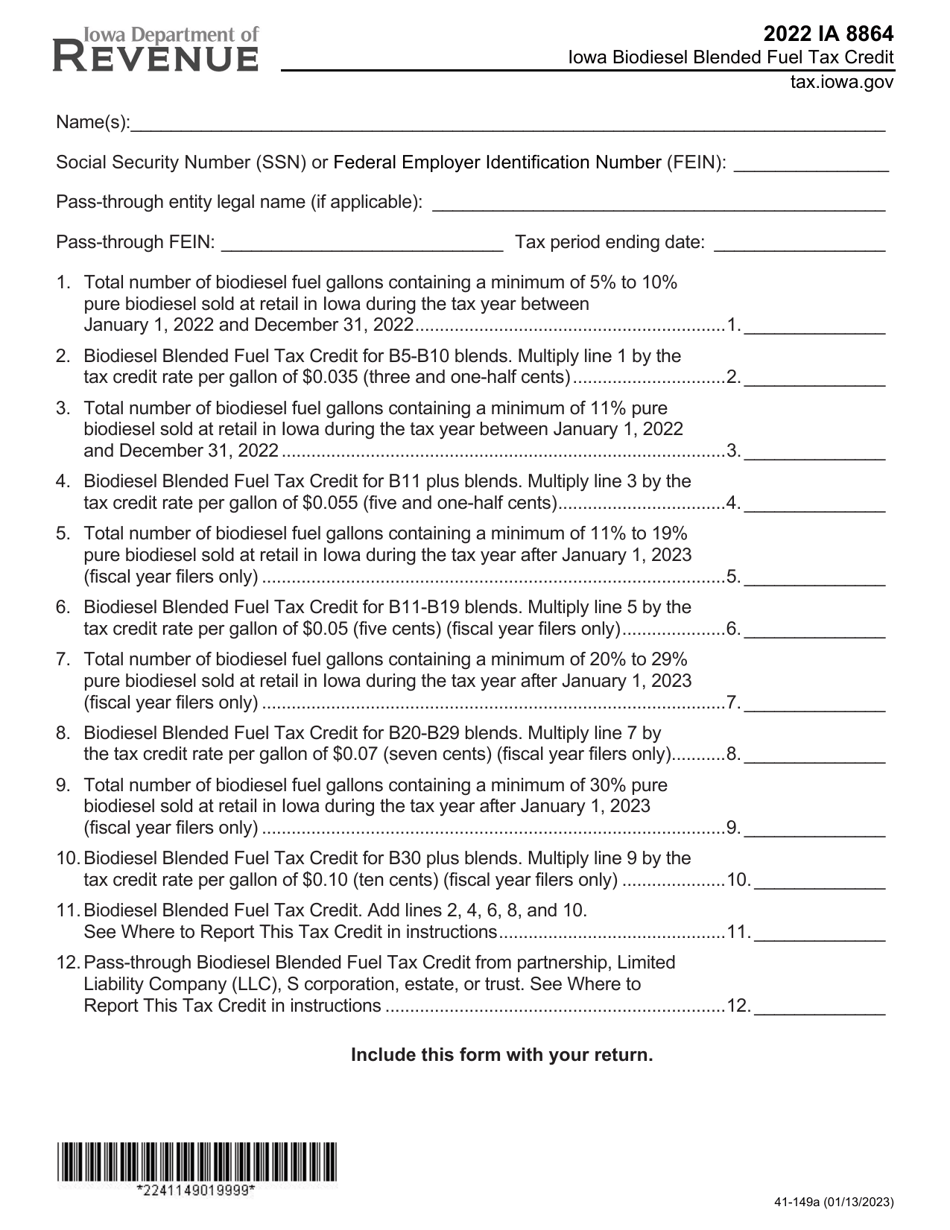

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IA8864 (41-149)

for the current year.

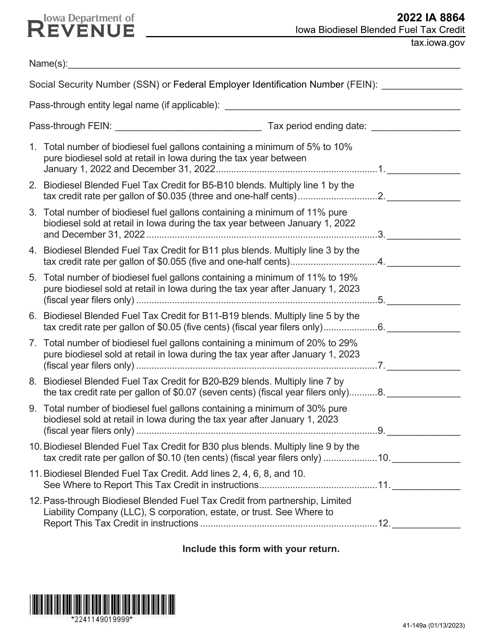

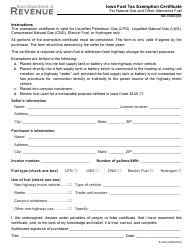

Form IA8864 (41-149) Iowa Biodiesel Blended Fuel Tax Credit - Iowa

What Is Form IA8864 (41-149)?

