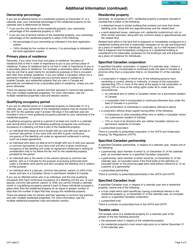

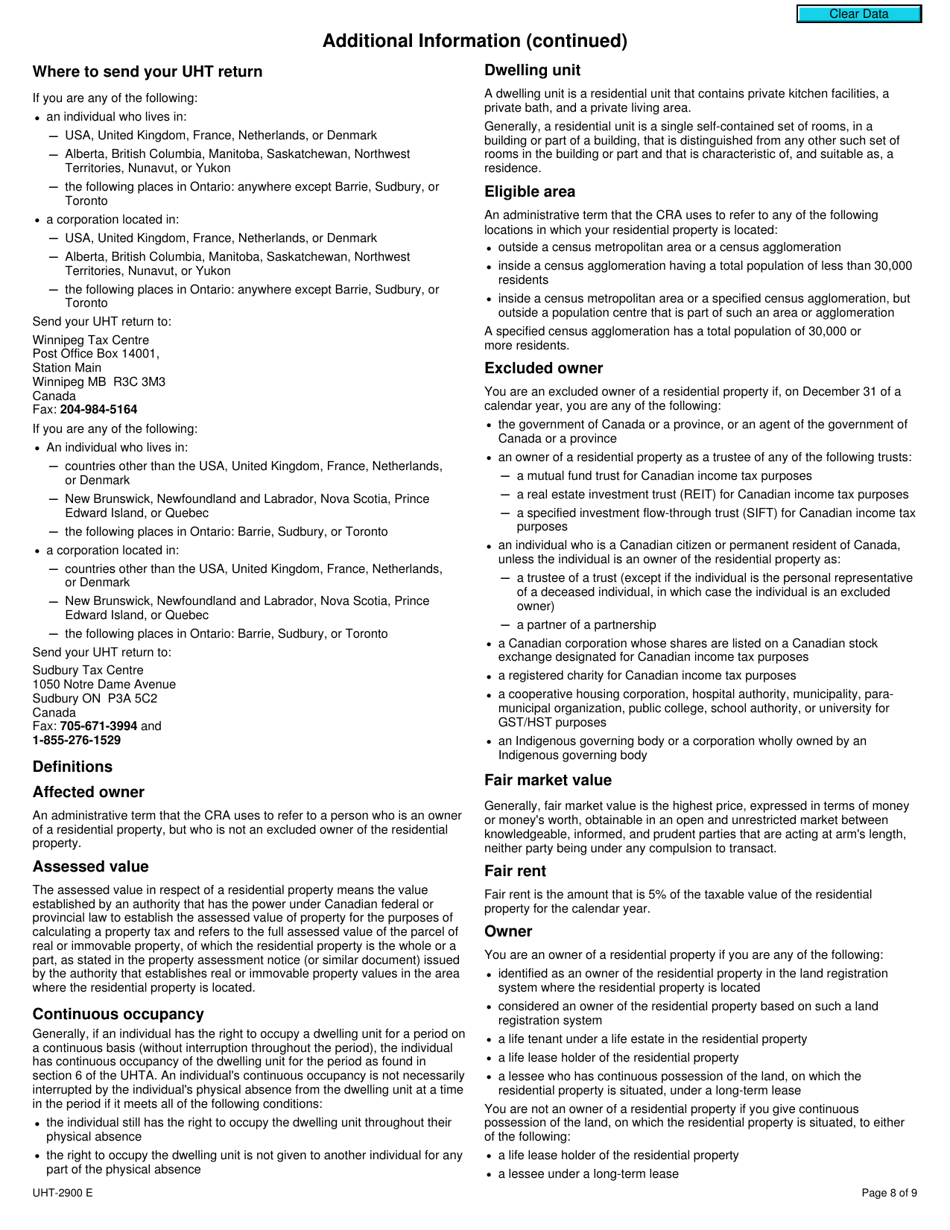

This version of the form is not currently in use and is provided for reference only. Download this version of

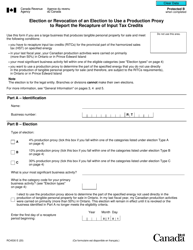

Form UHT-2900

for the current year.

