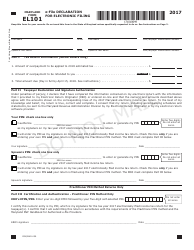

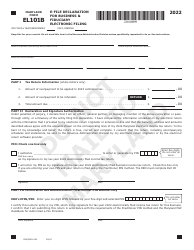

This version of the form is not currently in use and is provided for reference only. Download this version of

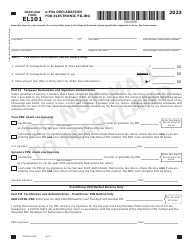

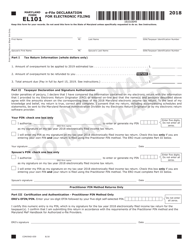

Maryland Form EL101 (COM/RAD-059)

for the current year.

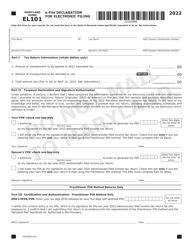

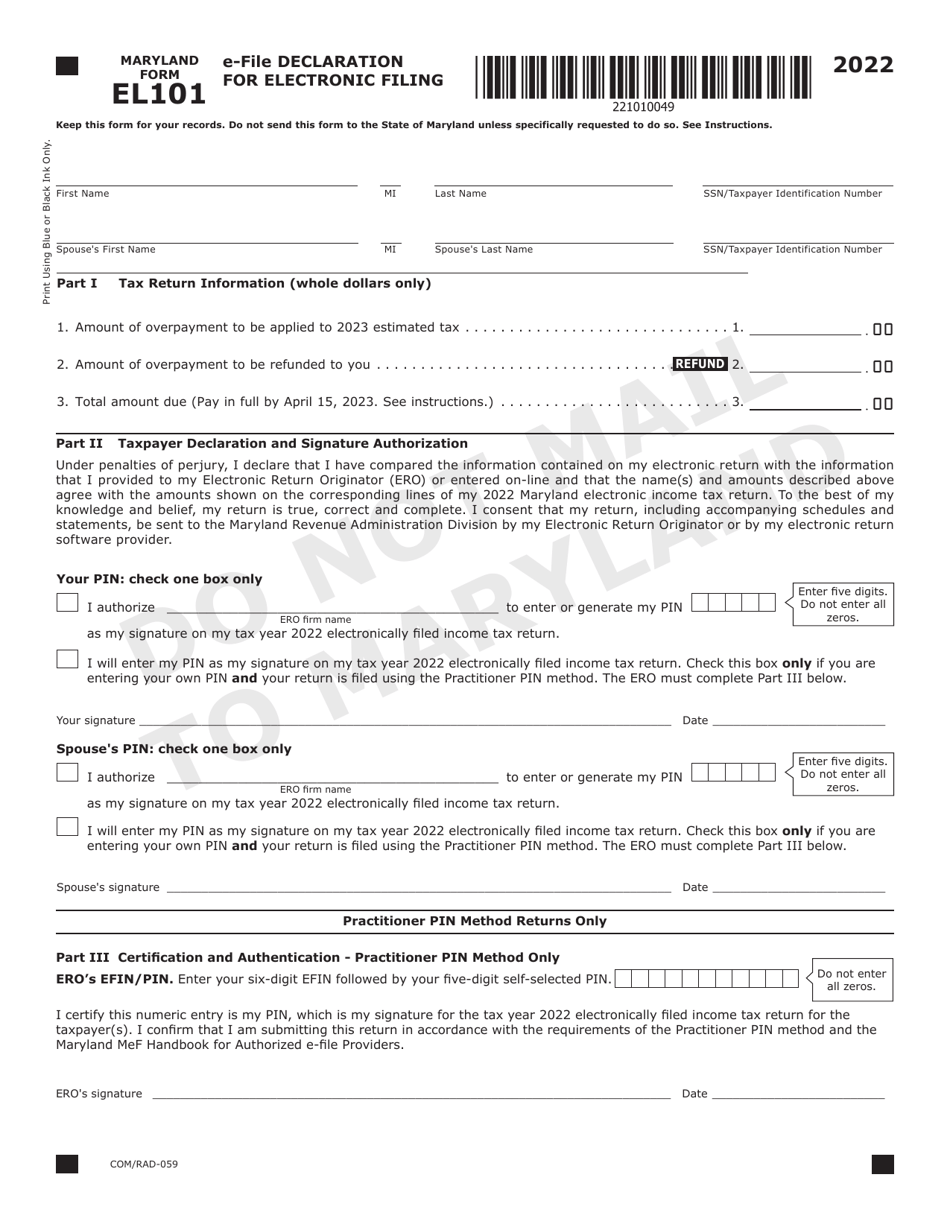

Maryland Form EL101 (COM / RAD-059) E-File Declaration for Electronic Filing - Maryland

What Is Maryland Form EL101 (COM/RAD-059)?

