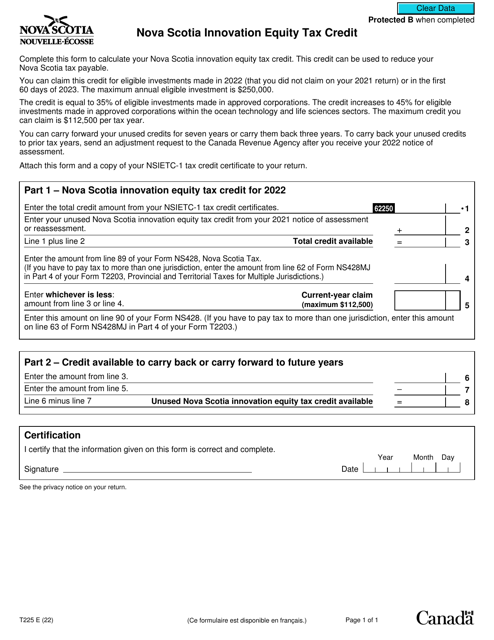

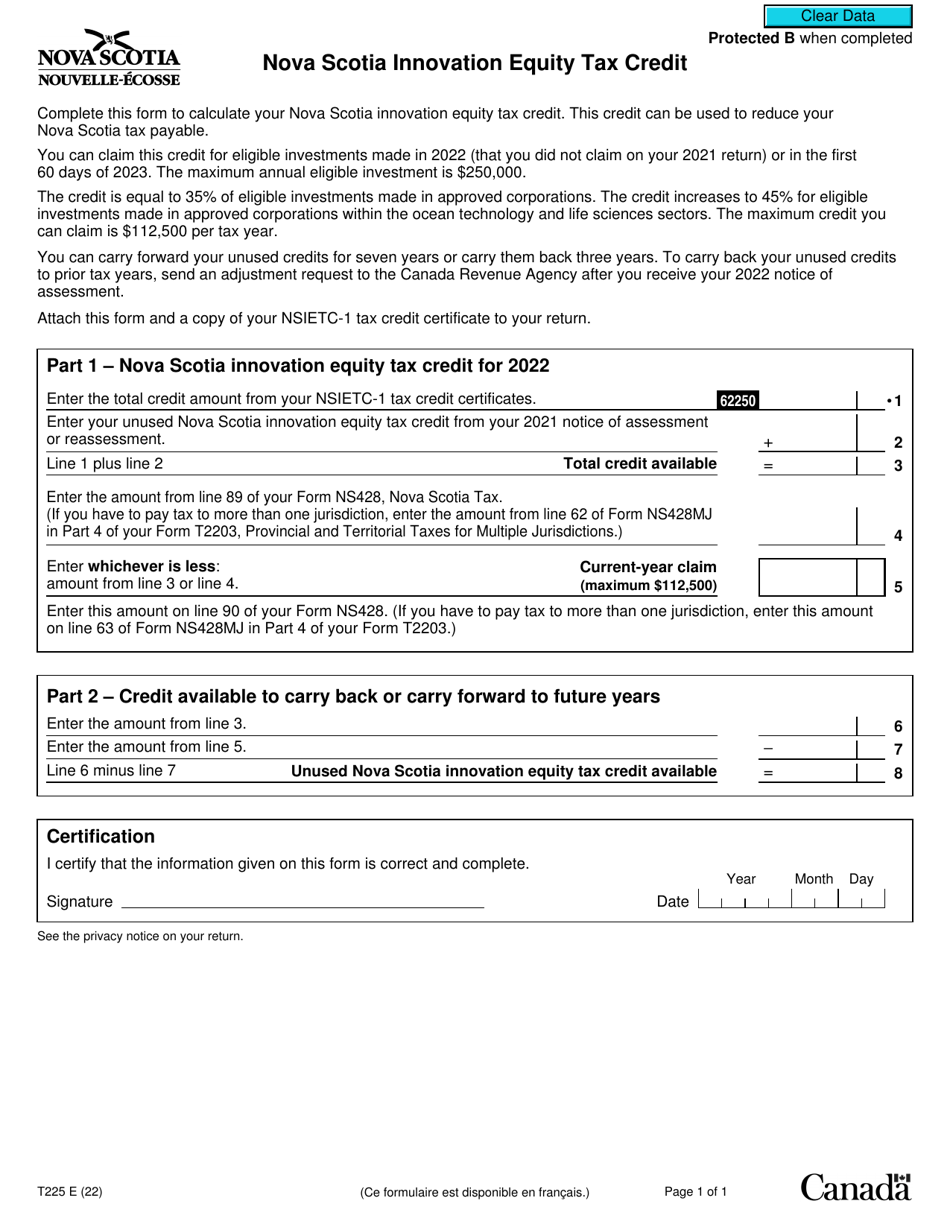

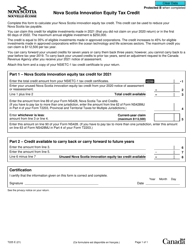

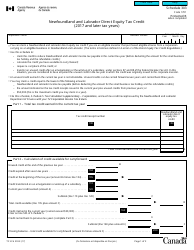

Form T225 Nova Scotia Innovation Equity Tax Credit - Canada

Form T225 Nova Scotia Innovation Equity Tax Credit is a tax credit form in Canada, specifically for the province of Nova Scotia. This form is used by eligible individuals or corporations to claim the Innovation Equity Tax Credit, which provides tax incentives for investments made in eligible Nova Scotia corporations.

The Form T225 Nova Scotia Innovation Equity Tax Credit is filed by individuals or corporations who are eligible to claim this tax credit in Nova Scotia, Canada.

FAQ

Q: What is the T225 Nova Scotia Innovation Equity Tax Credit?

A: The T225 Nova Scotia Innovation Equity Tax Credit is a tax credit program in Nova Scotia, Canada.

Q: Who is eligible for the T225 Nova Scotia Innovation Equity Tax Credit?

A: Eligible individuals and corporations who invest in eligible Nova Scotia corporations may be eligible for the T225 Nova Scotia Innovation Equity Tax Credit.

Q: What is the purpose of the T225 Nova Scotia Innovation Equity Tax Credit?

A: The purpose of the T225 Nova Scotia Innovation Equity Tax Credit is to encourage investment in innovative businesses in Nova Scotia.

Q: How much is the tax credit amount for the T225 Nova Scotia Innovation Equity Tax Credit?

A: The amount of the tax credit for the T225 Nova Scotia Innovation Equity Tax Credit is typically 35% of the investment amount.

Q: Are there any limitations or restrictions on the T225 Nova Scotia Innovation Equity Tax Credit?

A: Yes, there are certain limitations and restrictions on the T225 Nova Scotia Innovation Equity Tax Credit, such as the maximum amount of credits that can be claimed and the eligibility requirements for the investment.