This version of the form is not currently in use and is provided for reference only. Download this version of

Form T2157

for the current year.

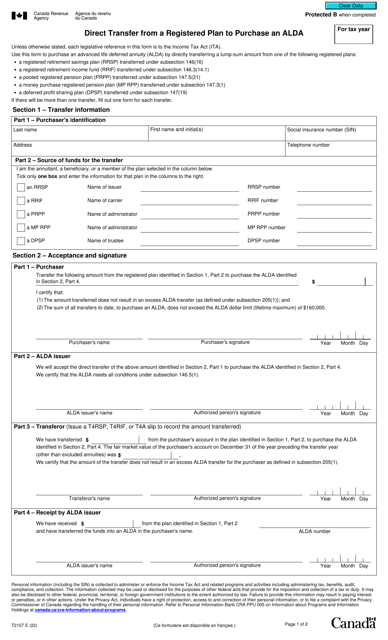

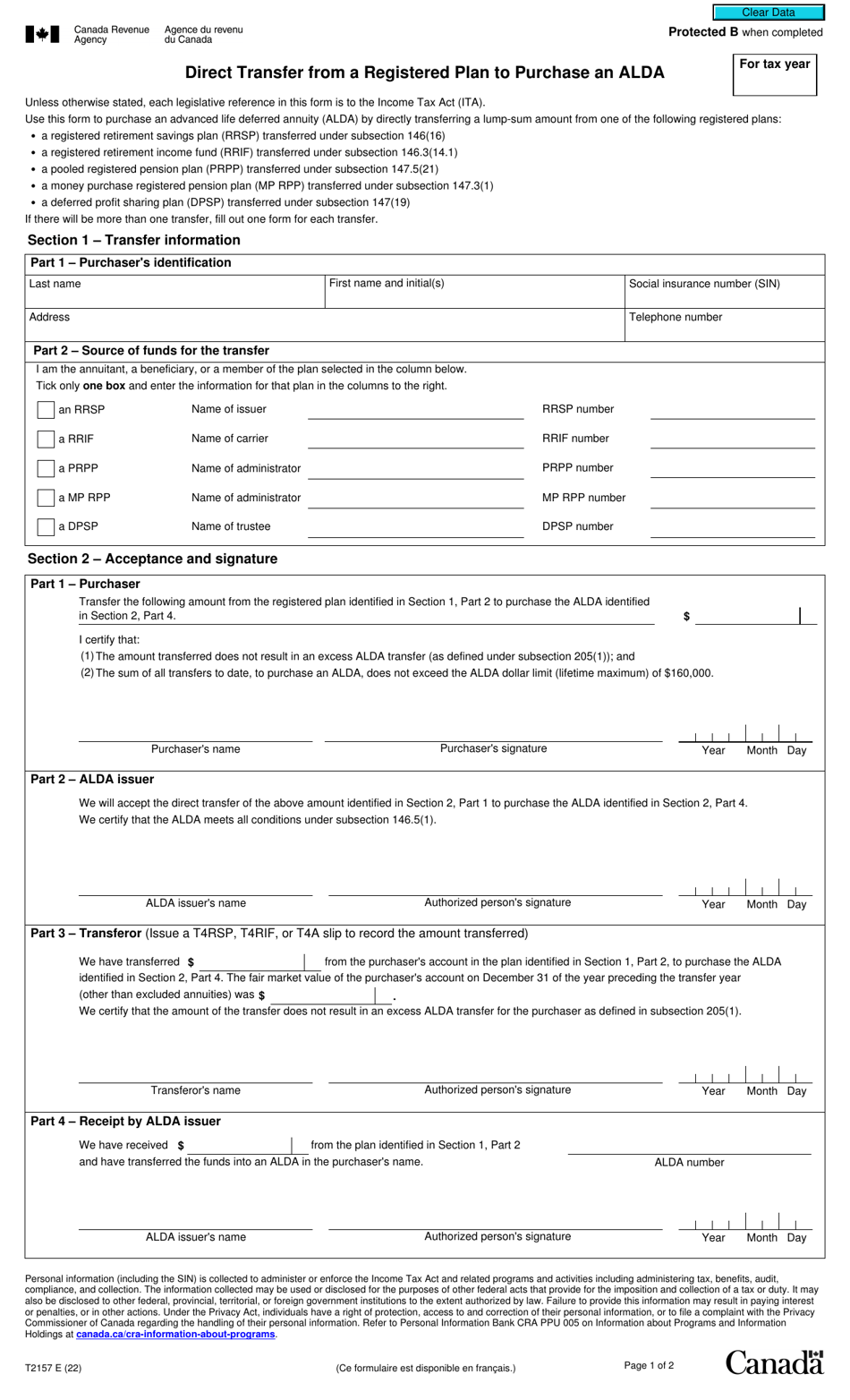

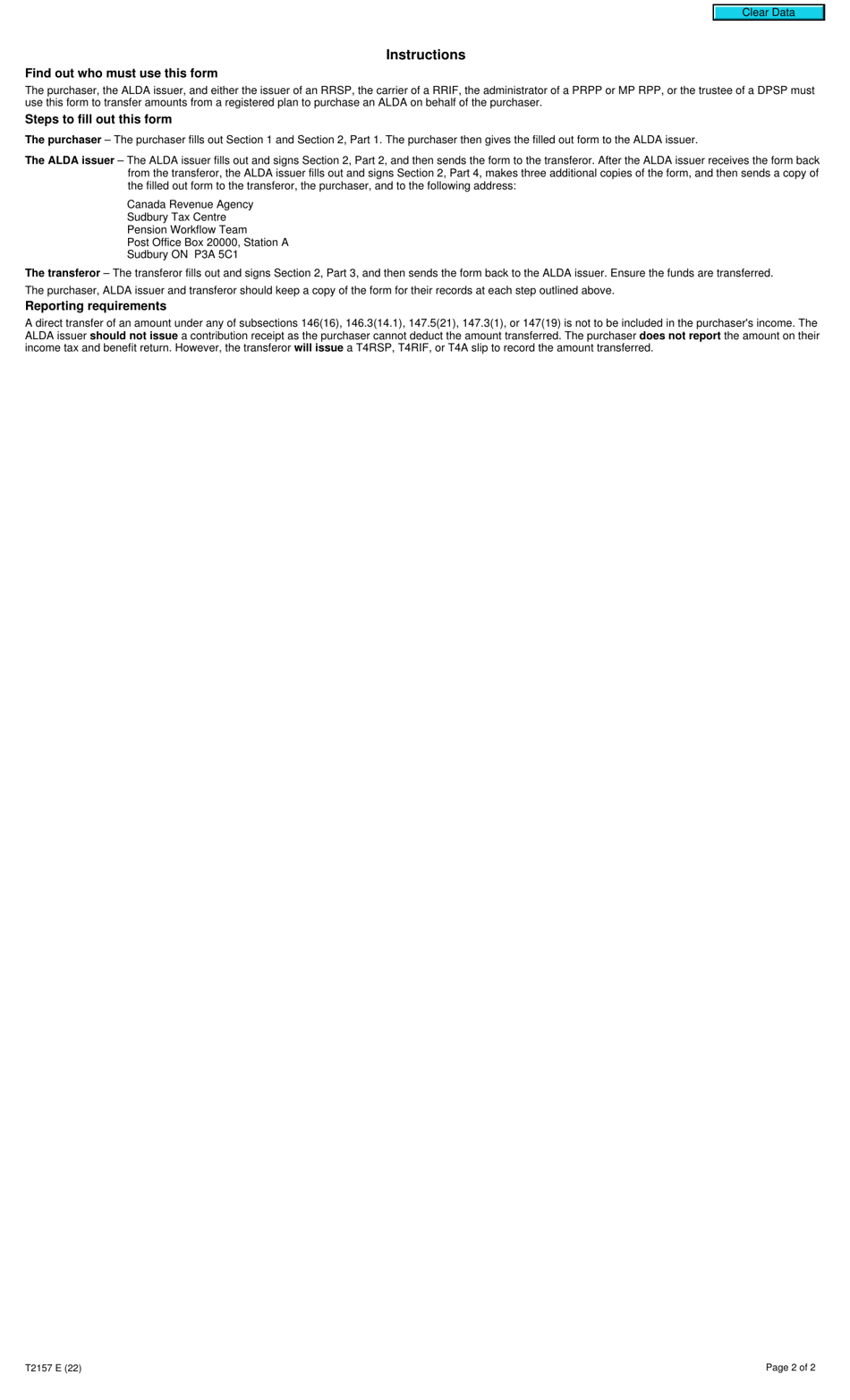

Form T2157 Direct Transfer From a Registered Plan to Purchase an Alda - Canada

Form T2157, Direct Transfer From a Registered Plan to Purchase an Alda, is a specific form used in Canada for transferring funds from a registered retirement savings plan (RRSP) or registered pension plan (RPP) to purchase an annuity that meets the requirements of an "Alda" (Alternative Crown Corporations Agreement).

This form is typically utilized by individuals who wish to transfer their retirement funds from a registered plan to acquire an annuity that is structured under the Alda regulations. The purpose of this transfer is to help individuals secure a stable and predictable income stream during their retirement years.

FAQ

Q: What is Form T2157?

A: Form T2157 is a form used in Canada for a direct transfer from a registered plan to purchase an Alda.

Q: What is a registered plan?

A: In Canada, a registered plan refers to a tax-advantaged investment account such as a Registered Retirement Savings Plan (RRSP) or a Registered Retirement Income Fund (RRIF).

Q: What is Alda?

A: Alda is not a term or product commonly known in Canada. It may refer to a specific brand, company, or product. More context is needed to provide a specific answer.

Q: Are there any tax implications for a direct transfer from a registered plan?

A: Yes, there may be tax implications for a direct transfer from a registered plan. It is recommended to consult with a financial advisor or tax professional to understand the specific tax implications based on your individual circumstances.