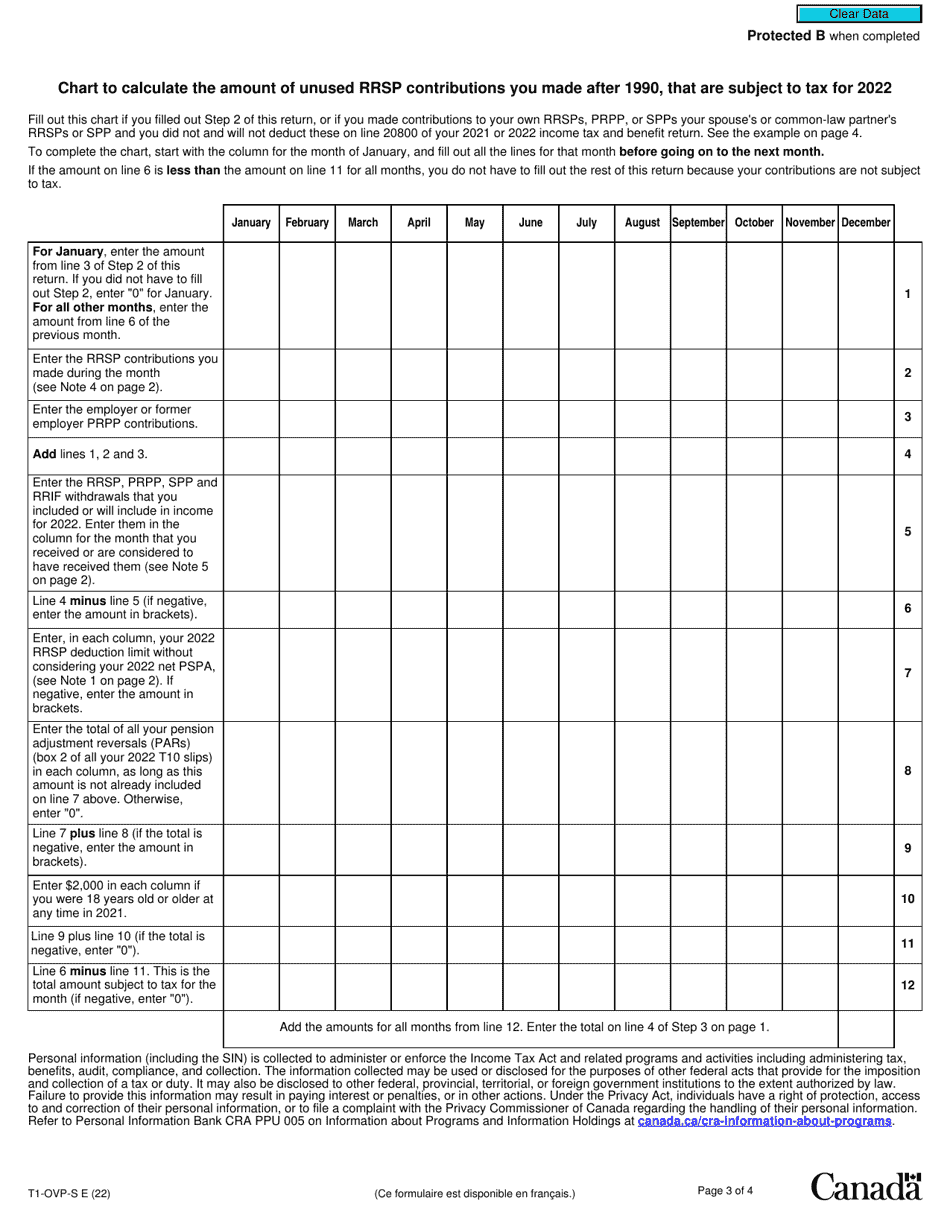

Form T1-OVP-S Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions - Canada is used to report and pay the tax owing on any excess contributions made to a Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP). It helps individuals correct their excess contributions and fulfill their tax obligations.

The individual who made excess contributions to their RRSP, PRPP, or SPP are required to file the T1-OVP-S form in Canada.

FAQ

Q: What is Form T1-OVP-S?

A: Form T1-OVP-S is the Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions in Canada.

Q: Who needs to fill out Form T1-OVP-S?

A: Individuals who have made excess contributions to their RRSP, PRPP, or SPP in Canada need to fill out Form T1-OVP-S.

Q: What are RRSP, PRPP, and SPP?

A: RRSP stands for Registered Retirement Savings Plan, PRPP stands for Pooled Registered Pension Plan, and SPP stands for Specified Pension Plan. These are retirement savings plans available in Canada.

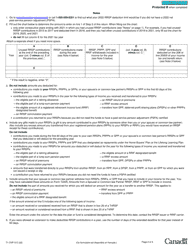

Q: What are excess contributions?

A: Excess contributions are contributions made to an RRSP, PRPP, or SPP that exceed the allowed contribution limit set by the Canada Revenue Agency.

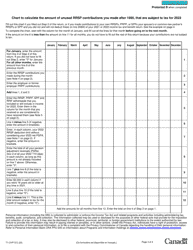

Q: How do I report excess contributions on Form T1-OVP-S?

A: You need to provide the details of your excess contributions and calculate the excess amount on Form T1-OVP-S.

Q: When is the deadline to file Form T1-OVP-S?

A: The deadline to file Form T1-OVP-S is generally the same as the deadline for your personal income tax return, typically April 30th of the following year.

Q: What happens if I don't file Form T1-OVP-S for excess contributions?

A: If you fail to report excess contributions on Form T1-OVP-S, you may face penalties and interest charges from the Canada Revenue Agency.