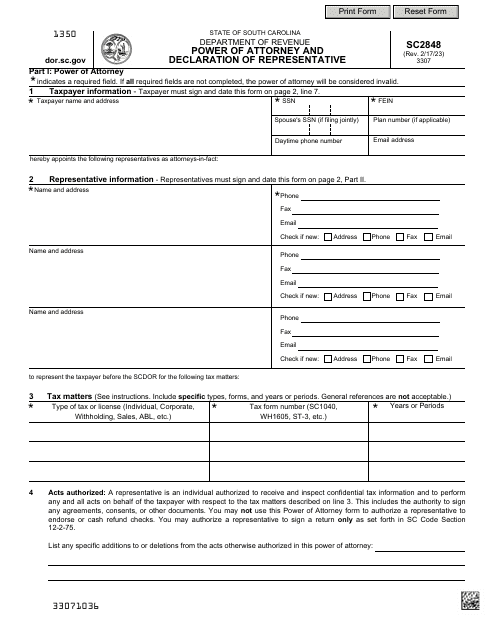

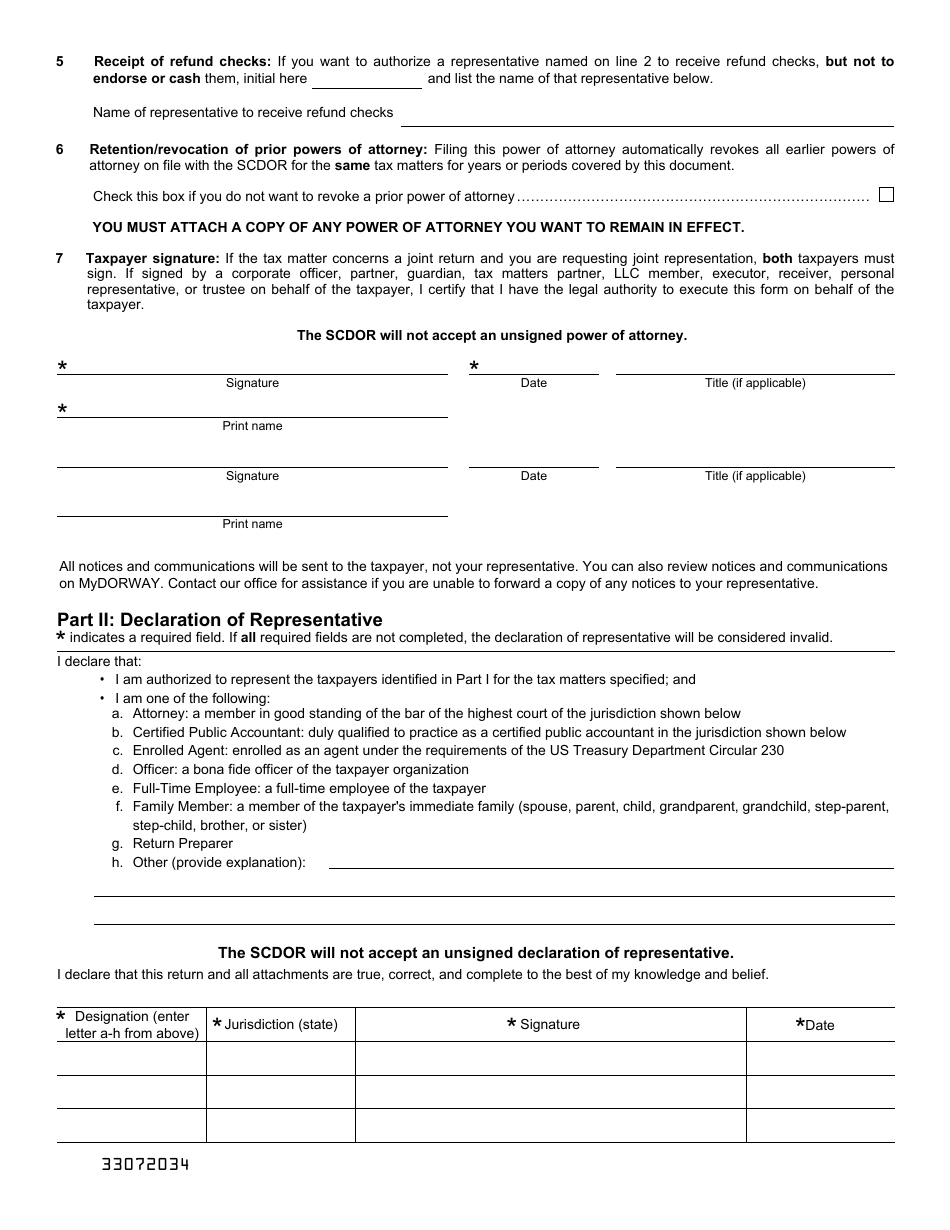

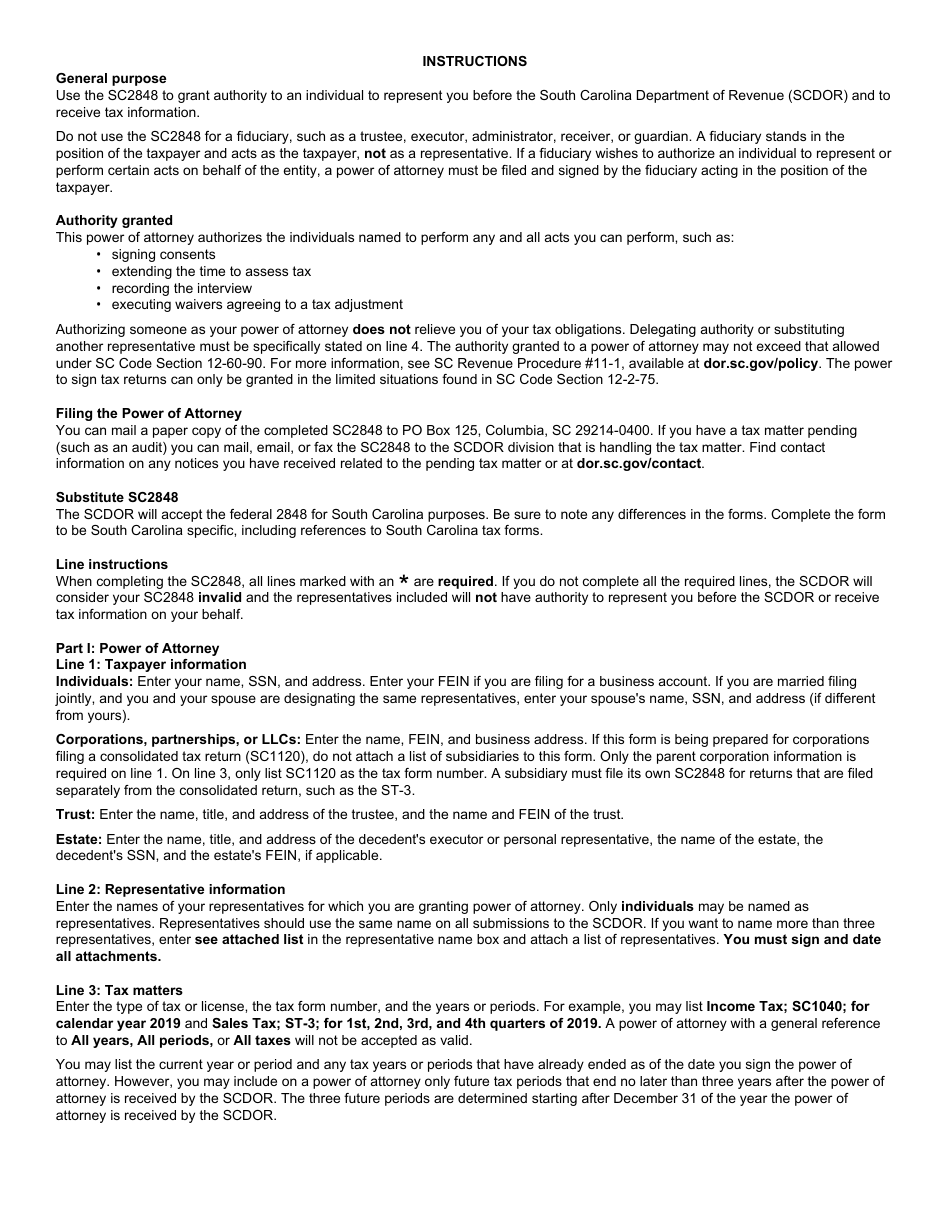

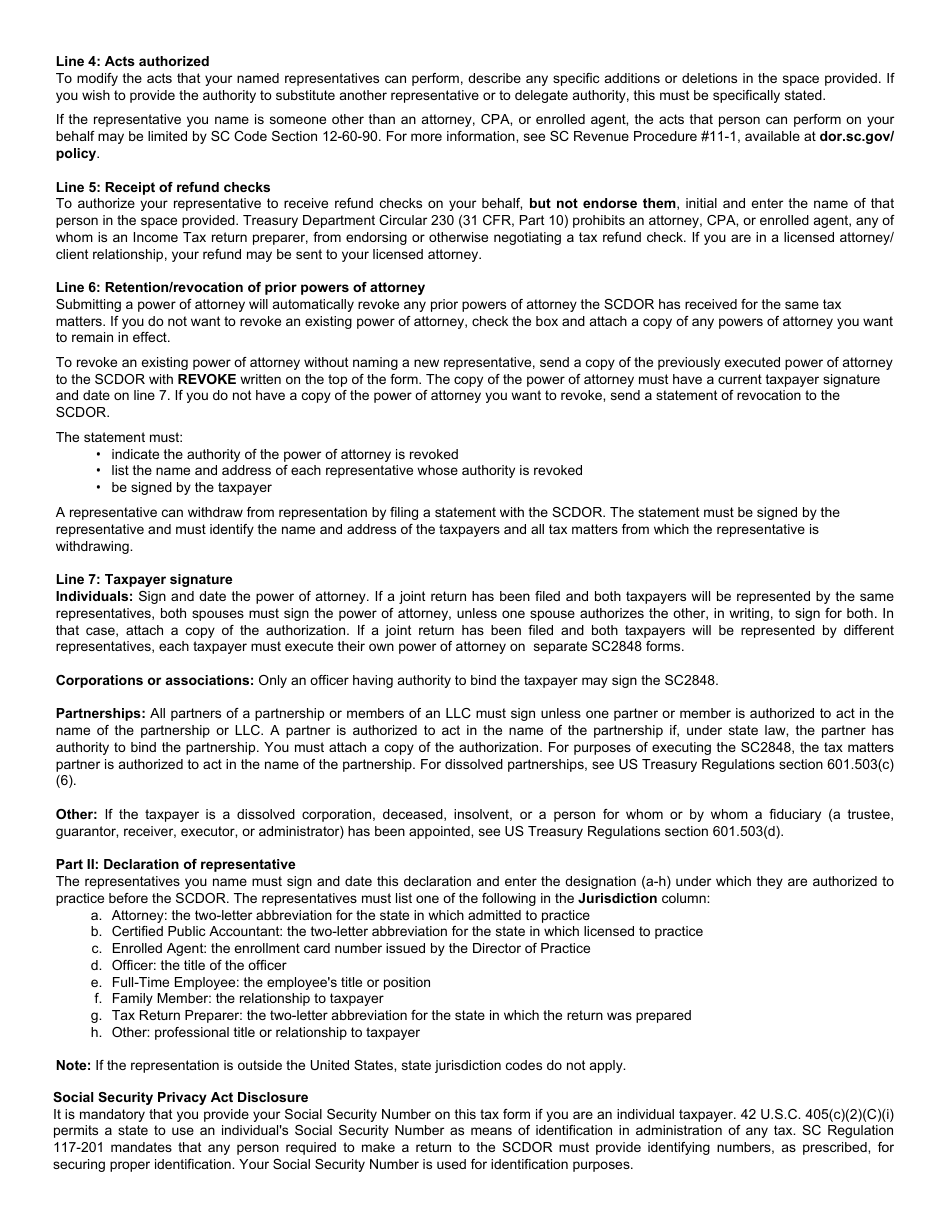

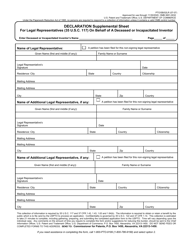

Form SC2848 Power of Attorney and Declaration of Representative - South Carolina

What Is Form SC2848?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC2848?

A: Form SC2848 is a Power of Attorney and Declaration of Representative form specific to South Carolina.

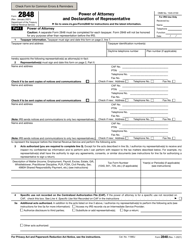

Q: What is the purpose of Form SC2848?

A: The purpose of Form SC2848 is to authorize someone to act as your representative in matters relating to your tax affairs in South Carolina.

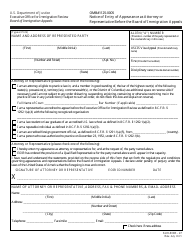

Q: Who can use Form SC2848?

A: Any individual or business who wants to appoint a representative to handle their tax matters in South Carolina can use Form SC2848.

