This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1139

for the current year.

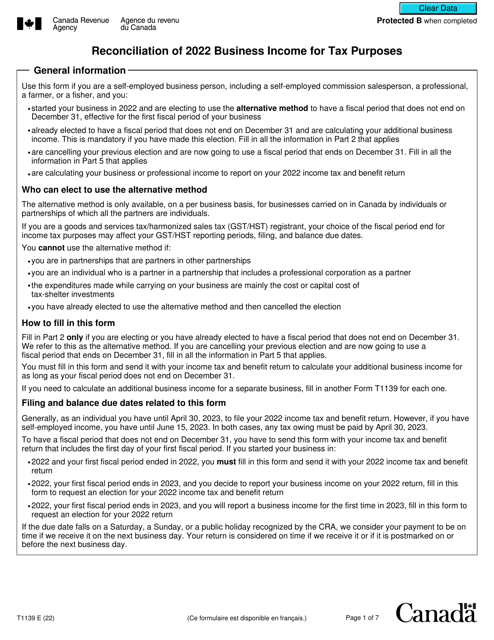

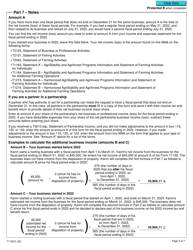

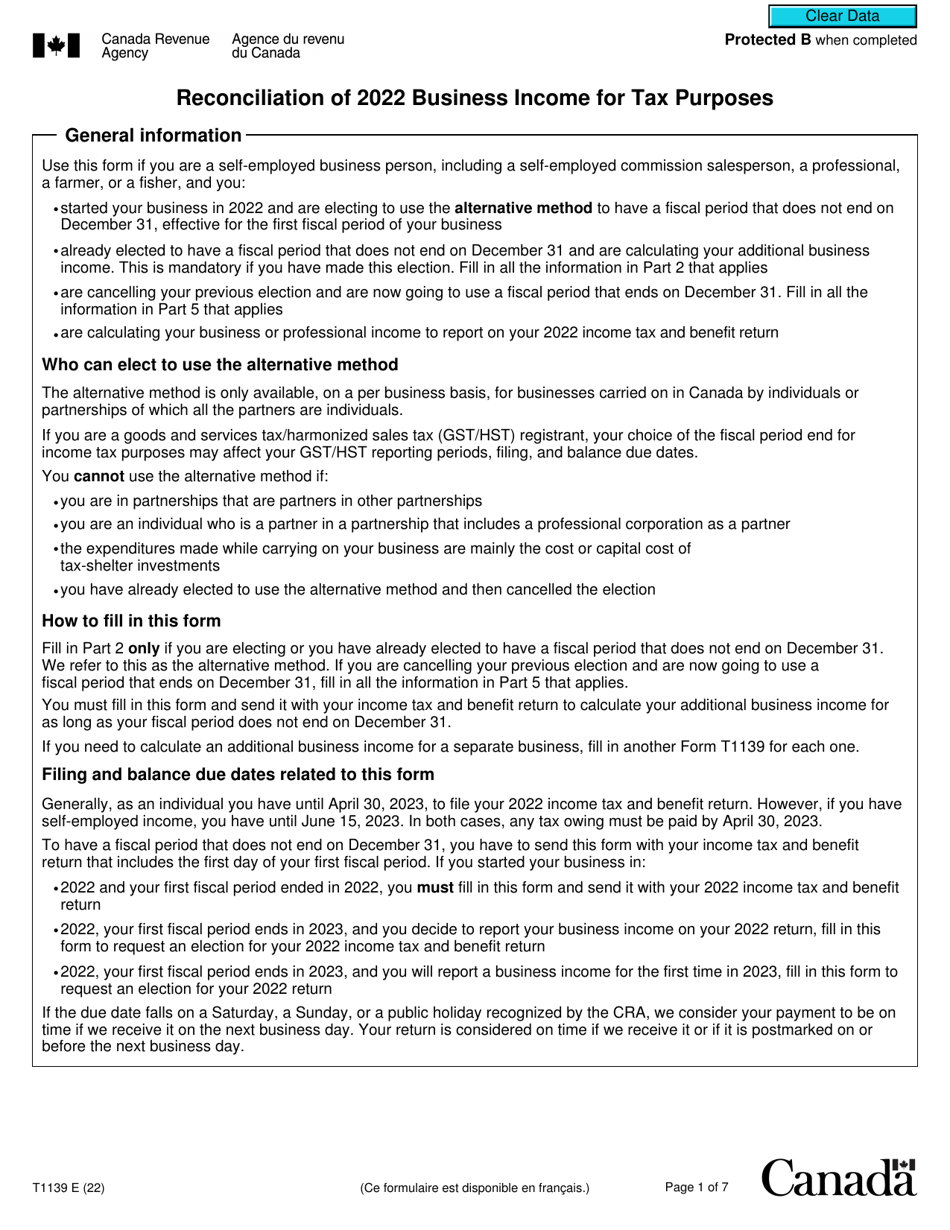

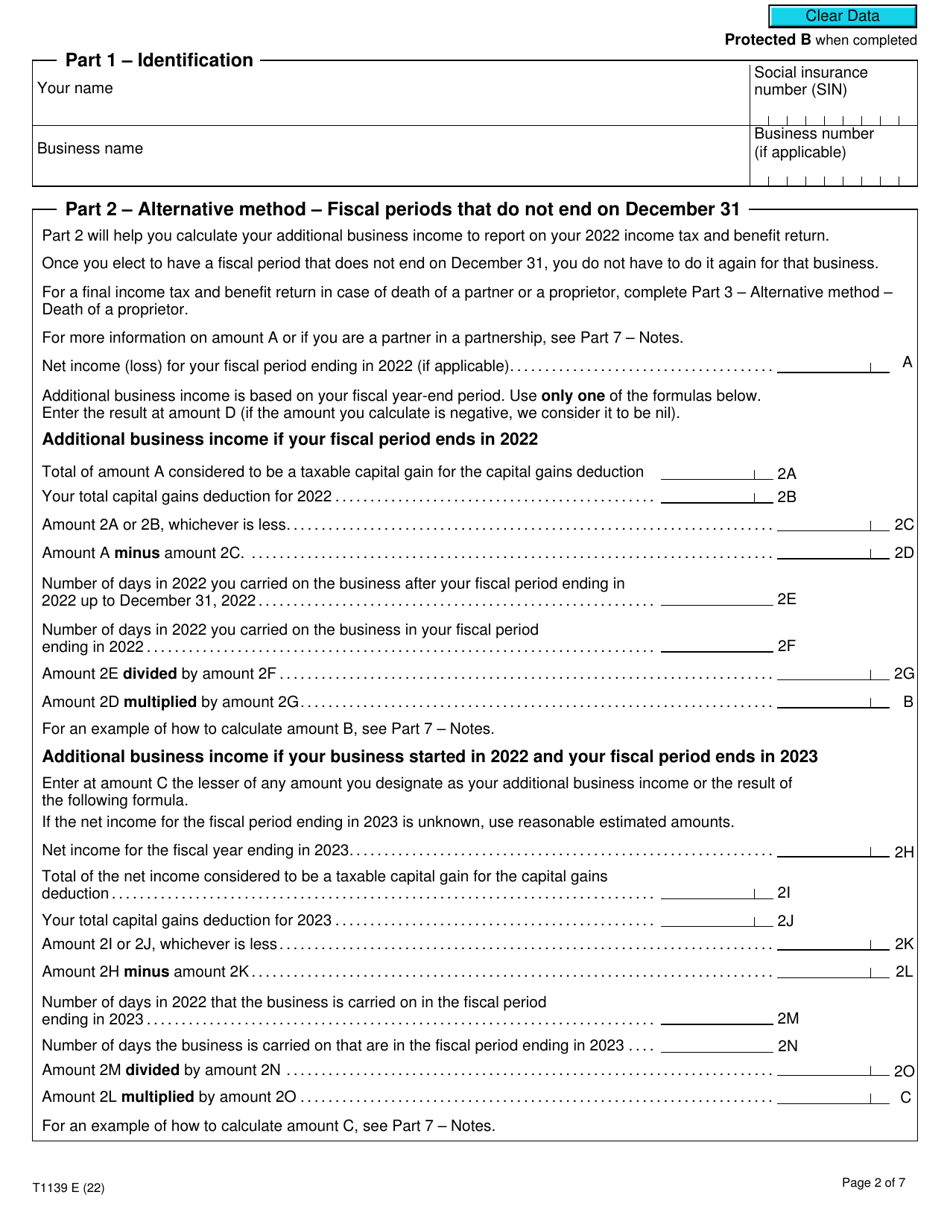

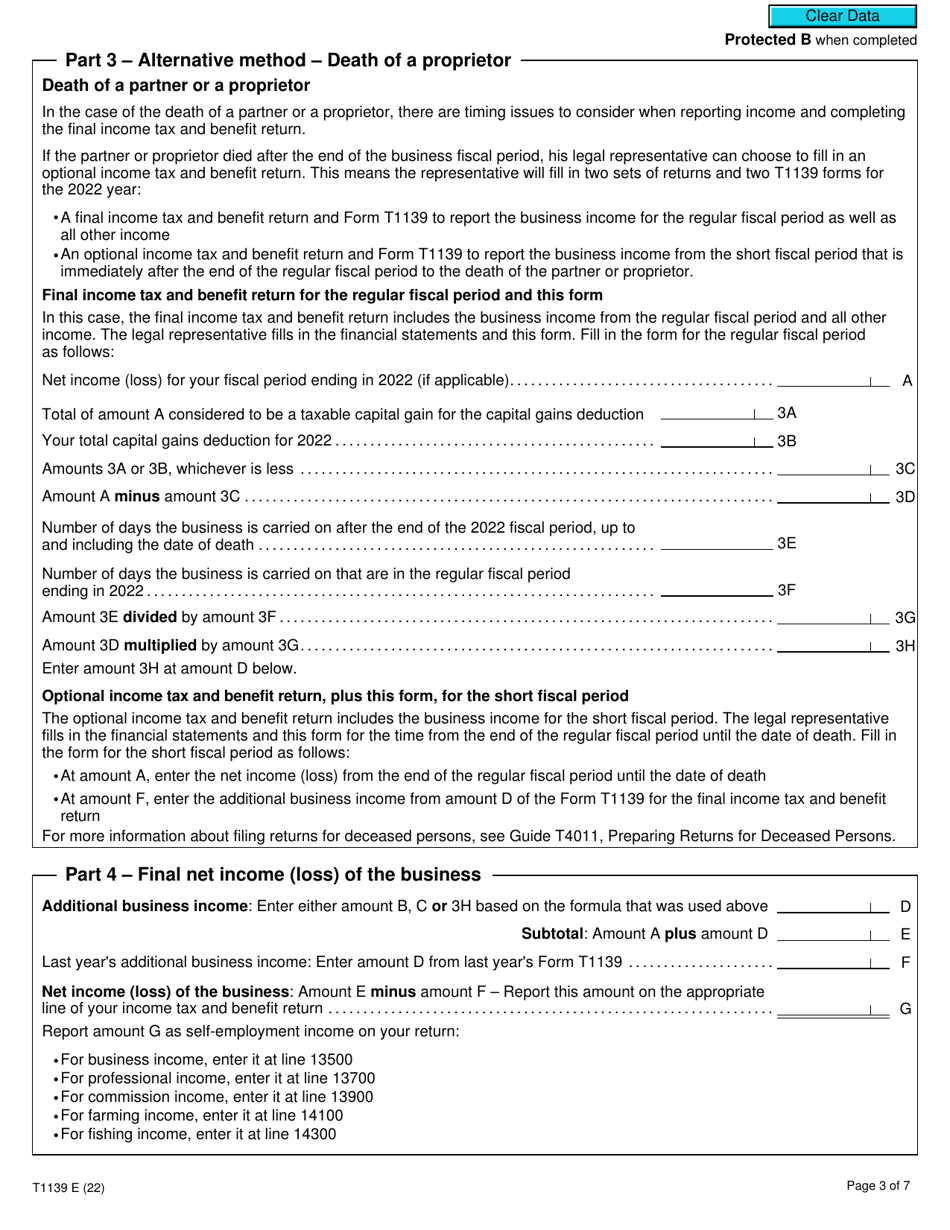

