This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1043

for the current year.

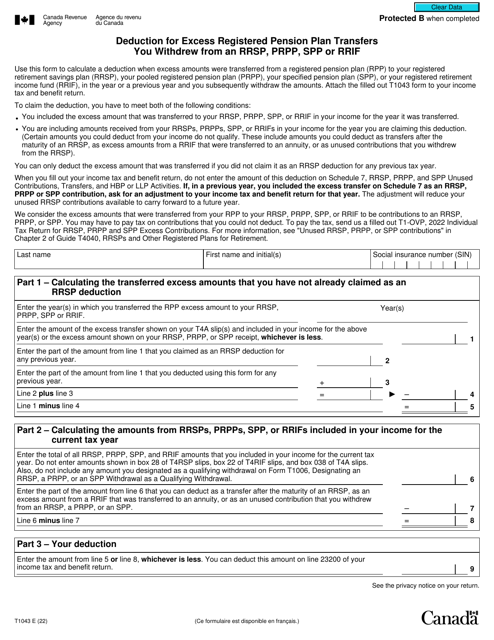

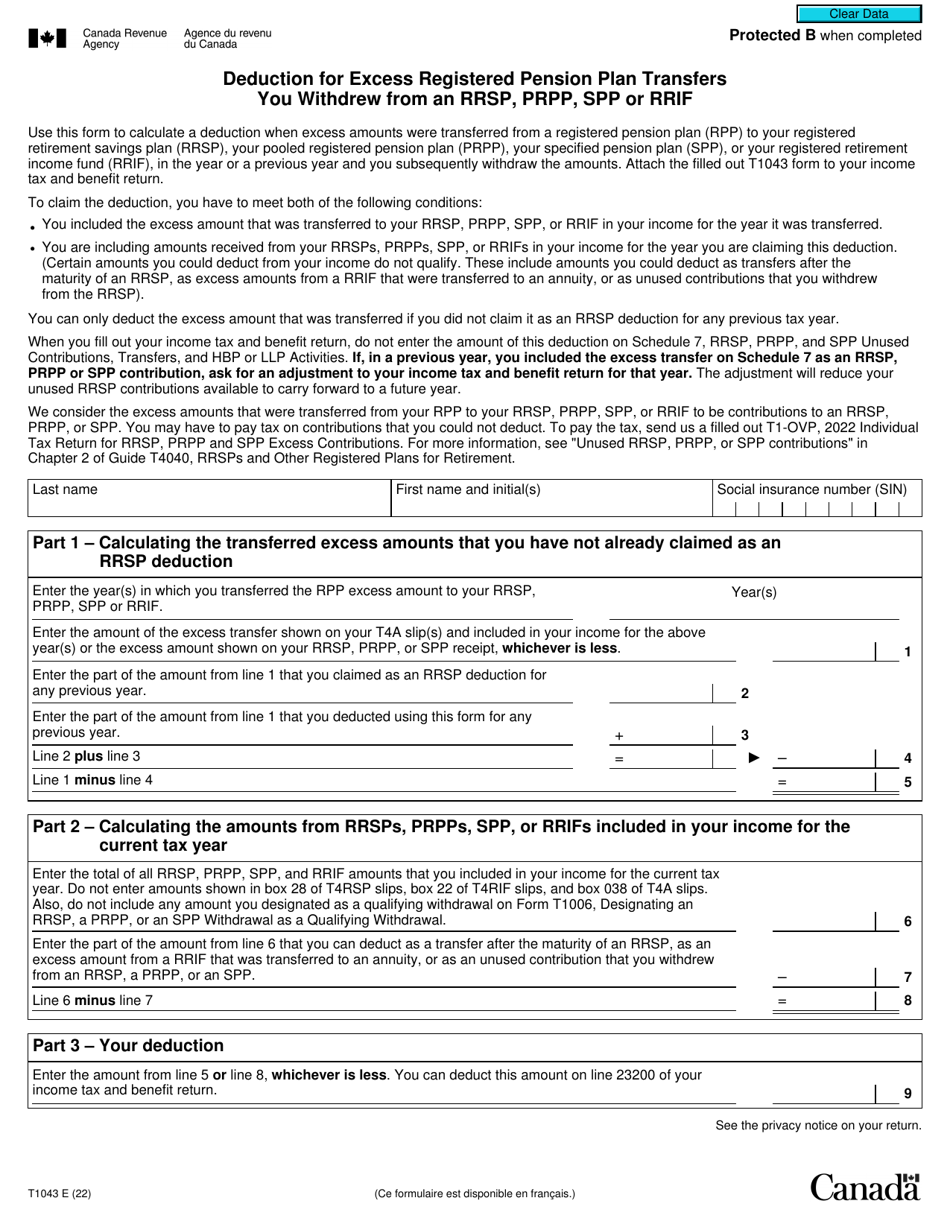

Form T1043 Deduction for Excess Registered Pension Plan Transfers You Withdrew From an Rrsp, Prpp, Spp or Rrif - Canada

Form T1043 Deduction for Excess Registered Pension Plan Transfers You Withdrew From an RRSP, PRPP, SPP or RRIF in Canada is used to claim a deduction for any excess amount withdrawn from a registered pension plan and transferred to your RRSP, PRPP, SPP, or RRIF. This allows you to avoid being taxed on the excess amount.

In Canada, the person who files the Form T1043 for deduction of excess registered pension plan transfers withdrawn from an RRSP, PRPP, SPP, or RRIF is the individual who made the withdrawals.

FAQ

Q: What is Form T1043?

A: Form T1043 is a tax form used in Canada.

Q: What is the purpose of Form T1043?

A: Form T1043 is used to claim a deduction for excess registered pension plan transfers withdrawn from an RRSP, PRPP, SPP, or RRIF.

Q: What are excess registered pension plan transfers?

A: Excess registered pension plan transfers refer to amounts withdrawn from a registered pension plan (RRSP, PRPP, SPP, or RRIF) that exceed the available contribution room for the individual.

Q: Who can use Form T1043?

A: Form T1043 can be used by individuals who have made excess registered pension plan transfers.

Q: Is the deduction claimed on Form T1043 refundable?

A: No, the deduction claimed on Form T1043 is not refundable.

Q: What other documents do I need to include with Form T1043?

A: You may need to include the related T4RSP, T4RPP, T4RIF, or T3 slip(s) with Form T1043, depending on your situation.

Q: When is the deadline for filing Form T1043?

A: The deadline for filing Form T1043 is the same as the deadline for filing your income tax return, which is generally April 30th of the following year.

Q: What happens if I don't file Form T1043?

A: If you are eligible to claim the deduction for excess registered pension plan transfers but do not file Form T1043, you may miss out on potential tax savings.