This version of the form is not currently in use and is provided for reference only. Download this version of

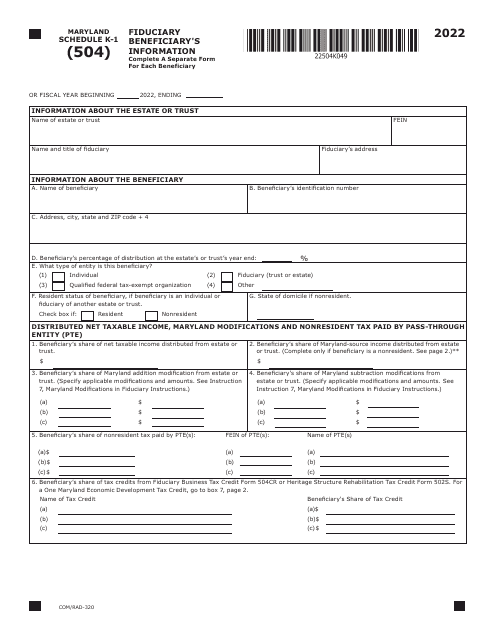

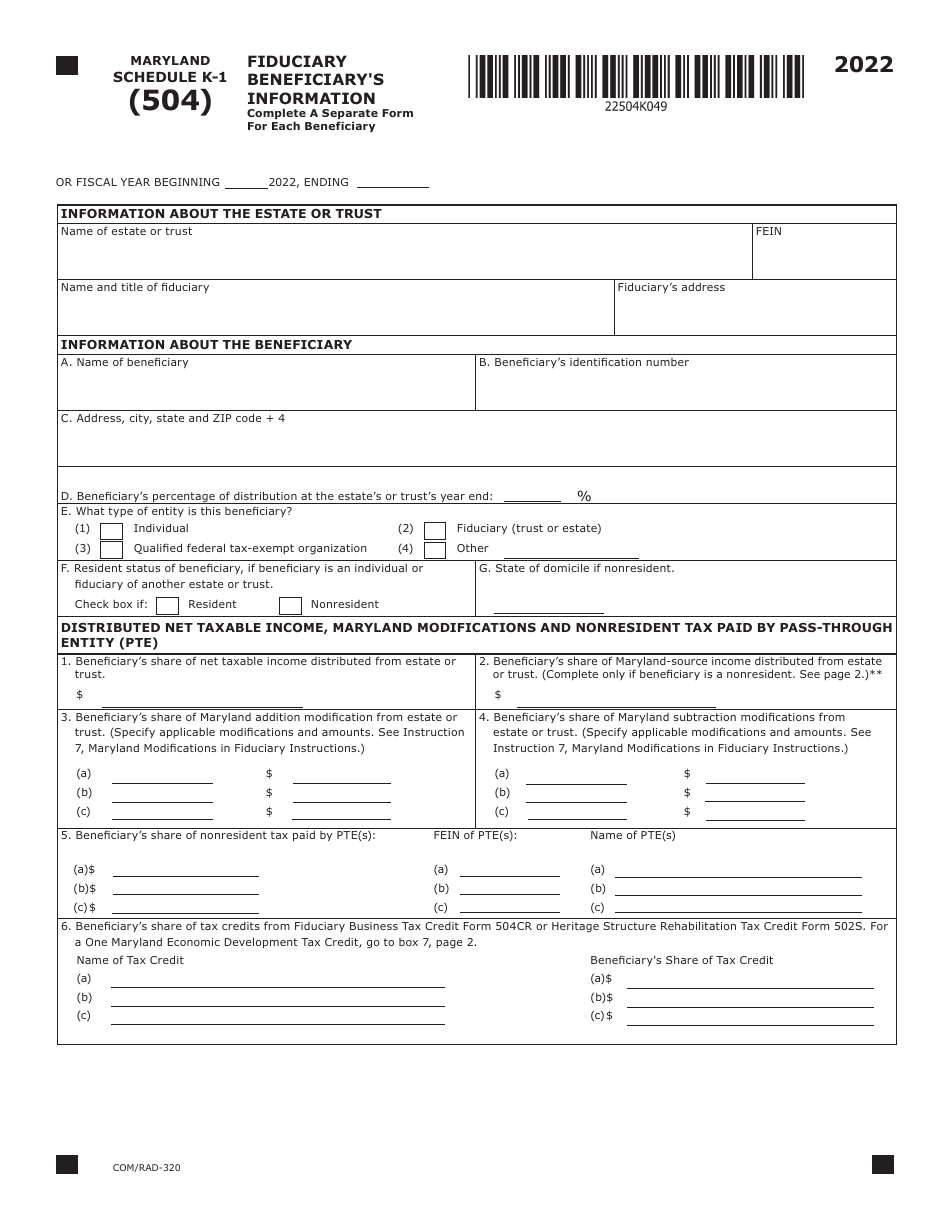

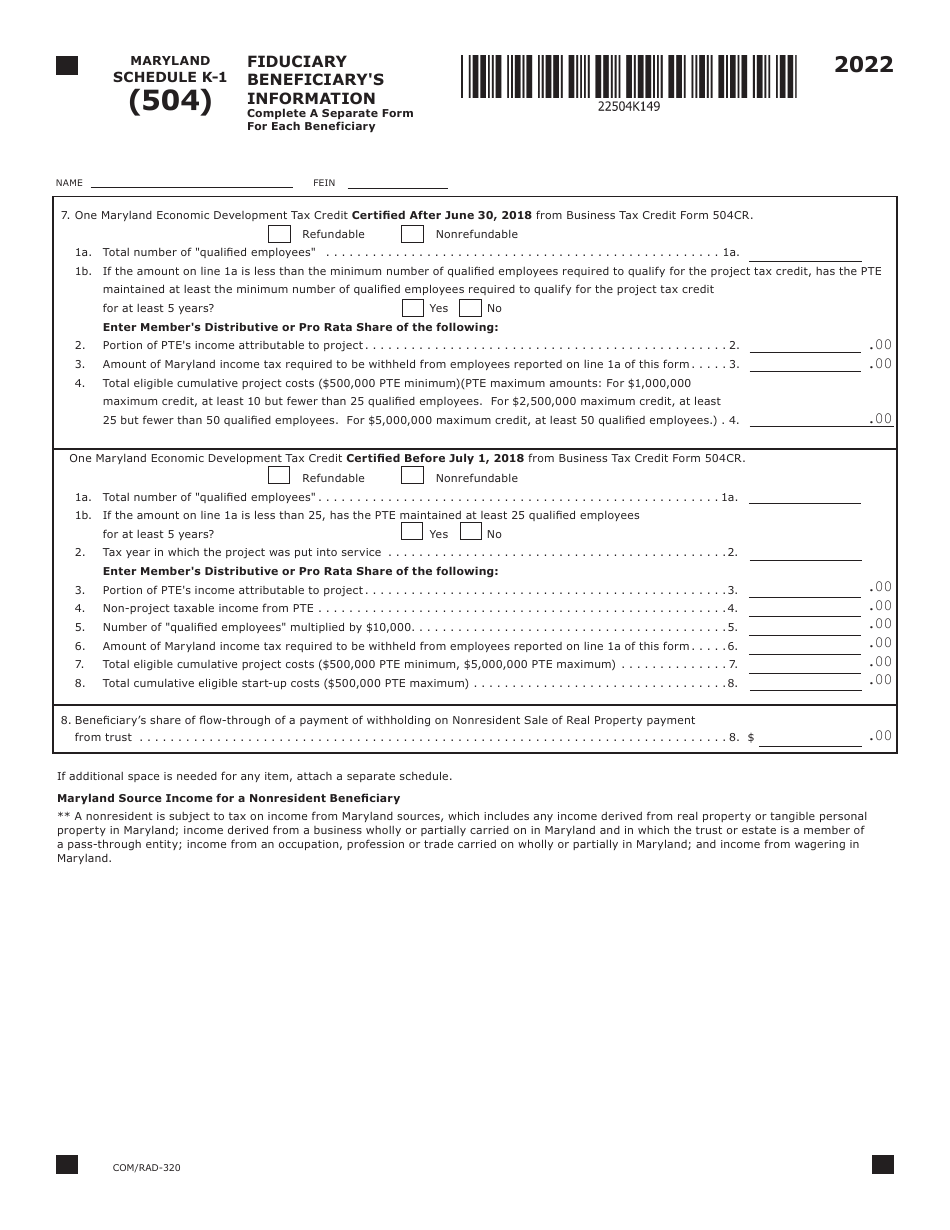

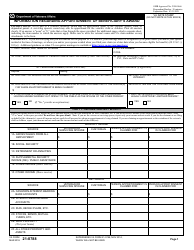

Maryland Form 504 (COM/RAD-320) Schedule K-1

for the current year.

Maryland Form 504 (COM / RAD-320) Schedule K-1 Fiduciary Beneficiary's Information - Maryland

What Is Maryland Form 504 (COM/RAD-320) Schedule K-1?