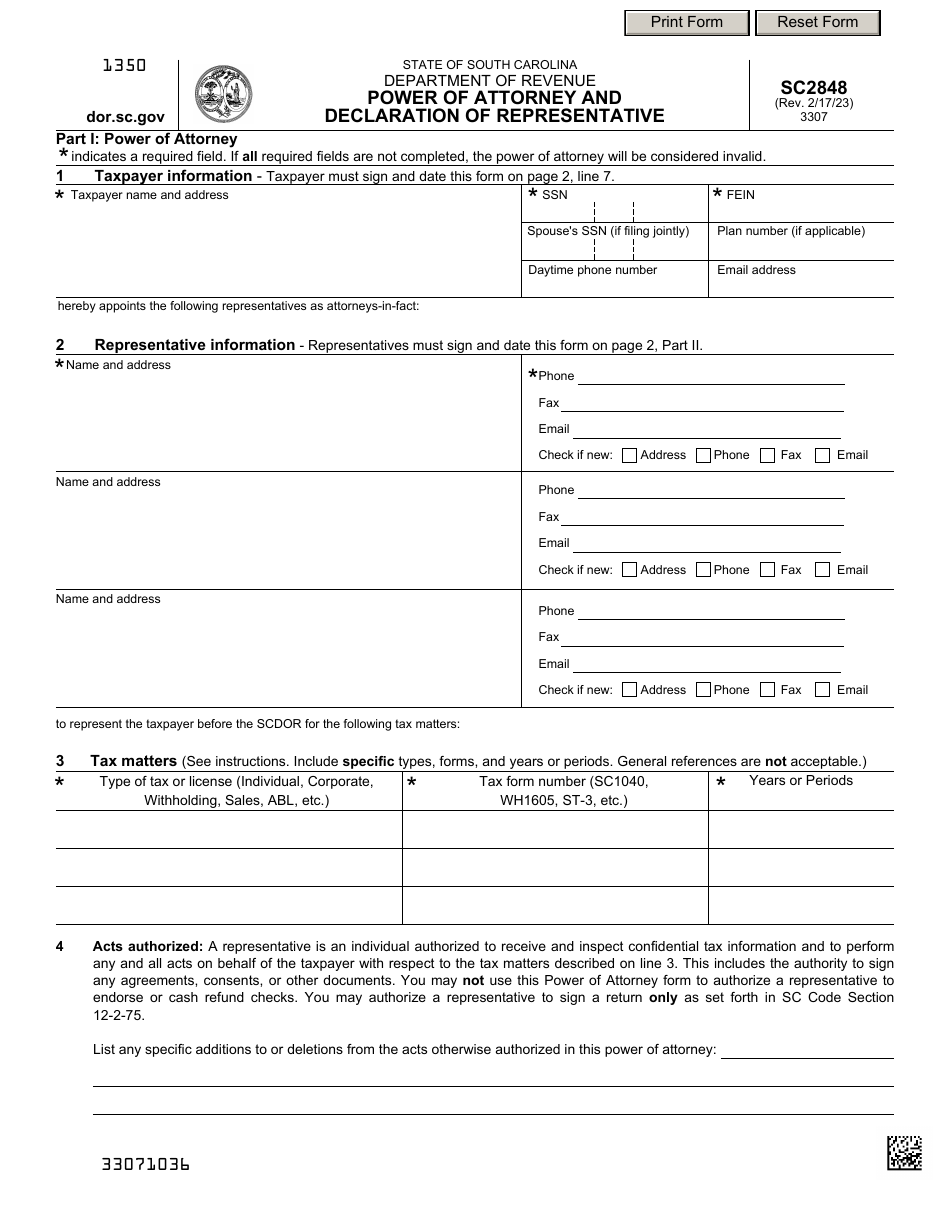

Q: What information is required on Form SC2848?

A: Form SC2848 requires the taxpayer's personal information, such as name and address, as well as the representative's information. The form also requires a detailed description of the specific tax matters the representative is authorized to handle.

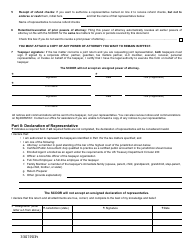

Q: Do I need to sign Form SC2848 in front of a notary?

A: No, you do not need to sign Form SC2848 in front of a notary. A signature under penalty of perjury is sufficient.

Q: Can I revoke or cancel a Power of Attorney granted on Form SC2848?

A: Yes, you can revoke or cancel a Power of Attorney granted on Form SC2848 at any time by submitting a written statement to the South Carolina Department of Revenue.

Q: How long is Form SC2848 valid for?

A: Form SC2848 remains valid until it is revoked or canceled by the taxpayer or the representative, or until the taxpayer's death.

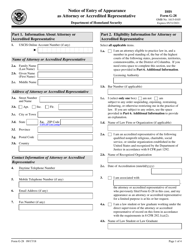

Form Details:

- Released on February 17, 2023;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SC2848 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.