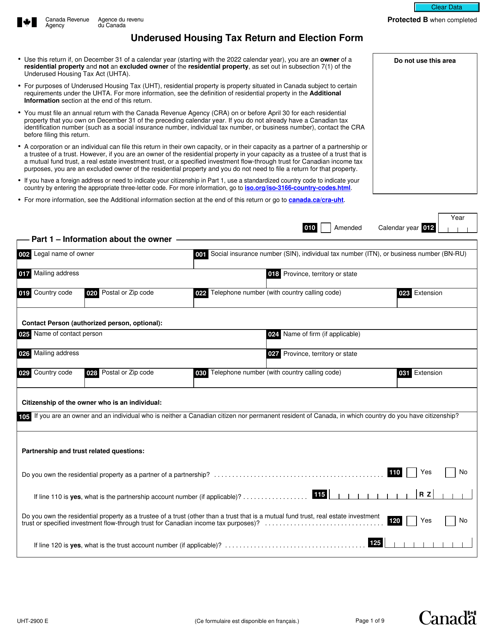

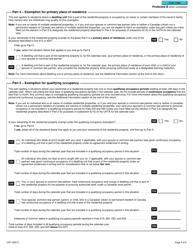

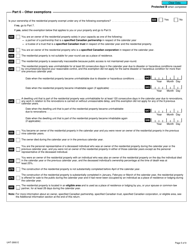

