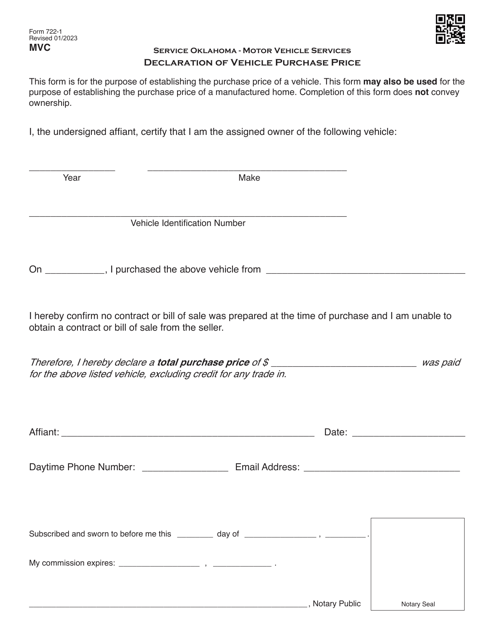

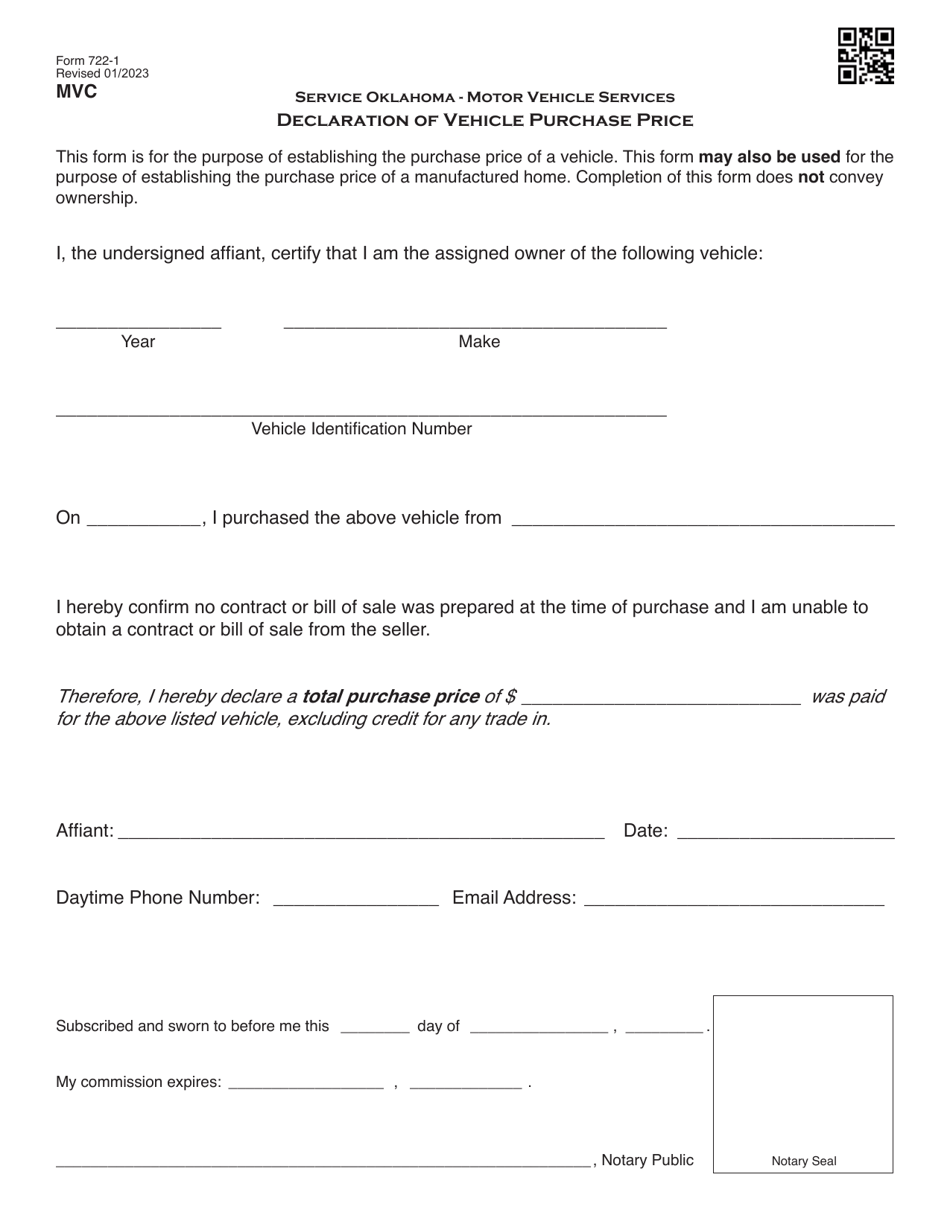

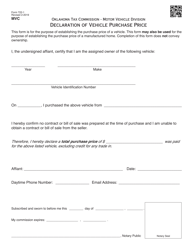

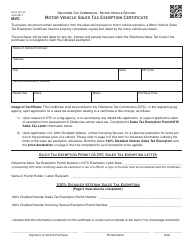

Form 722-1 Declaration of Vehicle Purchase Price - Oklahoma

What Is Form 722-1?

This is a legal form that was released by the Service Oklahoma - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 722-1 Declaration of Vehicle Purchase Price?

A: Form 722-1 Declaration of Vehicle Purchase Price is a document used in Oklahoma to declare the purchase price of a vehicle.

Q: Why do I need Form 722-1?

A: You need Form 722-1 to provide an accurate record of the purchase price when registering a vehicle in Oklahoma.

Q: Is Form 722-1 required for all vehicles purchased in Oklahoma?

A: Yes, Form 722-1 is required for all vehicles purchased in Oklahoma, including new and used vehicles.

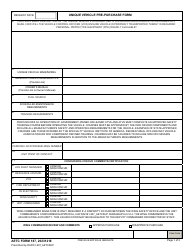

Q: What information do I need to fill out Form 722-1?

A: You will need to provide the vehicle identification number (VIN), year, make, model, purchase price, and buyer and seller information.

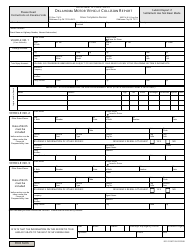

Q: When should I submit Form 722-1?

A: Form 722-1 should be submitted within 30 days of the vehicle purchase date or within 30 days of moving to Oklahoma with the vehicle.

Q: Do I need to pay any fees when submitting Form 722-1?

A: No, there are no fees associated with submitting Form 722-1.

Q: What happens after I submit Form 722-1?

A: After you submit Form 722-1, the Oklahoma Tax Commission will process your information and use it to assess and collect appropriate taxes and fees.

Q: Can I make changes to Form 722-1 after submission?

A: No, you cannot make changes to Form 722-1 after submission. It is important to ensure that all information provided is accurate before submitting the form.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Service Oklahoma;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 722-1 by clicking the link below or browse more documents and templates provided by the Service Oklahoma.