This version of the form is not currently in use and is provided for reference only. Download this version of

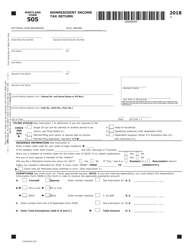

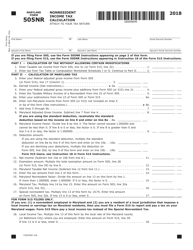

Maryland Form 505SU (COM/RAD-033)

for the current year.

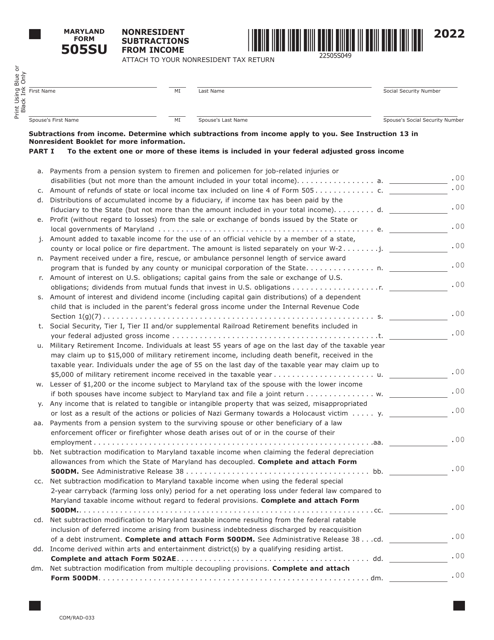

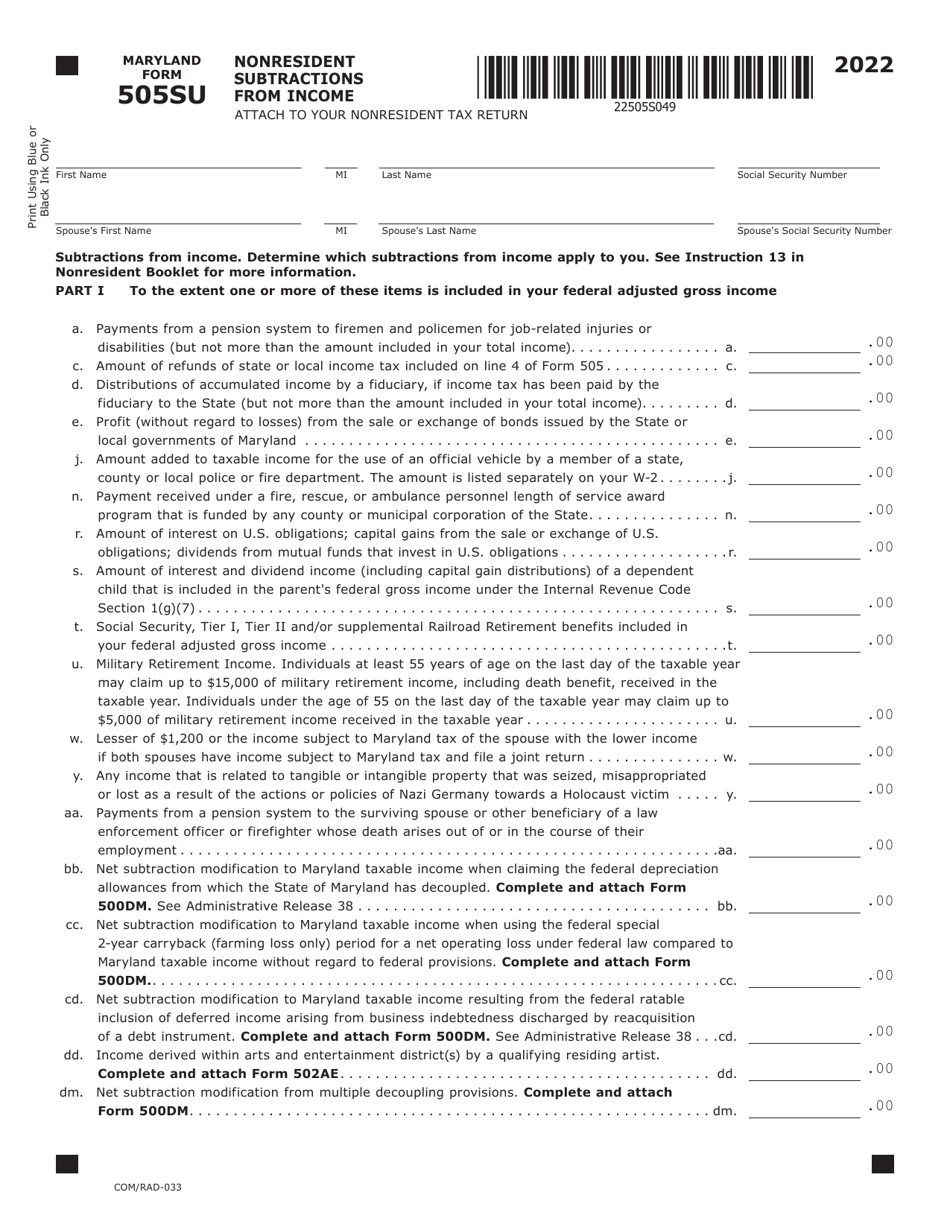

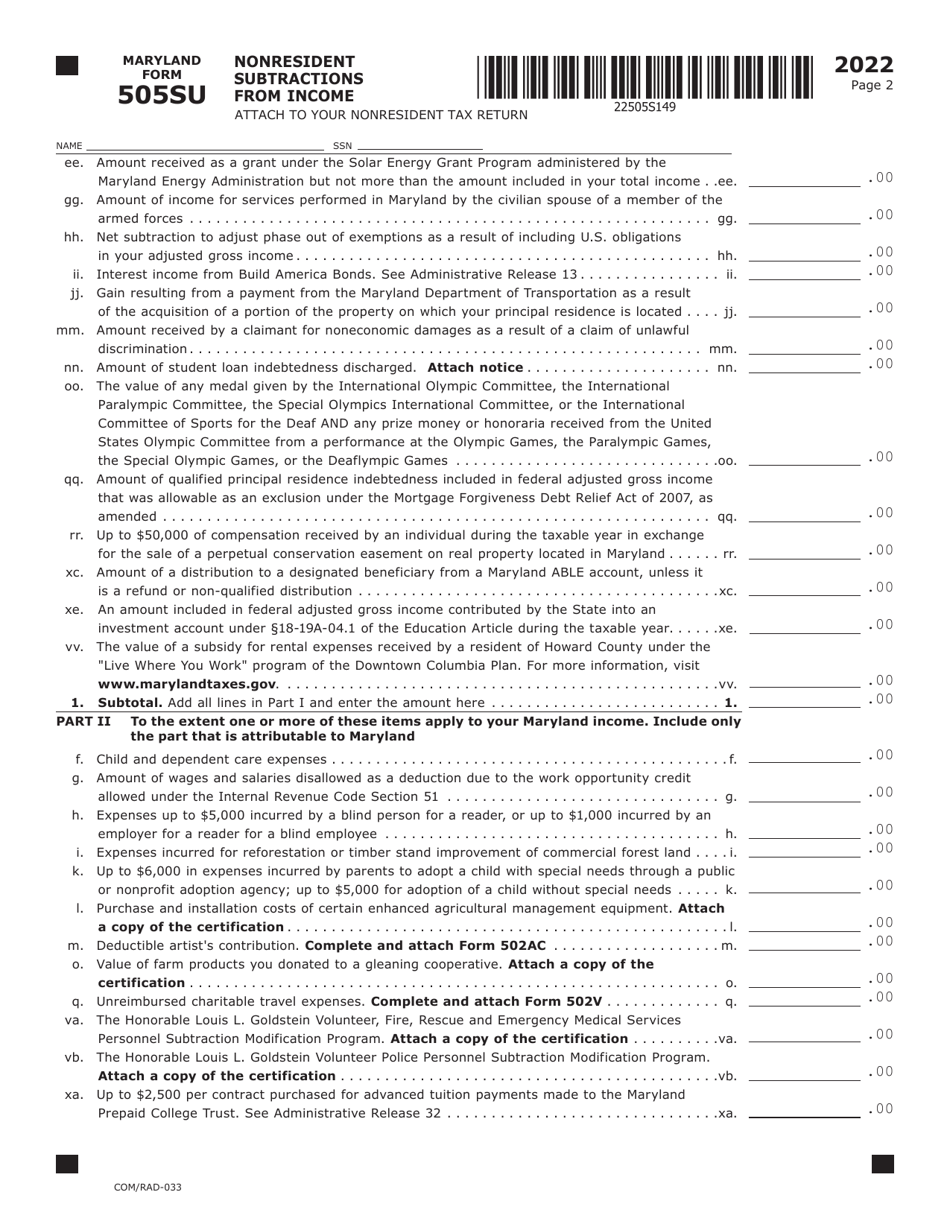

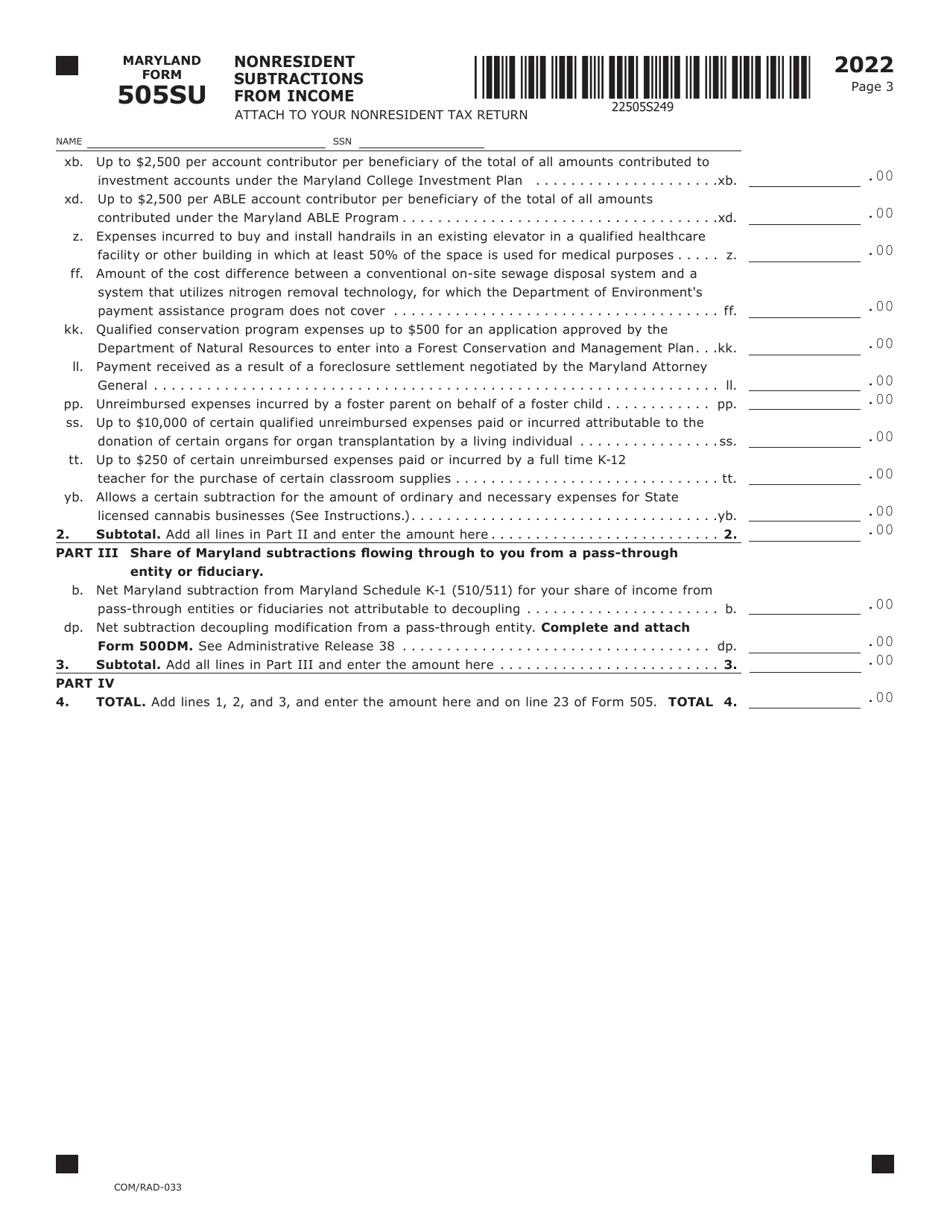

Maryland Form 505SU (COM / RAD-033) Nonresident Subtractions From Income - Maryland

What Is Maryland Form 505SU (COM/RAD-033)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 505SU?

A: Maryland Form 505SU is a form to claim nonresident subtractions from income in Maryland.

Q: Who should use Maryland Form 505SU?