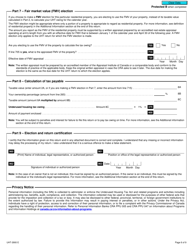

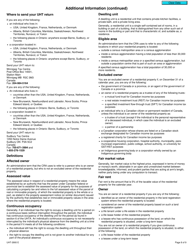

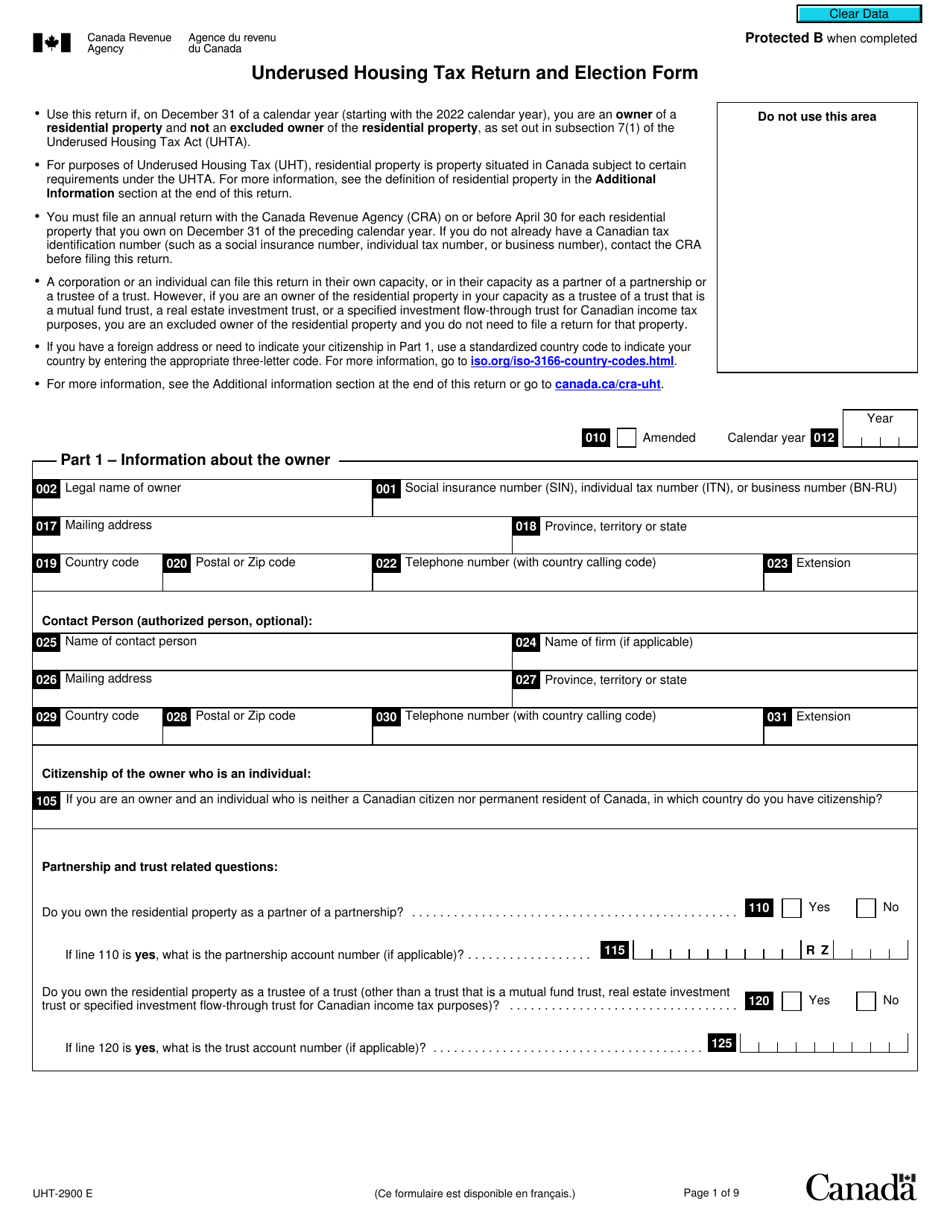

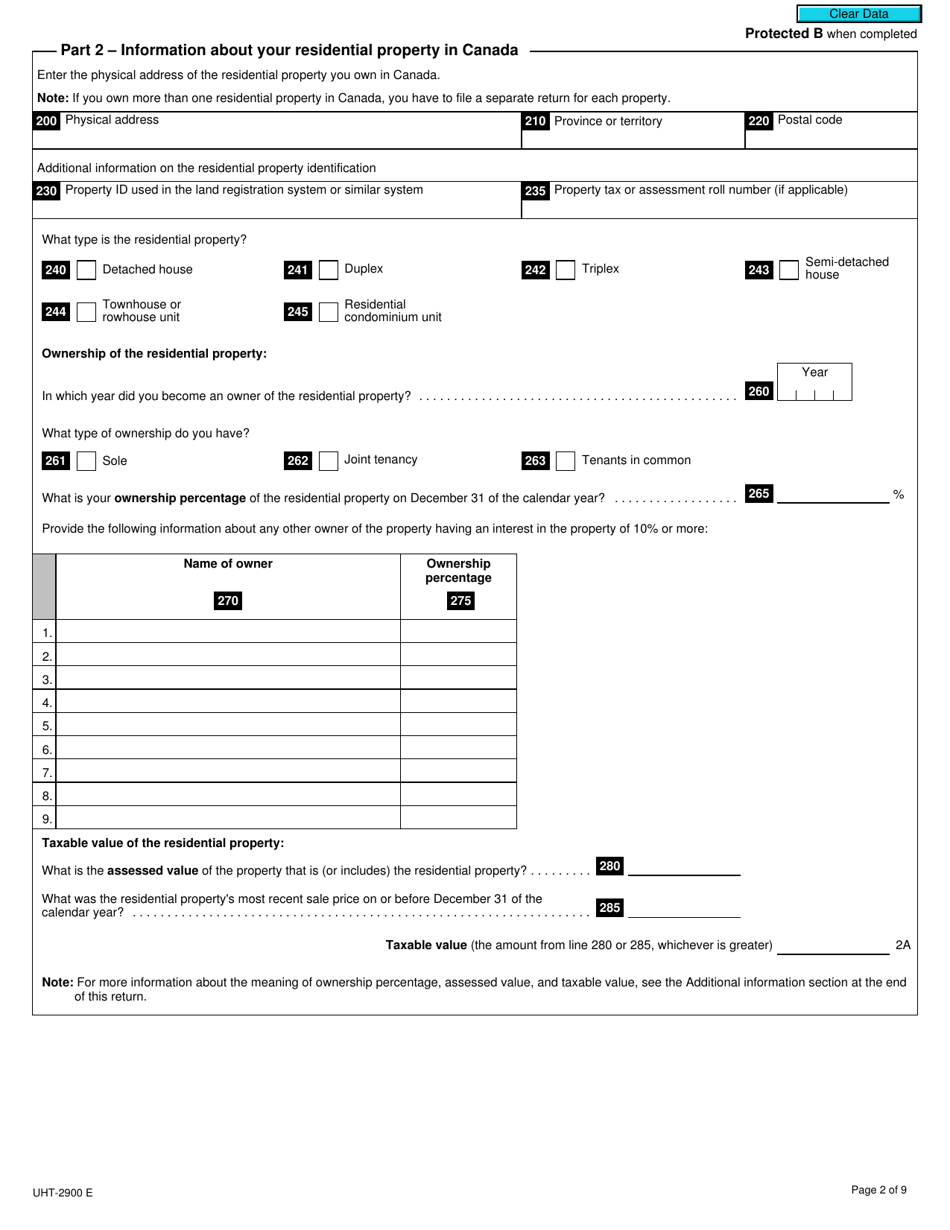

