This version of the form is not currently in use and is provided for reference only. Download this version of

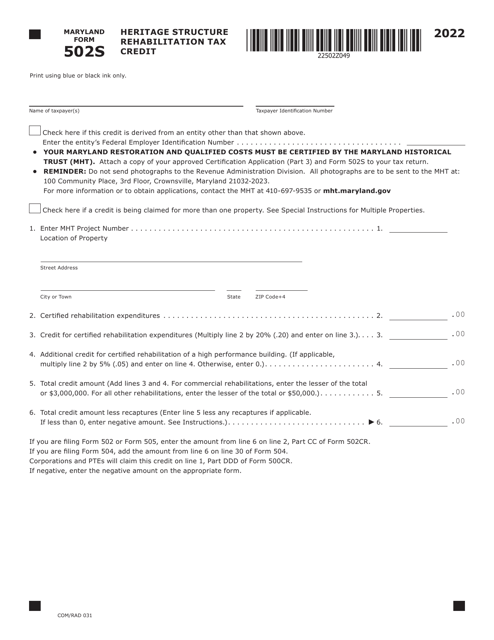

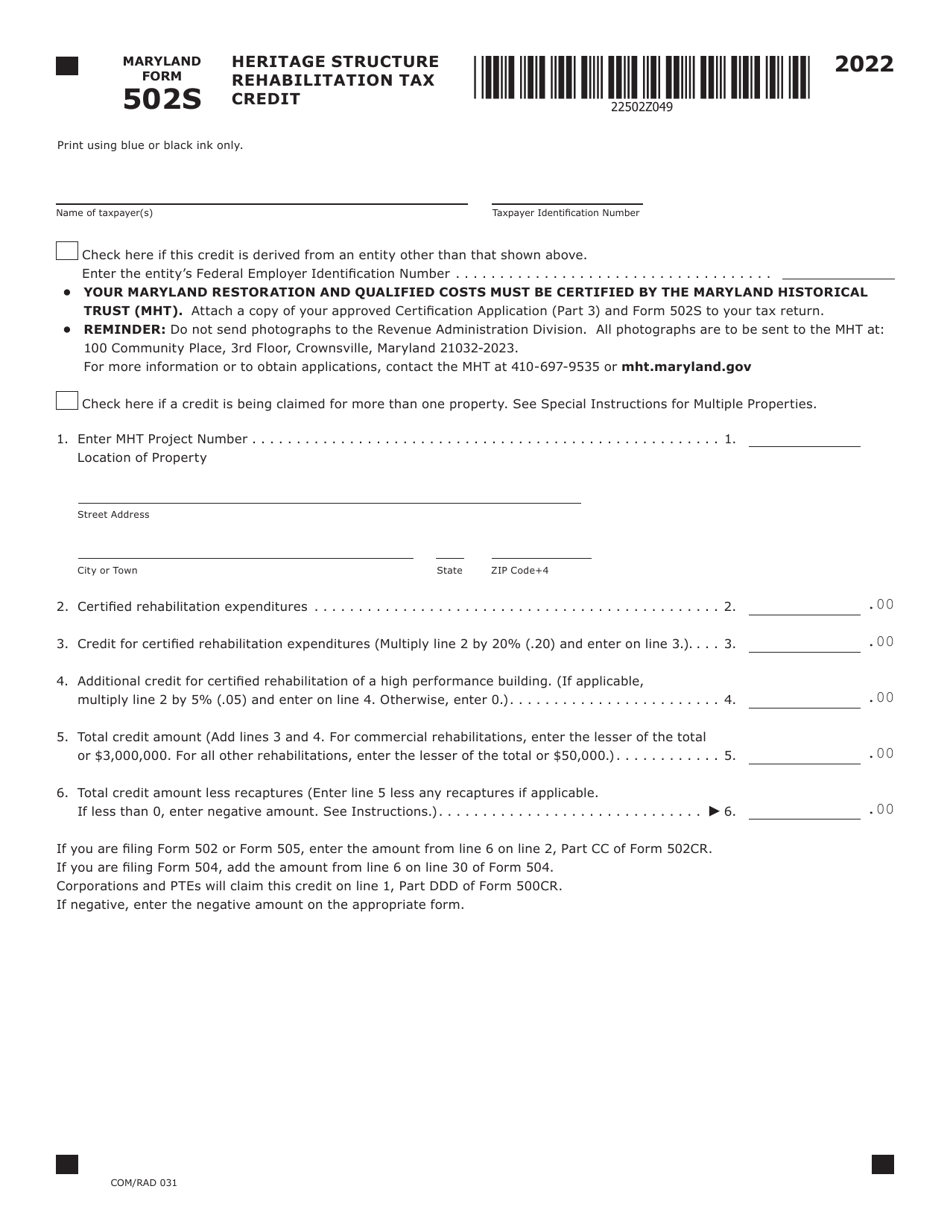

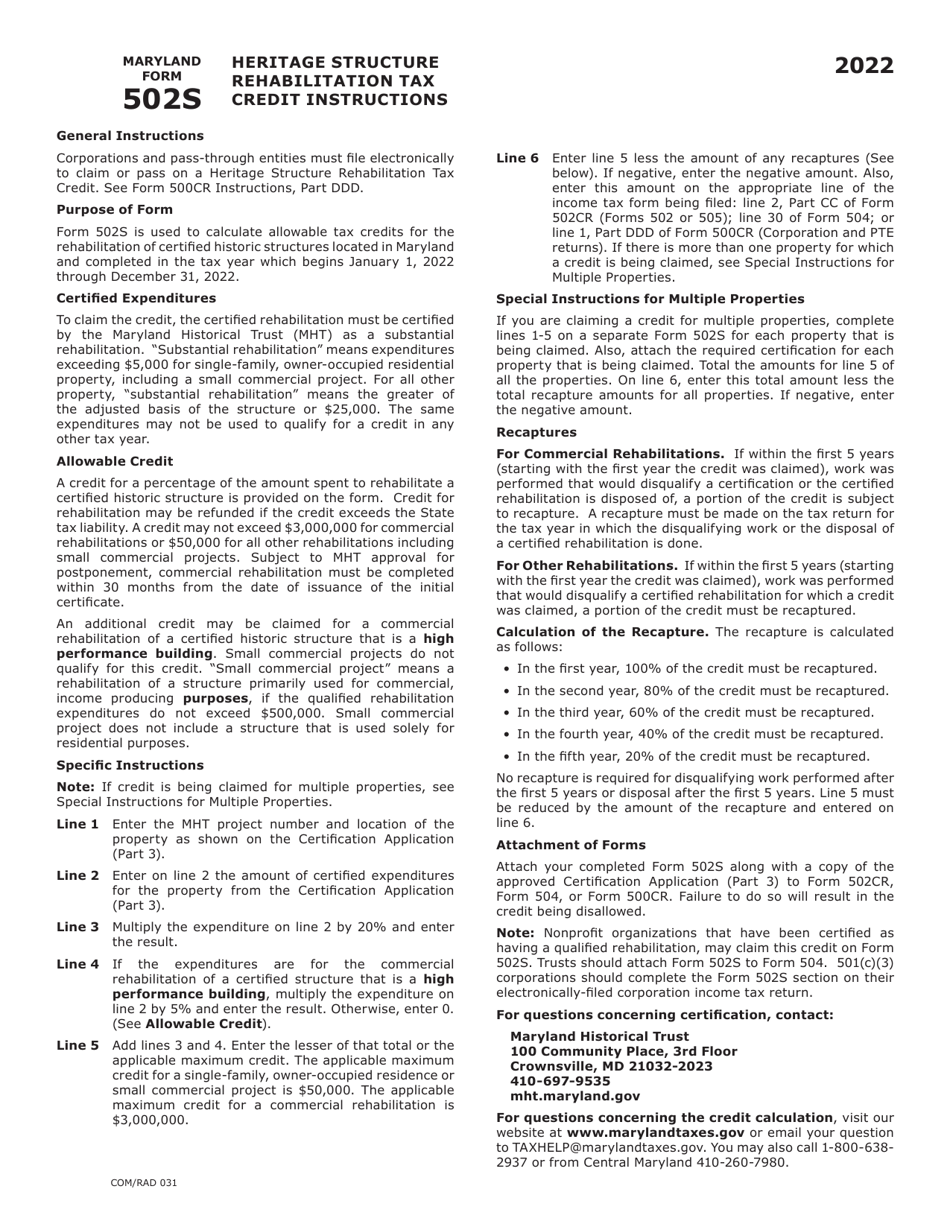

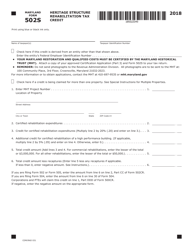

Maryland Form 502S (COM/RAD031)

for the current year.

Maryland Form 502S (COM / RAD031) Heritage Structure Rehabilitation Tax Credit - Maryland

What Is Maryland Form 502S (COM/RAD031)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 502S?

A: Maryland Form 502S is a tax form used for claiming the Heritage Structure Rehabilitation Tax Credit in Maryland.

Q: What is the Heritage Structure Rehabilitation Tax Credit?

A: The Heritage Structure Rehabilitation Tax Credit is a tax credit offered by Maryland for the rehabilitation of historic structures.

Q: Who is eligible to claim the tax credit?

A: Property owners who rehabilitate eligible historic structures in Maryland may be eligible to claim the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit is intended to encourage the preservation and rehabilitation of historic structures in Maryland.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 502S (COM/RAD031) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.