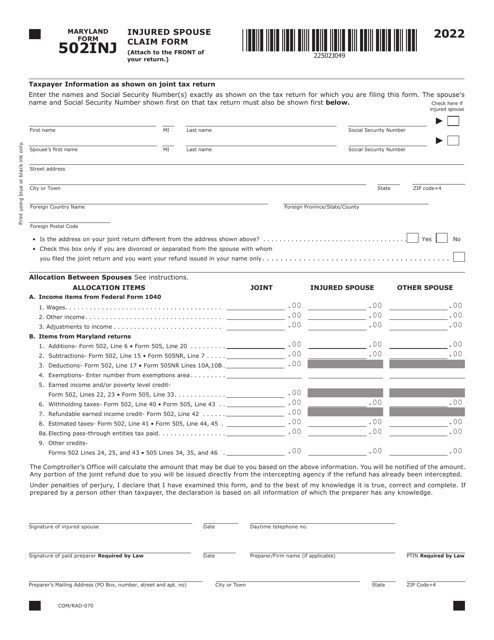

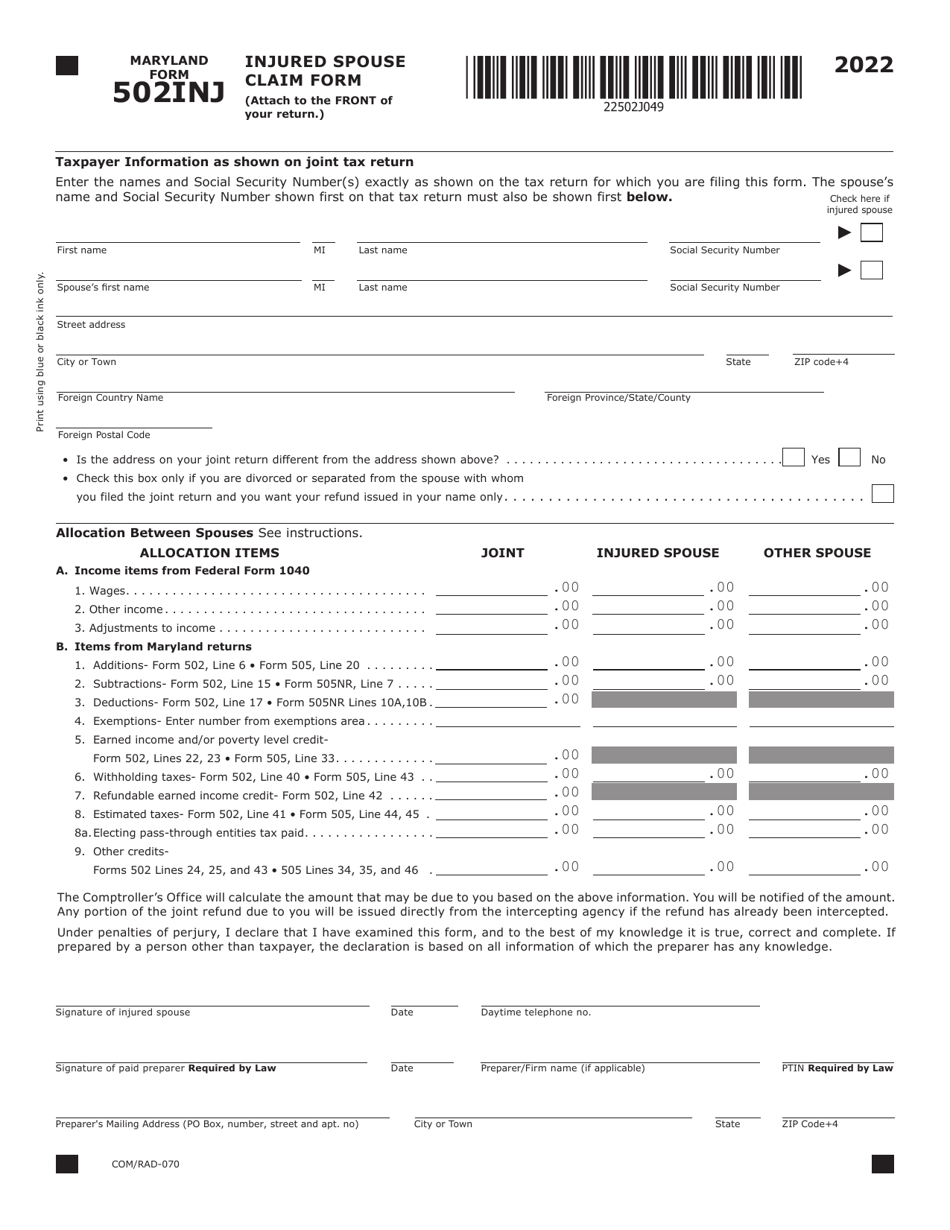

Maryland Form 501INJ (COM / RAD070) Injured Spouse Claim Form - Maryland

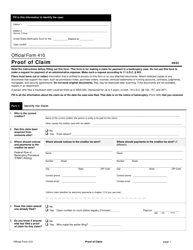

What Is Maryland Form 501INJ (COM/RAD070)?