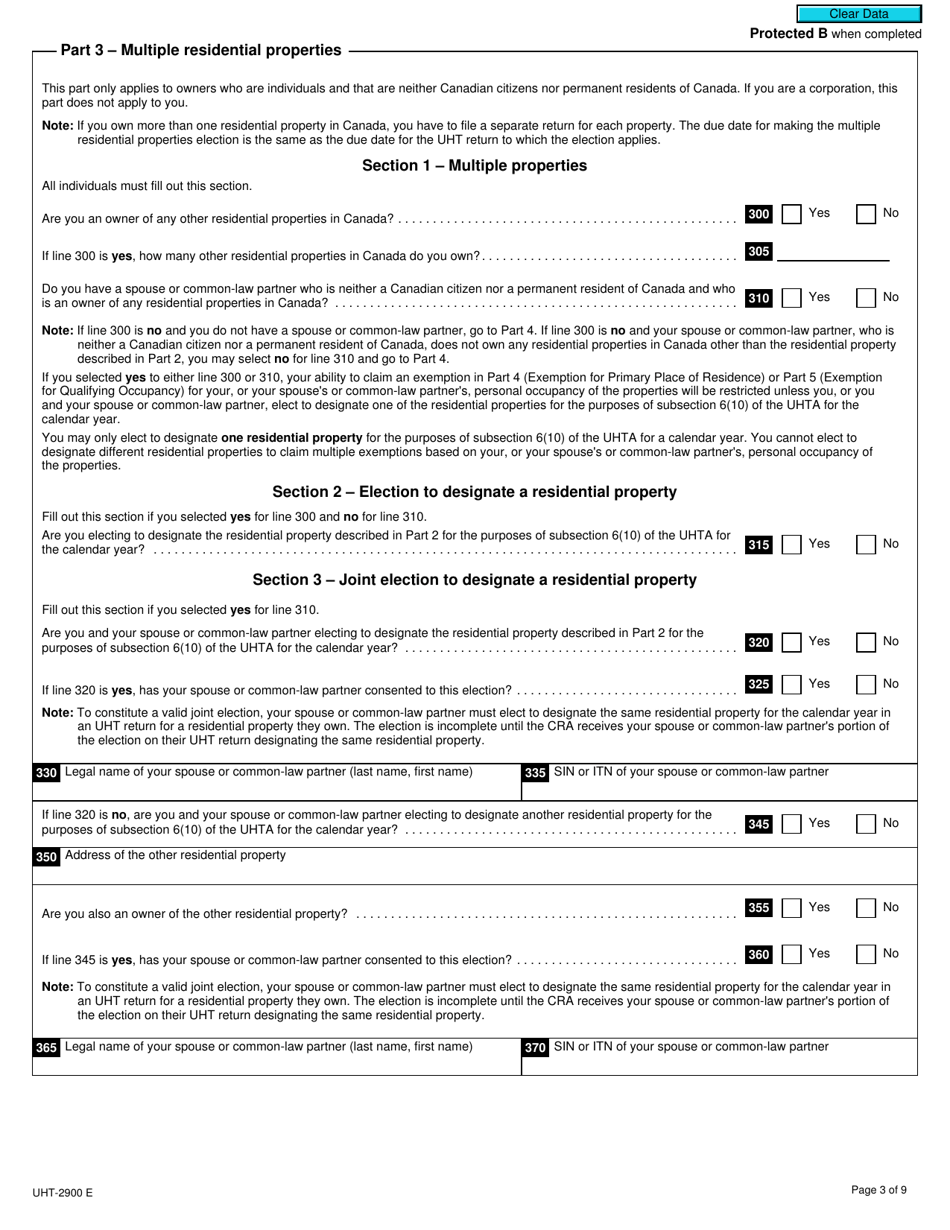

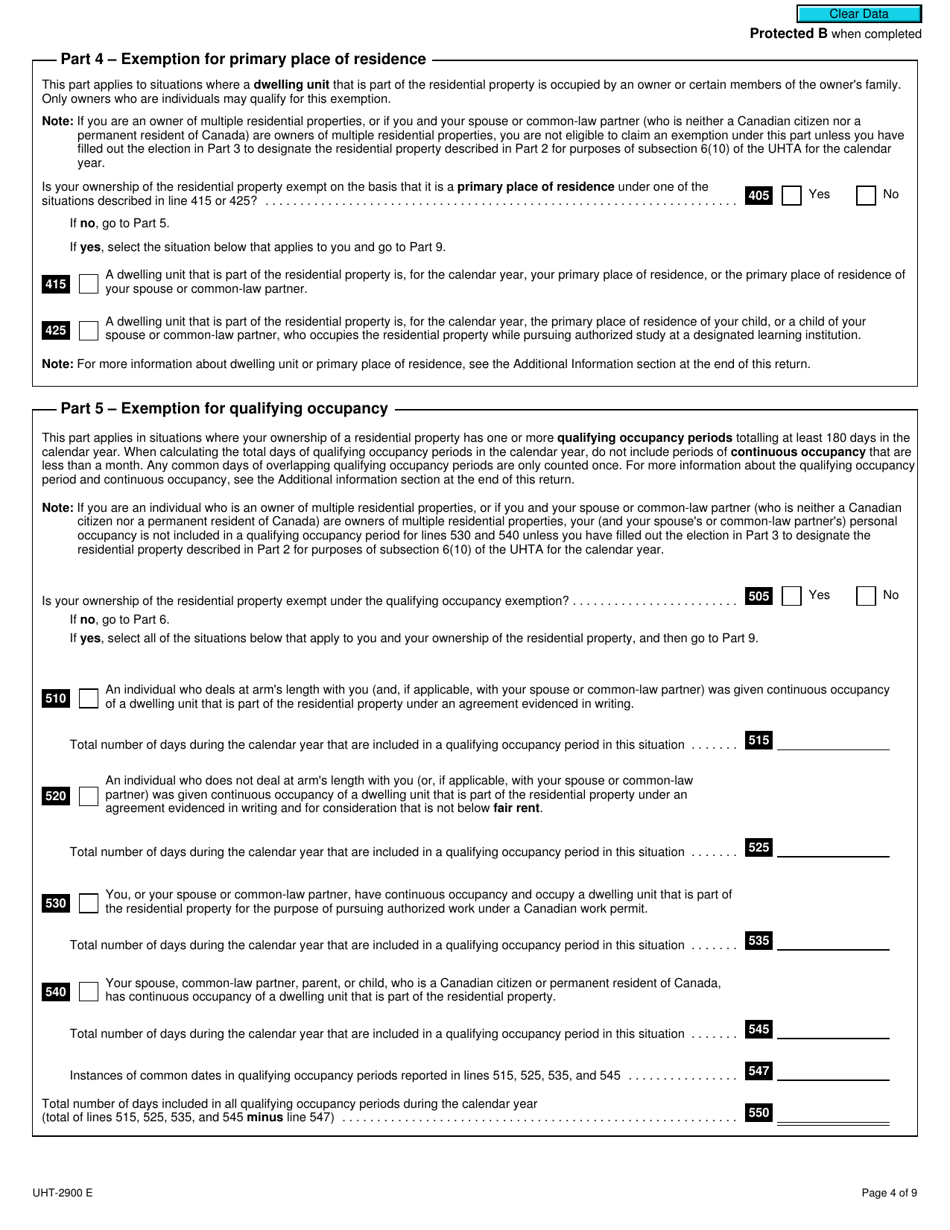

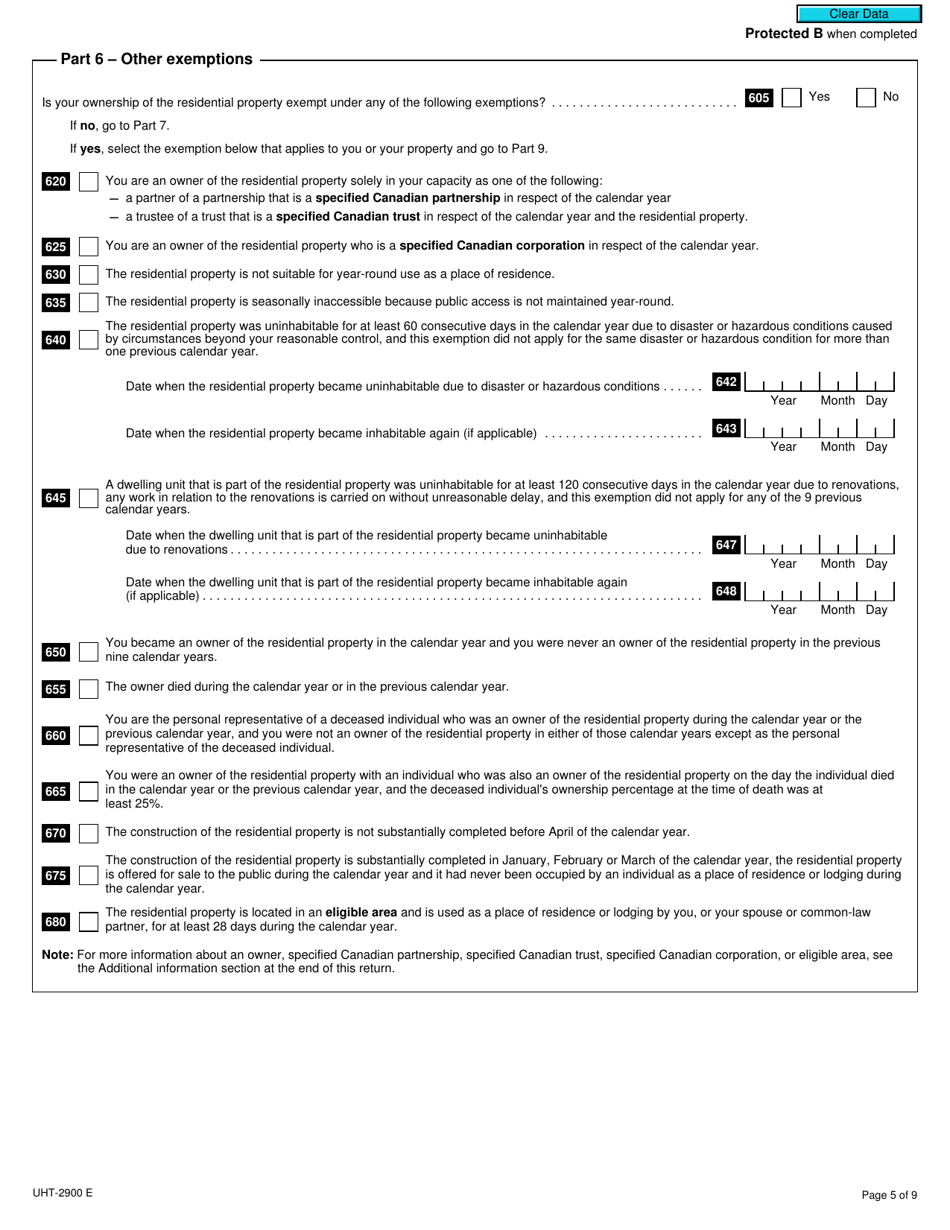