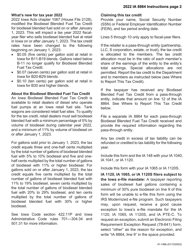

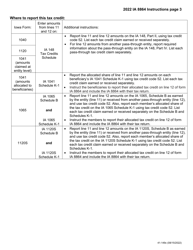

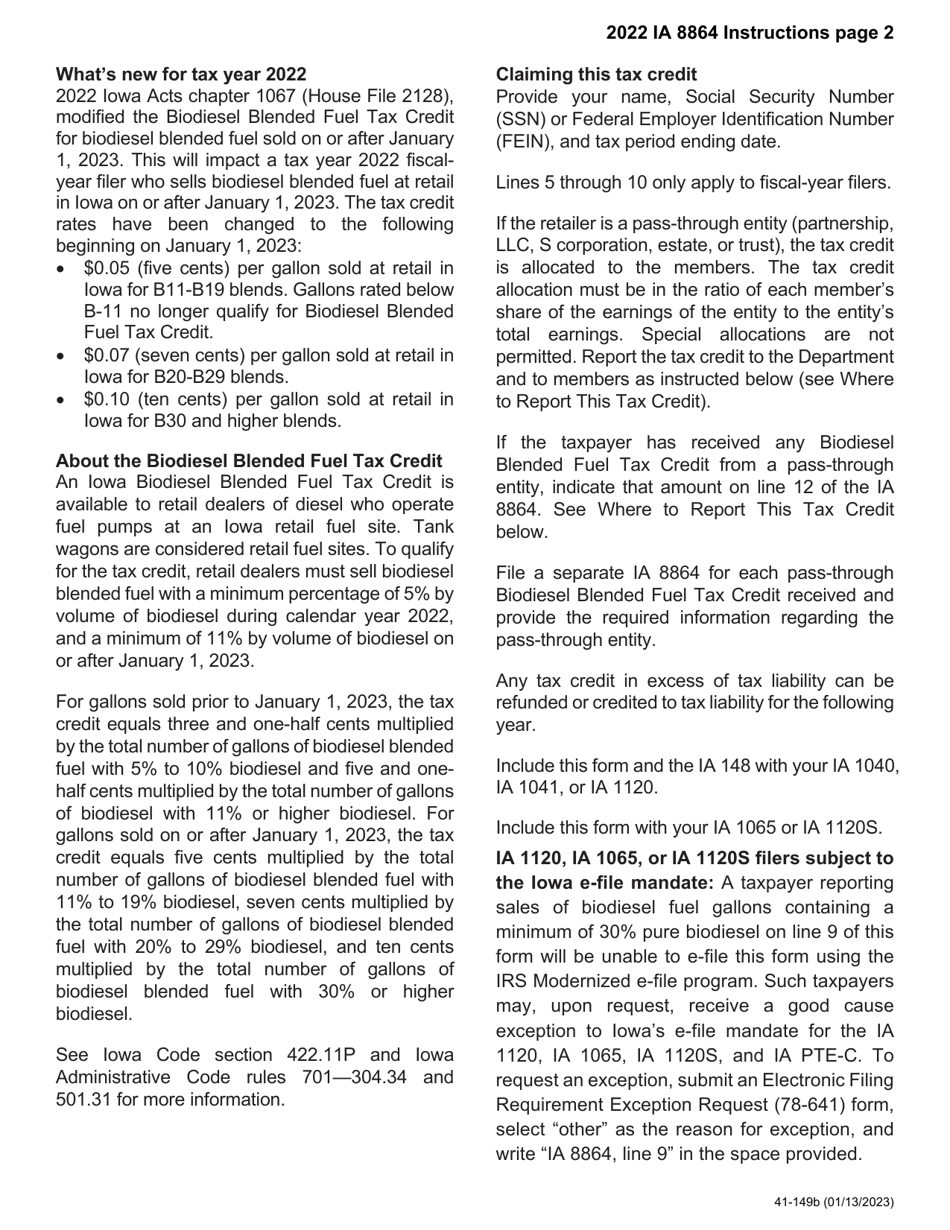

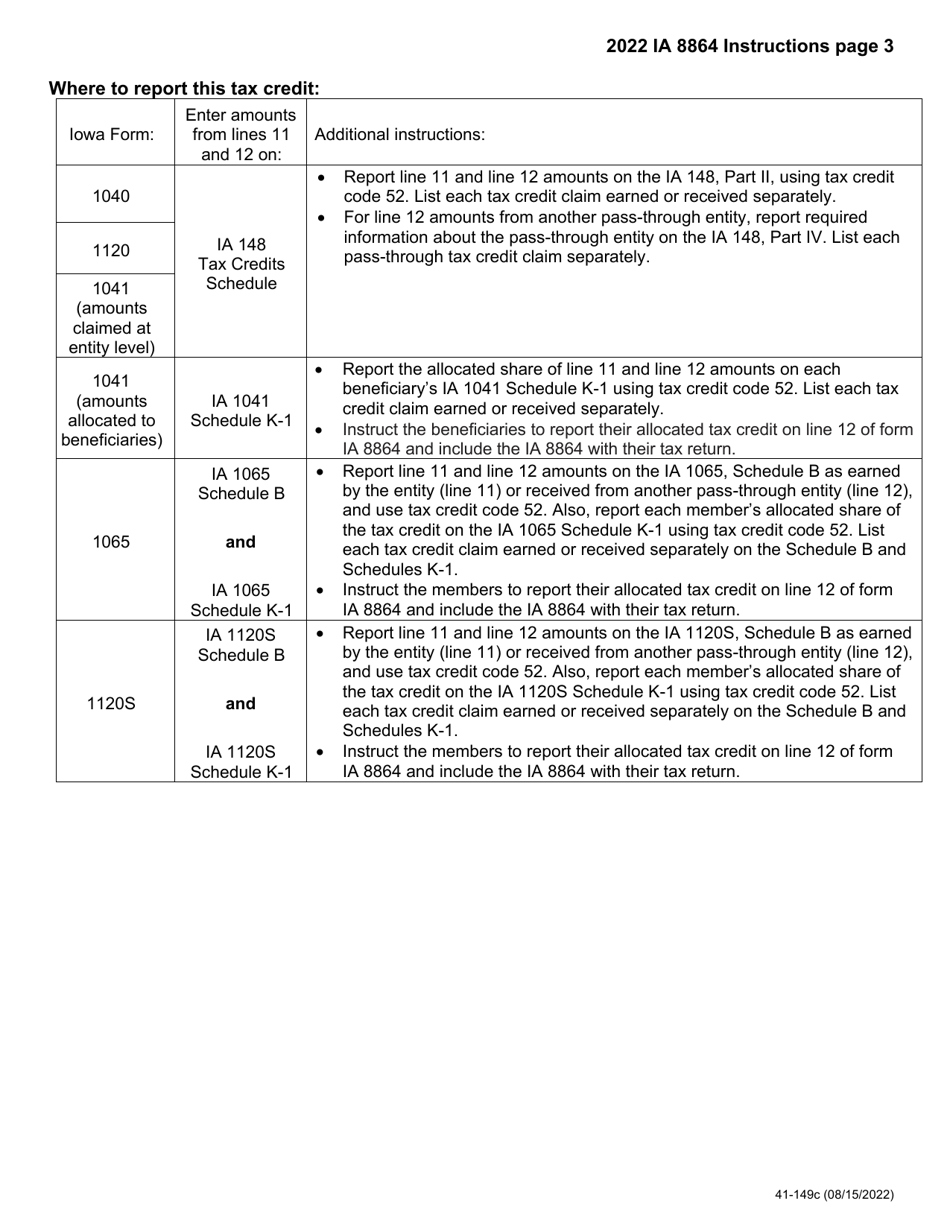

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IA8864?

A: Form IA8864 is the Iowa Biodiesel Blended FuelTax Credit form.

Q: What is the purpose of Form IA8864?

A: The purpose of Form IA8864 is to claim the Iowa Biodiesel Blended Fuel Tax Credit.

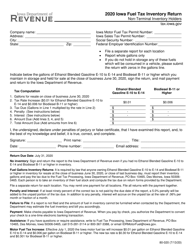

Q: What is the Iowa Biodiesel Blended Fuel Tax Credit?

A: The Iowa Biodiesel Blended Fuel Tax Credit is a credit available to individuals and businesses for blending biodiesel with other fuels.

Q: Who is eligible to claim the Iowa Biodiesel Blended Fuel Tax Credit?

A: Individuals and businesses that blend biodiesel with other fuels in Iowa are eligible to claim the tax credit.

Q: What is the deadline for filing Form IA8864?

A: Form IA8864 must be filed by April 30th of the year following the tax year in which the biodiesel blending took place.

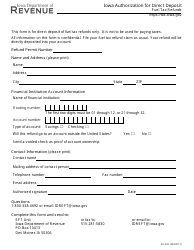

Form Details:

- Released on January 13, 2023;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IA8864 (41-149) by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.