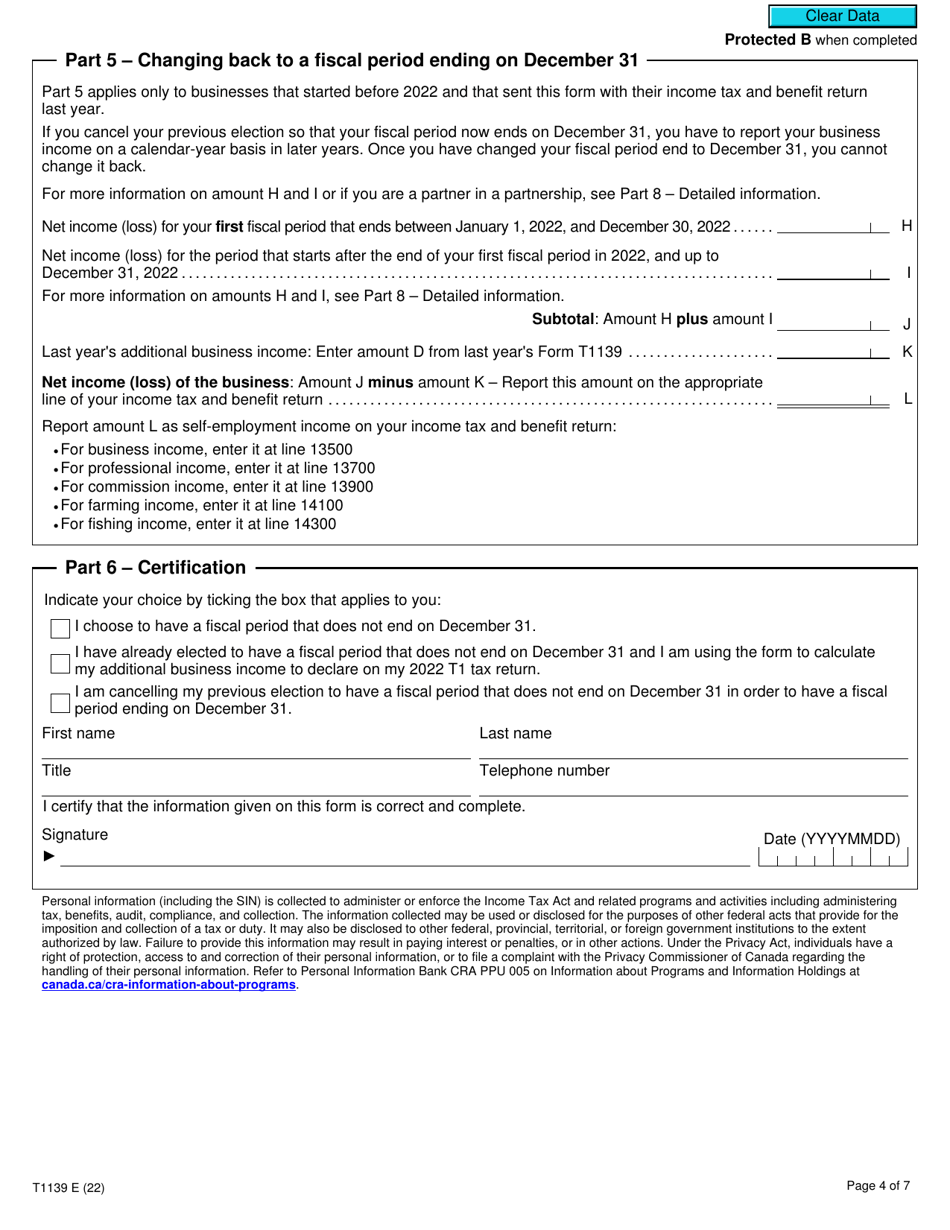

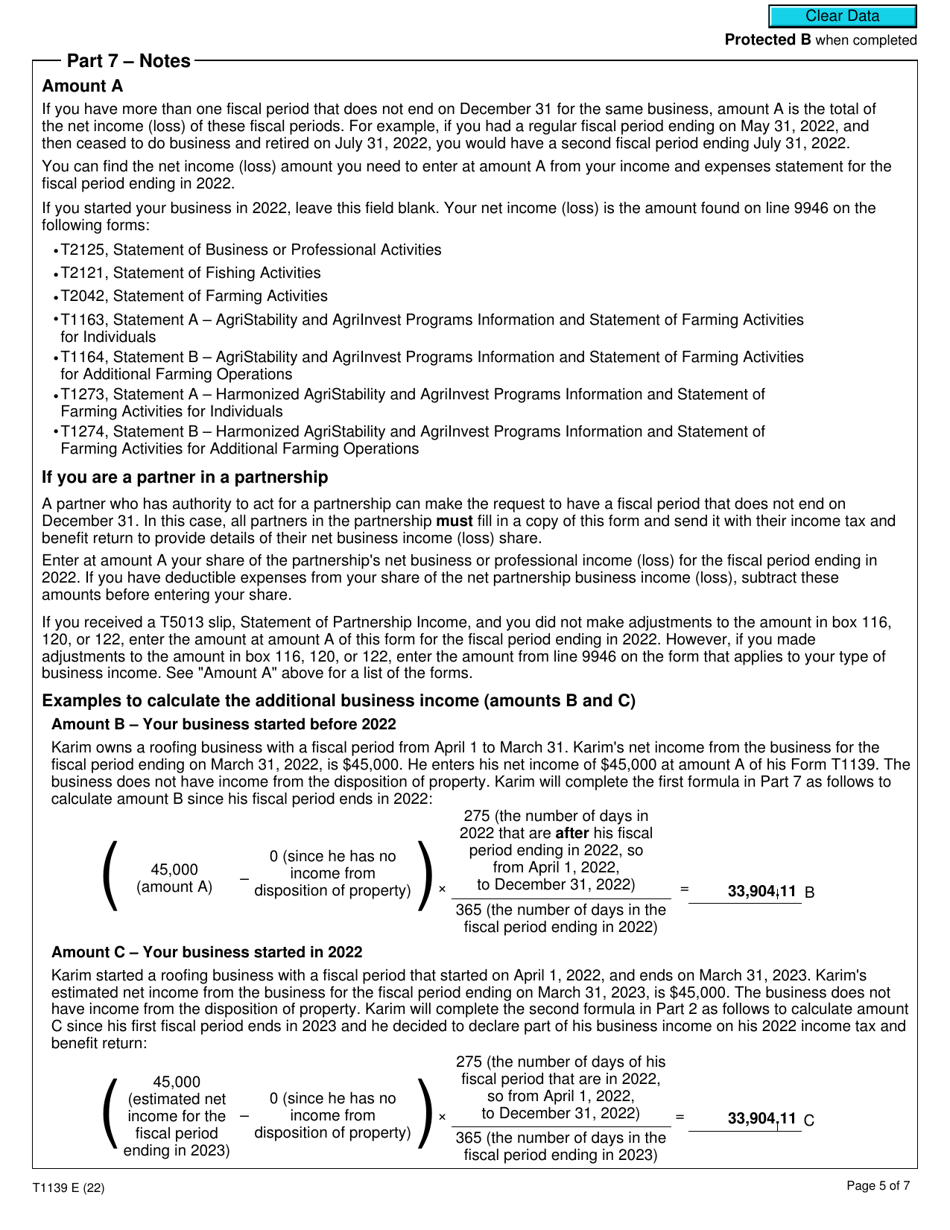

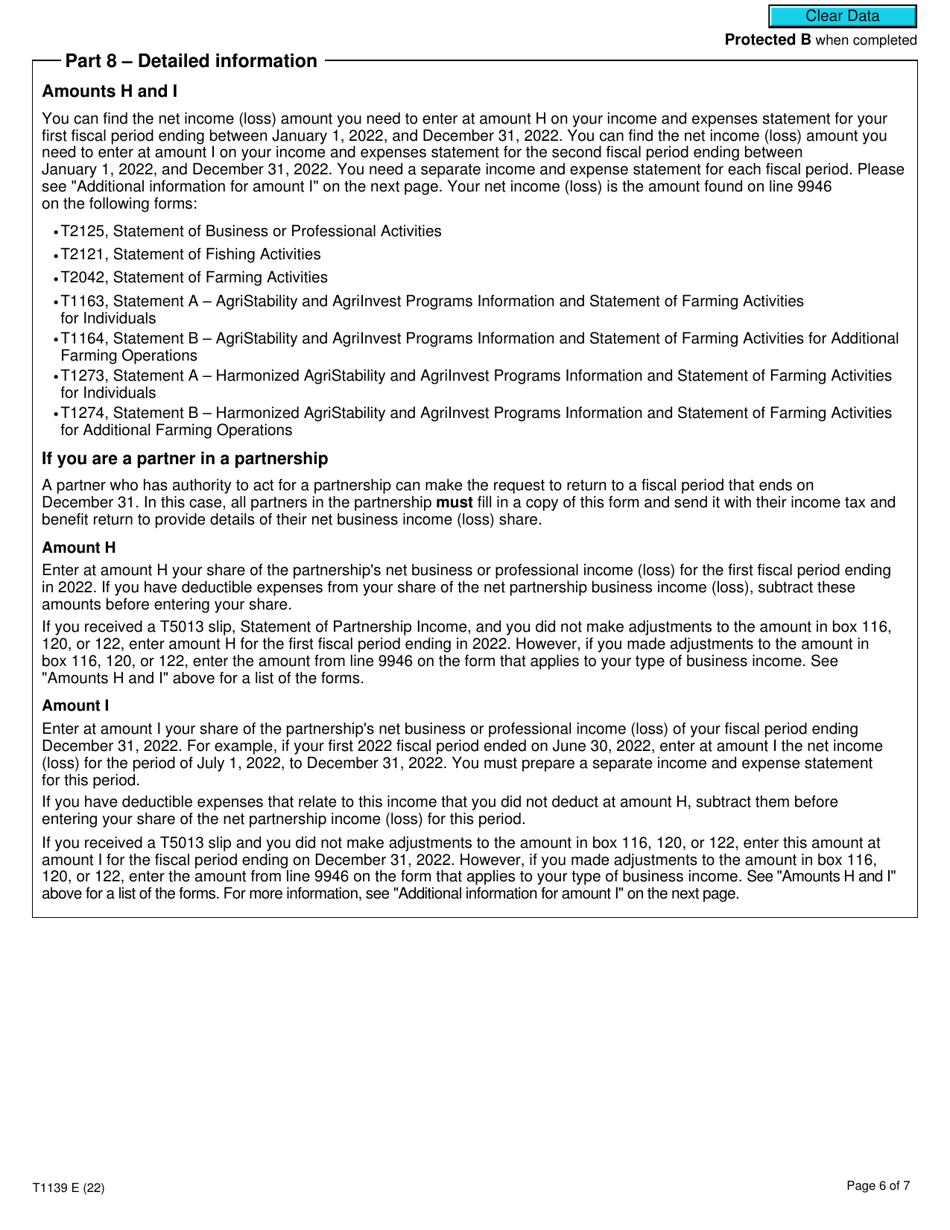

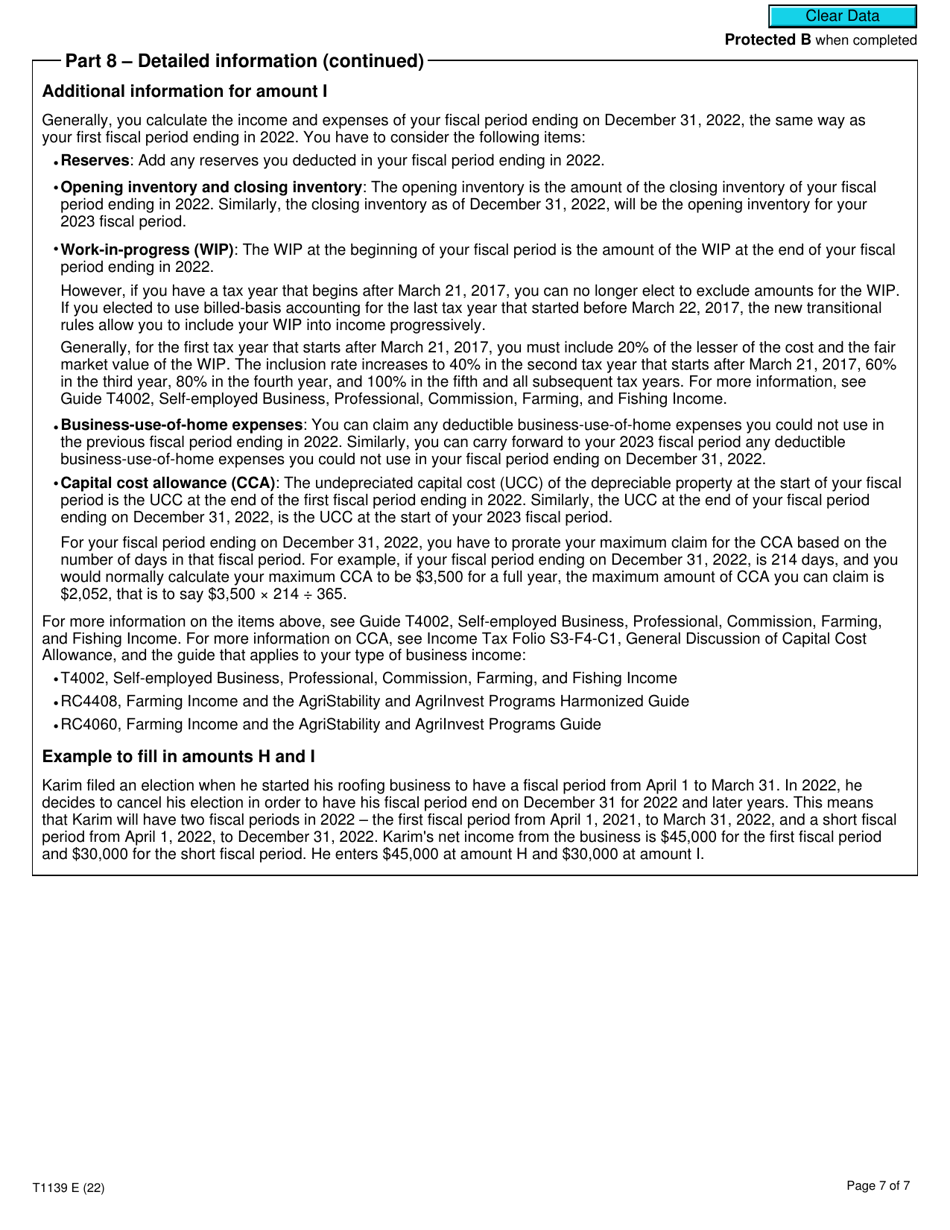

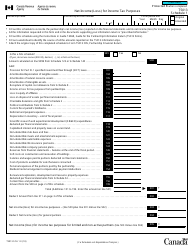

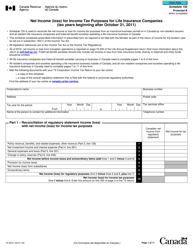

