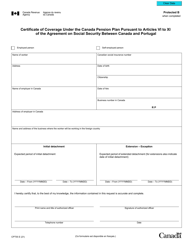

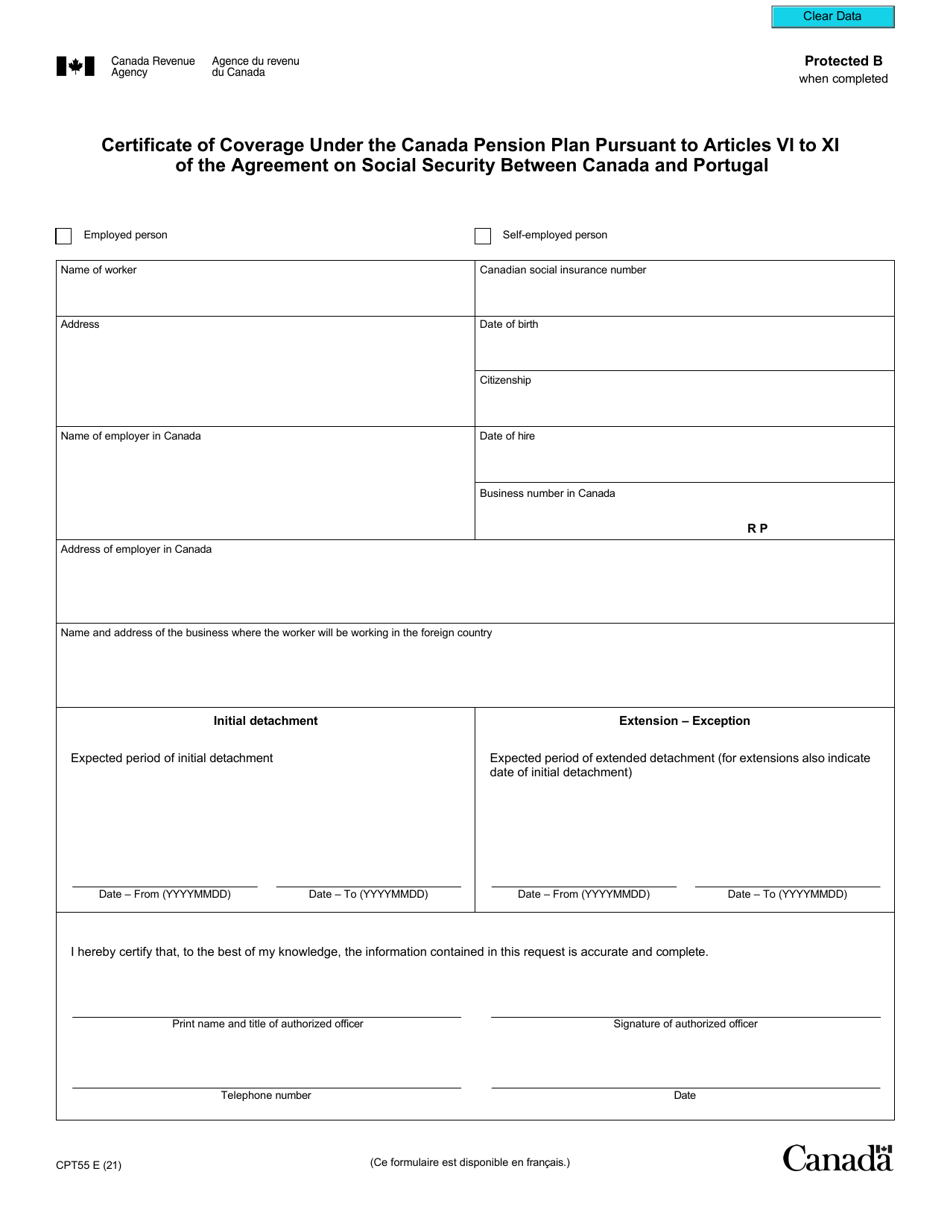

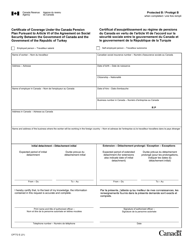

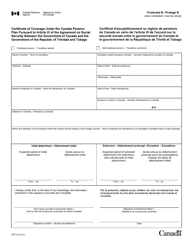

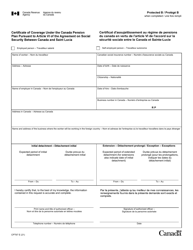

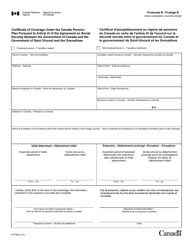

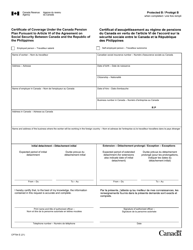

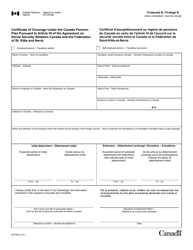

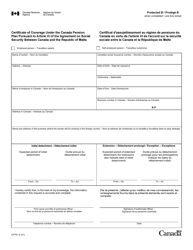

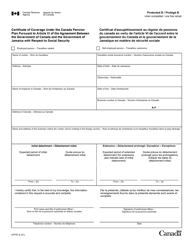

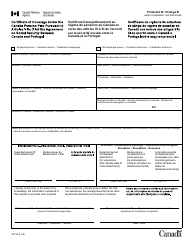

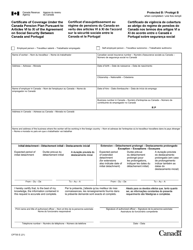

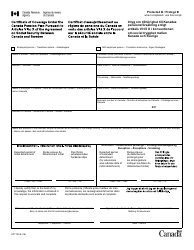

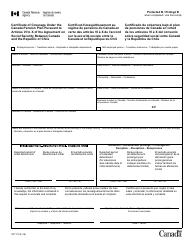

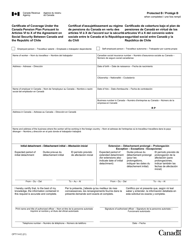

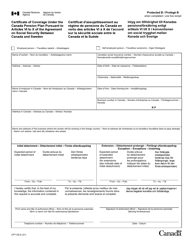

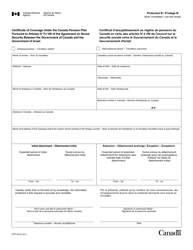

Form CPT55 Certificate of Coverage Under the Canada Pension Plan Pursuant to Articles VI to XI of the Agreement on Social Security Between Canada and Portugal - Canada

