This version of the form is not currently in use and is provided for reference only. Download this version of

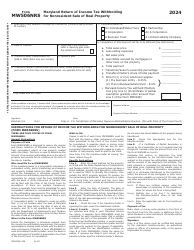

Maryland Form MW506R (COM/RAD-307)

for the current year.

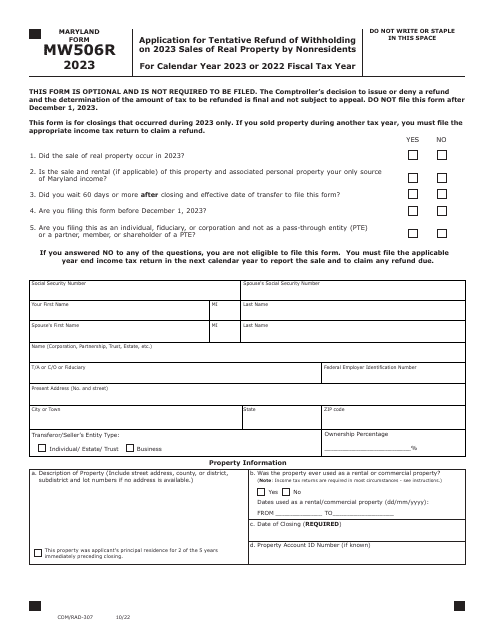

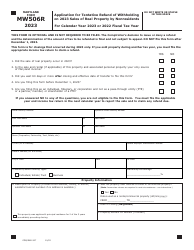

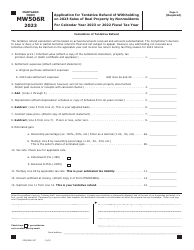

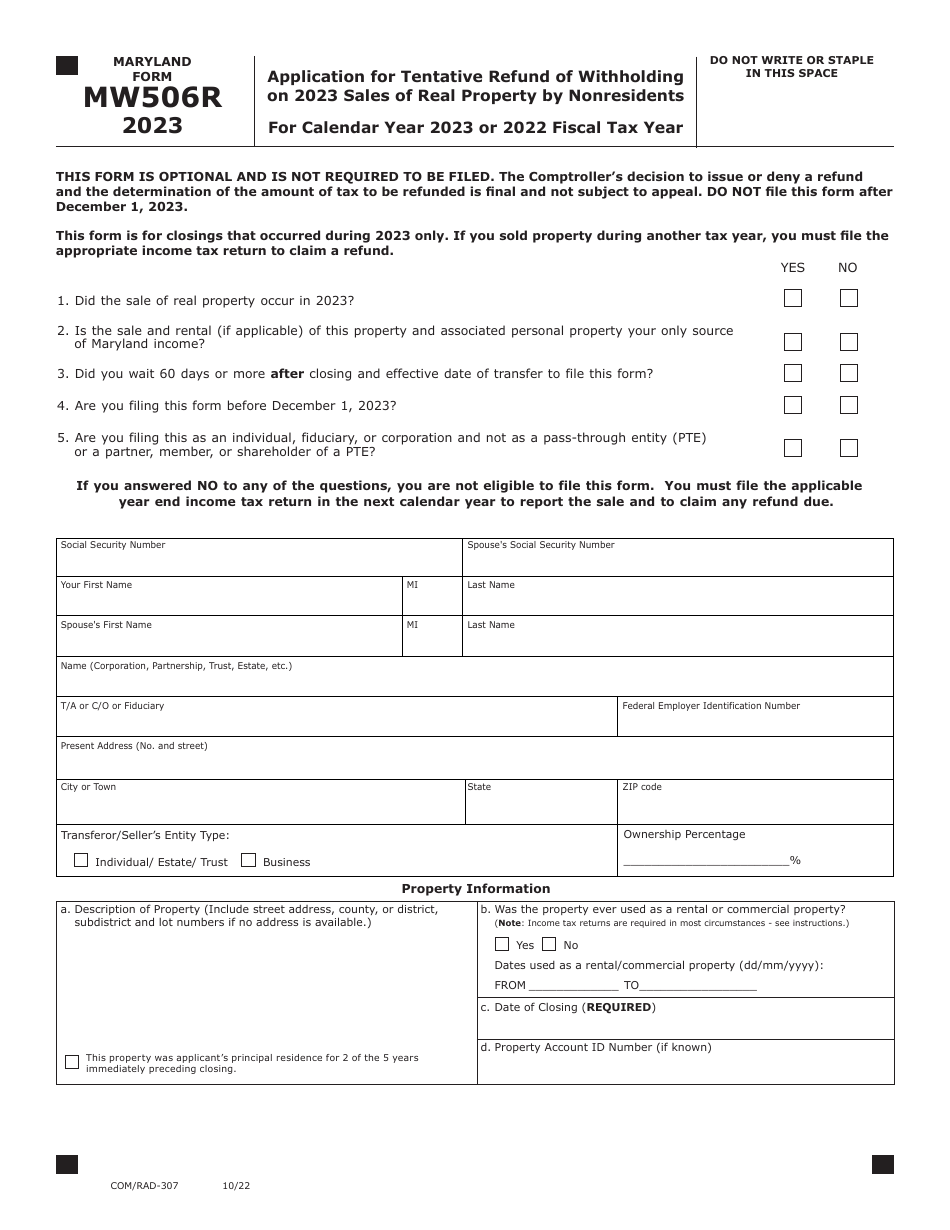

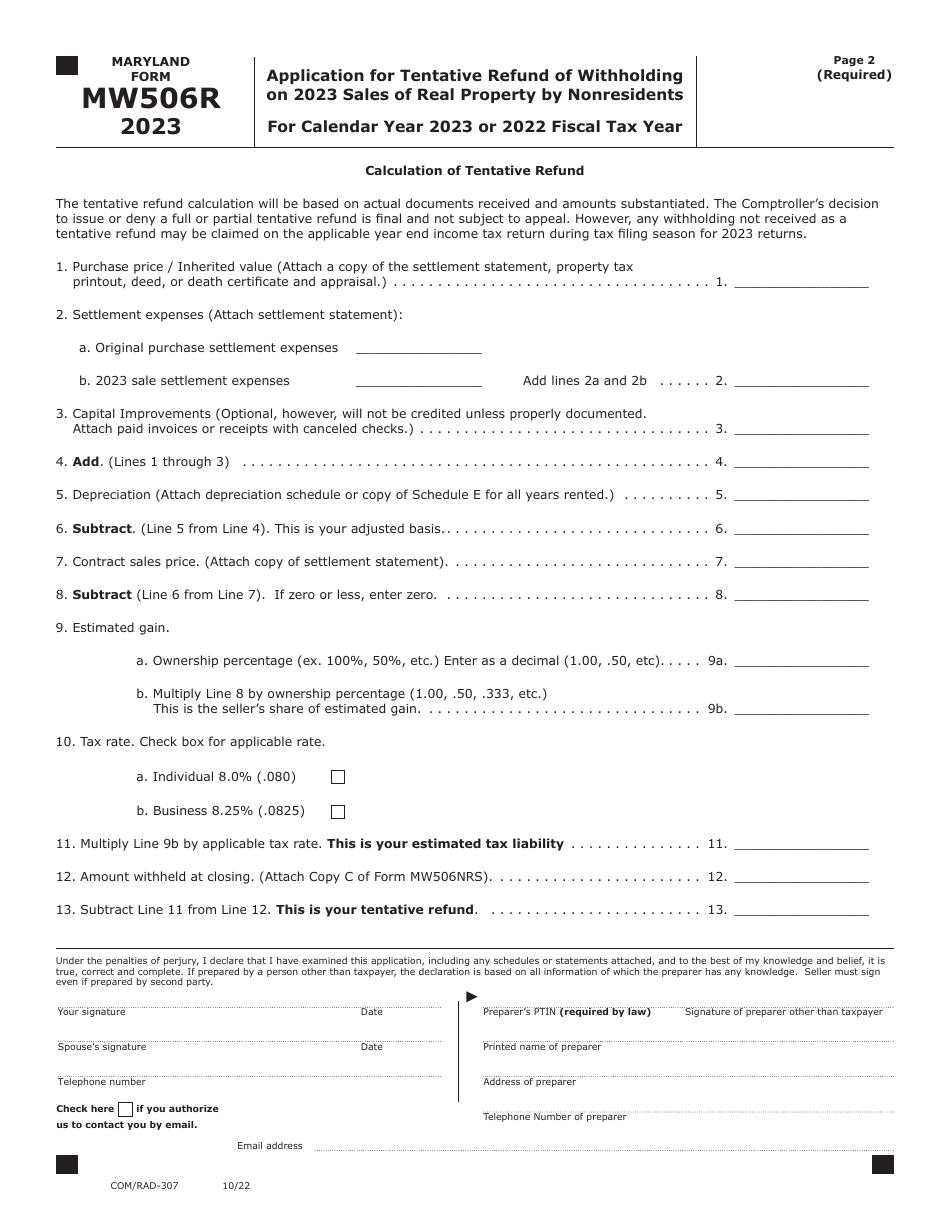

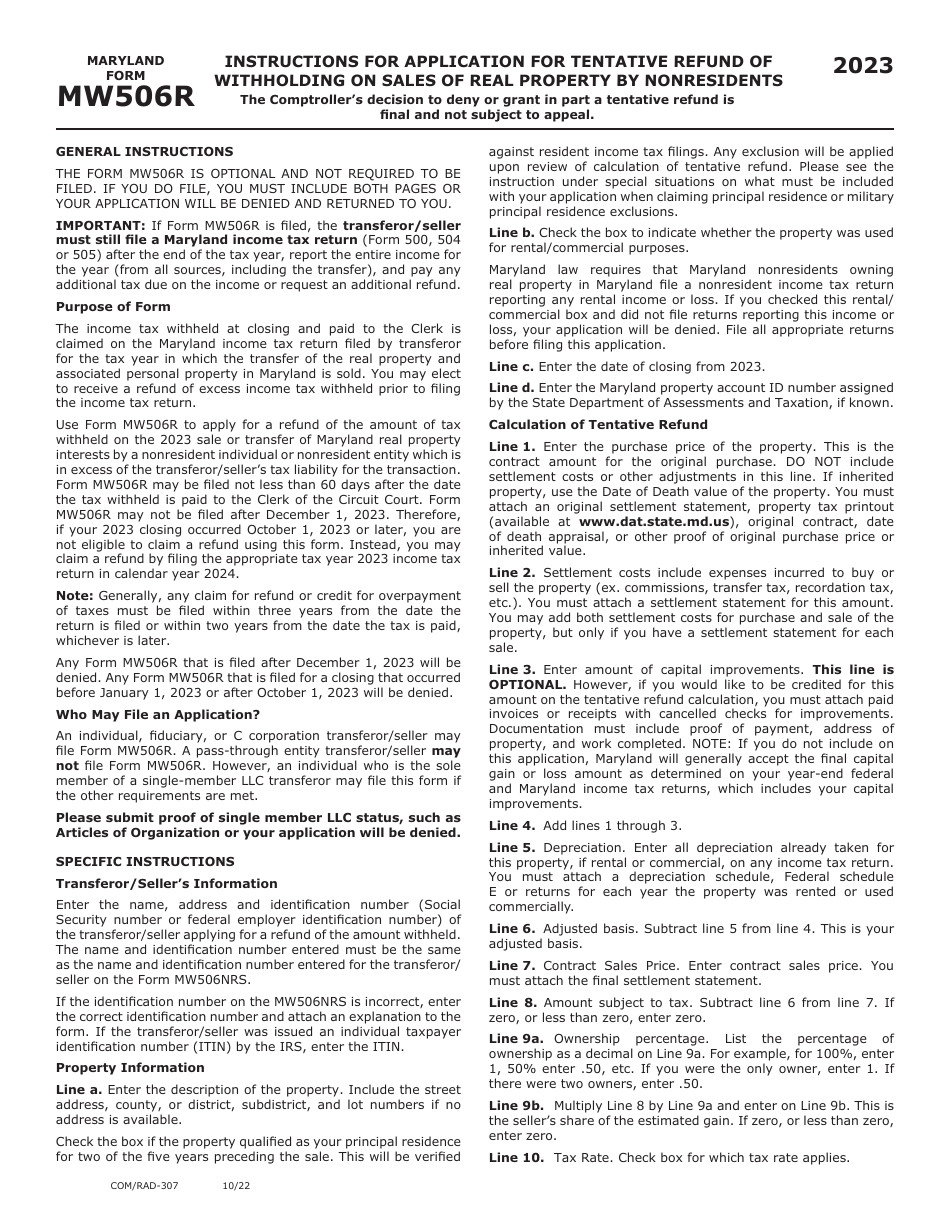

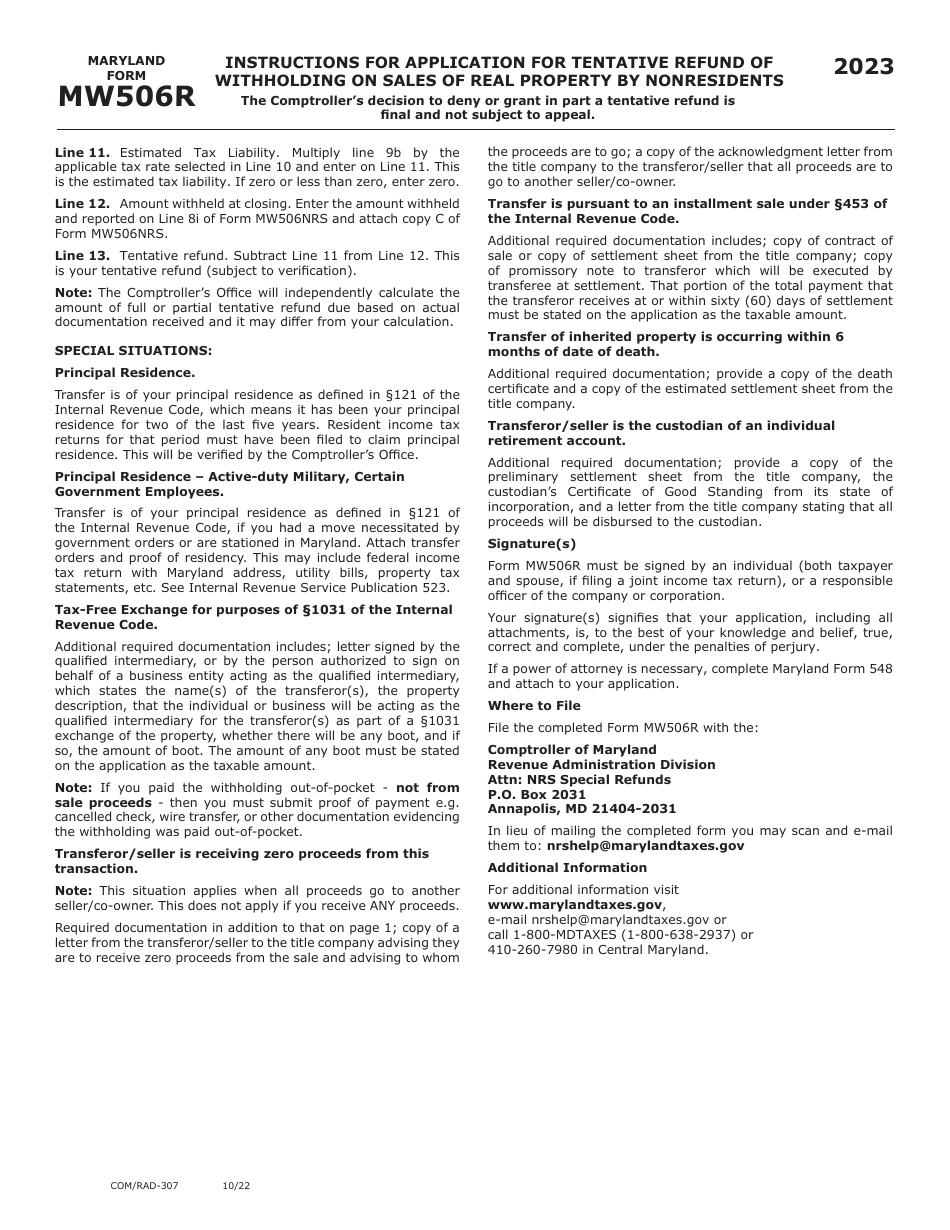

Maryland Form MW506R (COM / RAD-307) Application for Tentative Refund of Withholding on 2023 Sales of Real Property by Nonresidents - Maryland