A: Nonresidents who have income from Maryland may use Maryland Form 505SU to claim deductions.

Q: What are nonresident subtractions from income?

A: Nonresident subtractions from income are deductions that nonresidents can claim to reduce their taxable income in Maryland.

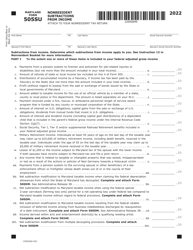

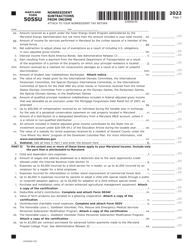

Q: What types of deductions can be claimed on Maryland Form 505SU?

A: Common types of deductions that can be claimed on Maryland Form 505SU include student loan interest, retirement income, and military pensions.

Q: Do I need to file Maryland Form 505SU if I am not a resident of Maryland?

A: No, you only need to file Maryland Form 505SU if you have income from Maryland and want to claim nonresident subtractions from income.

Q: When is the deadline to file Maryland Form 505SU?

A: The deadline to file Maryland Form 505SU is the same as the deadline for filing your Maryland state income tax return, which is usually April 15th.

Q: Can I e-file Maryland Form 505SU?

A: Yes, Maryland Form 505SU can be e-filed along with your Maryland state income tax return.

Q: Are there any additional requirements for filing Maryland Form 505SU?

A: You may need to include supporting documentation, such as copies of federal tax returns and W-2 forms, when filing Maryland Form 505SU.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 505SU (COM/RAD-033) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.