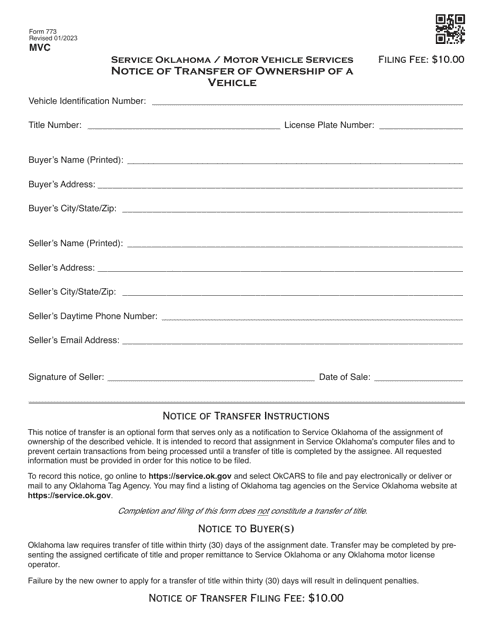

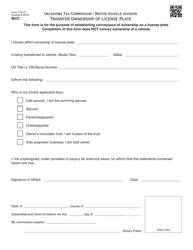

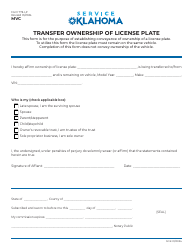

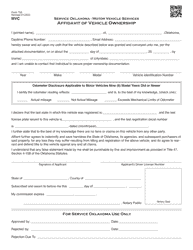

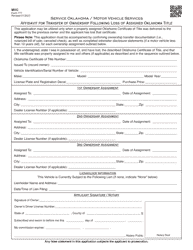

Form 773 Notice of Transfer of Ownership of a Vehicle - Oklahoma

What Is Form 773?

This is a legal form that was released by the Service Oklahoma - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 773?

A: Form 773 is the Notice of Transfer of Ownership of a Vehicle in Oklahoma.

Q: When is Form 773 used?

A: Form 773 is used when transferring ownership of a vehicle in Oklahoma.

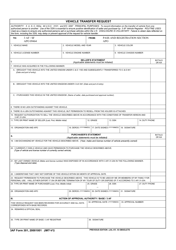

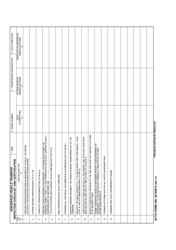

Q: What information is required on Form 773?

A: Form 773 requires information such as the vehicle identification number (VIN), buyer and seller information, and vehicle details.

Q: Do both the buyer and seller need to sign Form 773?

A: Yes, both the buyer and seller need to sign Form 773.

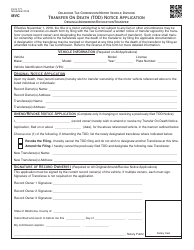

Q: Is there a fee to submit Form 773?

A: Yes, there is a fee associated with submitting Form 773.

Q: What should I do with Form 773 after completing it?

A: After completing Form 773, it should be submitted to the Oklahoma Tax Commission within 30 days of the vehicle transfer.

Q: Are there any penalties for not submitting Form 773?

A: Yes, there may be penalties for not submitting Form 773 within the required timeframe.

Q: Who can I contact for more information about Form 773?

A: For more information about Form 773, you can contact the Oklahoma Tax Commission.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Service Oklahoma;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 773 by clicking the link below or browse more documents and templates provided by the Service Oklahoma.