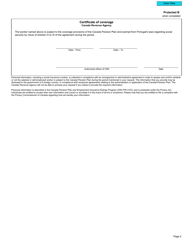

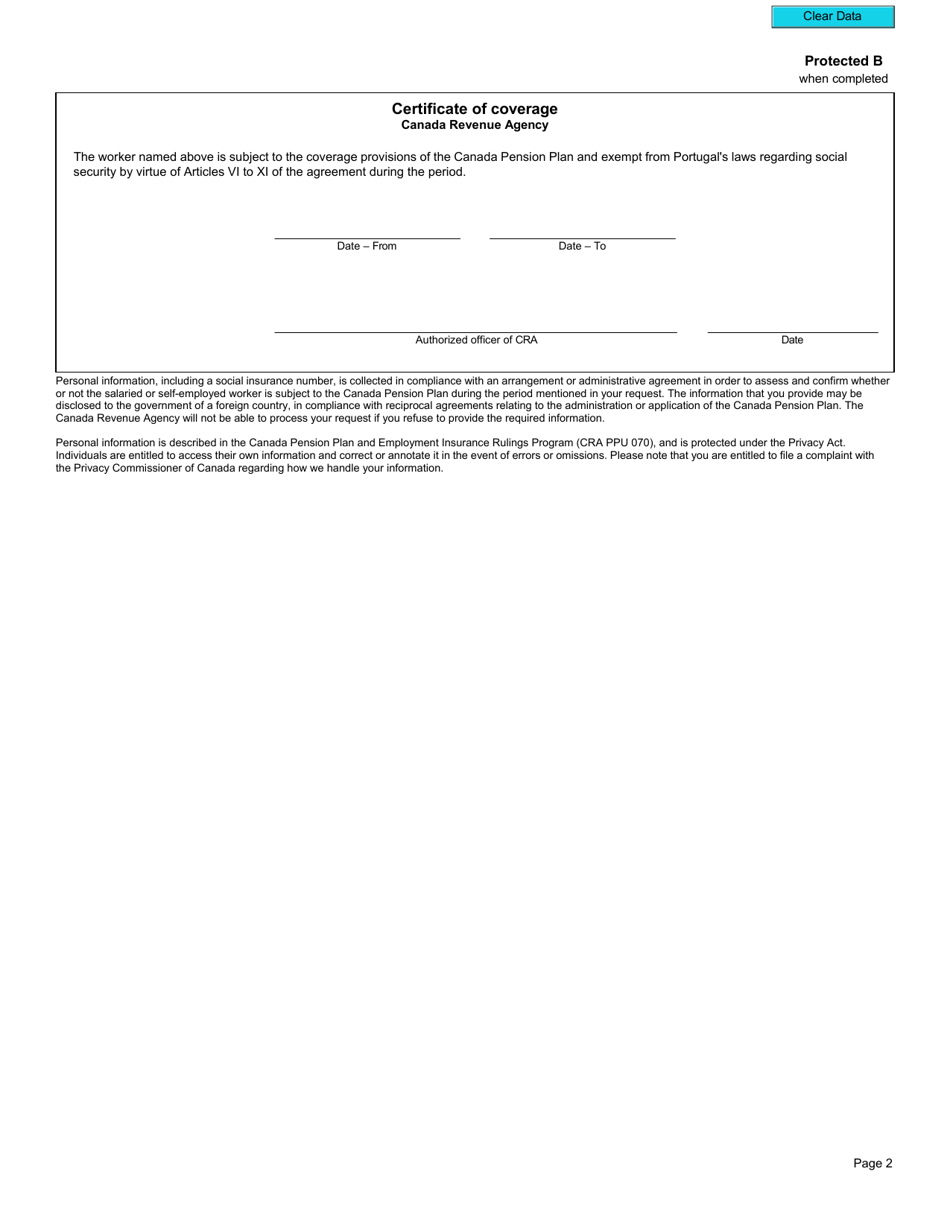

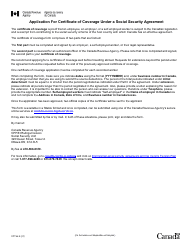

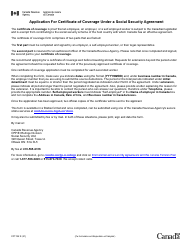

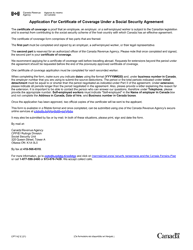

Form CPT55 Certificate of Coverage Under the Canada Pension Plan is used to certify a person's coverage under the Canada Pension Plan (CPP) when they are working in Portugal. This form confirms that the person is exempt from contributing to the Portuguese social security system and will continue to be covered by the CPP.

The form CPT55 Certificate of Coverage under the Canada Pension Plan is filed by individuals who are covered under the Canada Pension Plan and are employed or self-employed in Portugal, as outlined in the Agreement on Social Security between Canada and Portugal.

FAQ

Q: What is a Form CPT55 Certificate of Coverage?

A: Form CPT55 is a document that certifies coverage under the Canada Pension Plan (CPP) for individuals working in Canada and Portugal.

Q: What is the purpose of Form CPT55?

A: The purpose of Form CPT55 is to establish exemption from mandatory coverage under the social security system of one country for individuals temporarily working in the other country.

Q: Who is eligible to obtain a Form CPT55?

A: Individuals who are employed or self-employed in both Canada and Portugal, and who are required to pay social security contributions in both countries, may be eligible to obtain a Form CPT55.

Q: What is covered under the Canada Pension Plan (CPP)?

A: The Canada Pension Plan provides retirement, disability, and survivor benefits to eligible contributors and their families.

Q: What is the Agreement on Social Security Between Canada and Portugal?

A: The Agreement on Social Security is a bilateral agreement between Canada and Portugal that coordinates the social security systems of both countries.