This version of the form is not currently in use and is provided for reference only. Download this version of

Form 44-095

for the current year.

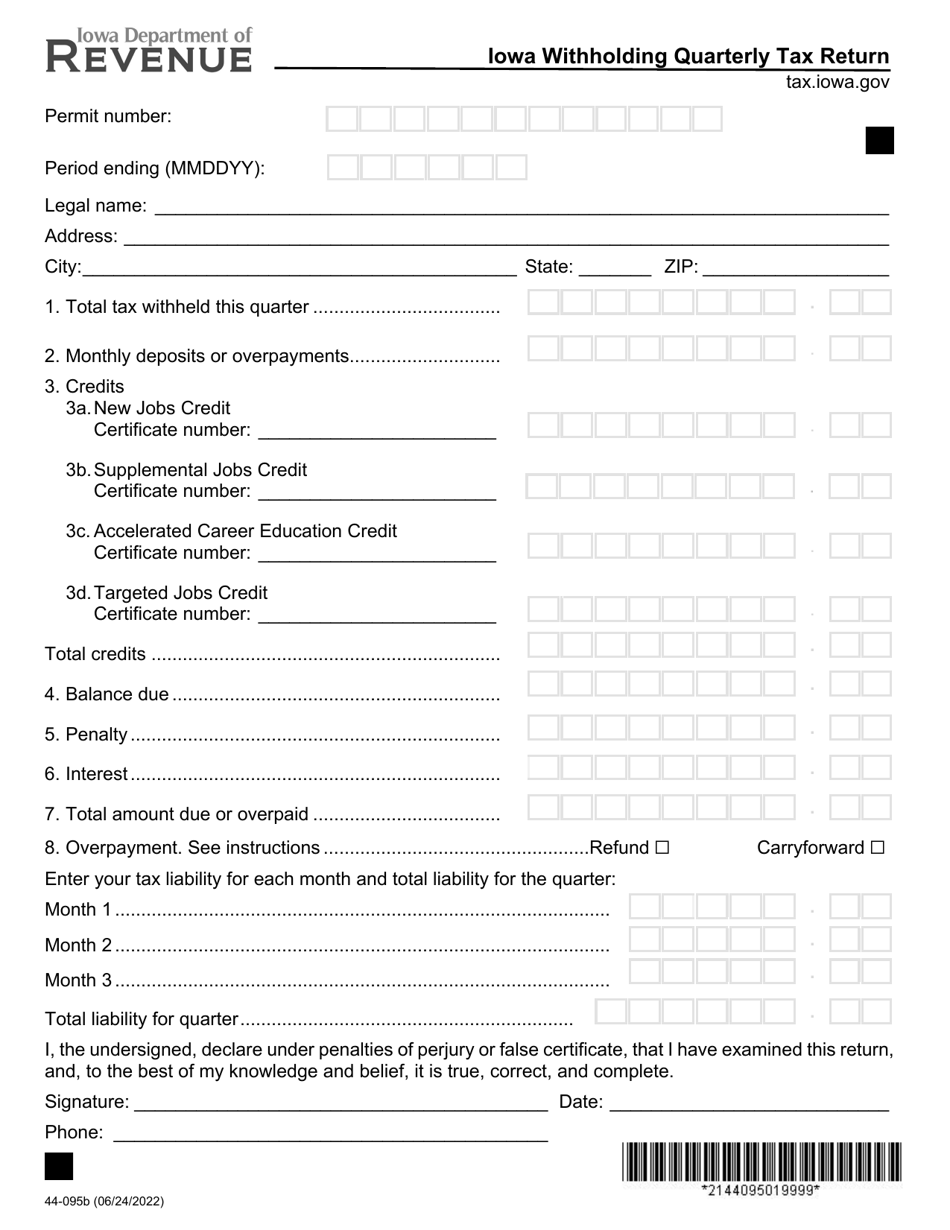

Form 44-095 Iowa Withholding Quarterly Tax Return - Iowa

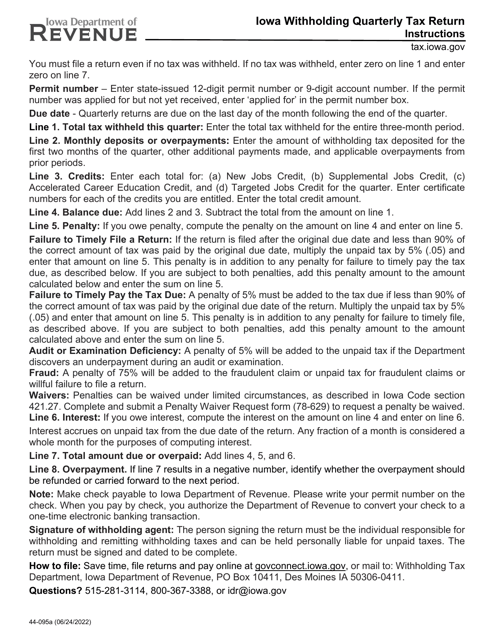

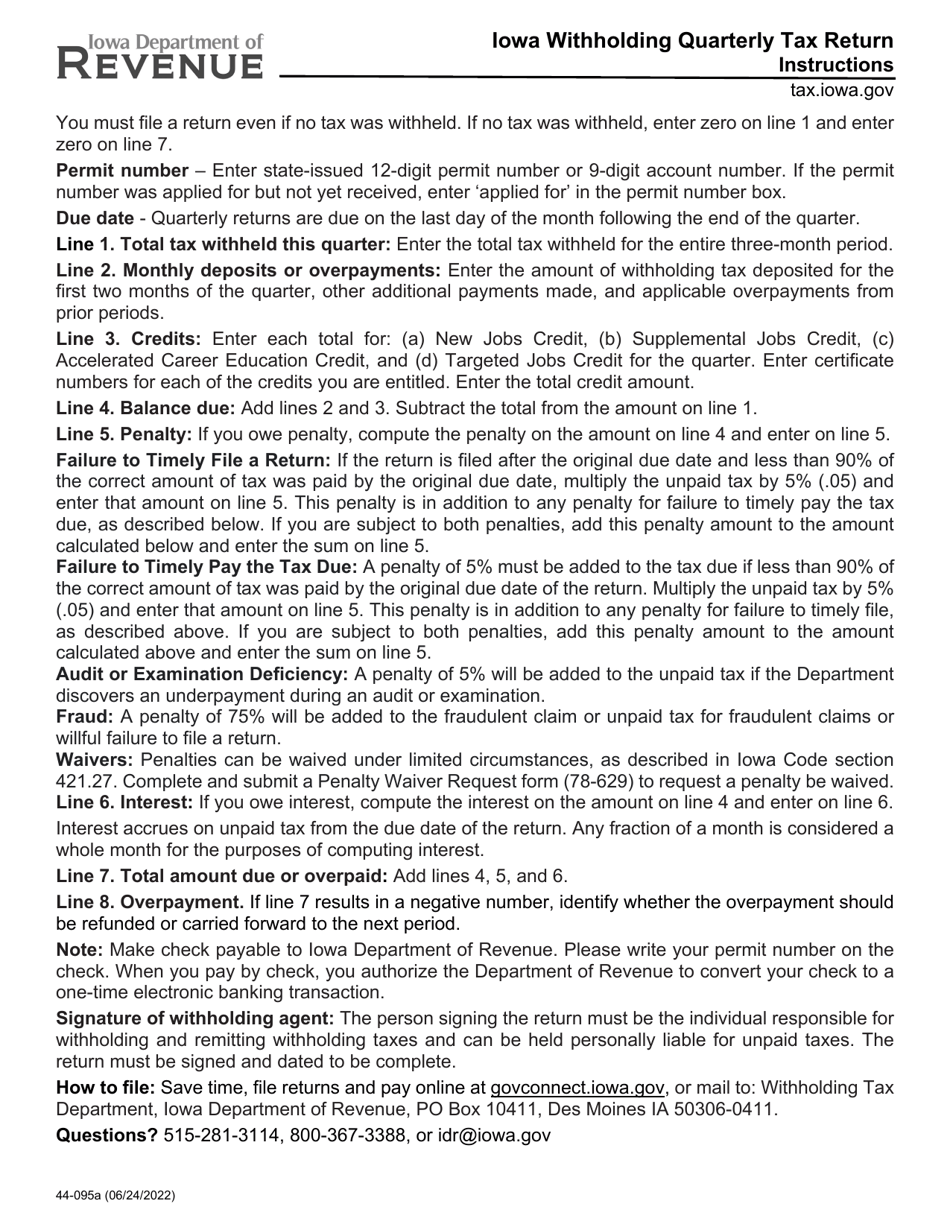

What Is Form 44-095?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 44-095?

A: Form 44-095 is the Iowa Withholding Quarterly Tax Return.

Q: Who needs to file Form 44-095?

A: Employers in Iowa need to file Form 44-095 to report and pay their quarterly withholding taxes.

Q: How often is Form 44-095 filed?

A: Form 44-095 is filed on a quarterly basis.

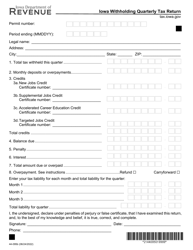

Q: What information is required on Form 44-095?

A: Form 44-095 requires information such as employer identification number, business name, address, total wages paid, and total Iowa income tax withheld.

Q: When is Form 44-095 due?

A: Form 44-095 is due on the last day of the month following the end of each calendar quarter.

Form Details:

- Released on June 24, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 44-095 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.