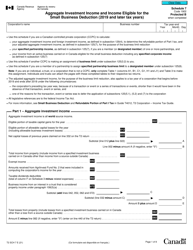

Form T1139 Reconciliation of Business Income for Tax Purposes - Canada

Form T1139 Reconciliation of Business Income for Tax Purposes in Canada is used to reconcile differences between a taxpayer's financial statements and their tax return. It helps ensure that the income reported on the tax return is accurate and in compliance with the Canadian tax laws.

The Form T1139 Reconciliation of Business Income for Tax Purposes in Canada is filed by self-employed individuals and businesses to reconcile their business income for tax purposes.

FAQ

Q: What is Form T1139?

A: Form T1139 is a document used in Canada to reconcile business income for tax purposes.

Q: Who needs to fill out Form T1139?

A: Canadian business owners or self-employed individuals who need to reconcile their business income for tax purposes.

Q: What is the purpose of Form T1139?

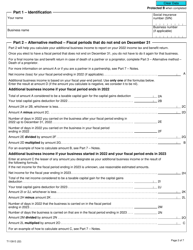

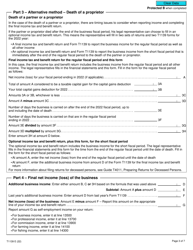

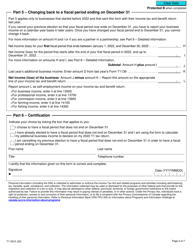

A: The purpose of Form T1139 is to calculate the difference between the income reported for tax purposes and the income reported for financial accounting purposes.

Q: What information is required to fill out Form T1139?

A: To fill out Form T1139, you will need to provide details about your business income, expenses, and any adjustments needed to reconcile the two.