What Is Maryland Form MW506R (COM/RAD-307)?

This is a legal form that was released by the Maryland Taxes - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

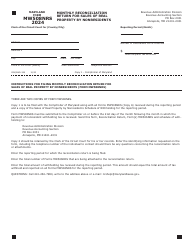

Q: What is Maryland Form MW506R?

A: Maryland Form MW506R is an application for a tentative refund of withholding on sales of real property by nonresidents in Maryland.

Q: Who can use Maryland Form MW506R?

A: Maryland Form MW506R can be used by nonresidents who have sold real property in Maryland and had withholding taxes deducted from the sale proceeds.

Q: What is the purpose of Maryland Form MW506R?

A: The purpose of Maryland Form MW506R is to request a refund of the withholding taxes that were deducted from the sale proceeds of real property by nonresidents.

Q: What information is required on Maryland Form MW506R?

A: Maryland Form MW506R requires information such as the seller's name, address, social security number or individual taxpayer identification number, and details about the sale of the real property.

Q: How can I submit Maryland Form MW506R?

A: Maryland Form MW506R can be submitted by mail to the Maryland Comptroller of the Treasury, Revenue Administration Division, Annapolis, MD 21411-0001.

Q: Is there a deadline for submitting Maryland Form MW506R?

A: Yes, Maryland Form MW506R must be submitted within three years from the date of the sale of the real property.

Q: Are there any fees associated with filing Maryland Form MW506R?

A: No, there are no fees associated with filing Maryland Form MW506R.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Maryland Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Maryland Form MW506R (COM/RAD-307) by clicking the link below or browse more documents and templates provided by the Maryland Taxes.