This version of the form is not currently in use and is provided for reference only. Download this version of

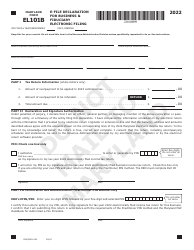

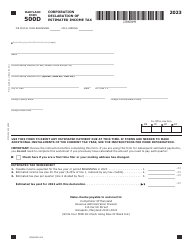

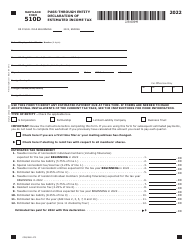

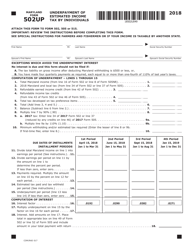

Maryland Form 504D (COM/RAD-068)

for the current year.

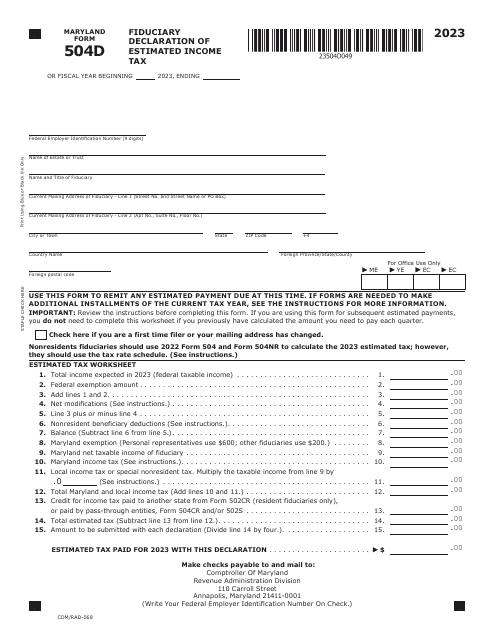

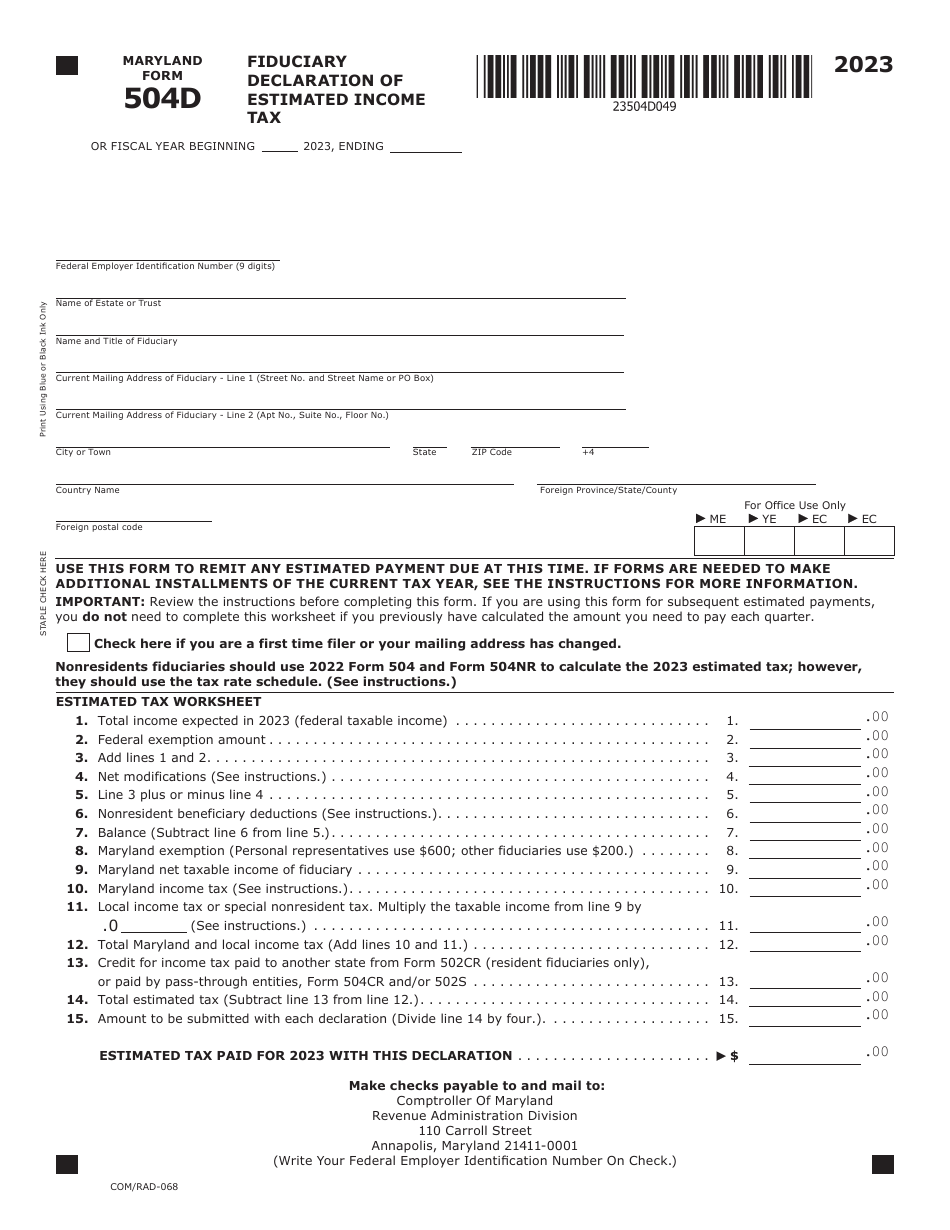

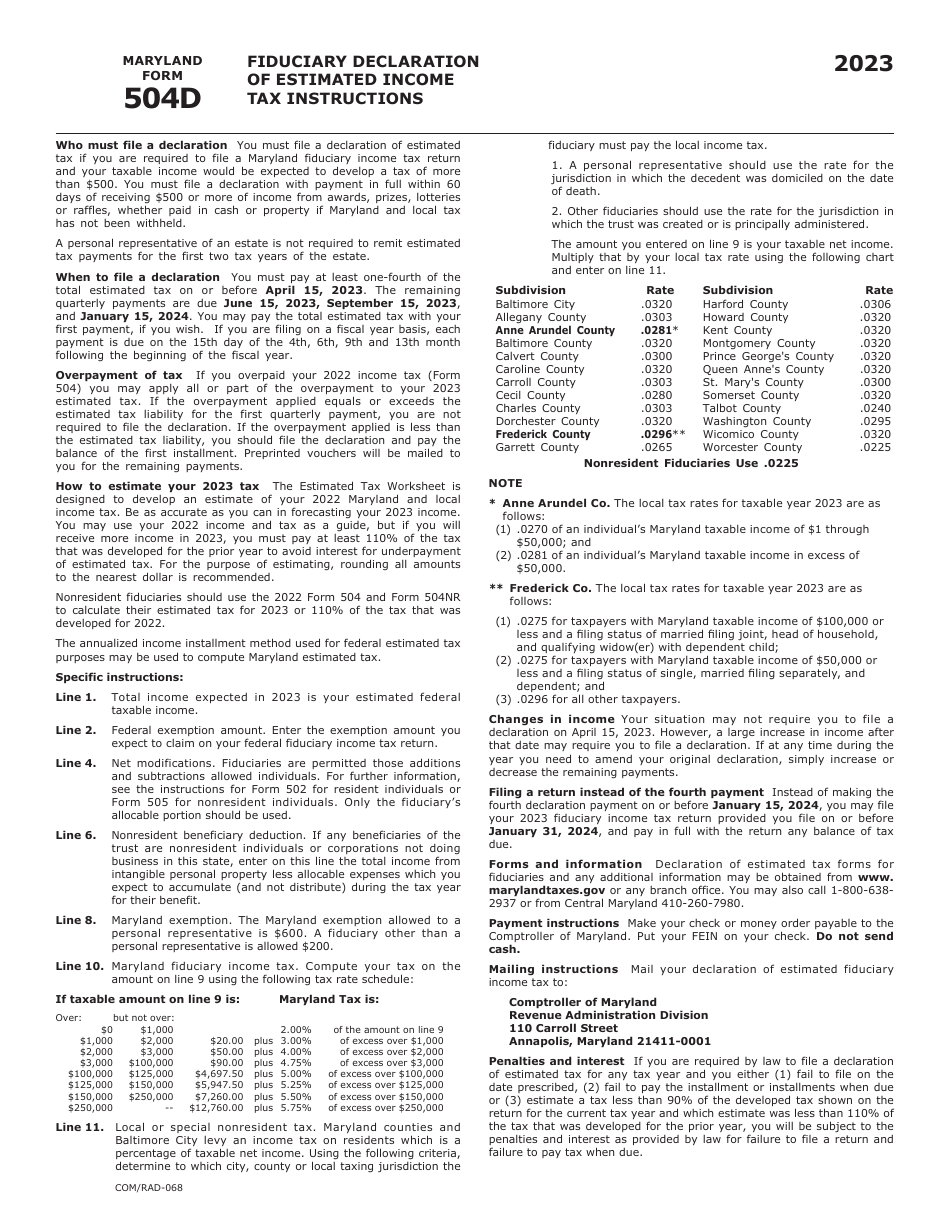

Maryland Form 504D (COM / RAD-068) Fiduciary Declaration of Estimated Income Tax - Maryland

What Is Maryland Form 504D (COM/RAD-068)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 504D?

A: Maryland Form 504D is the Fiduciary Declaration of Estimated Income Tax form for Maryland.

Q: What is the purpose of Maryland Form 504D?

A: The purpose of Maryland Form 504D is to declare and pay estimated income tax for fiduciaries in Maryland.

Q: Who needs to file Maryland Form 504D?

A: Fiduciaries in Maryland who have estimated income tax liability need to file Maryland Form 504D.

Q: When is Maryland Form 504D due?

A: Maryland Form 504D is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for not filing Maryland Form 504D?

A: Yes, there may be penalties for not filing Maryland Form 504D, including interest charges and late payment penalties.

Q: What information is required to complete Maryland Form 504D?

A: To complete Maryland Form 504D, you will need information such as the fiduciary's name and contact information, federal employer identification number, and estimated income tax calculations.

Q: Can I make changes to Maryland Form 504D after it has been filed?

A: Yes, you can make changes to Maryland Form 504D after it has been filed by filing an amended return using Maryland Form 504X.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 504D (COM/RAD-068) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.