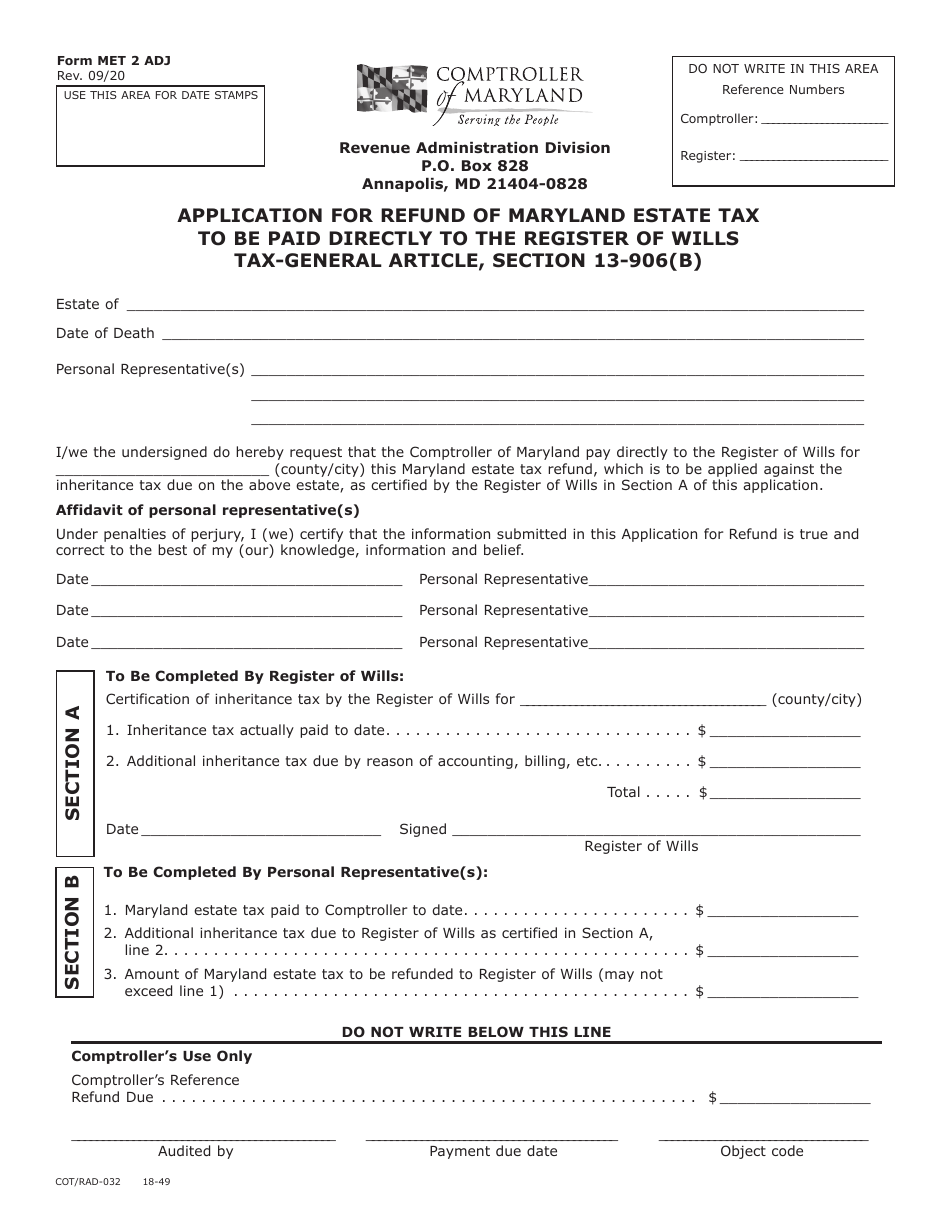

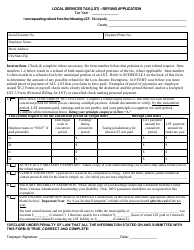

Form MET-2 ADJ (COT / RAD-032) Application for Refund of Maryland Estate Tax to Be Paid Directly to the Register of Wills Tax-General Article, Section 13-906(B) - Maryland

What Is Form MET-2 ADJ (COT/RAD-032)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MET-2 ADJ (COT/RAD-032)?

A: Form MET-2 ADJ (COT/RAD-032) is an application for refund of Maryland Estate Tax to be paid directly to the Register of Wills.

Q: What is the purpose of Form MET-2 ADJ?

A: The purpose of Form MET-2 ADJ is to request a refund of Maryland Estate Tax.

Q: What is the basis for filing Form MET-2 ADJ?

A: Form MET-2 ADJ is filed based on tax-general article, section 13-906(B) in Maryland.

Q: Who should I submit Form MET-2 ADJ to?

A: Form MET-2 ADJ should be submitted directly to the Register of Wills.

Q: What is the refund process for Maryland Estate Tax?

A: To request a refund of Maryland Estate Tax, you need to complete and submit Form MET-2 ADJ to the Register of Wills.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MET-2 ADJ (COT/RAD-032) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.