This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1159

for the current year.

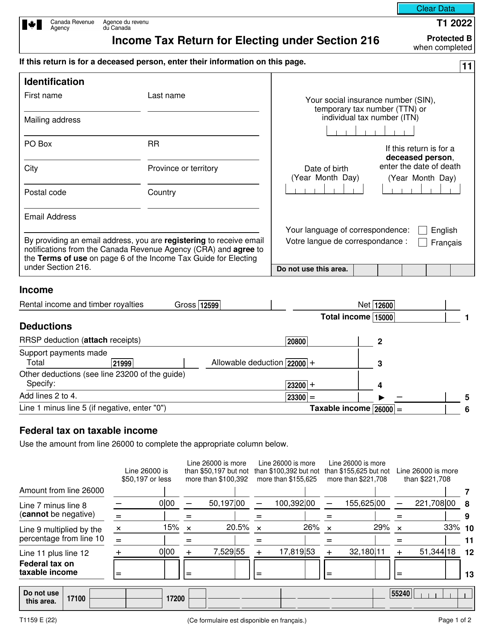

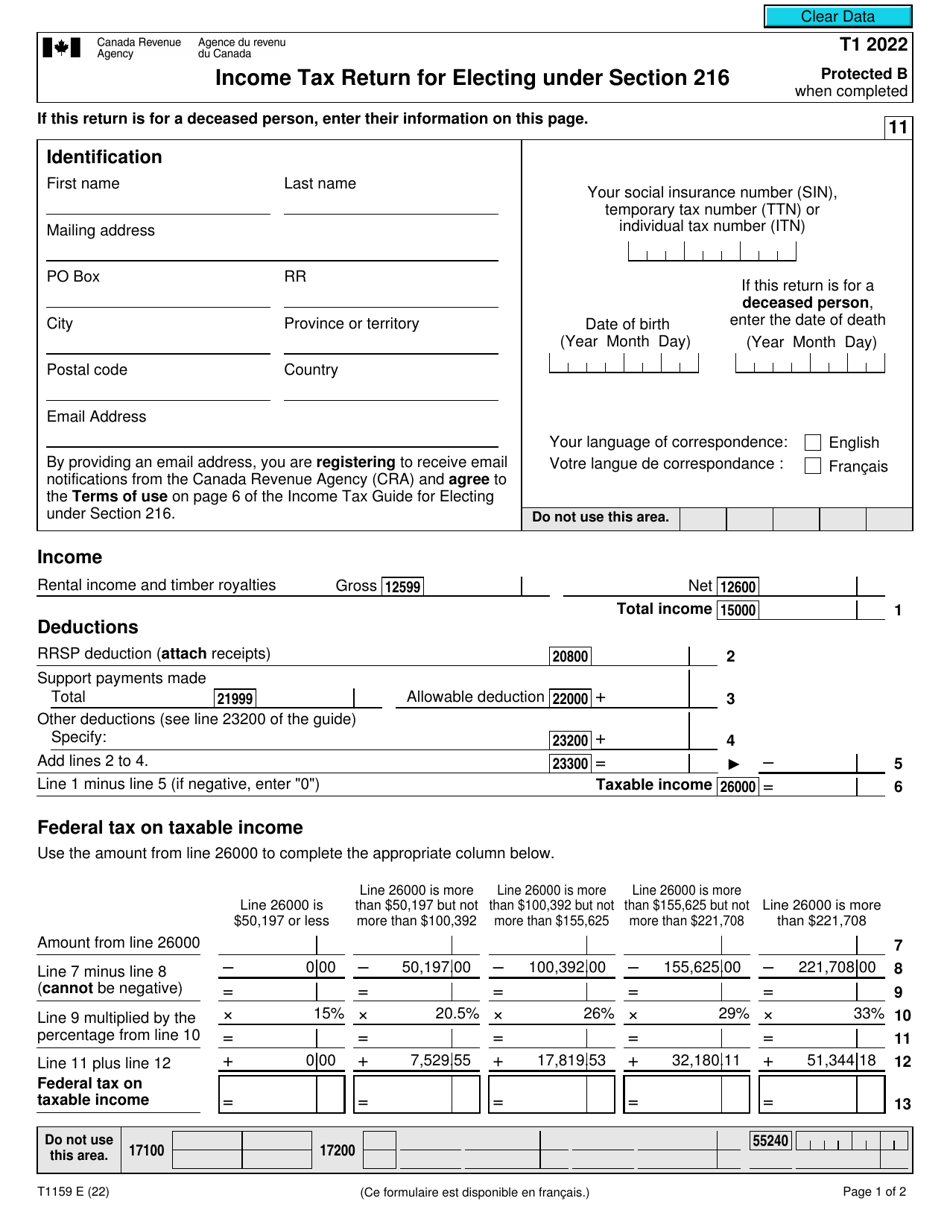

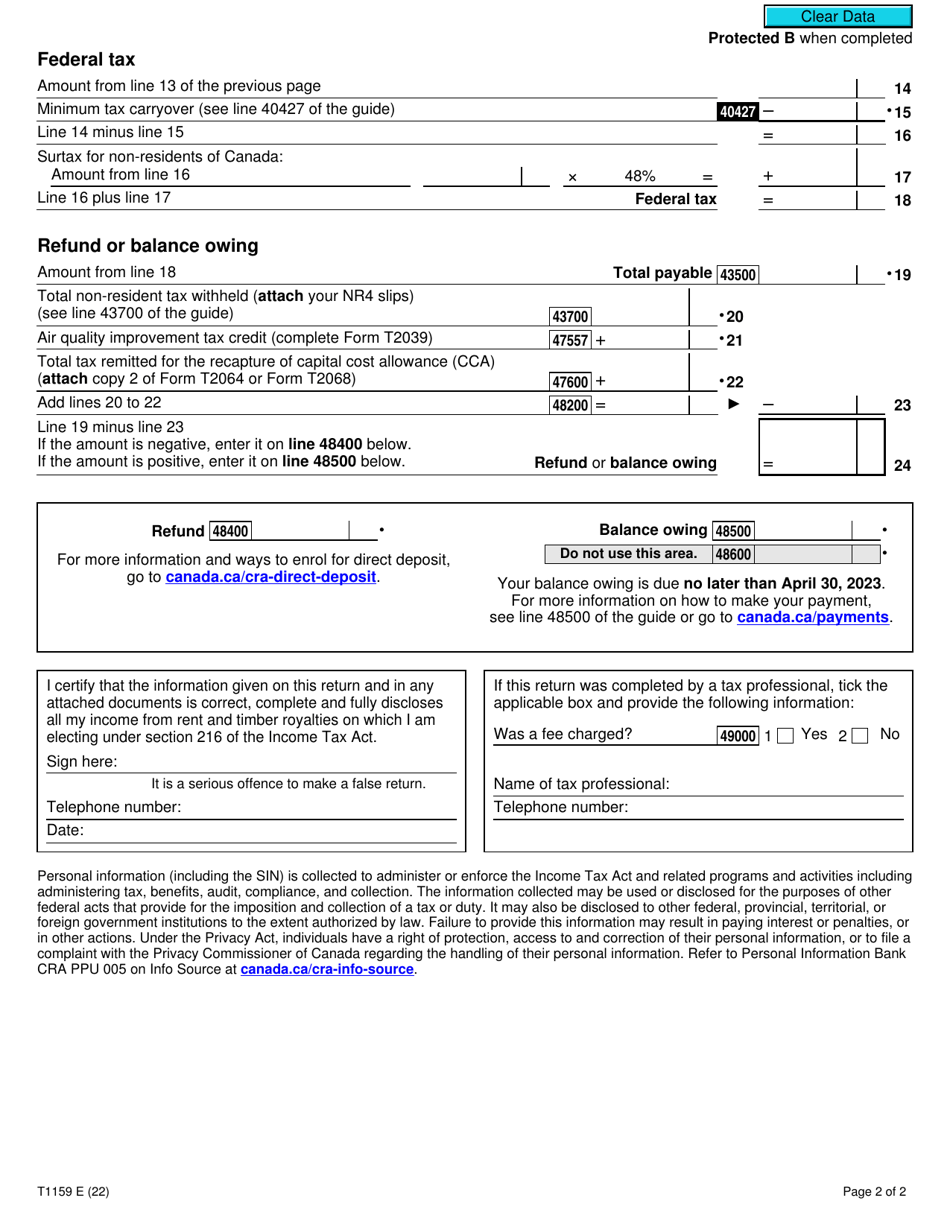

Form T1159 Income Tax Return for Electing Under Section 216 - Canada

Form T1159 is the Income Tax Return for Electing Under Section 216 in Canada. It is used by non-residents of Canada who earn rental income from Canadian properties and want to elect to pay tax on their net rental income instead of on the gross rental income. This form allows them to calculate their income, deductions, and credits related to the rental property.

The Form T1159 Income Tax Return for Electing Under Section 216 in Canada is filed by non-resident individuals who earn rental income from Canadian property.

FAQ

Q: What is Form T1159?

A: Form T1159 is the Income Tax Return for Electing Under Section 216 in Canada.

Q: Who is required to file Form T1159?

A: Non-residents of Canada who own rental properties or receive income from real properties in Canada and want to report and pay tax on that income.

Q: What is the purpose of Form T1159?

