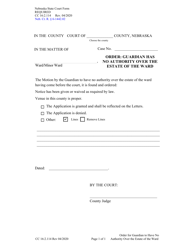

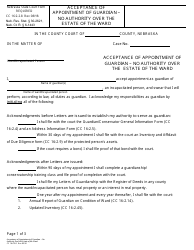

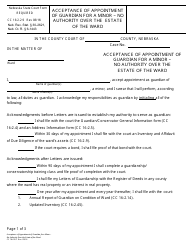

Instructions for Form CC16:2.37 Packet E - Nebraska

This document contains official instructions for Form CC16:2.37 , Packet E - a form released and collected by the Nebraska Judicial Branch. An up-to-date fillable Form CC16:2.37 is available for download through this link.

FAQ

Q: What is Form CC16:2.37 Packet E?

A: Form CC16:2.37 Packet E is a specific set of forms and instructions for filing taxes in Nebraska.

Q: What is the purpose of Form CC16:2.37 Packet E?

A: The purpose of Form CC16:2.37 Packet E is to provide taxpayers with the necessary forms and instructions to correctly file their taxes in Nebraska.

Q: Who needs to use Form CC16:2.37 Packet E?

A: Any individual or business entity that is required to file taxes in Nebraska may need to use Form CC16:2.37 Packet E.

Q: What documents are included in Form CC16:2.37 Packet E?

A: Form CC16:2.37 Packet E typically includes various tax forms, schedules, and instructions specific to Nebraska.

Q: Are there any filing deadlines associated with Form CC16:2.37 Packet E?

A: Yes, there are specific filing deadlines for different types of taxes in Nebraska. It is important to refer to the instructions provided in Form CC16:2.37 Packet E to determine the applicable deadlines.

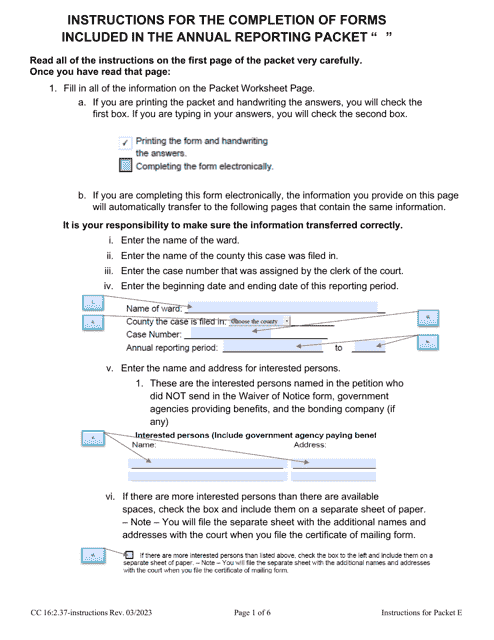

Q: Can I file Form CC16:2.37 Packet E electronically?

A: Yes, Nebraska generally allows for electronic filing of tax forms, including those included in Form CC16:2.37 Packet E. However, it is important to check the specific instructions and requirements for electronic filing.

Q: Is Form CC16:2.37 Packet E specific to Nebraska?

A: Yes, Form CC16:2.37 Packet E is specific to filing taxes in Nebraska and may not be applicable in other states.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Judicial Branch.