This version of the form is not currently in use and is provided for reference only. Download this version of

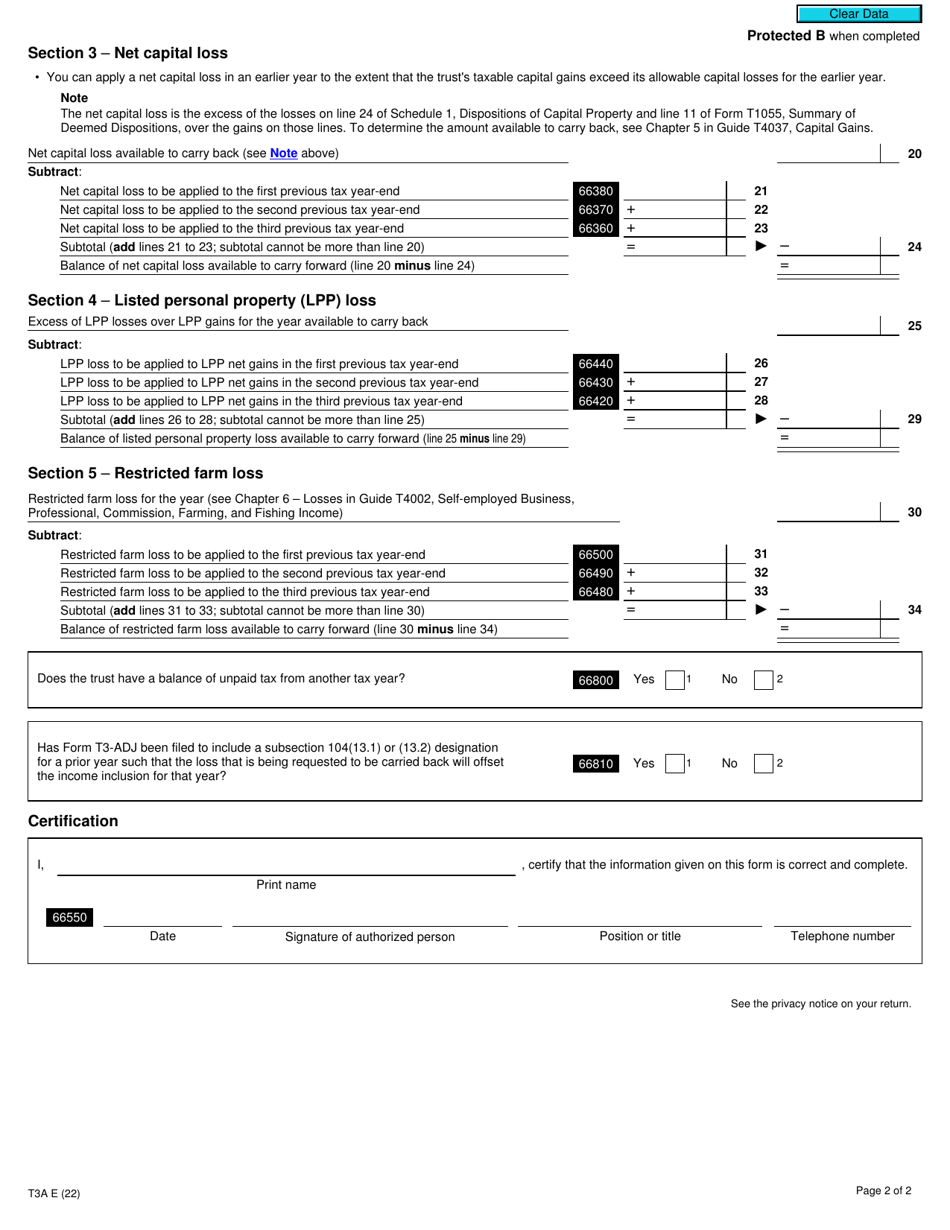

Form T3A

for the current year.

