This version of the form is not currently in use and is provided for reference only. Download this version of

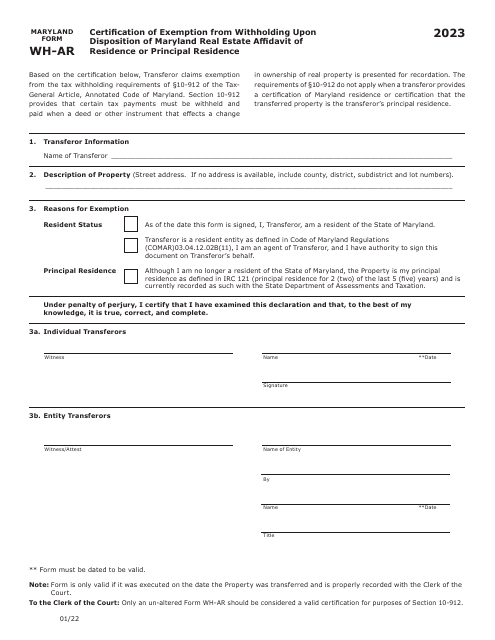

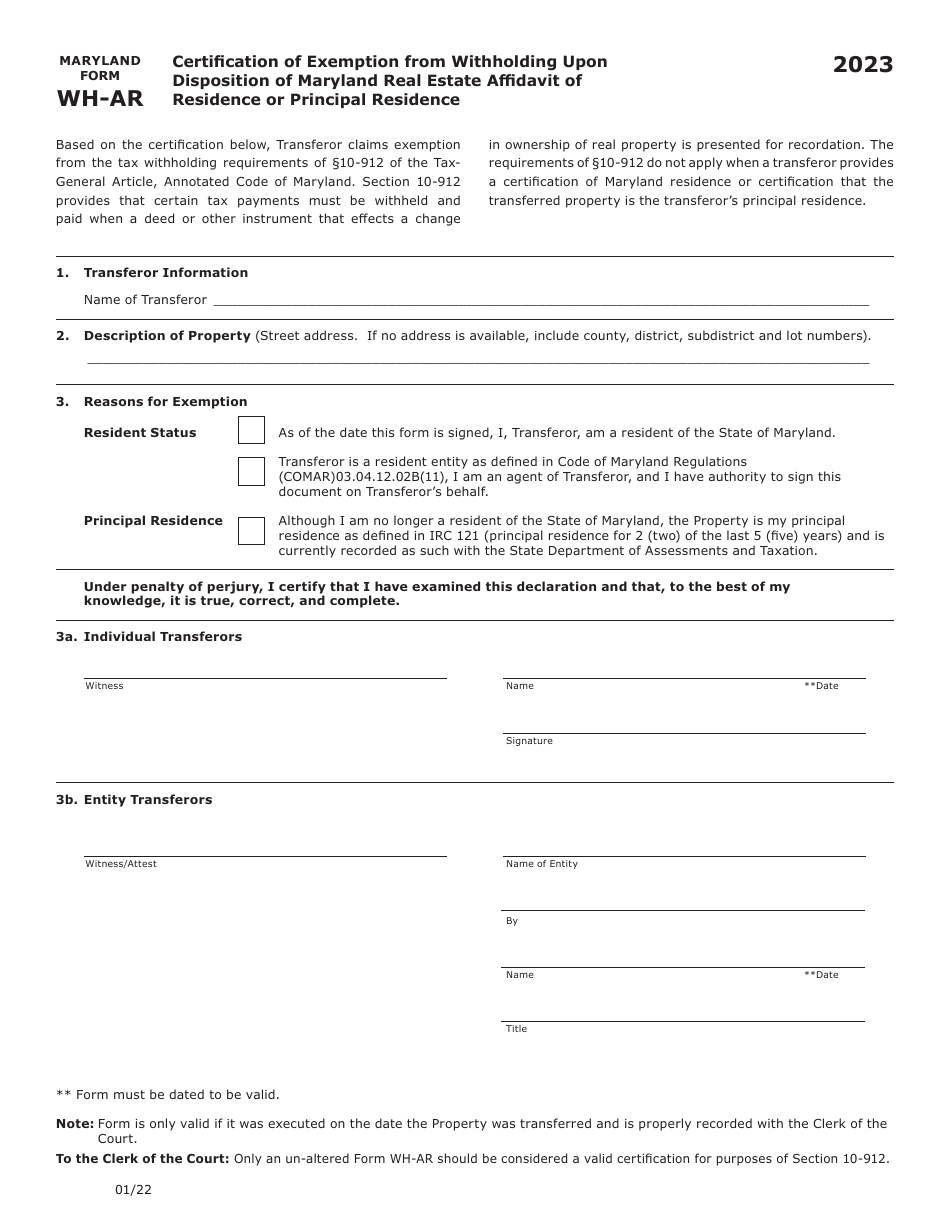

Maryland Form WH-AR

for the current year.

Maryland Form WH-AR Certification of Exemption From Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence - Maryland

What Is Maryland Form WH-AR?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Maryland Form WH-AR?

A: The Maryland Form WH-AR is a Certification of Exemption From Withholding Upon Disposition of Maryland Real Estate Affidavit of Residence or Principal Residence.

Q: What is the purpose of the Maryland Form WH-AR?

A: The purpose of the Maryland Form WH-AR is to certify that the seller of Maryland real estate is exempt from withholding tax upon the sale.

Q: Who needs to file the Maryland Form WH-AR?

A: The seller of Maryland real estate needs to file the Maryland Form WH-AR.

Q: What does the Maryland Form WH-AR certify?

A: The Maryland Form WH-AR certifies that the seller is a resident of Maryland or the property being sold is the seller's principal residence.

Q: What happens if the Maryland Form WH-AR is not filed?

A: If the Maryland Form WH-AR is not filed, the buyer of the property may be required to withhold a portion of the sales proceeds for taxes.

Q: Are there any fees associated with filing the Maryland Form WH-AR?

A: No, there are no fees associated with filing the Maryland Form WH-AR.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form WH-AR by clicking the link below or browse more documents and templates provided by the Maryland Taxes.