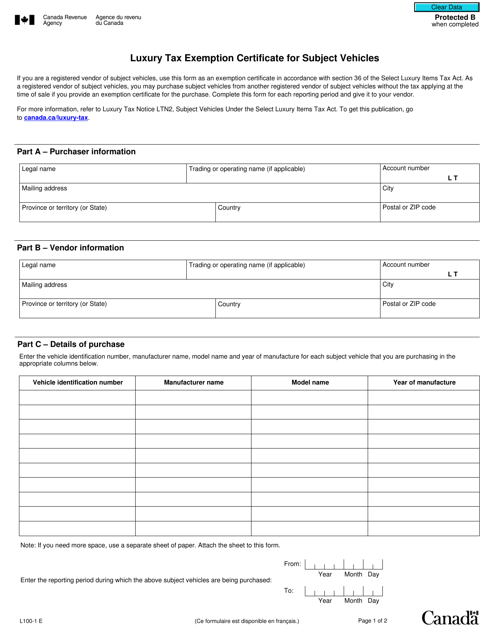

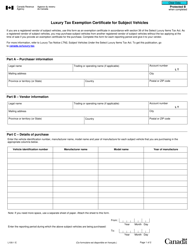

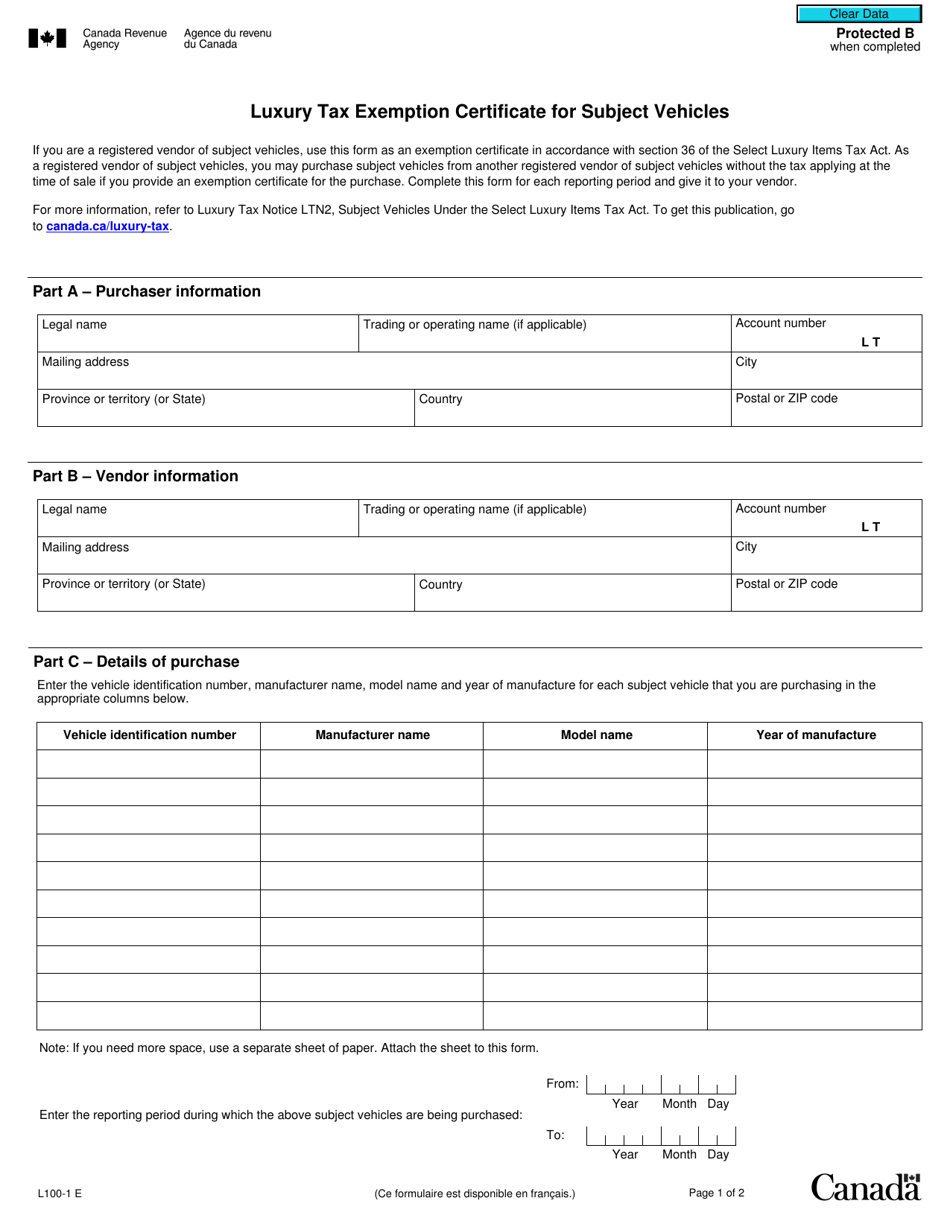

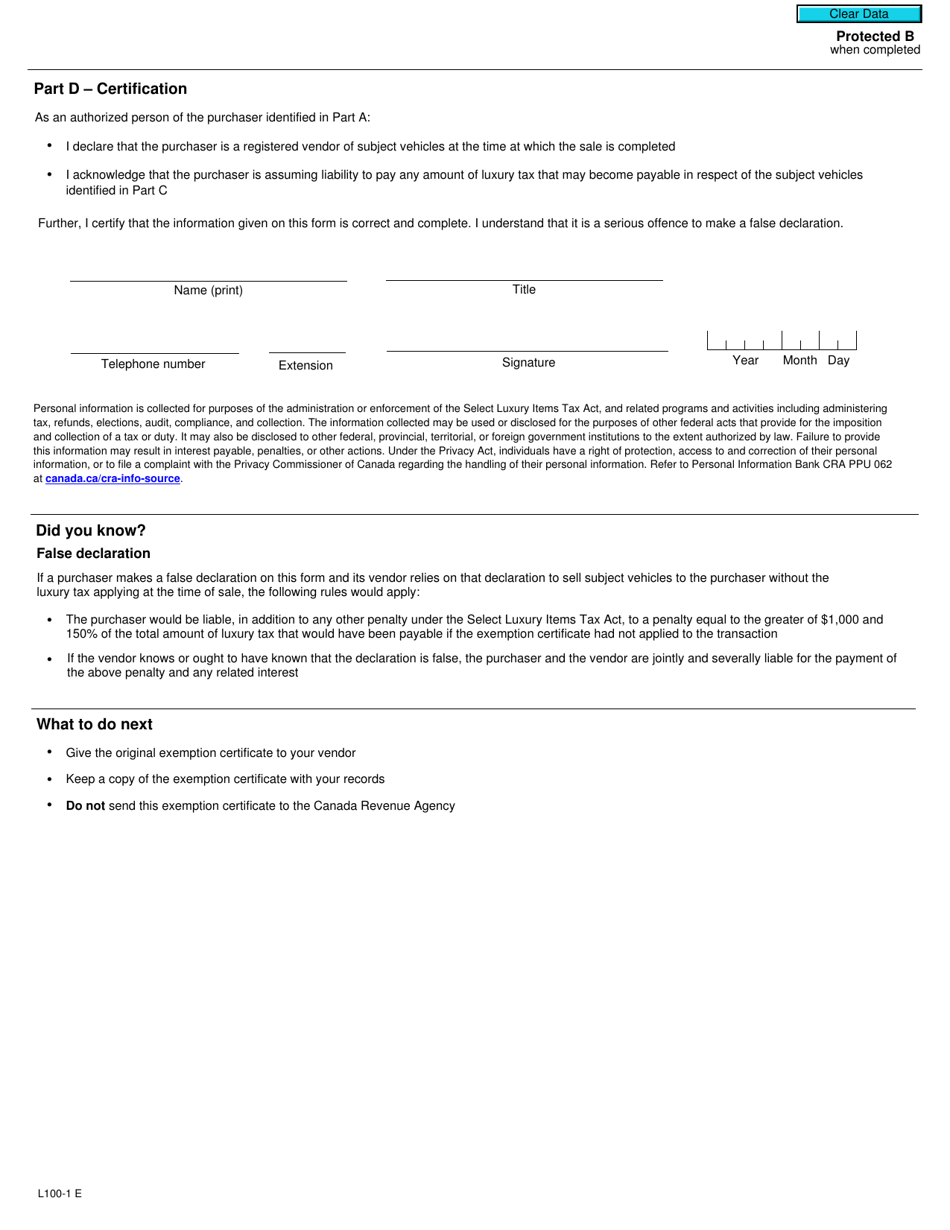

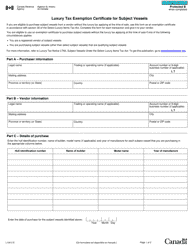

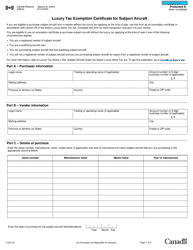

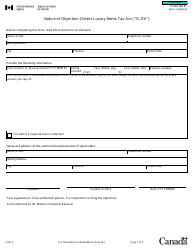

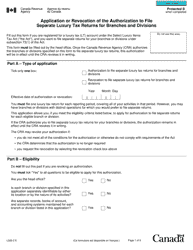

Form L100-1 Luxury Tax Exemption Certificate for Subject Vehicles - Canada

Form L100-1 Luxury Tax Exemption Certificate for Subject Vehicles in Canada is used to claim an exemption from luxury tax on certain vehicles. This form is typically used by individuals or businesses who are importing luxury vehicles into Canada and are eligible for a tax exemption.

FAQ

Q: What is Form L100-1?

A: Form L100-1 is a Luxury Tax Exemption Certificate for Subject Vehicles in Canada.

Q: What is the purpose of Form L100-1?

A: The purpose of Form L100-1 is to apply for exemption from luxury tax on certain vehicles in Canada.

Q: Who needs to complete Form L100-1?

A: Individuals or businesses who wish to claim exemption from luxury tax on qualifying vehicles in Canada need to complete Form L100-1.

Q: What are subject vehicles?

A: Subject vehicles are the qualifying vehicles for which luxury tax exemption is being sought through Form L100-1.

Q: Are there any eligibility criteria for luxury tax exemption?

A: Yes, there are specific eligibility criteria for luxury tax exemption on subject vehicles. These criteria are outlined in the instructions accompanying Form L100-1.