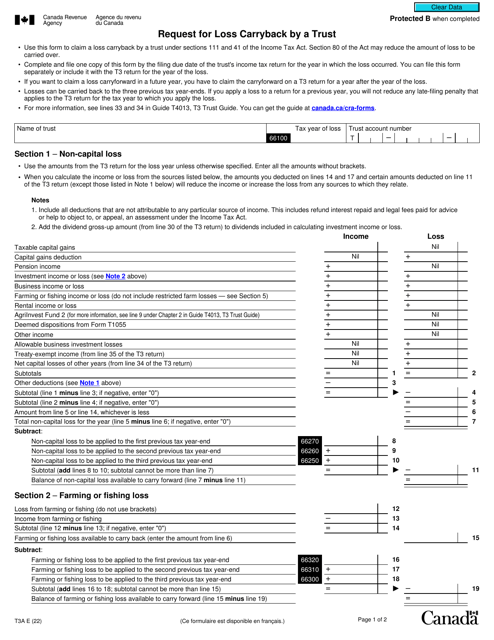

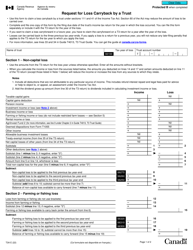

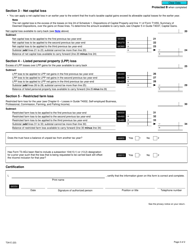

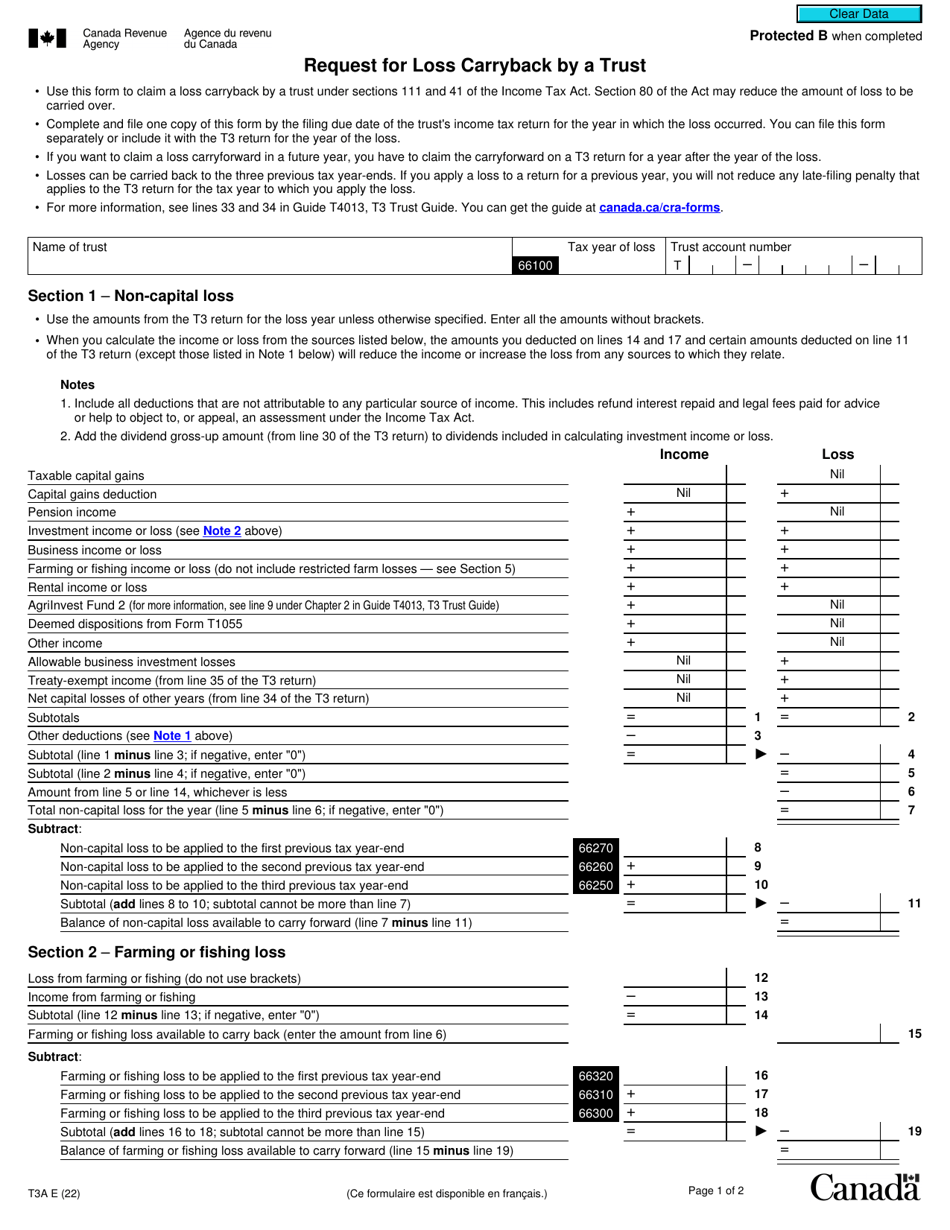

Form T3A Request for Loss Carryback by a Trust - Canada

Form T3A Request forLoss Carryback by a Trust in Canada is used to carry back losses incurred by a trust to a previous taxation year in order to reduce the trust's taxable income for that year. This can help to reduce the amount of tax owed by the trust.

In Canada, the trust itself is responsible for filing the Form T3A Request for Loss Carryback.

FAQ

Q: What is Form T3A?

A: Form T3A is a tax form used in Canada by trusts to request loss carryback.

Q: What is a loss carryback?

A: A loss carryback is a tax provision that allows a taxpayer to apply a loss from a specific tax year to a prior tax year to reduce the amount of tax payable.

Q: Who can use Form T3A?

A: Form T3A can be used by trusts in Canada that have incurred a loss in a tax year and want to apply that loss to a prior tax year.

Q: What is the purpose of using Form T3A?

A: The purpose of using Form T3A is to request the carryback of a trust's net capital losses, non-capital losses, or restricted farm losses to a prior tax year.

Q: What information is required in Form T3A?

A: Form T3A requires information such as the trust's name, trust identification number, tax year of the loss, amount of the loss, and the tax year to which the loss is being carried back.