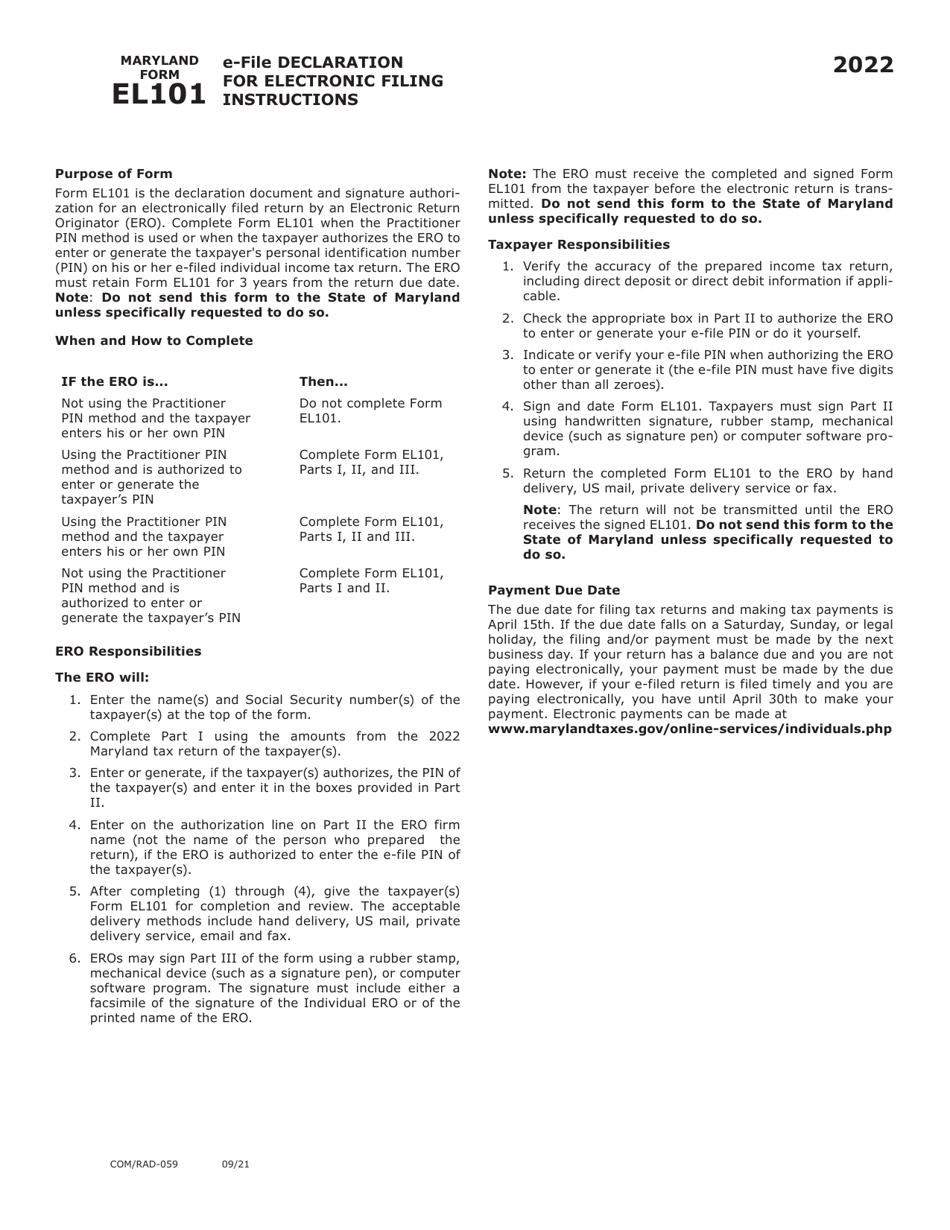

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form EL101?

A: Maryland Form EL101 is the E-File Declaration for Electronic Filing in Maryland.

Q: What is the purpose of Maryland Form EL101?

A: The purpose of Maryland Form EL101 is to declare that you will be filing your taxes electronically in Maryland.

Q: Who needs to file Maryland Form EL101?

A: Anyone who plans to file their taxes electronically in Maryland needs to file Form EL101.

Q: How do I file Maryland Form EL101?

A: Maryland Form EL101 can be filed electronically through the Maryland tax filing system.

Q: Is there a deadline for filing Maryland Form EL101?

A: Yes, Maryland Form EL101 must be filed by the tax filing deadline set by the state of Maryland.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Maryland Form EL101 (COM/RAD-059) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.