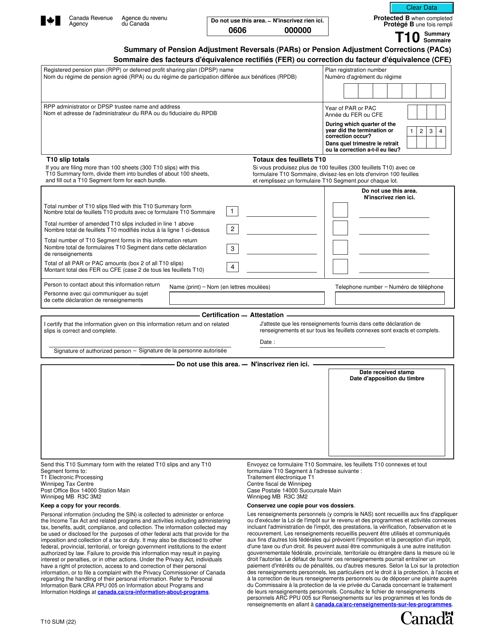

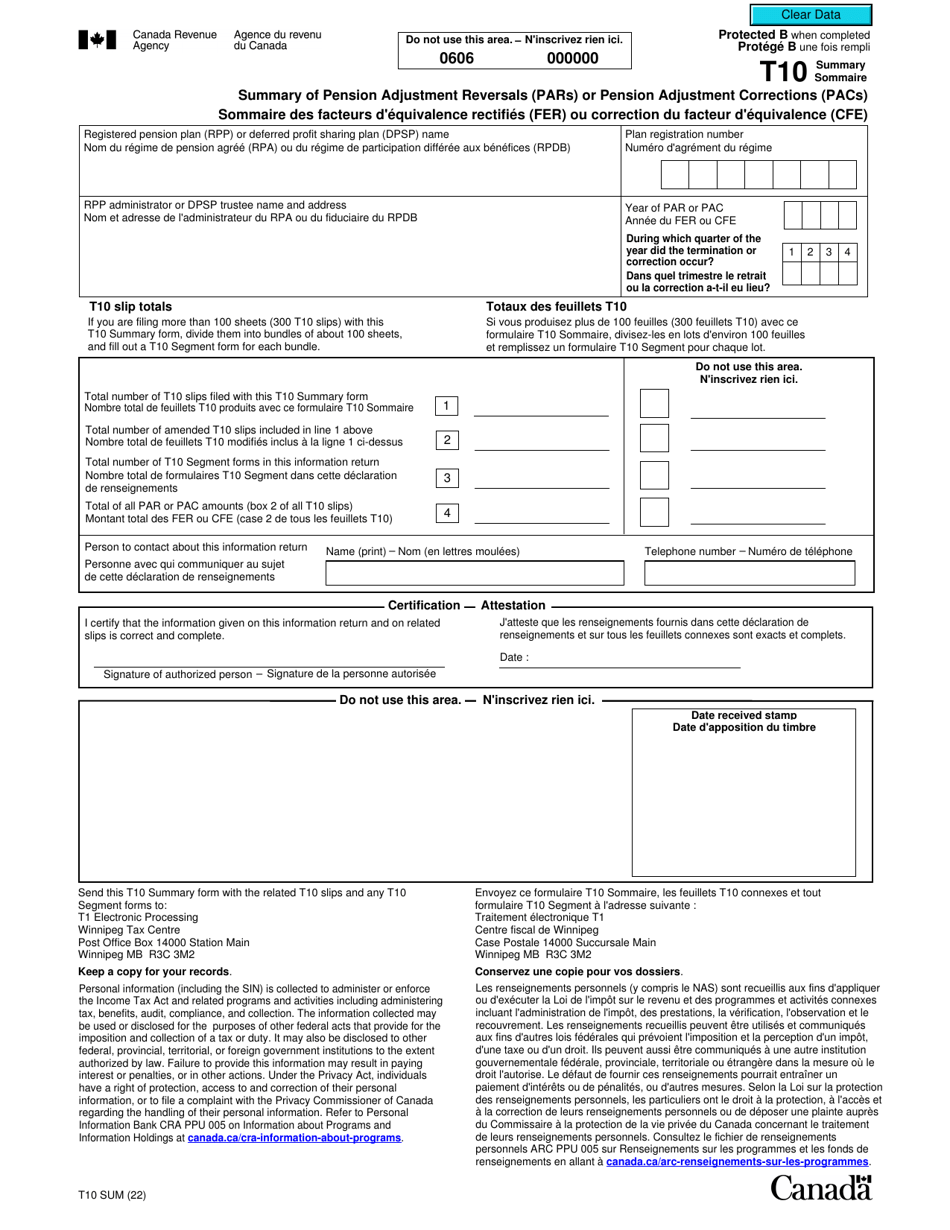

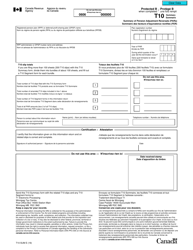

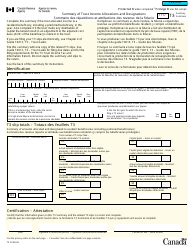

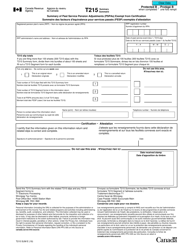

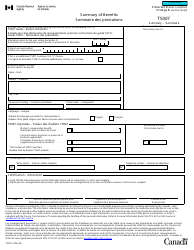

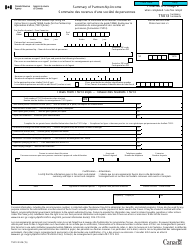

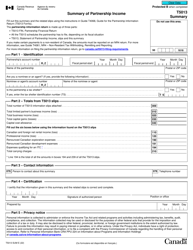

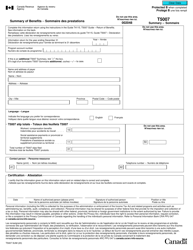

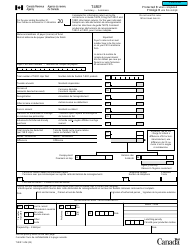

Form T10 SUM Summary of Pension Adjustment Reversals (Pars) or Pension Adjustment Corrections (Pacs) - Canada (English / French)

Form T10 SUM is used in Canada for the purpose of summarizing Pension Adjustment Reversals (PARs) or Pension Adjustment Corrections (PACs). This form is necessary for individuals who need to report any changes or corrections to their pension adjustments. It helps in ensuring accurate and updated pension information for tax purposes.

The Form T10 SUM, Summary of Pension Adjustment Reversals (PARs) or Pension Adjustment Corrections (PACs), in Canada, can be filed by the individual taxpayer.

FAQ

Q: What is Form T10 SUM?

A: Form T10 SUM is a summary of Pension Adjustment Reversals (PARs) or Pension Adjustment Corrections (PACs) in Canada.

Q: What is the purpose of Form T10 SUM?

A: The purpose of Form T10 SUM is to provide a summary of pension adjustment reversals or corrections in Canada.

Q: Who needs to file Form T10 SUM?

A: Employers or pension plan administrators who have made pension adjustment reversals or corrections in Canada need to file Form T10 SUM.

Q: Is Form T10 SUM available in both English and French?

A: Yes, Form T10 SUM is available in both English and French.