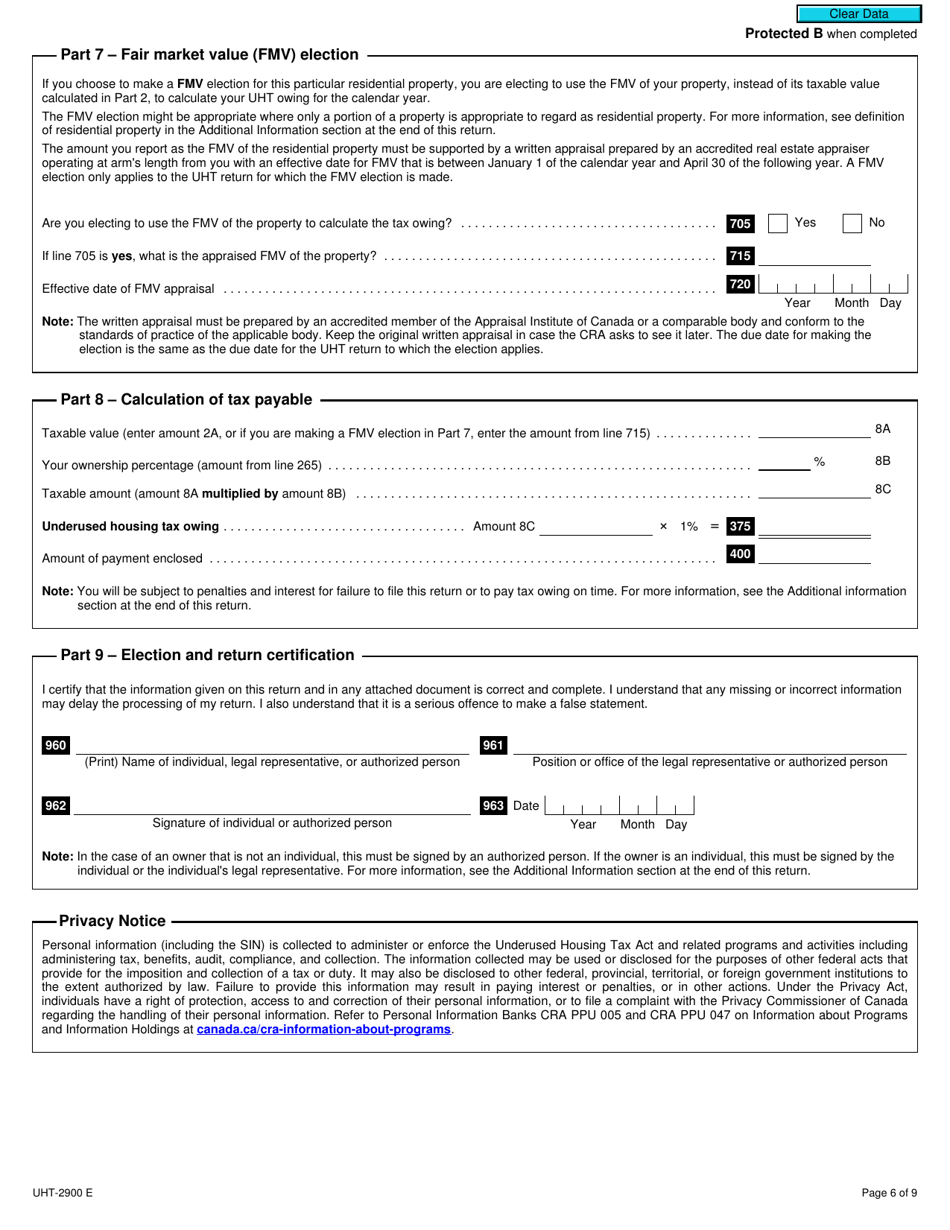

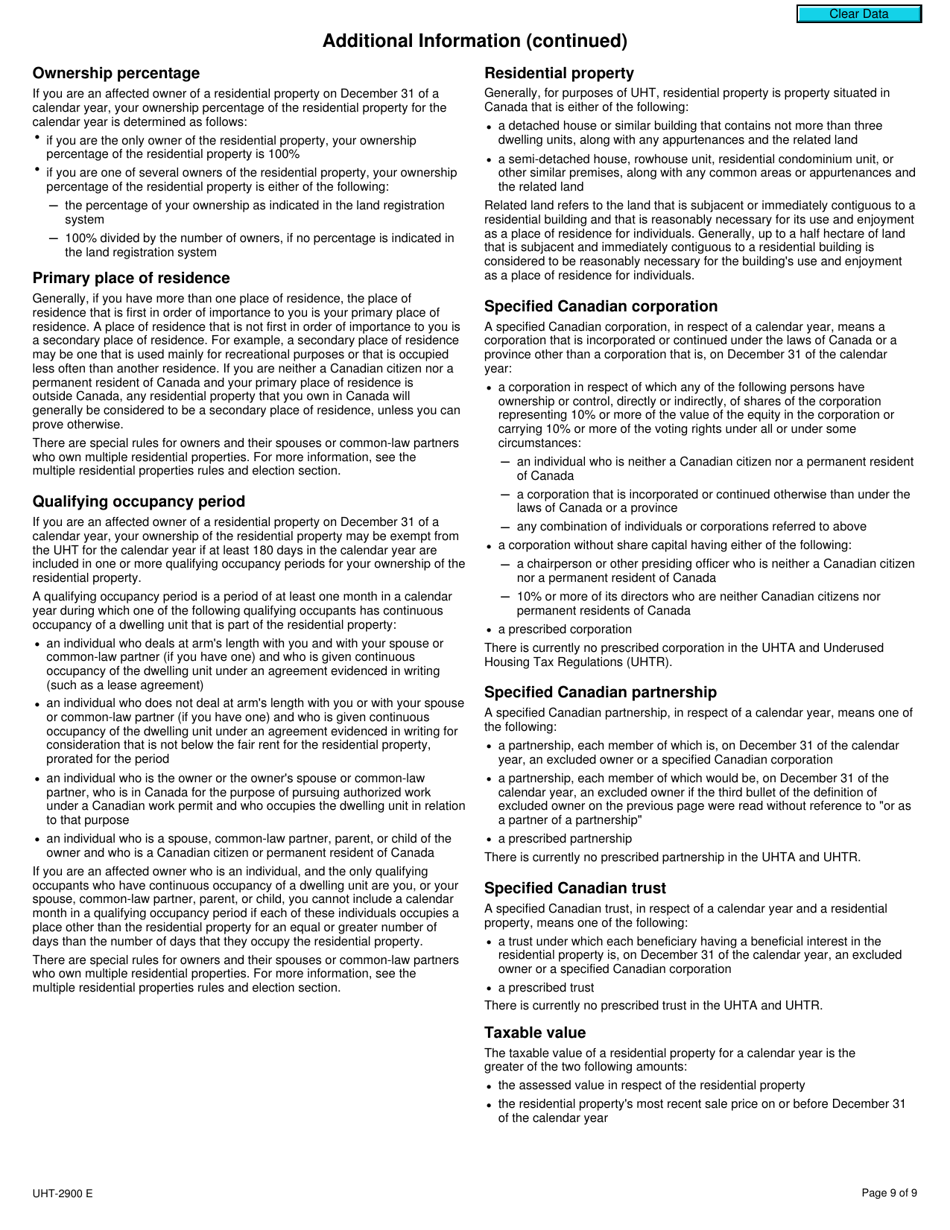

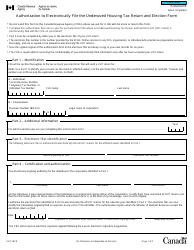

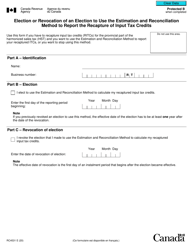

Form UHT-2900 Underused Housing Tax Return and Election Form - Canada

The Form UHT-2900 Underused Housing Tax Return and Election Form in Canada is filed by individuals who own residential properties that are considered underused.

