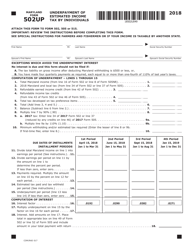

This version of the form is not currently in use and is provided for reference only. Download this version of

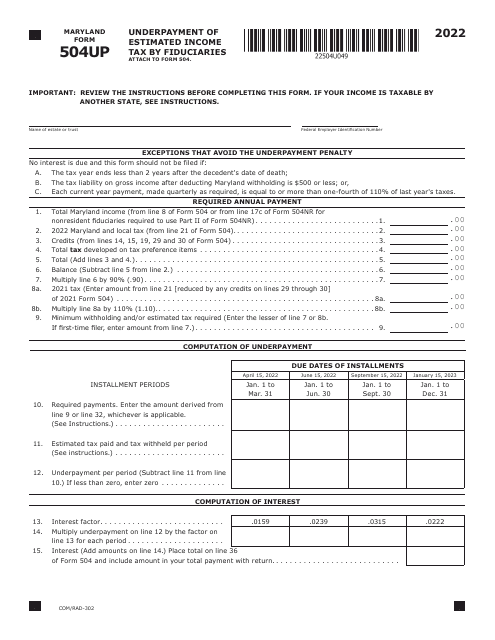

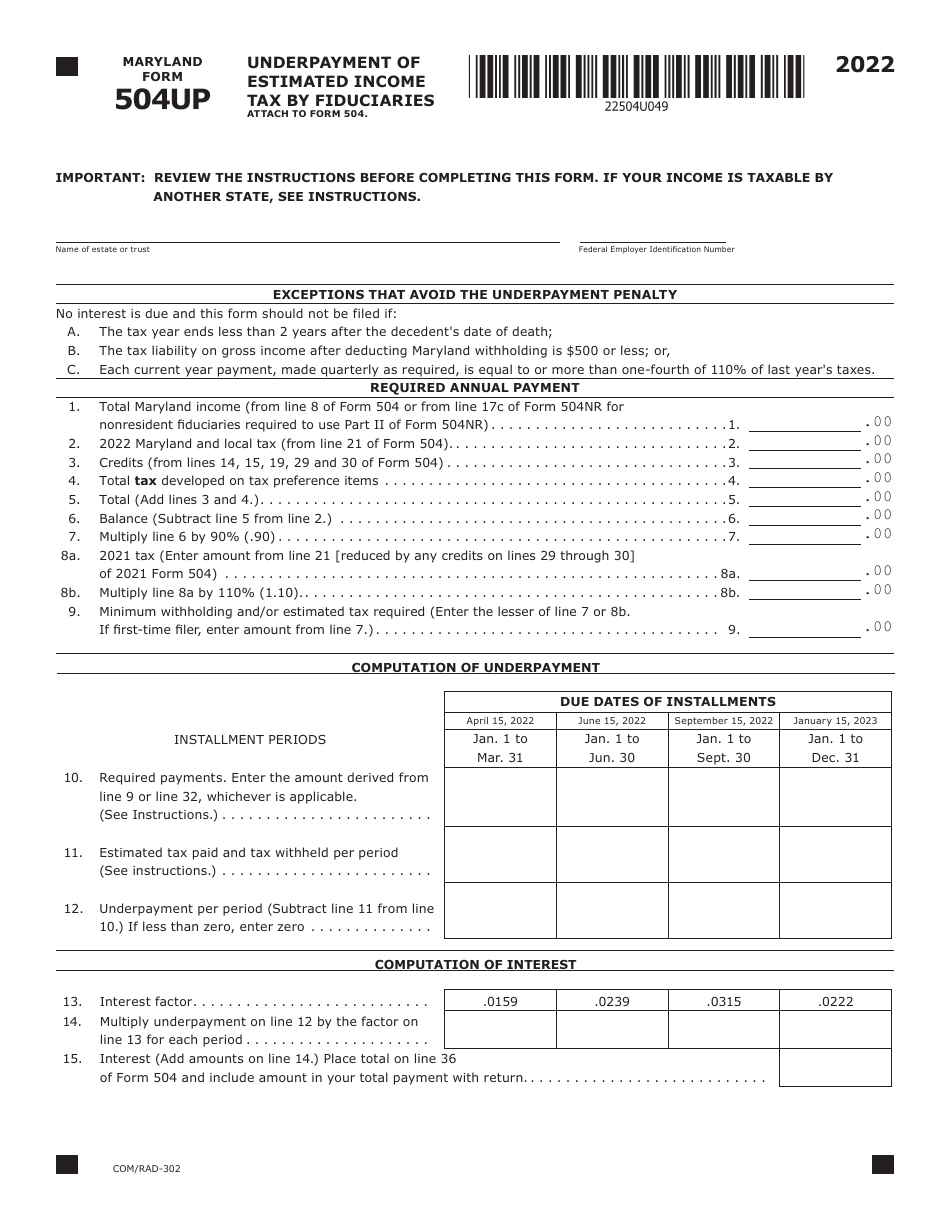

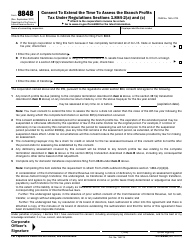

Maryland Form 504UP (COM/RAD-302)

for the current year.

Maryland Form 504UP (COM / RAD-302) Underpayment of Fiduciary Income Tax - Maryland

What Is Maryland Form 504UP (COM/RAD-302)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 504UP?

A: Maryland Form 504UP is the form used to report and pay the underpayment of fiduciary income tax in Maryland.

Q: Who needs to file Maryland Form 504UP?

A: Fiduciaries who have underestimated or underpaid their income tax in Maryland need to file Form 504UP.

Q: What is considered an underpayment of fiduciary income tax?

A: An underpayment of fiduciary income tax occurs when the amount of tax paid by the fiduciary is less than the required amount.

Q: When is the deadline for filing Maryland Form 504UP?

A: The deadline for filing Form 504UP is the same as the deadline for filing the fiduciary income tax return, which is generally April 15th.

Q: Are there any penalties for underpayment of fiduciary income tax?

A: Yes, there may be penalties and interest charges for underpayment of fiduciary income tax in Maryland.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 504UP (COM/RAD-302) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.