A: Form T1159 is used to report rental income or income from real property in Canada and calculate the tax payable on that income.

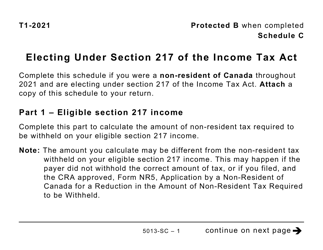

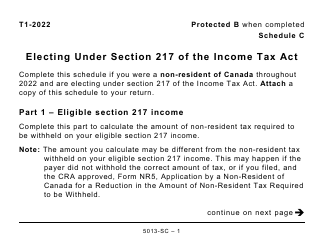

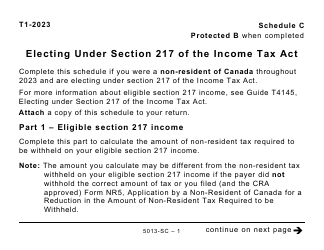

Q: What is Section 216?

A: Section 216 of the Canadian Income Tax Act allows non-residents to elect to be taxed on their Canadian rental income at a prescribed rate instead of the normal withholding tax rate.

Q: Are non-residents of Canada required to file Form T1159?

A: Non-residents who have rental income or income from real property in Canada are required to file Form T1159.

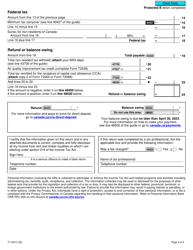

Q: When is Form T1159 due?

A: Form T1159 is due on or before June 30 of the year following the tax year.

Q: What happens if Form T1159 is filed late?

A: Late-filing penalties and interest may apply if Form T1159 is filed after the deadline.

Q: Is there a penalty for incorrect or incomplete filing of Form T1159?

A: There may be penalties for incorrect or incomplete filing of Form T1159, including a penalty for each failure or omission.