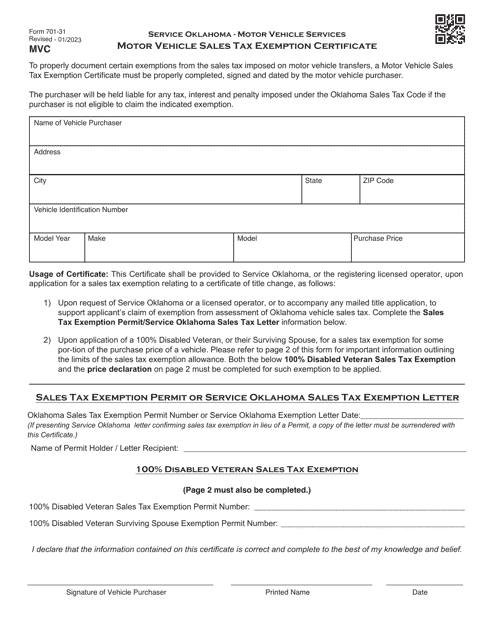

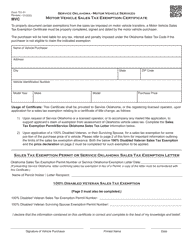

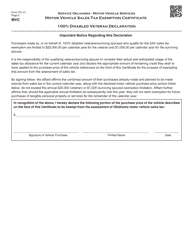

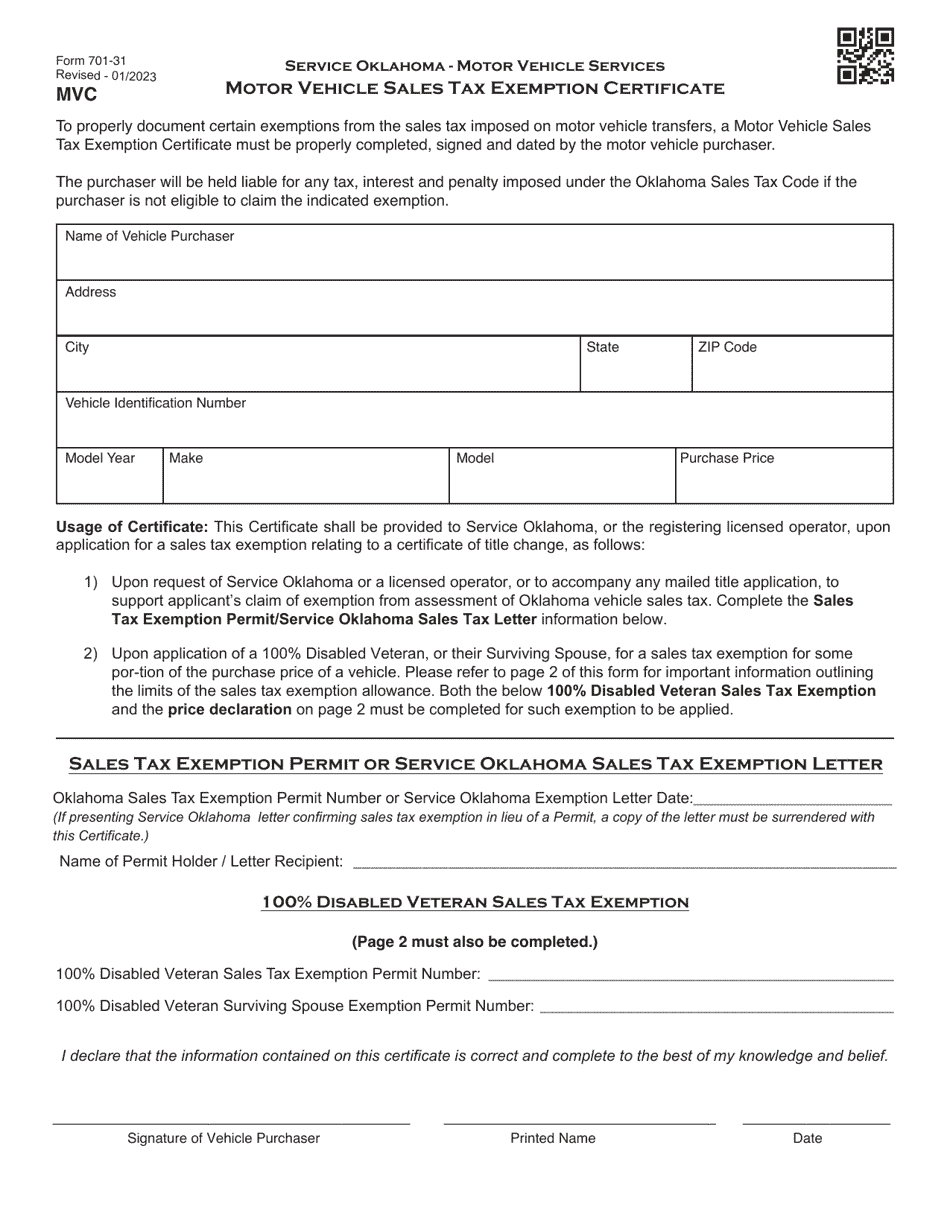

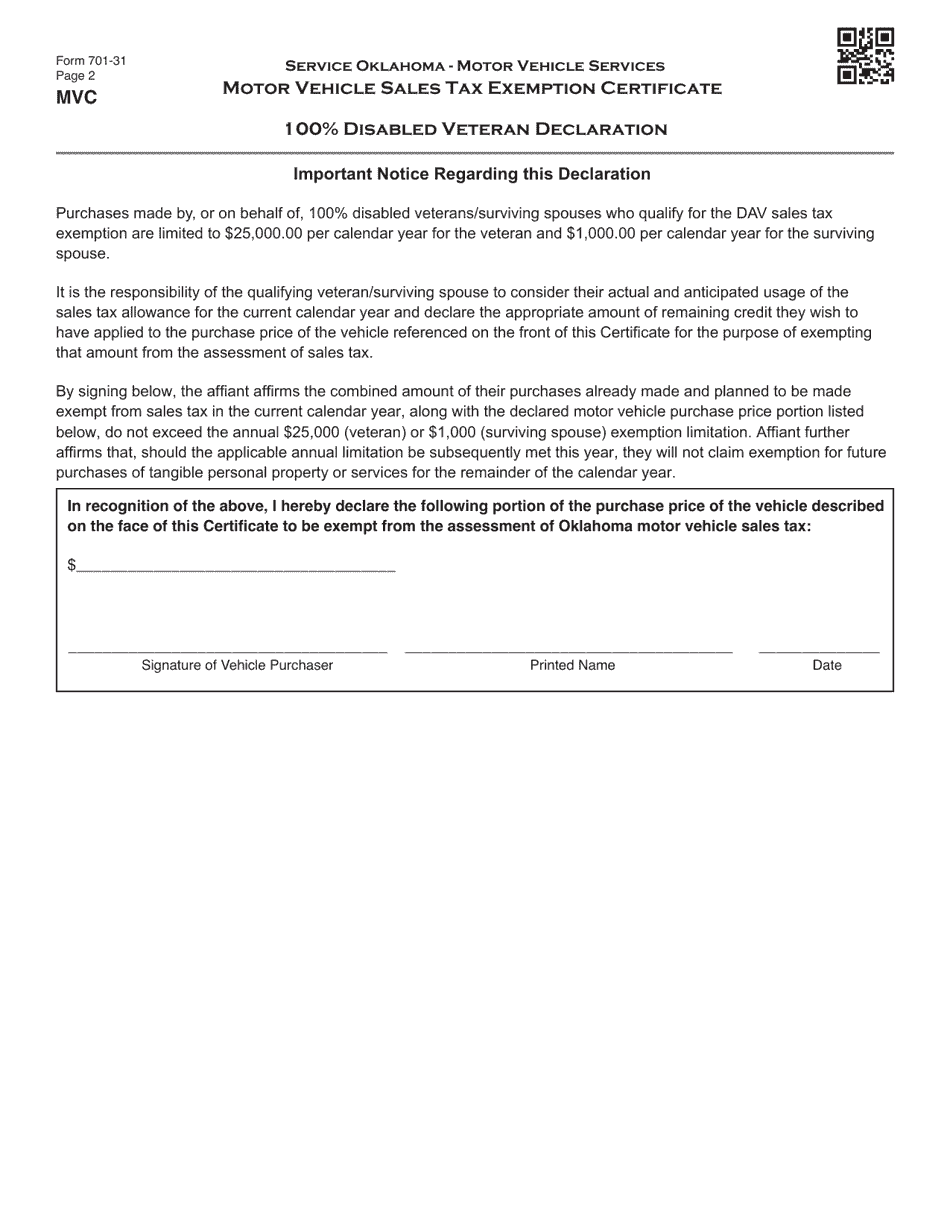

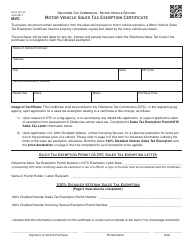

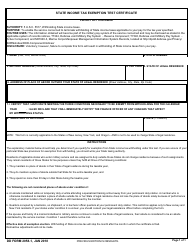

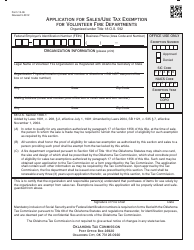

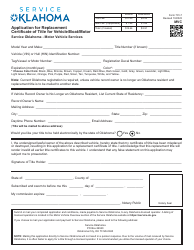

Form 701-31 Motor Vehicle Sales Tax Exemption Certificate - Oklahoma

What Is Form 701-31?

This is a legal form that was released by the Service Oklahoma - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 701-31?

A: Form 701-31 is the Motor VehicleSales Tax Exemption Certificate for Oklahoma.

Q: What is the purpose of Form 701-31?

A: The purpose of Form 701-31 is to claim exemption from paying motor vehicle sales tax in Oklahoma.

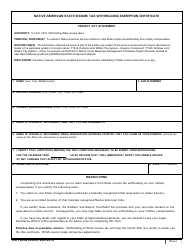

Q: Who can use Form 701-31?

A: Form 701-31 can be used by individuals and entities who qualify for a sales tax exemption on motor vehicle purchases in Oklahoma.

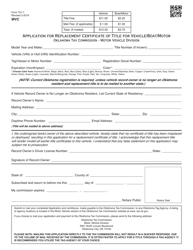

Q: What information is required on Form 701-31?

A: Form 701-31 requires information such as the buyer's name, address, social security number or federal ID number, vehicle details, and the reason for the exemption.

Q: Are there any fees associated with filing Form 701-31?

A: No, there are no fees associated with filing Form 701-31.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Service Oklahoma;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 701-31 by clicking the link below or browse more documents and templates provided by the Service Oklahoma.