FAQ

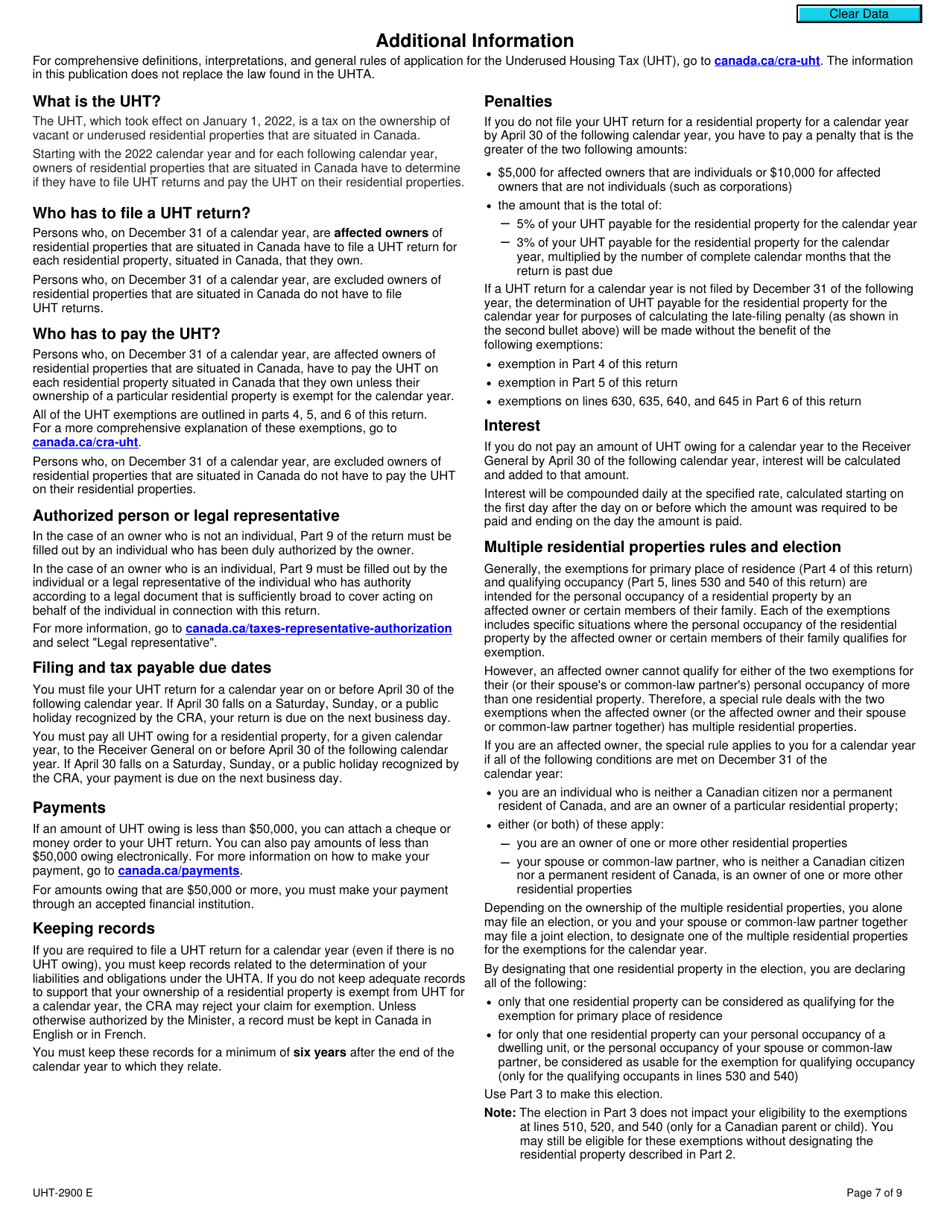

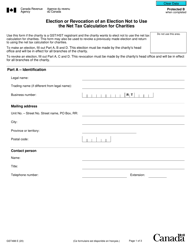

Q: What is Form UHT-2900?

A: Form UHT-2900 is the Underused Housing Tax Return and Election Form used in Canada.

Q: Who needs to file Form UHT-2900?

A: Individuals or businesses who own underused housing properties in Canada need to file this form.

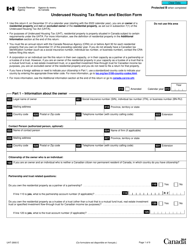

Q: What is considered underused housing?

A: Underused housing refers to residential properties that are not being fully utilized, such as vacant houses or unoccupied apartments.

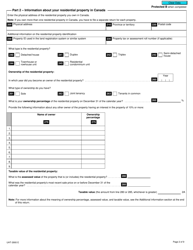

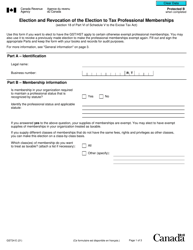

Q: What is the purpose of filing Form UHT-2900?

A: The purpose of this form is to report underused housing properties and elect to be subject to a special tax rate in Canada.

Q: How do I file Form UHT-2900?

A: Form UHT-2900 should be completed and filed with the appropriate tax authorities in Canada, along with any required documentation.

Q: What is the deadline for filing Form UHT-2900?

A: The deadline for filing Form UHT-2900 may vary, so it is important to check with the tax authorities or consult a tax professional for the specific deadline.

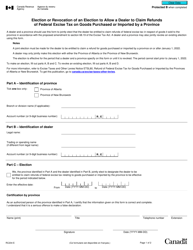

Q: Are there any penalties for not filing Form UHT-2900?

A: Yes, failure to file Form UHT-2900 or providing false information can result in penalties and potential legal consequences.

Q: Can I claim any deductions or credits on Form UHT-2900?

A: Deductions or credits may be available, but it depends on the specific circumstances. Consult a tax professional for guidance on applicable deductions or credits.

Q: Is Form UHT-2900 applicable in the United States as well?

A: No, Form UHT-2900 is specific to Canada and is not applicable in the United States.