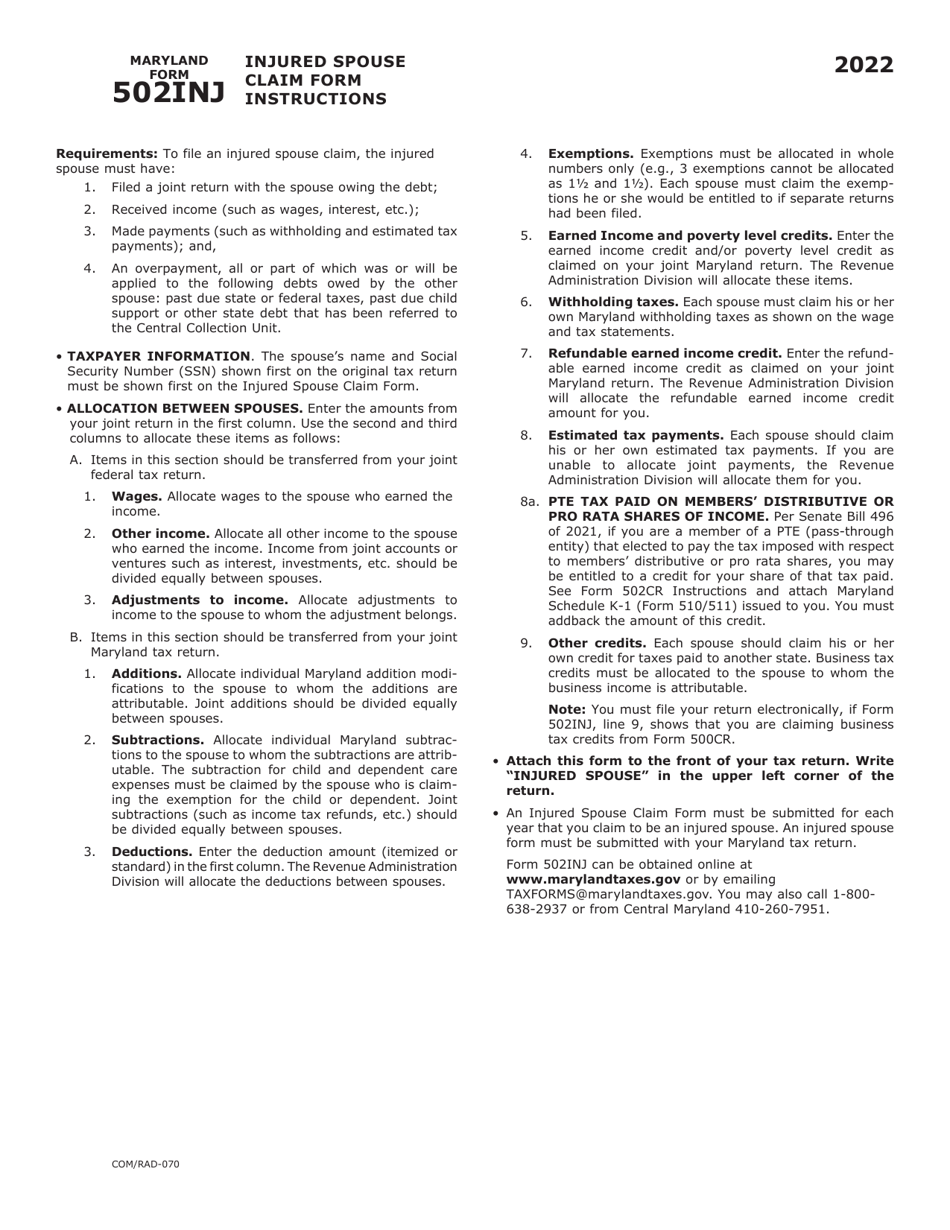

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 501INJ?

A: Maryland Form 501INJ is the Injured Spouse Claim Form for Maryland.

Q: What is the purpose of Maryland Form 501INJ?

A: The purpose of Maryland Form 501INJ is to allow an injured spouse to claim their share of a joint tax refund, which may otherwise be offset or applied to the other spouse's debts.

Q: Who can use Maryland Form 501INJ?

A: Maryland Form 501INJ can be used by a spouse who has had their share of a joint tax refund offset or applied to the other spouse's debts.

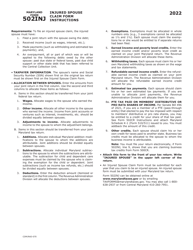

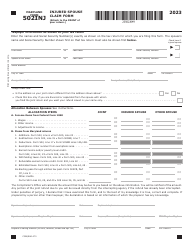

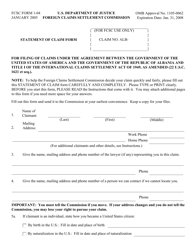

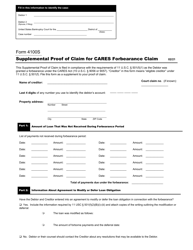

Q: How do I fill out Maryland Form 501INJ?

A: You need to provide your personal information, details of the joint tax return, and any necessary documentation to support your claim.

Q: Is there a deadline to submit Maryland Form 501INJ?

A: Yes, Maryland Form 501INJ must be submitted within 3 years from the original due date of the joint tax return.

Q: Can I file Maryland Form 501INJ electronically?

A: No, Maryland Form 501INJ cannot be filed electronically. It must be mailed to the Maryland Comptroller's office.

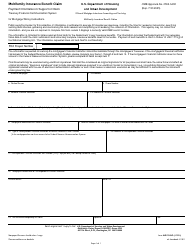

Q: What happens after I submit Maryland Form 501INJ?

A: The Maryland Comptroller's office will review your claim and determine if you qualify for an injured spouse allocation. If approved, you will receive your share of the joint tax refund.

Q: What should I do if I have additional questions about Maryland Form 501INJ?

A: If you have additional questions or need further assistance, you should contact the Maryland Comptroller's office for guidance.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 501INJ (COM/RAD070) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.