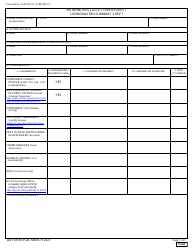

This version of the form is not currently in use and is provided for reference only. Download this version of

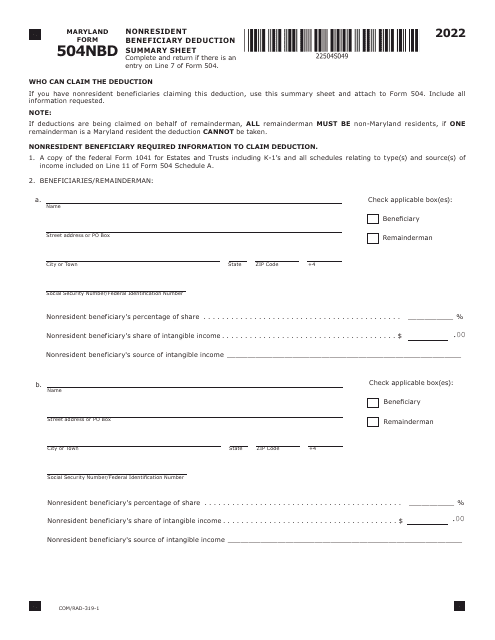

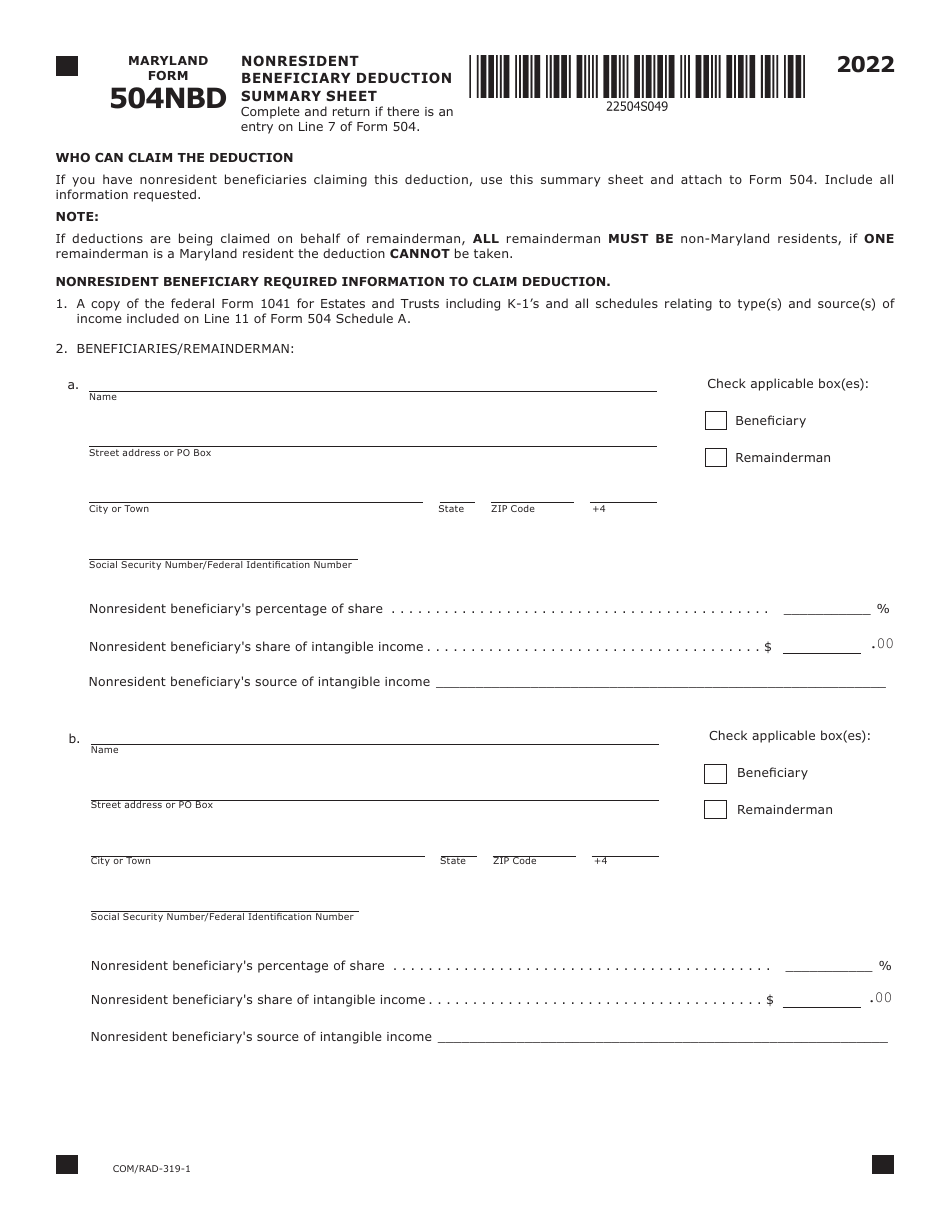

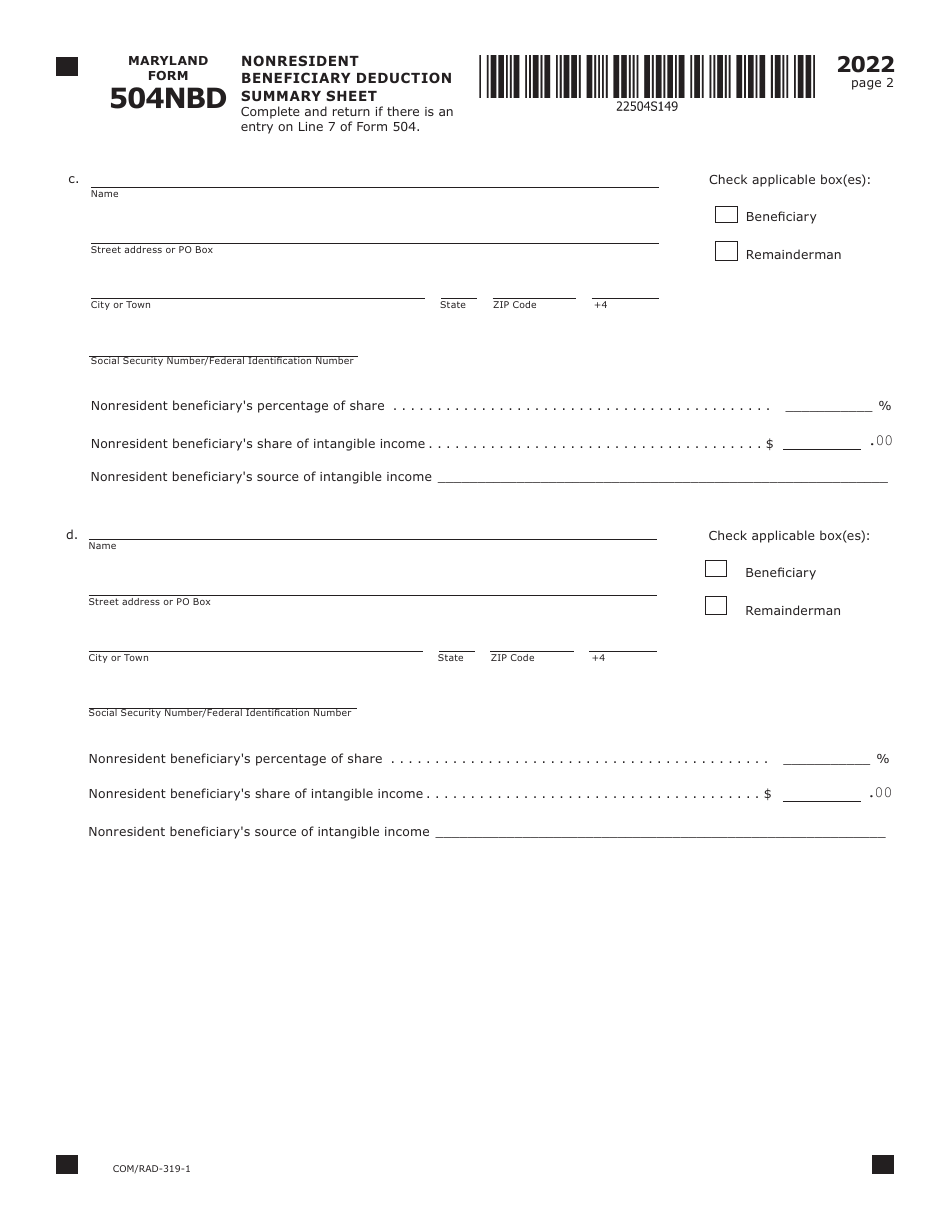

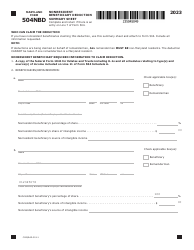

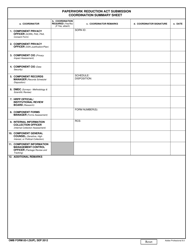

Maryland Form 504NBD (COM/RAD-319-1)

for the current year.

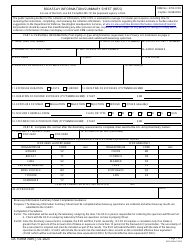

Maryland Form 504NBD (COM / RAD-319-1) Nonresident Beneficiary Deduction Summary Sheet - Maryland

What Is Maryland Form 504NBD (COM/RAD-319-1)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 504NBD?

A: Form 504NBD is the Nonresident Beneficiary Deduction Summary Sheet specifically for Maryland.

Q: Who is eligible to use Form 504NBD?

A: Nonresident beneficiaries who want to claim deductions on their Maryland taxes.

Q: What is the purpose of Form 504NBD?

A: The form is used to report and calculate deductions for nonresident beneficiaries in Maryland.

Form Details:

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form 504NBD (COM/RAD-319-1) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.