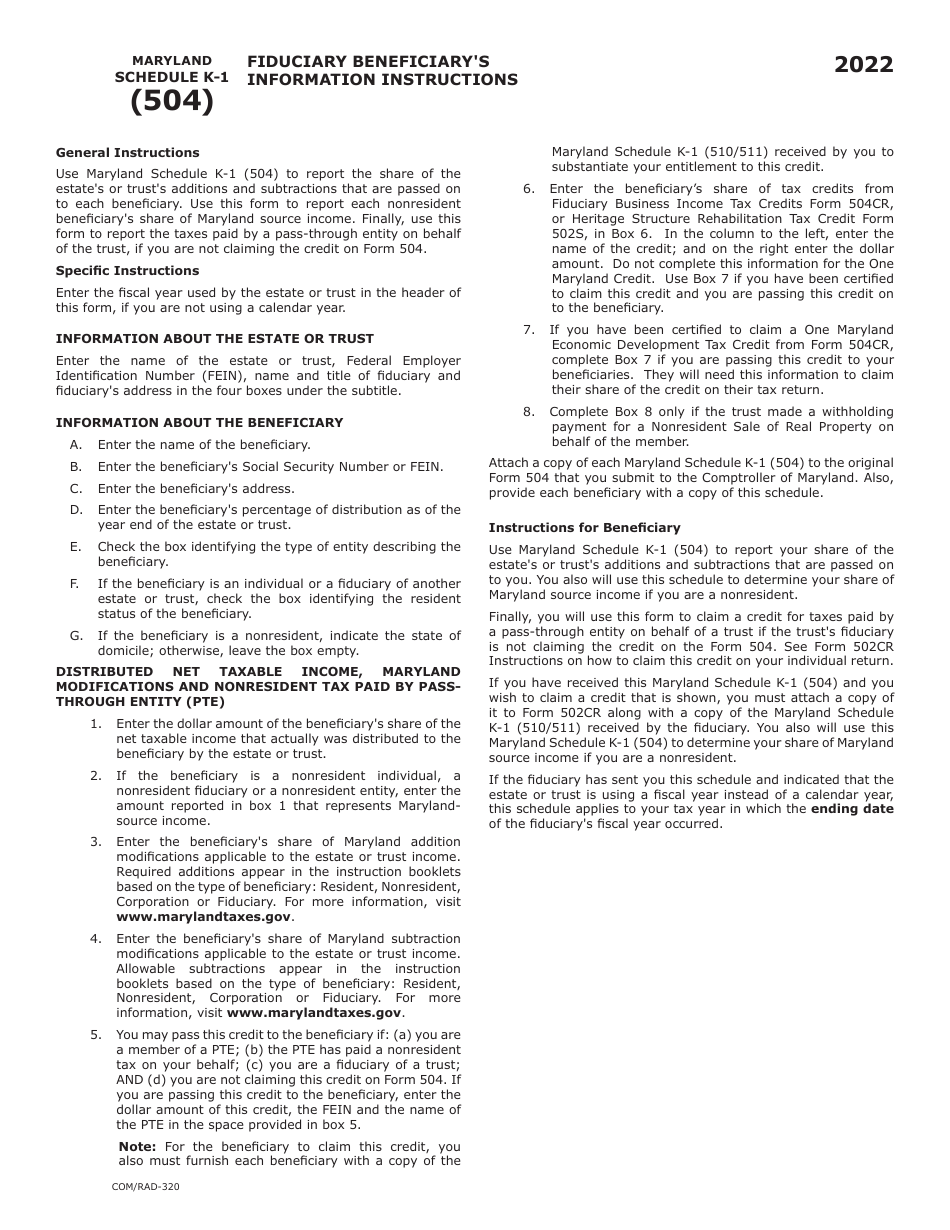

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland.The document is a supplement to Maryland Form 504, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Maryland Form 504 (COM/RAD-320)?

A: Maryland Form 504 (COM/RAD-320) is a schedule used to provide fiduciary beneficiary's information for tax purposes in Maryland.

Q: What is Schedule K-1?

A: Schedule K-1 is a form that reports the income, deductions, and credits allocated to each partner or shareholder of a business entity.

Q: Who needs to file Maryland Form 504?

A: The fiduciary of an estate or trust that has Maryland taxable income must file Maryland Form 504.

Q: What information is required on Maryland Form 504?

A: Maryland Form 504 requires the fiduciary beneficiary's information, including their name, Social Security number, and share of income.

Q: When is the deadline to file Maryland Form 504?

A: The deadline to file Maryland Form 504 is usually April 15th, but it may vary depending on the tax year.

Q: Are there any penalties for late filing of Maryland Form 504?

A: Yes, there may be penalties for late filing of Maryland Form 504, including interest charges and potential fines.

Q: Can Maryland Form 504 be filed electronically?

A: Yes, Maryland Form 504 can be filed electronically using the Maryland Business Express portal.

Q: Is Maryland Form 504 the same as federal Schedule K-1?

A: No, Maryland Form 504 is specific to Maryland state taxes and provides information for the state's tax purposes.

Q: Can I amend Maryland Form 504 if I made a mistake?

A: Yes, you can file an amended Maryland Form 504 to correct any mistakes or update the information provided.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 504 (COM/RAD-320) Schedule K-1 by clicking the link below or browse more documents and templates provided by the Maryland Taxes.